Erik is a true Renaissance man who turns 60 this year and finds himself at a turning point. He has a PhD in Dramatic Art, a Master’s in astronomy and an MFA in acting. Erik lives outside of Boston and currently works at a world-class scientific institution focusing on a large data archive for astronomy and astrophysics. In his free time, he builds telescopes, writes poetry, listens to jazz music and spends quality time with his cat, Oort Cloud. He comes to us today because, in his words:

I feel stuck. I’ve been at my current job for 13 years and have no place to go but sideways: at the facility where I work, if one lacks a Ph.D. in physics or astronomy, there is only so far one can go.

As he nears retirement, Erik is also contemplating a move to a more rural location that would give him access to dark skies–a need for every astronomer.

What’s a Reader Case Study?

Case Studies address financial and life dilemmas that readers of Frugalwoods send to me requesting advice. Then, we (that’d be me and YOU, dear reader) read through their situation and provide advice, encouragement, insight and feedback in the comments section.

For an example, check out the last case study. Case Studies are updated by participants (at the end of the post) several months after the Case is featured. Visit this page for links to all updated Case Studies.

The Goal Of Reader Case Studies

Reader Case Studies are intended to highlight a diverse range of financial situations, ages, ethnicities, geography, goals, careers, incomes, family composition and more!

The Case Study series began in 2016 and, to date, there’ve been 59 Case Studies. I’ve featured folks with annual incomes ranging from $17,160 to $200k+ and net worths ranging from -$317,596 to $2.9M+.

I’ve featured single, married, partnered, divorced, child-filled and child-free households. I’ve featured gay, straight and trans people. I’ve featured men, women and non-binary folks. I’ve had cat people and dog people. I’ve featured folks from the US, Australia, Canada, England, South Africa and France.

I’ve featured people with PhDs and people with high school diplomas. I’ve featured people in their early 20’s and people in their late 60’s. I’ve featured folks who live on farms and folks who live in New York City.

The goal is diversity and only YOU can help me achieve that by emailing me your story! If you haven’t seen your circumstances reflected in a Case Study, I encourage you to apply to be a Case Study participant by emailing [email protected].

Reader Case Study Guidelines

I probably don’t need to say the following because you folks are the kindest, most polite commenters on the internet, but please note that Frugalwoods is a judgement-free zone where we endeavor to help one another, not condemn. There’s no room for rudeness here–the goal is to create a supportive environment where we all acknowledge that we’re human, we’re flawed, but we choose to be here together, workshopping our money and our lives with positive, proactive suggestions and ideas.

A disclaimer that I am not a trained financial professional and I encourage people not to make serious financial decisions based solely on what one person on the internet advises. I encourage everyone to do their own research to determine the best course of action for their finances. I am not a financial advisor and I am not your financial advisor.

With that I’ll let Erik, today’s Case Study subject, take it from here!

Erik’s Story

Hi Frugalwoods. I’m Erik. Looked at objectively (I think — I’m told I’m very hard on myself), I’m a 59-year-old “permanent student” (though not in school at the moment, I’m thinking about getting a degree in mathematics, and I’m always studying something!) and poet/caver/would-be telescope maker/intellectual omnivore with, really, no career to speak of. I have had more of a semi-random chain of jobs of checkered interest since getting my Ph.D. in 1992 … kind of a “drunkard’s walk” of work.

Most of my advanced degrees are in Theatre, but I also have an M.S. in astronomy. When I was a kid I wanted to be an astronaut or an astronomer… or the next Edgar Allan Poe! My march to science, however, was knocked askew when I tried out for a play (in order to look more well-rounded on college applications) and discovered that, for the first time in my life, I was getting attention from the opposite sex. This was the most powerful hallucinogen imaginable for the young man I was at the time, and its effects lasted for many years — through an MFA in acting and a Ph.D in Dramatic Art.

So, now, here I am: I have training as a stage actor but haven’t acted in 25 years. All told, by this time I probably should have been a (perhaps tenured) college/university professor teaching theatre; however, after one year as a college instructor, I allowed personal matters (my first divorce) to kick me out of the quest for a permanent academic post, and as a result I have mostly worked in IT. I believe this (devolving upon IT as a “second career”) is a not-uncommon scenario for people in the arts and humanities.

I’ve been married and divorced twice; my 2nd ex-wife is my best friend. She and I have sometimes (OK, often) discussed a future where, if neither of us winds up re-married, we buy land together and build individual “huts” on it — with a connecting tube so cats can go back and forth, of course.

Erik’s Current Job and Home

In 2008 I moved from Brooklyn, NY, where I had a lousy job with four hours a day of commuting, to the Boston area to take a job at a world-class scientific institution. I work in a large data archive for astronomy and astrophysics.

This is something like a return to my childhood dream of being an astronomer, but I only support the science. It’s sometimes a bitter position where I get to watch others do the things I once dreamed about. My work includes writing programs in Perl to provide various forms of access to the data, writing some database backed webpages, and classifying papers from astronomy journals (with respect to how they use the data). It sounds cool.

I have a loony black cat named Oort Cloud — I named her for a theorized (by astronomers, that is) cloud of cometary bodies in the Solar system that has never been observed. The joke is that Oort Cloud the cat, who is shy, has “never been observed” by cat sitters. She keeps me alive with her cuteness and weirdness.

I’ve spent most of my life in perpetual monetary woes, but recently a couple of raises at work + an inheritance from my father has lightened that somewhat. I read too much. I write poetry. I study everything that I find interesting. My goal is to do “citizen science” in astronomy (this is the main goal — I have lots of others too: learn German/Spanish/French; learn to play the piano, etc. etc.). The overwhelming passion of my life has been knowledge — I haven’t had all that much luck with other common passions.

What brings you to submit a Case Study?

In general, I feel stuck. I’ve been at my current job for 13 years and have no place to go but sideways: at the facility where I work, if one lacks a Ph.D. in physics or astronomy, there is only so far one can go. I’ve made some effort to find another job, but I got a late start as an IT person and am now pretty … uhm, superannuated for a field where youth and energy are emphasized. I started encountering ageism in my 40s. I have never been good at job searching. And now I’m making excuses… 🙁

More specifically …

When I am outside and look up at night, I can’t see the stars, apart from the very brightest ones and the Moon and planets; furthermore, I have no backyard, no place to set up my telescope even if I could see lots of stars. I live in a one-bedroom apartment, and the light pollution here in metro Boston is horrible. It’s difficult for me to convey how distressing this truly is for me, and how important it is that it change, and soon. I’ve reluctantly lived in large, light-polluted metro areas for decades, because that is where the work is — and my lifestyle has been, I’d say, that of a permanent graduate student: renting apartments, furnishing them sparely and cheaply, and buying too many books.

I don’t so much mind the crummy furniture as I do being stuck in suburbia far from being able to see the Milky Way, far from mountain or forest trails, far from quiet nights with fireflies, crickets and sweet air. I can’t say I care much for the bulk of western civilization, so my ideal situation would be a cabin/house somewhere in the country, with a good view of the sky, with (very importantly) a space I can use for a workshop for more telescope building — and, ideally, with a fireplace. My dream is being able to see the stars whenever I want, and be able to work on astronomy projects (the “citizen science” I refer to above) and write.

I often think about moving abroad to Germany or France or, closer to home, to Mexico. I am afraid I don’t feel very connected to my country any more.

What’s the best part of your current lifestyle/routine?

I enjoy a certain style of freedom: I’m single, with no children and (whether due to the rumored coldness of Bostonians or my own misguided hermit life choices) no real social circle. Apart from work, I do what I want to do when I want to do it. If I want to take up drawing, or playing the piano, I do it. If I want to stay up until 3 in the morning listening to avant garde jazz in my boxers, I do that (as long as I’m on headphones — I live in an apartment!).

What’s the worst part of your current lifestyle/routine?

The distance from peace, quiet, starry nights and nature (and caves! plus, New England caves are kind of gnarly, and even those are far away from the Boston area). If I’m going to be a hermit, I’d prefer it to be in a place that’s at least pretty, or in another country entirely. I also have no place to work on telescopes and other projects, which is a huge constraint on what I want to be able to do. I am finding it extremely difficult to pay attention to the things that matter most to me.

Oh, and if I never have to hear a pair of Bostonians communicate using their car horns ever again, it will be too soon.

Where Erik Wants to be in Ten Years:

Finances:

- I have more money now than I have ever had, but… that’s not saying a lot!

- I am convinced that, for a 59-year-old, I’m in a terrible financial state. Am I?

- In ten years I would like to be in a not-terrible state. I would also like to know enough to be able to assess my situation with more specificity and skill than I can now.

Lifestyle:

- I want to be at least semi-retired and spending the bulk of my time doing things that are important to me.

- I want to be able to travel internationally when I want, without worrying about the money.

- I want to be able to really do the art and science projects I come up with, not just dream about them.

Career:

- In 10 years I will be 69 years old, and I would like to have been retired for a few years — or, if not, doing something I truly love and that hardly feels like a job.

