Veronica is a wildlife biologist for the state of North Carolina, where she lives on a farm with her two dogs, Porter and Stout. Veronica’s mother recently passed away and she is set to receive an inheritance from her mother’s estate. Veronica would like our help discerning how she should manage this inheritance, particularly in light of the fact that she’s participating in the twelve-step Debtors Anonymous program as well as receiving treatment for PTSD.

What’s a Reader Case Study?

Case Studies address financial and life dilemmas that readers of Frugalwoods send to me requesting advice. Then, we (that’d be me and YOU, dear reader) read through their situation and provide advice, encouragement, insight, and feedback in the comments section. For an example, check out last month’s case study. Case Studies are updated by participants (at the end of the post) several months after the Case is featured. Visit this page for links to all updated Case Studies.

I probably don’t need to say the following because you folks are the kindest, most polite commenters on the internet, but, please note that Frugalwoods is a judgement-free zone where we endeavor to help one another, not to condemn.

And a disclaimer that I am not a trained financial professional and I encourage people not to make serious financial decisions based solely on what one person on the internet advises. I encourage everyone to do their own research to determine the best course of action for their finances. I am not a financial advisor and I am not your financial advisor.

With that I’ll let Veronica, this month’s Case Study subject, take it from here!

Veronica’s Story

Hi, Frugalwoods! I’m Veronica, I’ll be 40 in April, and I live with my two awesome mountain cur dogs, Porter and Stout, in a rural part of central North Carolina. I moved to this region from an even more remote area of the state for a job promotion during the second half of 2018.

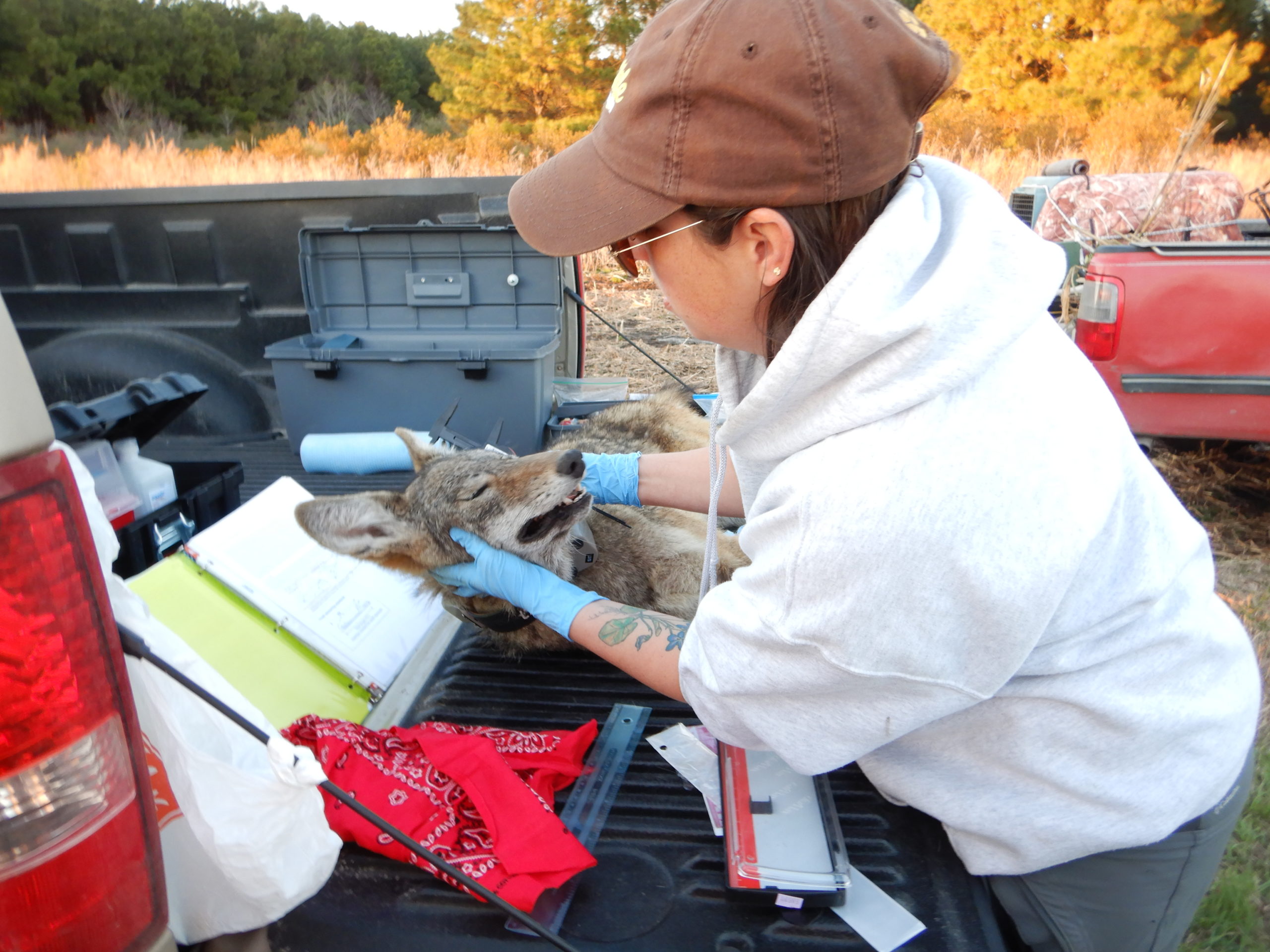

I work for the state wildlife agency in my “dream job” as a wildlife biologist. It’s deeply purposeful work and I’m grateful to be able to provide service in this way, even if the dream ended up not aligning with the reality of the job–I’m completely okay with that!