- My psychiatrist keeps telling me he envisions me as an eccentric bookseller, and I keep telling him that health insurance + enough money to live on are important to me! 😉

Erik’s Finances

Income

| Item | Amount | Notes |

| Erik’s net income | $4,022 | Salary minus health insurance, TIAA-CREF deductions, taxes, etc. |

| Ex-wife’s phone payment contribution | $80 | We share an AT&T account. Long story. |

| Monthly subtotal: | $4,102 | |

| Annual total: | $49,224 |

Debts

| Item | Outstanding loan balance | Interest Rate | Monthly required payment |

| Auto Loan (University Credit Union) | $7,020 | 4.99% interest | $176.43 |

| Platinum Rewards Mastercard (University Credit Union) | $792 | (I can’t seem to find this) | I could pay this off right now |

| Total: | $7,812.35 |

Assets

| Item | Amount | Notes | Interest/type of securities held | Name of bank/brokerage |

| TIAA-CREF | $247,892 | This is my retirement account through my employer. They put in 12% of my salary annually. | Currently in money markets for safety | TIAA-CREF |

| Beneficiary IRA | $117,776 | Another part of the inherited stuff | I let LPL Financial do the investing. Here’s what it’s invested in:

|

LPL Financial. It appears I pay them an annual maintenance fee of $40.00. That’s all I can find in terms of fees. |

| Money Market account | $104,210 | Part of what I inherited from my Dad | OK, this is a little weird, but … I consult with a friend of mine on stock stuff, and last March, when the market went flop due to COVID pressures, etc. he had been advising me to move stuff to safer places for some time. So I took everything that’s there and put it in money markets, which earn zilch but are safe. And it’s sat there ever since. I did much the same with the TIAA-CREF funds. I’ve been waiting for him to say it’s okay to move stuff back. |

Vanguard |

| Savings account | $61,503 | 0.1% interest | University Employees Credit Union | |

| Checking account | $23,461 | 0% interest | University Employees Credit Union | |

| Total: | $554,841.69 |

Vehicles

| Vehicle make, model, year | Valued at | Mileage | Paid off? |

| Hyundai Elantra 2012 | $3,770 | 56,341 | No, the amount I owe is listed under “debts” |

Credit Card Strategy

| Card Name | Rewards Type? | Bank/card company |

| HUECU Mastercard | none | University Employees Credit Union |

Expenses

| Item | Amount | Notes |

| Rent | $1,450 | |

| Food – Groceries | $275 | |

| Phone | $168 | |

| Food – Doordash, et al | $144 | |

| Car Insurance | $134 | Safety Insurance |

| Gas (apartment) | $129 | |

| Therapist (weekly) | $100 | |

| Internet | $94 | |

| Medications | $90 | |

| Pet (veterinary) | $68 | (very much an estimate) |

| Pet (food) | $65 | |

| Alcohol (nakedwines.com) | $55 | |

| Electric | $45 | |

| Gas (car) | $30 | I don’t drive much |

| EZ Pass | $25 | |

| Sirius XM | $21 | |

| Books (addiction) | $20 | |

| Netflix | $14 | |

| Duolingo (language learning app) | $10 | |

| Crtierion Channel | $10 | |

| Monthly subtotal: | $2,946.58 | |

| Annual total: | $35,358.96 |

I know there are other things, but I don’t keep granular enough records 🙁

Erik’s Questions for You:

- How do I get from where I am to where I want to be?

- How do I assess my current resources? I am wondering if I am slightly unusual in that I am just me. That is, none of my assets go toward anyone else (such as children’s educations, etc).

- Do I have enough resources to make a start?

- I don’t know how to figure out how much money I need; I’ve never been good at money matters. In some ways I suppose I am already frugal: I certainly don’t think I have spent as much on furniture and clothing as many other people do … but on the other hand, I could certainly stand to lose my book addiction! And do I really need Netflix, or any of the other things I’m subscribed to?

Liz Frugalwoods’ Recommendations

I want to start off by thanking Erik for bringing his Case Study to us. I think a lot of folks will see themselves reflected in his story, which makes today’s conversation all the richer. Before we dive into Erik’s questions, I want to reassure him that he is not in as dire a financial situation as he assumes! I think that with a few crucial changes, Erik can right some financial wrongs and set himself on a great financial trajectory. Ok, let’s get to it!

Don’t Forget About Social Security and Medicare

Two key variables Erik didn’t mention are Social Security and Medicare. Since Erik’s been working for decades, he should qualify for Social Security.

I recommend he calculate his expected monthly Social Security payments by following these instructions on how to retrieve his earnings tables from ssa.gov (the government’s Social Security website). Knowing the dollar amount he can expect to receive in Social Security every month will form a crucial baseline for his retirement budget. Note that Social Security benefits increase the later you start taking them.

Next up, Erik should be eligible to receive Medicare at age 65. He mentioned his concern with having affordable healthcare and so it’s good news that he’s just five years away from Medicare. I suggest he go through these steps on the government’s Medicare website to determine his eligibility and anticipated premium amount.

Erik’s Assets

The most significant changes I’m going to suggest for Erik relate to how his assets are invested and managed.

The Bad News

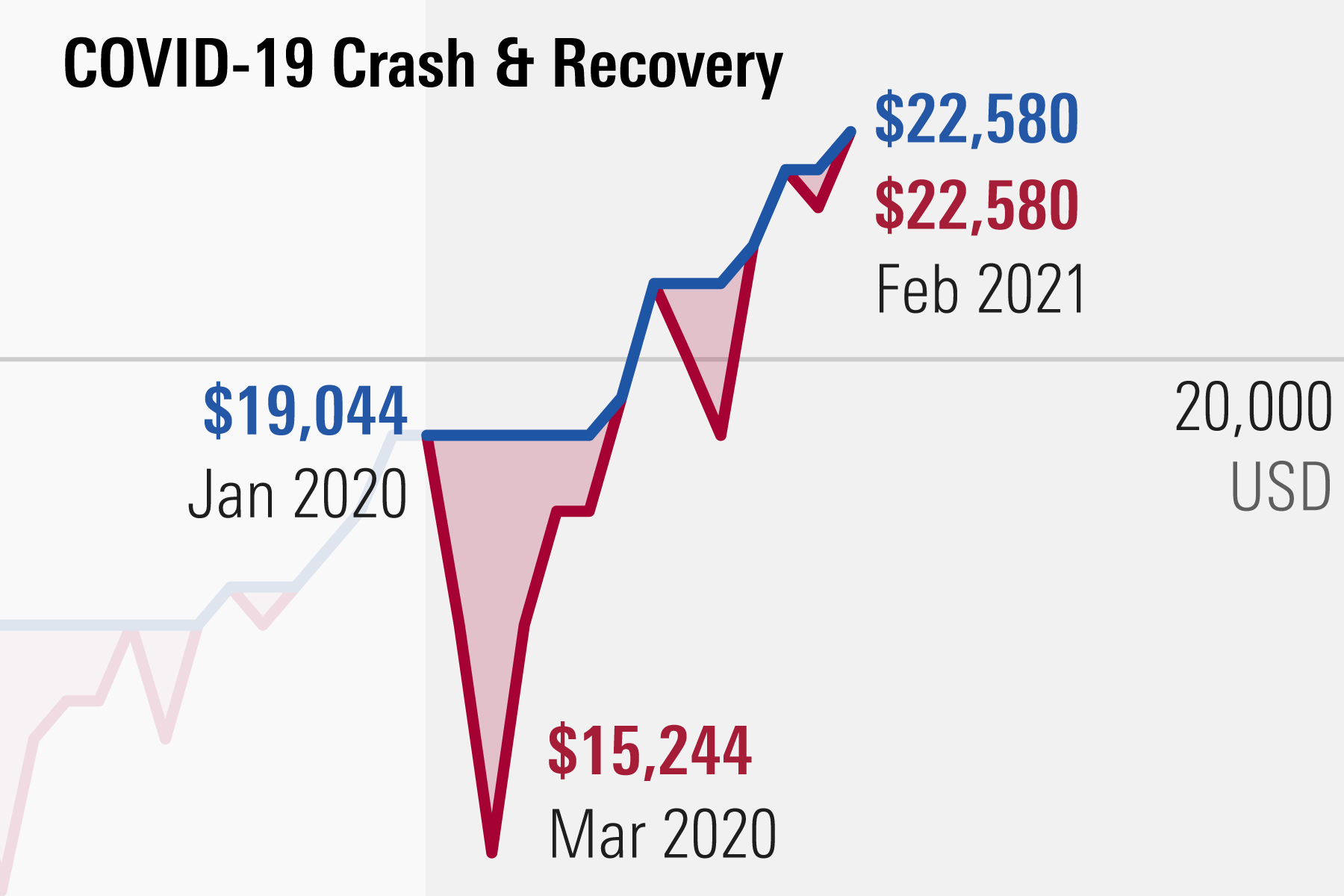

Unfortunately, moving his investments out of the stock market and into money market accounts caused Erik to miss out on one of the greatest bull markets in history. Sadly, I imagine his sold those equities as a loss and then proceeded to miss out on doubling his money. While there’s nothing to be done about it now, I want to highlight this as a cautionary tale. This is why I recommend, over and over again, to invest your money and LEAVE IT INVESTED. Very few people make money by pulling their money in an out of the market. A lot of people make money by leaving it invested for decades. That is how investing works and it’s the only way to go.

While Erik’s friend was correct that yes, the markets initially flopped a bit due to Covid, they then proceeded to grow astronomically. Kiplinger put it best when they said:

As a trying and tragic 2020 comes to a close, the stock market provided one of the year’s few silver linings.

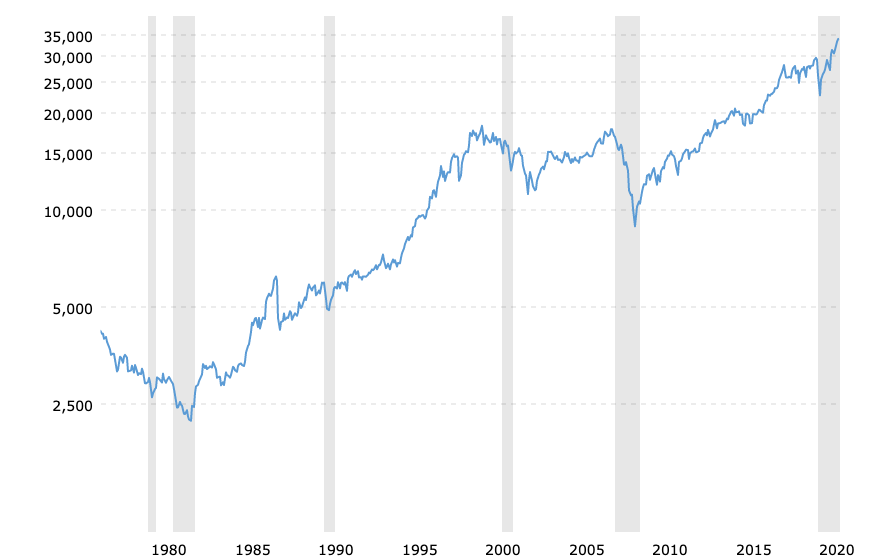

I’m going to use a few graphs to illustrate why it’s best to invest and stay invested for decades, no matter what happens to the markets on a given day, week, month, year or years.

Here’s a graph from Macro Trends showing the Dow Jones Industrial Average’s performance from 1980 to the present:

As you can see, the market fluctuates up and down, up and down, but overall, on the whole, over time, it goes up. I like to remind myself of this with the following:

Gotta gotta go down to go up.

Anytime you feel that twinge of panic and want to sell your stocks? Just remember: gotta gotta go down to go up.

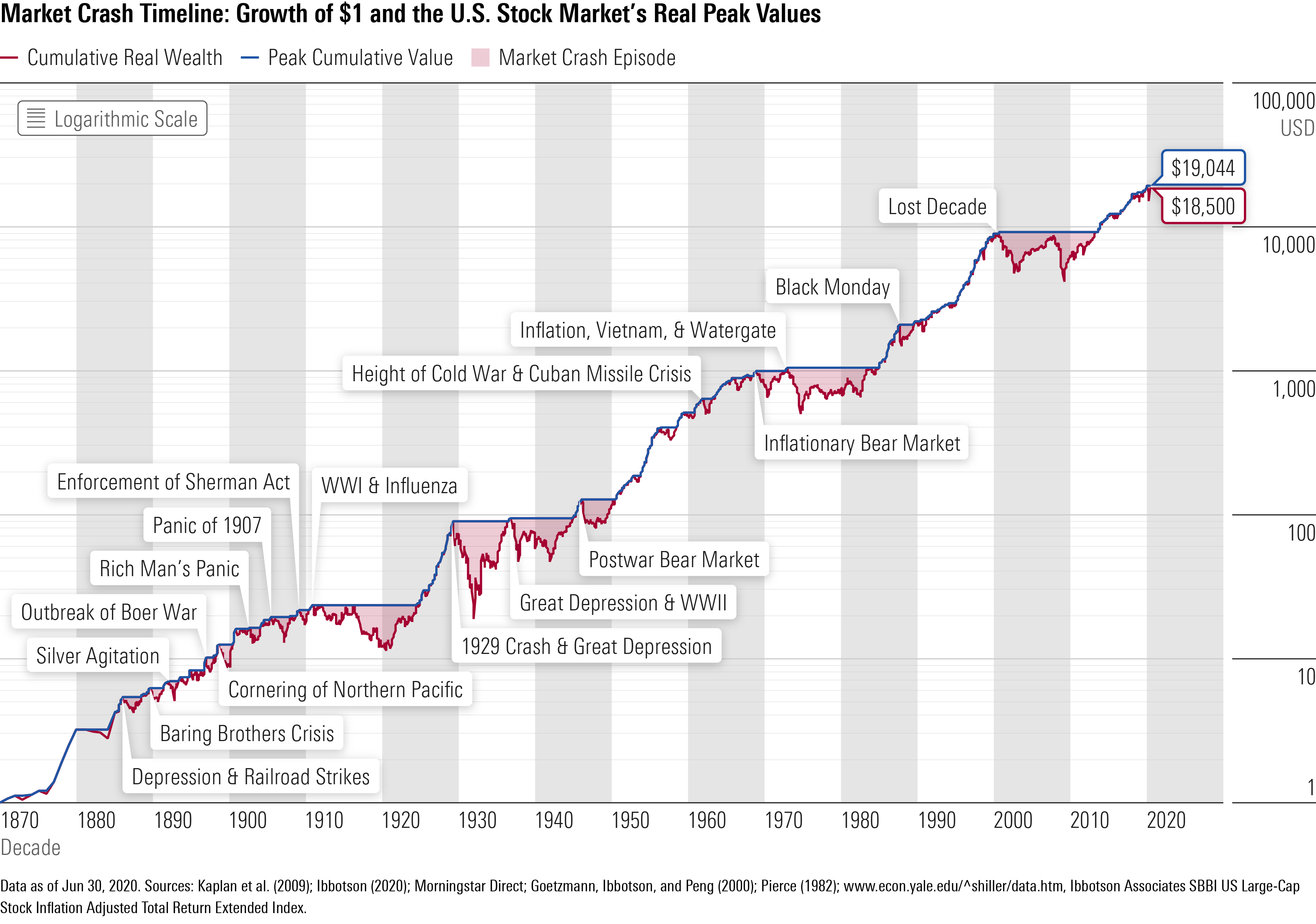

For an even broader view of the market’s performance, check out this graph from Morningstar:

As we can see, from 1870 to the present day, the market experiences dips, depressions and recessions, but eventually, it rebounds.

I like Morningstar’s assessment of the pandemic crash, as follows:

This historical stock market return data provides clear evidence that market crashes aren’t as unique as one might have thought. The term ‘black turkey’ is more apt, since they appear every so often—and this year’s coronavirus-caused crash is only the most recent example.

Given what this data shows about the regularity of market declines, it’s clear that market risk is about more than volatility. Market risk also includes the possibility of depressed markets and extreme events.

These events can be frightening in the short term, but this analysis shows that for investors who can stay in the market for the long run, equity markets still continue to provide rewards for taking these risks.

Does this mean that the market will always and forever rebound and continue to go up? Maybe yes, maybe no. All we have is historical data and past performance is not a promise of future performance, but it is a guide.

Here’s another explanation of what the pandemic did to the market, from CBS News:

It was one year ago that the terrifying free fall for the stock market suddenly ended, ushering in one of its greatest runs. On March 23, 2020, the S&P 500 fell 2.9%. In all, the index dropped nearly 34% in about a month, wiping out three years’ worth of gains for the market.

That turned out to be the bottom, even though the coronavirus pandemic worsened in the ensuing months and the U.S. economy sank deeper into recession. Massive amounts of support from the Federal Reserve and Congress limited how far stocks fell, and by August the market recovered all its losses.

As time passed, the quick development of coronavirus vaccines helped stocks shoot even higher. So did growing legions of first-time investors, who suddenly had plenty of time to get into the market using free trading apps on their phones.

It all led to a 76.1% surge for the S&P 500 and a shocking return to record heights. This run looks to be one of the, if not the, best 365-day stretches for the S&P 500 since before World War II. Based on month-end figures, the last time the S&P 500 rose this much in a 12-month stretch was in 1936, according to Howard Silverblatt, senior index analyst at S&P Dow Jones Indices.

Hence, the pandemic ended up ushering in the greatest market rise in the 85 years. Unfortunately for Erik, what this means is that he missed out on what will likely be the greatest market growth period of his entire lifetime.

To put an even finer point on it, I want to share one final graph, also from Morningstar:

Morningstar’s concise assessment wraps us up perfectly:

The market downturn caused by the COVID-19 pandemic was one of the most severe in recent history, but it also proved to be one of the fastest recoveries. This episode reinforces two important lessons for long-term investors:

- Don’t panic and sell stocks when the market crashes.

- It’s very hard to predict how long the stock market recovery will take.

Ok, everybody got it? BUY AND HOLD. Do not panic sell stock EVER. Gotta gotta go down to go up.