I’m an explorer at heart and I’ve been very fortunate to live a fairly non-traditional life. As a result, I’ve experienced many incredible, once-in-a-lifetime experiences. However, the downside is that I’ve had to relocate frequently and haven’t made much money over the years. This is a VERY common experience in my field, which is highly competitive. I am happy to report that with my current position, I finally have a stable salary with benefits!

Veronica’s Hobbies and Volunteer Work

Outside of work, I enjoy travel and I hope to start taking one international trip annually in addition to the smaller domestic trips I currently make. I also deeply enjoy practicing photography, making jewelry, and doing whatever sort of art or craft that strikes my fancy. I love hiking, especially climbing mountains, and dearly hope to move to the mountain region of this state in the next few years, so that I can go hiking on a daily basis.

I LOVE to learn and take classes when I can. I also enjoy teaching and I hope I can teach some art classes and workshops in the future. A fun thing I get to do with my job is partner with our state natural sciences museum to co-lead wildlife education tours – it’s so much fun and I get to do some non-traditional education and outreach as well as enjoy photography.

I’m fairly introverted, but I try to meet up with friends once in a while, though not as often as I’d like. With all the moving around over the past dozen years (over a dozen moves!), I’ve gotten used to doing everything solo or with my dogs in tow. This is a new stage in my life where I’m not moving so much, and it’s been really wonderful to think about settling down and creating longer-term plans. I recently completed an End of Life Doula training and I hope to do volunteer work in the next couple of years in that capacity. My awareness is that the purpose for my life is to bring healing to this world. I plan to write a memoir and am working on a large legacy art project about my mom and our Alzheimer’s journey. I am currently volunteering as an Alzheimer’s advocate for our state’s legislative representatives.

Veronica’s Mother

I’m also at a cross-roads of sorts right now. I recently lost my dear mama after a nine-year journey through early-onset Alzheimer’s. It was a profound journey to go on with her, as her legal guardian and daughter, and I shared caretaking duties with my sister.

It brought the three of us much closer as a little family and I will forever be grateful for that. It was an honor to devote the majority of my 30’s to my mom and her wellbeing and the experience was worth all the sacrifices that came with it.

The story doesn’t end there, however, as I am now administering her estate with my sister. My mom was the essence of living frugally for your values (she would have really enjoyed this blog) and as a result, despite the astronomically high costs of caretaking services, I will inherit a fairly substantial portfolio of funds (more on that below).

I am extremely nervous about what to do with this inheritance. Since I have A LOT of catching up to do in terms of emergency and retirement savings, I want to utilize these funds wisely and to my long-term advantage. But, I would also like to use some to increase my quality of life in the here and now (more on that in a moment).

Veronica’s PTSD and Treatment

I also need to provide some background on myself that’s probably not the usual Reader Case Study information, but that’s entirely pertinent to my case. I was recently diagnosed with complex PTSD and am receiving treatment. Over the last several decades, my PTSD symptoms included addictive and compulsive behavior (a new awareness for me), which manifested as compulsive spending. I went through a series of debt and deprivation cycles until it became so unmanageable that I had to reach out for help. Three years ago, I started a 12-step program called Debtors Anonymous and it has literally saved my life.

Debtors Anonymous helped me turn my life around and enabled me to develop trust, faith, and a willingness to face my problems and take supported actions to solve them. I am eternally grateful to this program for helping me get to where I am today. I plan to continue in Debtors Anonymous during my PTSD treatment since it helped me develop a solid foundation of self-care coping mechanisms. Given this background, you can see why I’m nervous about receiving an inheritance, even though I’m in a good place with my recovery.

One element of participating in Debtors Anonymous is that I cannot have, or utilize, credit cards. I know from my own experience that I cannot handle credit cards responsibly. I have one credit card account open with a zero balance in order to keep my credit score in the good range (it’s currently over 700) but it has no card associated with it and I will never use the account. A great aspect of the program is that I keep very detailed financial records of all my income, debts, savings, and spending. I currently have 2.5 years of data on my financial life!

Veronica’s Income

Another challenge I’m experiencing relates to my salary. Since I work for the state government, there is no mechanism in place for my agency to adjust salaries as needed without going to the state legislature. This has resulted in salaries lagging way behind other states in our region despite being one of the fastest growing states with an even faster growing cost of living. This is an issue my agency has been working on for a few years and it’s unlikely to resolve anytime soon. In the meantime, my salary only enables me to live paycheck to paycheck with very little ability to save.