The reason I’m spending so much time on this is that I want everyone to feel that they have an understanding of how investing in the stock market works. The best primer on investing I’ve ever read is the book, The Simple Path To Wealth by JL Collins, a version of which is also available on his blog’s “Stock Series.”

But the past is the past and what’s done is done. So what should Erik do with his investments now?

Is the Stock Market a Magical Unicorn of Free Money?

Nope! You could invest all your money today and lose 60% of it tomorrow. There is real, genuine, actual risk in investing in the market and it’s not for everyone. Some folks prefer to keep their money in savings accounts because they cannot handle the fluctuations of the stock market. I am not telling Erik (or anyone else) to toss all your money into the market and assume you’ll be a billionaire. I am outlining the historical trends of the market and explaining long-term investing. You will have to do your own research to figure out if investing in the market makes sense for you. I link you now to this article on the worst market timer ever. Closing quotes:

Losses are part of the deal when investing in stocks. How you react to those losses is one of the biggest determinants of your investment performance.

Saving more, thinking long-term and allowing compound interest to work in your favor are your biggest accelerants for building wealth. These factors have nothing to do with picking stocks or a complex investment strategy. Get these big things right and any disciplined investment strategy should do the trick.

Get Rid of the Money Market Accounts

A money market account is essentially a savings account. Erik is correct that money markets aren’t risky, but they also offer very little reward since the interest rates are typically below 1%. This would be ok if he planned to spend all of his money in the short term, but this is not so great if you’re planning to use your money in the future. Erik’s retirement should, in my opinion, be invested in something that’s going to make him more money over time.

Let’s take a closer look at each of his accounts:

1) Retirement account through employer, TIAA-CREF: $247,892

- Erik should investigate the investment options available with this account, other than money markets.

- At age 60 and–assuming he’s in good health–Erik potentially has 40 years of life ahead of him. He may want to get his money working for him so that he’ll have enough to carry him through retirement and old age.

2) Beneficiary IRA:

- I suggest Erik roll this over into an account that he controls. I strongly, strongly, strongly suggest he move away from using LPL Financial to do his investments for him because, frankly, they’re screwing him over. If it were me, here’s what I would do:

- Call Vanguard and tell them he has a Beneficiary IRA with another company that he’d like to roll over. I’m saying Vanguard because Erik already has an account with them.

- Explain that it was inherited from his father and ask Vanguard what they suggest he roll it into.

- The reason–and need–for this conversation with Vanguard is that Beneficiary IRAs have some quirky and specific rules governing them. Vanguard should be able to help him figure out what he can (legally and profitably) roll it over into.

Get Rid of LPL Financial

While Erik notes he’s only paying LPL Financial a $40 annual maintenance fee, he’s actually losing a fairly exorbitant piece of his inheritance to them by way of Expense Ratios. This right here is one thing that I–pardon my vitriol–really HATE about traditional financial advisors. They conceal their fees under the guise of “investing in your best interest” and “monitoring the global markets to keep you competitive” when in fact? They’re just taking your money.

What Is an Expense Ratio?

Expense ratios are the fees you pay for the investments you hold, which are listed as a percentage. You want a low expense ratio, so that you’re not losing a ton of money to fees. Many a shady stock broker has raked in millions by charging high fees. When choosing a brokerage and a fund to invest in, it’s imperative to evaluate the expense ratio. Why on EARTH they can’t just call them “fees” is beyond me. Oh wait, I know why, because then people would realize they were getting screwed.

The bad news is that the stuff LPL Financial has Erik invested in has criminally high expense ratios:

- The MFEGX (MFS GROWTH CL A) has an expense ratio of 0.87%

- OPPAX (INVESCO GLOBAL CL A) has an expense ratio of 1.06%

- MWEFX (MFS GLOBAL EQUITY CL A) is at 1.16%

- MFIOX (MFS INCOME CL A) is 0.76%

- …ok I got too depressed googling these expense ratios and just stopped, but we’ll assume the rest are as astronomical

For comparison, Fidelity’s Total Market Index Fund (FSKAX) has an expense ratio of 0.015% and Vanguard’s Total Market Index Fund (VTSAX) has an expense ratio of 0.04%

I realize that these percentages sound meaningless and similar, but they add up to real money when you’re talking about hundreds of thousands of dollars.

To figure out how much Erik is losing to fees, I used this handy mutual fund calculator from Nerd Wallet. I input the total amount Erik has in his Beneficiary IRA, along with the expense ratio of 1.16 and learned that he’s losing around $1,366.20 PER YEAR in fees to LPL Financial, plus the $40 annual fee they charge for a total of $1,406.20 annually.

By comparison, if Erik had his Beneficiary IRA invested in Vanguard’s Total Market Index Fund (VTSAX), with an expense ratio of 0.04%, he’d spend $47.11 annually in fees, which is $1,359.09 LESS than he’s currently paying LPL Financial. Again, you might cry “small potatoes!” But, over the course of an investing lifetime, which in Erik’s case could be another 40 years, that’s $54,363.60 he’ll save if he switches over to a fund with a low expense ratio (and it would actually be even more money saved because as your money grows, the expense ratio gobbles up more and more).

3) Money Market Account: $104,210

If it were me, I would invest this money into something that delivers a return. In order to better understand his options, I recommend that Erik read the book, The Simple Path To Wealth by JL Collins (a version of which is available on his blog’s “Stock Series.”) Investing would allow the possibility for Erik’s money to grow over time, as opposed to stagnating. Might he lose money in the market? Absolutely! Did we just do a ton of cool charts and graphs about how the market behaves over time? We did. I will note it’s convenient that he already has an account with Vanguard…

4) Cash (checking and savings account): $84,964

In some instances, I would say this is too much cash to have on hand (because checking/savings/money market accounts aren’t earning interest and aren’t keeping up with the market), BUT, in Erik’s case, he may actually want to keep this money liquid.

The reason I say this is that he expressed interest in potentially changing jobs and/or moving. And if there’s one thing that moving always is, it’s expensive. Given the potential for change and volatility in Erik’s near future, I think it probably makes sense to keep this money liquid at present. Once he settles down after moving/changing jobs, he might consider investing a chunk of this.

It’s prudent to always keep an emergency fund in a checking/savings account, but beyond that, he could consider investing it. Again, not investing money = the opportunity cost of losing money over time. An emergency fund is typically three to six month’s worth of your expenses. In Erik’s case, since he’s not 100% sure of his monthly expenses, he should round up to be safe. Monthly spending of $2,946.58 x 6 = $17,679.48, so let’s say round that up to $20k for safety.

Move The $84K An Account That Earns Some Interest!!!

I gotta say, I am super unimpressed with Erik’s University Credit Union. Their credit card offers no rewards and their savings account offers the tragic interest rate of 0.1%. I mean seriously, Credit Union, what are you doing here? Nothing helpful. While no one is going to get rich on the interest earned from a savings account–that’s what the stock market is for–you can at least earn a tidbit.

An account I like is the American Express Personal Savings account, which–as of this writing–earns 0.40% in interest (affiliate link). If Erik put his $84,964 into this account, he’d earn $340 PER YEAR in interest as opposed to the $0 he’s earning with his current checking account. Again, these percentages all seem sort of small and meaningless, but they add up over time.

Debts

Erik, pay these off today! With $84k in cash, there is no reason to carry a $7,812.35 debt load. Pay off the car and the credit card right now (seriously, this minute) and don’t go into debt again.

Credit Card

Erik noted that his credit card earns no rewards, which is sad times! There are tons of no-fee credit cards that offer awesome travel or cash back rewards. As long as Erik can commit to paying his card off in full every single month–with no exceptions–he should consider getting a card that earns him some rewards! Here’s a post I wrote about how to do this: The Easiest $486 I’ve Ever Made: How To Use Cash Back Credit Cards To Your Advantage.

And here are a few cards for Erik to consider:

1) Blue Cash Everyday® Card from American Express offers a hierarchy of cash back percentages:

- 3% Cash Back at U.S. supermarkets (on up to $6,000 per year in purchases, then 1%)

- 2% Cash Back at U.S. gas stations and at select U.S. department stores

- 1% Cash Back on other purchases

- Earn 20% back on Amazon.com purchases in the first 6 months of card membership (up to $150 back)

- Earn $100 back if you spend $2,000 within the first 6 months of card membership

2) Capital One Quicksilver Cash Rewards Credit Card:

- Unlimited 1.5% cash back on all purchases

- Earn $200 if you spend $500 or more in purchases within the first three months of card membership

3) Capital One SavorOne Cash Rewards Credit Card:

- 3% cash back on dining and entertainment

- 2% at grocery stores

- 1% on all other purchases

- Cash back won’t expire for the life of the account; no limit to how much you can earn

- Get $200 if you spend $500 on purchases within the first three months from account opening

- 5% cash back on travel purchased through Chase

- 3% on dining at restaurants and drugstores

- 1.5% on all other purchases

- No minimum to redeem for cash back, rewards do not expire as long as your account is open

- Earn $200 if you spend $500 in your first 3 months from account opening

If he’s more interested in travel rewards, a lot of people love the Chase Sapphire Preferred

(note: these credit card links are affiliate links).

Erik’s Question #4: I don’t know how to figure out how much money I need

Part of this answer stems from figuring out how much money he spends. It’s impossible to calculate what you’re going to need if you don’t know what you’re spending. A person can live happily by spending $45k per year; a person can feel that they need to spend $2M per year to live happily. In order to figure this out, I recommend Erik start tracking his expenses in a serious way. He has the basic outline of his expenses, but he noted that he doesn’t track his spending on a granular level. I use and recommend the free expense tracking software from Personal Capital because, well, it’s free and it works and it’s easy to use. Here’s a more detailed explanation of how I use Personal Capital (note: these Personal Capital links are affiliate links).

Retirement Calculator

This is imperfect, but, I’m going to use Fidelity’s (oversimplified) rule of thumb to give Erik some context:

Fidelity’s rule of thumb: Aim to save at least 1x your salary by 30, 3x by 40, 6x by 50, 8x by 60, and 10x by 67.

By that metric, Erick should have 8 times his salary saved at this age, which would be $393,792 ($49,224 x 8). At present, his assets stand at $554,841.69, which means he’s in great shape! One of the major caveats I have is that Erik’s rent is really really really inexpensive. This is awesome! However, it does give a distorted sense for how much money he might need in retirement should he require long term care, a nursing home, a home health aide, etc.

I’m a big fan of online calculators and I suggest Erik play around with Engaging Data’s Post-Retirement Calculator to determine whether or not he’s likely to run out of money in retirement.

I think his ability to retire will hinge, in part, on what his Social Security benefits are and if he’s willing to remain as frugal as he is now.

Career and Lifestyle: Get to Dark Skies!

I’ve spent a lot of time on the mechanics of Erik’s finances and I want to close with a discussion of his lifestyle and career. I hear, and understand, his desire for a quieter, more rural area with dark skies (hmmm, sounds where I live….. ) and I want him to be able to do that.

I envision several options:

1) Stay at his current job at least until minimum Social Security age, which is 62, but ideally a bit longer. The reason I say “longer” is that Social Security benefits increase with age (and depend on the year you were born). In other words, the longer you wait to start collecting Social Security, the greater the amount will be. Focus on saving money and researching places to move after retirement.

2) Determine if the rural land arrangement with his second ex-wife is a real option. If they want to do this, they should probably do it sooner rather than later. At the very least, if they want to do this, I’d start researching locations and land prices ASAP. Building from scratch on rural land is more expensive than buying an existing rural home, so they may want to reconfigure their thoughts on that. There’s a reason why we didn’t build our rural house. The cost of putting in a well, a septic system, a driveway, running electricity and internet to the house… there’s a huge list of expenses with rural building before you even consider the cost of the home itself.

Of course, the more rural you’re willing to be (i.e. no running water, no electricity, no internet), the cheaper it is. I will note that there are quite a few unique properties in Vermont with multiple homes on them–Mr. FW and I seriously considered buying an old commune that had several buildings on the land, including an awesome yoga yurt (I really wanted that yoga yurt… ). In looking around, they very well might find something already built that’ll suit their needs.

In terms of employment, could Erik work remotely for his current employer? Say from a yurt in the woods of Vermont? I mean, I’m sure there are other states they could move to, but Vermont has some really dark skies… ;). If remote work is not an option with his current employer, another idea would be to….

3) Start job searching at universities in small towns with rural adjacent communities.

Universities often value age and experience in a way that tech employers don’t and, since he has so much experience, he might be able to easily parlay that experience to another university. There are plenty of world-class institutions close to dark skies and cheap housing…. Dartmouth College, Middlebury College to name a few. But seriously, there are plenty such institutions around the country, not just in New England.

The caveat here, yet again, is that Erik’s rent is so low that I kind of doubt he’s going to be able to find something as cheap to buy or rent. It’s also not the greatest time to be buying a house, since the housing market is white hot at the moment, but the middle of the country might have deals. Alternately, continuing to rent might be a great strategy. There’s no rule that a person needs to buy a house in order to be financially stable. Erik is a very financially stable renter and that might be a great long term strategy for him.

4) Erik mentioned the possibility of living abroad and, in my opinion, he should travel abroad but not move abroad. Seems it would be far easier and less expensive to find a better location fit in the US and then do extensive travel abroad.

Summary:

- Calculate his expected monthly Social Security payments by following these instructions on how to retrieve his earnings tables from ssa.gov

- Determine his eligibility and anticipated premium amount for Medicare by following these steps on the government’s Medicare website

- Stop taking investing advice from his friend. While I have no doubt Erik’s friend is well-intentioned, his advice caused Erik to lose out on the greatest stock market increase in 85 years. If Erik had remained invested in the market, it’s possible he’d have double the amount of money he does today.

- Move his investments out of money market accounts. And fast. Every day of delay is a day he’s missing out on potential growth in the market.

- Call Vanguard (because he already has an account with them) to discuss his options for rolling over the Beneficiary IRA into a Vanguard account. Be explicit about the type of IRA this is and ask for a menu of options for the rollover. Google every term you’re unsure of (that’s how I learned all of this!). Then, roll the account over and FAST. The faster Erik can get away from LPL Financial, the better off his investments will be for the long term and the less money he’ll lose to fees.

- Keep the $80k in cash for now, but consider investing what’s not needed for his emergency fund in the future, after any potential move/job change has settled out. Move this money into a savings account that earns interest, such as the American Express Personal Savings account (affiliate link).

- Pay off the $7,812.35 in car and credit card debt immediately.

- Get a credit card that earns either travel rewards or cash back (affiliate link). There’s no reason to use a credit card that doesn’t earn rewards (as long as you can pay it off IN FULL every single month. You don’t pay the “minimum amount due,” you pay the full balance every month).

- Start tracking his expenses using either the free service from Personal Capital or some other systematic approach (affiliate link). No more guessing!

- Start researching universities in rural areas with dark skies. Apply for open positions and see where that takes him.

- Have a serious conversation with ex-wife #2 about the potential of going in together on rural property and land. If that’s the path, start researching and do it soon! Explore the feasibility of either: a) remote work with current employer; or, b) employment with a rural-adjacent university.

- Enjoy and keep us posted!

Ok Frugalwoods nation, what advice would you give to Erik? We’ll both reply to comments, so please feel free to ask any clarifying questions!

Would you like your own case study to appear here on Frugalwoods? Email me ([email protected]) your brief story and we’ll talk.

Absolutely pay off the debts now. Rural-ish living with a university job sounds like a good compromise. I like that Liz took the ex wife commune thing seriously, and I think it’s a good idea to give that proper thought because if it’s an option you seriously consider, now is the time to do proper prep. And if it isn’t, don’t let it hold you back with a ‘something will sort itself out’ shrug. I don’t mean to be rude, but the ‘something will turn up’ idea appears too much in my head so I’m telling me as much as you!

You remind me a bit of my brother who gains qualifications for fun and is building his second house in semi-rural Canada after emigrating from the UK a few years ago. Your dreams of astronomy somewhere without light pollution sounds wonderful.

I wonder if there might be something about picking 1 or 2 hobbies and learning experiences, as it seems like you have a few at the moment? For example, do you need duolingo and caving and astronomy right now? Perhaps dropping one would save money and also give you time to do some prep work for the future like investigating places to live? Again, I’m telling me as much as you 🙂 as I want the answer, but the research feels boring.

I spent 2 years building up the courage to join the stock market after reading various blogs (very much including Frugalwoods!). In a complete coincidence I bought in in the middle of March 2020, mostly because Liz had been in my head for years telling me that it didn’t matter what the market does, I should be in it for the long haul. That turned out to be a great idea, but I really try not to look at it much or think of it as money that I have access to, as it’ll drop and scare the heck out of me at some point. I’m looking to buy a house at the moment and really have to try hard to not think about the investment money.

Good luck!

Thanks! I had somewhere along the line gotten the idea that it was better credit-score-wise to have a debt (like the car loan) and pay it off slowly rather than in one lump, since this — I guess — demonstrated reliability or somesuch. It seemed counterintuitive but wouldn’t have been the first counterintuitive money-thing I’d encountered. But it sounds like I should just pay it off …

You are spot on about the number of, uh, enthusiasms I have. The reality is worse — I have many more — but on the other hand since I’m not terribly active in any of them they aren’t really costing me much.

How about looking for a job in a cheap part of Europe. Portugal has cheap housing, university and free healthcare. But there are lots of countries/places offering that. If retirement in 3 years, look about retiring in a country with a pensionado rule, where you don’t pay taxes. To me 1400$ a month for a one bedroom appartement is absolutely outrageous. But first pay off your car.

Thanks. I have indeed heard great things about Lisbon.

the only thing I’d say is that as someone about to enter his 60’s, with hopefully many happy years ahead, the fact is that health issues do start to accumulate as one gets older. Hopefully these will be minor and manageable, but given his desire to go quite rural / off-grid, somewhere within striking distance of solid medical support would be a good idea. I know various different people who retired / escaped city living at relatively older ages and 10-15 years into it, the bane of their existence is often the 3 hour round trip to the *only* rheumatologist / cardiologist/ nephrologist for miles around, or worse, in need of dental care and it being a total odyssey to get to anything beyond very basic care.

Basically, factor in the boring medical side of later life before choosing where you go for your Dark Skies life (which sounds fantastic by the way!).

Caroline – definitely. I’ve already had a few reminders of how body parts wear out since moving here in 2008. I won’t go into details. I’m glad I’m still relatively healthy. Thanks.

Lots of good recommendations made already but a few top of mind thoughts from me:

-You’re in better shape than you probably realize since you do have some money saved up and you seem to live frugally

-Get your money out of money market and savings accounts ASAP and invest them in low cost mutual funds

-At your age, you can actually start accessing 403b and IRA funds immediately without penalty (you said you’re 59. You can do this if you’re >=59.5)

-You’re pretty close to Social Security retirement age and given your frugal lifestyle, SS might cover a significant portion of your living expenses

-In the Northeast, you’re likely to find some more help with health insurance than other places. I’m not familiar with New England states but in NY for example they have something called the Essential plan which is very affordable if you meet the income requirements

-In general, I would recommend reading up more on FIRE, looking into taxes and health insurance topics and then if you feel you need more help, go talk with a fee only advisor and tell them what it is you’re trying to achieve

-Bottom line, you can probably move somewhere rural and work part-time or no-time sooner than you think. Good luck!

I loved reading this, it’s very encouraging. Thank you so much.

What is FIRE?

Erik, FIRE is the acronym for Financial Independence/Retire Early

Wonderful advice; best of luck to Erik actioning this! A word about health insurance over 60: the ACA offerings vary in price state to state but are quite pricey in the 60-65 age group. I believe it was $800./month apiece for us at age 64 a couple of years ago, for a Bronze plan with $7000. deductable and higher out of pocket. At least insurance is available if not affordable! Medicare is much cheaper with lower deductables. If you can get a job offering health insurance, that would be ideal. We were retired during our early 60’s so paid out of pocket.

Also, SS will ding you if you take it at age 62 and are still working; I think something like $0.50 on the dollar. That goes away at 65 when you can keep the total SS amount plus anything you make on the side.

The SS offset to earnings only goes away when a person reaches their full retirement age. For most people that is a couple of years after age 65.

It is so true about the cost of healthcare through the marketplaces after 60 but before Medicare. I was laid off at 62 due to Covid.While I conceivably could have retired early based on my savings. However when I looked at the cost of health care for the next 3 years I went back to work and half my salary –but it was worth it to avoid paying $700 a month with a steep deductible for the next 3 years. Preserve those savings!

Yes to the health insurance- I used to work for an insurance company and prices on the open market were astronomical in the 60-65 age group. Hundreds of dollars for pretty skimpy plans. If you can stay on employer-sponsored health insurance until 65, your options are SO much better. The best Medicare supplement is still usually hundreds of dollars less per month than the worst individual plan on the open market.

Biden opened an ACA special enrollment period and health insurance is capped at 8.5% of income, removing the penalty for going over the 400% income ACA cliff, for a couple of years. There’s a move in Congress to make this change permanent. One of Biden’s campaign promises was to bring Medicare down to age 60. We’ll see what happens with this…Since you work at a university, you should check on their retirement/pension options. You might even qualify for cheaper retirement insurance or other perks with the university.

Erik – I have no idea if this would be helpful or interesting to you but thought I’d throw it out there. My family and I live in the northern-most mountains of Western NC not far from Boone and ASU. Based on your interests, it sounds as if you would love it here, too – every kind of outdoor activity you can imagine, a great university and skies so dark you cannot see your hand in front of your face most of the time. If you would consider a big move, this area might appeal to you. Also, I am guessing the cost of living would be less than you are used to. Best of luck in your journey!

https://dso.appstate.edu/

I second this. The biodiversity of the North Carolina mountains and the proximity of dark skies plus a number of colleges… It could be a good place and housing is not expensive. Lots of “crunchy” types if that is you, esp. in places like Boone and Black Mountain, etc.

Plus… as a caver… you’re closer to TAG and WV….

Katharine – YES to TAG and WV!! My grotto did (I’m not sure they still do) a yearly WV trip. The best!

Erik might want to check out the “Caretaker’s Gazette” for cheap living arrangements. It’s basically a classified ad publication for people looking for things like short or long-term house or pet-sitters, or more long-term opportunities for help on “estates.” There’s a great variety in each posting, and sometimes they just want someone to help with property maintenance in exchange for lodging. And bonus- there are always international listings! If nothing else this might be a way to try out international living for a few months with affordable lodging to see if you like a community before fully committing. Or – Erik could use it to find someone to watch Oort Cloud while he travels abroad!

Sara – thanks so much, I will definitely check this out!

Hi Eric, you seem like a really cool guy! What about a tiny house? They can be cheap, you can plonk it down on a piece of land but also move it of necessary. Check out the Youtube channel ”Living big in a tiny house” for tons of inspiration. Good luck!

I am definitely interested in tiny houses. Thanks! I just need to look more into ’em.

Eric

I live in Pennsylvania ( Pittsburgh)and while house prices have been going up, it is still an affordable place to live.

And you would love all the Universities ( CMU for example) and nature all around the city.

As to moving to Europe : this has been a dream of mine for a while as I am born in Germany and lived there for the first 30 years of my life and have family there. I just came back last week from a 4 week stay and I can honestly say that I could not live there anymore ( I also spent a year in Germany about 20 years ago – gladly moved back to the States- there are no friendlier people.)

As to your resources: if I had your kind of money and savings, I would retire today and just do what I always wanted to do which in my case is writing.

I feel that you are doing pretty good financially but I understand the advice about the stock market. If I would have left the money in that I invested 4 years ago, it would have doubled.

But I don’t know much about the stock market but a lot about the real estate market – so I invest in houses.

If you want to explore beautiful pennsylvania, my boyfriend and I would be happy to show you around.

One of my 4 homes is empty right now until June 30 and you could stay there – it is fully furnished and very nice.

” if I had your kind of money and savings, I would retire today” – yep. If I can find an advisor who can show me the way to manage this … I tell you, it’d be astronomy and poetry all the way.

I love Pittsburgh, by the way, and PA in general. My 2nd honeymoon was in Pittsburgh! 😀 Also, my last girlfriend and I accidentally discovered this amazing small town tucked away in Eastern PA a couple of years ago: Bellefonte. I still think about that place!

Totally agree about living near a rural college/university. Might I suggest rural upstate NY? Tons of state(SUNY) and private colleges with a low cost of living as long as you aren’t trying to live on a lake. Plus very dark skies if you are in a place like the Adirondacks and the scenery ain’t too bad. Also Central NY/Mohawk Valley is a place with VERY low cost of living and a decent number of colleges.

Good luck, Erik

Jimfectious. I love upstate NY. My one college teaching job was at a SUNY school. That was a great year!

I agree with all of the above. However, I might research other countries as options. My son is a recruiter living in Germany, and we had a conversation just yesterday about the cost of US housing/living vs. what it takes to live comfortably in Germany and other EU nations. He was speaking from a young adult’s perspective (not as a retiree). Worth a look!

Rebecca – thanks. I am definitely keeping my options open. Fortunately I seem to be pretty good at languages … my trip to Germany was originally intended to include the Czech Republic as well, and I was groovin’ on the Czech language! 🙂

I really appreciated hearing this story, since it reminds me of where I want to see myself someday–surrounded by books and many different fun projects out in the woods. I think it’s a gift to be interested in so many things, although sometimes I struggle with whether my work is really in alignment with my identity since I’m I have so many different passions. (Should I have tried to go to art school? Or leaned into botany?) I guess if you have so many passions it’s impossible for work to capture all of them. Anyway, no advice, just glad to hear a story that resonated!

A – another thing to consider is whether one actually wants work and passion to mix at all, that is, in the workplace. As mentioned in the profile, I once wanted to be an astronomer, and that’s made working FOR astronomers … a bit of a double-edged sword at times. And I certainly would never want to wind up disliking astronomy because a job went sour! I’m glad I went and finally got a degree in it, even though since it’s not a Ph.D. it doesn’t really ‘mean’ so much where I currently work.

I also often wish I wasn’t interested in … SO many things. But it’s certainly never boring.

I agree strongly with your first sentence, Erik. Not because I think work necessarily sours you on your passions, but because I found that when my job was doing what I love–writing–I completely stopped writing for myself. After a workday of doing it, there’s just nothing left in the tank. I’m a big fan of doing jobs that you like just fine and having the energy around work hours to do what you love.

A – have you read The Midnight Library? An interesting look into the exact internal conflict you’re having 🙂

It seems Erik is a bit of a dreamer and travels on a different plain that most of us. As such I doubt he will following financial recommendations. I suggest he hire a fee based advisory to look in detail at his investments and retirement plans, tell him the reality of it all and set him on a path that he can follow with minimum decision making. I would also encourage him to look for work that he can enjoy as a priority over the compensation and something that he can continue even in retirement on a part-time basis. Perhaps even related to the theater or arts. That weekly counseling fee he pays can be a hefty burden in retirement. Is the $100 net of insurance coverage? Medicare only covers these services is they are provided by someone who accepts Medicare assignment.

Hi Richard — yes indeed, spot on with “dreamer,” but I do hope to add some financial knowledge and grounding even at this late point in my day. You’ve got some great suggestions for me here — thanks!

You may also want to consider property tax rates when choosing a place to live. You could save thousands of dollars a year in retirement on that alone. I think being happy with where you live is more important, but it could be worth seeing if you can get the best of both!

Amanda – great point. Thank you!

The reality is that Erik’s retirement assets (including money market funds) can be reasonably expected to generate only about $19,500 in annual income AND that assumes he is invested in a way that can be expected to earn at least 6% per year which is certainly not the case. Are we sure he has no pension from the institution? Assuming a gross pay of $60,000 a person retiring today at age 62 could expect roughly $13,368 in SS benefits. That means that a good starting point to think about is a gross retirement income in the area of $33,000 per year. Erik needs to build his assets over the next several years.

Fellow academic here. My path is similarly complicated; I started in the health sciences, picked up a couple of degrees in theology, and now teach at the (very liberal) seminary of a large, secular university. It’s a great gig and I love what I do.

But there’s the thing, I don’t get the sense that you love what you do, or love where you live. You have diverse interests and are clearly very talented. Can you parlay those skills into a unique mix of employment and lifestyle that allows you to live the life you envision. I agree with Liz that you might want to explore possible teaching gigs at universities or community colleges in smaller, more rural communities – particularly because you are comfortable living a low-cost life?. You could teach any number of topics including creative writing, drama/theatre, or some creative combo of sciences/humanities. Could you augment your income with some kind of coaching or creative side gig? I have a great friend who works with me at the seminary, but has a side hustle coaching writers working on screenplays (she has a MFA and a background in film).

Also, do you like being a hermit, or do you crave community? If it’s the latter, do you explore some sort of co-op or communal living arrangement in your new locale?

My one more conventional thought would be to get a recommendation for a good financial advisor. That’s made the difference in my more complicated journey.

I suppose my point in all of these thoughts is that you are clearly an out-of-the-box kind of guy. My guess is that you could find an out-of-the-box answer to your dreams, rather than working a more conventional job in IT in a city you don’t really love.

I was thinking just what you are and what came to my mind was he should start his own YouTube channel!! I’d totally watch it. He has so many interests & is a very interesting guy and YT can earn you a very good income IF you do it right. My advice? Erik should document his journey because so many people would love to go along for the ride who only dream of living this multi-passionate life that Erik has! He can at least make 20K-40K from YT at the lower end & since he loves to learn (I totally understand this one & only $ has stopped me from more formal education, I have my Master’s) he could probably pick up the whole YT world quickly, plus there’s plenty of how to’s on YT. It would be a win-win, creativity, it’s mobile & $.

Daisy — 100% yes. I need to apply what creativity I have to areas where I’ve failed to so far do so: career, finance, and more.

Where I currently work I’ve sometimes thought I could offer coaching services to scientists since their presentation skills are not always the best — in some ways the stereotypes are true: Q: how do you know you’re talking to an extroverted physicist? A: he looks at the tips of YOUR shoes.

I have — probably incorrectly — assumed that academia was out of the question for me, since I got my Ph.D in 1992 and have only published minimally (mostly book reviews, things like that). I suppose it’s possible that somewhere there’s a small college in need of someone who can teach both acting and observational astronomy! 😉 You never know.

And yes, you and Richard are correct: I do need a financial advisor. I’m hoping I can still learn how to be more financially responsible, but I could really use the brainpower of someone who has dedicated her life to this kind of thing to get me started.

A quick note, Erik, make sure that you hire a fee-only fiduciary as a financial advisor!

Hello!

Vanguard should discuss this with you but just in case-

Please make sure to take into account how the SECURE Act of 2019 changed beneficiary IRA distributions. It is likely Erik will be legally required to take all of the money out of the account within 10 years of the date of death.

Hope that helps!

That depends on when he inherited the IRA

My Dad passed away in April 2019. I need to research the SECURE Act implications.

The new beneficiary IRA 10-year rule applies to relatives who passed away as of Jan. 1, 2020. So it doesn’t apply to your situation. You do have to take a yearly RMD going forward based on the amount in the account on Dec. 31st. Schwab has RMD calculators, including one for beneficiary IRAs. If you don’t take the RMD, the IRS has a heavy penalty.

It was signed into law December 20, 2019 and took effect in 2020. So I doubt he has to be concerned.

Move to New Mexico! Tons of space jobs, the darkest skies in the nation, low cost of living, and no traffic. Get on board with a government contracting company and you’ll plenty of opportunity and great benefits. 350 days of sunshine per year with the only International Dark Sky Sanctuary in the nation.

Derek, I think there are a couple other International Dark Sky Sanctuaries in the US including Rainbow Bridge National Monument in my home state, Utah. But with Erik’s interests, I also immediately thought “move to the West”!

There’s a brand new Dark Sky Park in Maine, too!

That was my immediate though too, Cathy – Erik, you need to come out West! It it obvious that you HATE Boston, and I don’t blame you. I think you might find a lot of what you love, including job opportunities, out West. Even the big cities (excluding, like, L.A.) are more dark-sky friendly, and there’s a ton of outdoorsy stuff within a reasonable distance of almost any city. Utah, New Mexico, Arizona, Oregon…there might be someplace that really strikes a balance of affordable living, available jobs, and access to the kinds of things you love.

I was going to suggest New Mexico! And we have caves, too. Plus lots of academic and scientific job opportunities. And tiny houses, and hiking, and outdoors, and not a lot of traffic.

I think this advice is fantastic! If I were to put myself in your shoes, I would probably consider investing my cash in the stock market for long term growth. No one likes to see their hard earned money go up and down, subject to the stock market’s volatility, but unfortunately that’s simply part of the game. As long as I look into the long-term and focus on my ultimate goals: preserving wealth and capital appreciation, I think I would be OK in seeing the value of my invested money fluctuate. The only caveat here is that I would be sure to set aside an emergency savings fund with 3 to 6 months’ worth of liquid (cash) living expenses so I could always draw on that cash during difficult times.

Good luck on your journey!

Cheers,

Fiona

Fiona – thanks. I think my first step is to put everything back where it was before the 03/2020 dive. My Vanguard funds were in an index fund and the TIAA-CREF funds were in what they call a “Lifecycle” fund that targets a particular retirement year.

After that – 1. get a financial advisor and then 2. move the stuff that’s with LPL to Vanguard, where I can have more influence over it.

A word of caution. We don’t know for sure, but he may have missed the bulk of the bear market and putting a large sum into the market today may mean a period of time with low or no growth, so be prepared and don’t panic if it happens. Diversification in investments will be crucial as will at least a five year horizon.

Yes to this! Can’t time bulls and can’t time bears.

He could roll into a money market and then dollar average (or other strategies). All is not lost.

Richard – I figure I probably have, yeah. :/ The friend mentioned in the article really is … well, brilliant. He has charts to match anybody’s charts and I often had a hard time following what he was trying to demonstrate … and it’s not like he hasn’t done well for himself and his family! I am taking it as evidence that no one can “beat” the market … which is not to say one can’t do well.

I will add a comment here that if you can’t understand what someone is telling you about investing or your finances, probably don’t do it! All of this is google-able and understandable. Erik, you’re a brilliant person and will have no trouble discerning what to do. When/if you meet with a fee-only fiduciary financial advisor, feel free to stop them and ask for a definition anytime you don’t understand what they’re talking about. This stuff is not mysterious, it’s math!

Mrs. F – thanks. I joke that I’m good at math until someone drops ‘$’ signs in front of the numbers, but … it’s a joke. There really is no reason that I can’t fathom this stuff as well as anyone.

With his coding skills Erik ought to find a job working remotely—if he is sure he would like being outside an office and would be productive. But you actually have a job supporting astronomy already (!) so maybe stay where you are until retirement and find an astronomy club to join and buy a small van to travel to meetups.

Meanwhile you would have some years to plan retirement. The Southwest US is full of amateur astronomy enthusiasts, so New Mexico is a great idea, Nevada a better one if taxation is a factor. Many live out of RVs, perfect for moving around for astronomy club meetups. Only risk is all that expensive gear behind a flimsy door. BTW, most astronomers I know spend a lot on cameras, software and telescopes which I don’t see in your budget. The ex-wife co-housing idea sounds kind of risky to me, you did divorce after all and you are both still young enough to find other partners.

The talk at my workplace (and probably a lot of workplaces) is that the last very weird year+ has proven that many of us CAN do our jobs remotely. So I’ve floated the idea to my bosses of my moving further away. I haven’t pushed the distance factor very far (I don’t know that they’d go for me being more than, say 3 or 4 hours away, but who knows?).

Of course, last week my remote setup got seriously hosed on the work end (nothing I had done) … and I sat for a couple of days thinking “yeah, I hope this doesn’t shoot the whole ‘I can work remotely just as well’ thing in the foot …!”

You mention the cost of equipment and that’s a consideration. I long ago put photography into what I call, at the risk of being crude, my “f*ck-it list” — it’s the list of things I have admitted to myself I simply don’t have time enough to get to, given everything else. Also, I’m ostensibly anyway a telescope maker, which lowers the cost of those … now if I can only find a living situation where I can have a workshop …

Derek, you’re a unique individual. How refreshing you are (at 66 I am contemplating going back to school for another degree, so I understand that). I actually think you underspend on your books habit, and I think you have done a great job of saving. I’m actually five years older than you, and I will caution against relying on the largesse of the Medicare system. I have parts A (free), B (mandatory payment of $200 a month), D ($16/mo) and G ($104/year which covers all deductibles, co-pays and gaps after an initial $300 copay). It goes up in cost every year. $320 is a lot for Medicare, but of course, the coverage is excellent, and it’s still a lot cheaper than insurance. Still, it’s an expense that needs to be planned for. That said, I live in an urban area also, and I see the $1450 apartment in Boston as a good deal. I agree with the commenter who suggested New Mexico.

” I actually think you underspend on your books habit.” Now THAT is the last thing I expected anyone to say! 😀 I have some catchin’ up to do …

Many thanks for the cautions re: Medicare.

Since astronomy is your passion and you feel stuck, get out of Boston ASAP. Go somewhere with access to observatories and clear night skies. Arizona is home to Kitt Peak, the Mt Graham Telescope (there are actually 3 up there) and the Lowell observatory. (I’m biased toward Arizona because I live here and love it). Arizona is becoming more progressive, particularly in the cities like Tucson and Flagstaff. You could probably work at one of the universities and get a PhD in astronomy for little to nothing. The salary you would make, plus returns from your investments would allow you to live quite comfortably. Remember you also have social security coming soon. But you definitely need to take a look at your expense ratios and choose some lower cost index funds. And those money market funds and near 0 percent interest rates are actually loosing you money to inflation. Bonds are lower risk but provide more returns. So to summarize, leave Boston to follow your passion. Good luck!

Erik, it seems more like you are in good shape financially but in need of a tribe and some adventure. Not very frugal but honestly, before buying a place in the country I would consider toughing it out for 5 more years while going on some epic quests (10 best astronomy labs? Hello ifa! 10 best book stores? A week in Portland with daily trips to Powells). You would probably meet interesting people or find interesting semi-retirement work while exploring. Then, once you find your spot you could set up from there. It can cost more to buy a place, move there, and decide it is not for you. Good luck to you whatever you decide.

Erik I agree with Dominic. My first thought in reading the cas study was Arizona because of the great astonomy community there. Tucson or Flagstaff are both wonderful places to move to, make new friends, get a new career going, and explore the new landscape.

Dominic – I love AZ. About 20 years ago, when I first started getting back into astronomy, I took some time off and spent a few days at an “astronomy bed and breakfast” at an observatory SE of Tucson (I think the nearest town was Benson). It was fantastic. The B & B no longer exists, though the place is still an observatory.

Erik – I too live in metro Boston but it’s much darker here. Rent is slightly higher but not much (on the RI border) but if you have a 1 bedroom, you may be able to commute from NH or somewhere else with darker skies to achieve one immediate dream while working on the others. Look for a comparable or lower rent and see if you can get that. 🙂 My dad loves to look at the stars in our driveway and we often comet hunted as kids for even darker spots. It is possible. 🙂

Nora – that sounds lovely. I grew up in suburban Cincinnati and can recall nice nights with the stars in my own back yard.

Did you find any comets? That’s so cool.

I like to remind everyone that Medicare is NOT free. My husband and I pay a total of $10,300/year for Med. Part B, a supplement (which pays the 20% Medicare approves but doesn’t pay and the annual deductible), and a drug plan(his is less expensive as he never took drugs-now on Eliquil and paying almost $500.00/month). We’ve had 5 surgeries between us and were VERY thankful that we had the more expensive supplement. It is something we didn’t consider before retirement, and thankfully have been able to handle it. We have been retired since 2000(age 54) and the stock market and some great bonds have been very helpful.

Lucinda – thanks, these are definitely things to keep in mind!

I really appreciate all the experience here.

Only Erik’s net salary was mentioned. He should be sure to max out his retirement contributions. Assuming he has a 401k, he is over 50 so can make an additional $6,500 catch-up contribution each year. That puts his total allowed 401k contribution for 2021 at $26,000.

Inflation is a real problem. With all his money sitting in money market accounts the purchasing power of his portfolio is actually decreasing each year. He needs to invest at least part of his money to combat that.

The inherited IRA complicates the situation. He has mostly outsourced his financial planning so I suggest he do so again by switching to a fee only financial planner. He needs advice about what to do with the Inherited IRA, his retirement account, and his investments to protect them from inflation and continue to generate income so he can retire from W2 employment. We don’t know whether the IRA is a Roth or Traditional so it’s hard to tell whether he will have to take required minimum distributions (RMDs), which need to be factored into his plans for retirement. If he gets to a point where RMDs are required and he doesn’t know he has to take them he could end up with a massive penalty. https://www.investopedia.com/articles/personal-finance/102815/rules-rmds-ira-beneficiaries.asp

Alternatively, Erik can treat learning about personal finance as his latest academic pursuit/hobby, take your advice, start reading personal finance books and come up with his own plans. The information is out there.

I like the idea of him settling into a more rural property with multiple buildings. Even if the ex doesn’t live there he could generate extra income with the additional buildings – occasional Air BnB or allow people to camp on his property. Even better for a self-described hermit – possibly rent studio/garage/tinkering/storage space, let someone farm/garden on it, etc. The possibilities are endless and it could provide him with extra income that he has complete control over.

Good luck Erik!

AJ –

“Alternatively, Erik can treat learning about personal finance as his latest academic pursuit/hobby.”

100% this. Thanks. I’m good at learnin’ stuff, no reason I can’t be good at learnin’ THIS stuff. :^)

Great advice from Mrs. FW and others. I just want to put in a word of caution regarding calling Vanguard for help. We needed to do this recently and found it a frustrating experience. Their support people used to be uniformly excellent, but now it’s hit or miss. You may get an unhelpful person, unfortunately, or you may be asked to agree to have them call you back, which they may or may not do. If you luck into a good person on the first try, you’ll be all set, but if your experience is like ours, you’ll need perseverance. I finally got what I needed by sending a secure message and waiting a couple of days.

Unrelated, we also made the move from the Boston area to the country a few years ago, landing in southern Vermont. Replacing traffic and competition with nature and dark skies is the best!!

Good luck! Like others, I find your story interesting and hope you find a solution that works for mind, body, and soul.

Hi Stephanie. I love VT and have some connections there.

I haven’t had that particular experience with Vanguard but it’s alarming how many customer service situations I’ve gotten into where different reps say … well, not only different but diametrically opposed things. It’s as if the staff aren’t allowed to talk to one another. And that, of course, is only if you can get a bona fide human being on the line.

I also recommend using a life expectancy calculator that factors in health conditions, lifestyle, etc to determine how long you need your retirement income to last. Yes, this can be depressing, but the data is out there so you may as well use it to plan accurately. An added bonus of this method is watching your life expectancy change as you play around with the lifestyle factors. It can be a real kick in the pants to improve your lifestyle (if you need it.). Here is a link with a bunch of different calculator options: https://www.newretirement.com/retirement/longevity-trends-and-life-expectancy-calculators/

AJ – thank you for this! It’s something I think about. On the one hand, I had a heart attack in 2014; on the other, I’ve been a runner since not long after that. So I go back and forth from “save for that land/house!” to “buy a huge telescope! who knows how long you’re gonna be around.” Sheesh … sorry if that comes off dark.

If you’re serious about moving overseas, move and/or create the US investment accounts you want *before* you leave. Once you are resident overseas, your ability (due to mix of onerous government regulation and the resulting institutional hesitancy to accommodate the expat population) to invest in US financial products is very limited. FWIW, Ireland has designated Dark Skies area in the rural west. Dublin is as bad as Boston for congestion and cost.

Cara – many thanks. I’ve been wondering about this aspect of moving overseas.

Erik, consider Missouri that has 6,000+ caves, so many that we are known as the Cave State! It’s very affordable to live rurally here. You would have a lot of options for dark skies. It’s great that you know yourself and what makes you happy. Good luck!

Hi Genevieve. Thanks! There is apparently a saying in Kentucky cave country — “It’s not much of a house, but we’ve got one hell of a basement.” Sounds like MO has one hell of a basement, too. 🙂

One nice thing about being a member of the National Speleological Society is that one can email local clubs (we call ’em “grottoes”) and say “Hi! I’m going to be in X-ville on the 24th. Do you all have anything going on?” So I could do that with Missouri — even if I’d have to invent a reason to go.

Do you have a FSA or HSA option at work? With pricey therapy and some regular prescriptions and routine care, you could see savings with a FSA depending on fees.

Your rent for Boston area is very cheap. A budget and future plans need to assume that this could drastically increase at any moment. The real estate market is hot and your building could be sold tomorrow and rent there or another property nearby could be double what you are paying.

Land is expensive. Have you thought of leasing land and a tiny home? Regulations vary by state and town but there are many places in New England where you could have a tiny home on or off the grid on leased land.