While I was my mom’s guardian, I received a small commission that helped me greatly as I couldn’t get a second, part-time job (as being a guardian is like having a second full-time job). Now that my mom has passed on, I am no longer receiving that commission and I am unsure about how to increase my income. I’ve worked long and hard and made many sacrifices to get to where I am in my career and I don’t want to give it up, but I need to earn more. I’m not entirely certain how that’s going to be resolved, but two possibilities are to go federal or into the private sector (e.g. with an energy company).

I need to put in a few more years in my current position before I can make a move and my hope is to coordinate that with a move to the mountains and the purchase of my first home and land. That plan still leaves me wondering what to do in the short term to cover my monthly expenses.

Since I live in a rural area, there aren’t many options for part time work. It isn’t worth driving an hour+ to the nearest city for a low-paying part time job (in terms of time or gas), so I’m not sure what other options are available. Committing to PTSD treatment will be a time commitment as well since there are no practitioners within an hour of where I live. Ideally, I’d be able to find some sort of remote, work from home, part time gig and I’m really open to hearing suggestions on this!

I’m also interested in developing a side business to sell my art, but I view that as a longer-term strategy/plan since I know it takes a lot of work and time to build up a viable business. I would love to exhibit my photography and sell my jewelry on consignment at a gallery somewhere (no idea how to do any of that). I would also love to do public speaking about my art and life… again, that seems like a longer-term plan.

Veronica’s Goal: Moving To The Mountains and Buying a Farm

One of the last pieces of advice my mom gave me before passing was to “follow my bliss, to live in what brings me joy.” It has been a long held dream of mine to own land in the mountains with a large farmhouse that I can lovingly restore (though it would need to be in good enough condition to live in!). Along with learning, living close to nature is a priority . I currently rent an old farmhouse on a farm and I absolutely love it. I would love to own my own land and steward the land for the time that I’m there.

I’m definitely going to stay in North Carolina, and am targeting the mountain region specifically. The only other area I would consider moving to is the mountain region of Virginia, should an appropriate job open up there. There are real limitations to the wildlife profession, job-location-wise, and I have lived in enough regions throughout the country to understand where fits me best.

Federal jobs at my level (GS-11/12) are very limited at present, due to a position back filling moratorium (thanks to the current presidential administration), but that may change with time. I am building a strong network of federal connections across the state, which may prove helpful. Private sector jobs may be more available in the nearer term, but I haven’t dug deeply enough into the market quite yet, though I have a few connections with biologists who work for large energy companies so there’s opportunity to inquire.

Once I purchase land, I might lease fields for organic agriculture and woodlots for agroforestry. Not only would those practices meet my land stewardship values, they would also bring in some income. I’m not sure how much potential income agricultural land leases could bring in and I plan to research that extensively this year. Checking out the USDA loan program website recently, my income level would be eligible for a USDA loan.

While I would love to be able to pay a traditional down payment on a land and home, I don’t know how feasible that is considering how much retirement savings I have to catch up on. And there’s the fact that I have approximately $53k in student loans looming over my head. I am currently in the Public Service Student Loan Forgiveness Program (PSLF), but the history of that program doesn’t lend itself to trustworthiness for the level of risk involved. Since I’m in that program, I’m on an income driven repayment program where the monthly payments don’t even pay off the annual interest, which is then added to the principle at the end of the year.

Essentially, each year that I’m in the Public Service Student Loan Forgiveness Program, my principle will continue to grow. My income level doesn’t allow me to make any additional payments on this loan monthly and I have seven more years in the program before my loans could be forgiven (assuming the program is still around). This seems like a huge risk and one that I’m not sure I want to continue taking. I also have a car loan (on a car I purchased used for a great price but went upside down on a previous vehicle loan for a nightmare truck situation to the tune of $5k – long story I’d rather forget).

The Best Part Of Veronica’s Life

No rat race! Since I’m considered field staff, I have a home office and am able to work remotely from almost anywhere in the state. I have near complete autonomy to structure my daily schedule. This flexibility has been a huge value-add to my work life. I get to travel to some really beautiful places for work, I love living on a farm, and I love living in an old farmhouse. My dogs and I enjoy the nature that surrounds us every single day. Plus, I have space for an art studio (slash guest bedroom) since I live alone.

The Worst Part Of Veronica’s Life

Isolation, hands down. Where I live is pretty different culturally from my personal values, so while I’m friendly with everyone, I don’t have a sense of community or of having any of “my people” in close proximity. The nearest “big” city is over an hour away, which means a lot of driving if I want to take classes or attend social get-togethers. Since I’ve moved so often over the last decade, my friends are scattered across the country.

It’s been an okay tradeoff thus far, especially when I was caring for my mother because I didn’t have any spare time. However, I know that in the future I’ll want to be in a local community that’s more culturally aligned with my values. I’ve found a few potential regions in the mountains of North Carolina, so I’m hopeful I’ll be able to make the move in the next five years (if not sooner).

The other downside is my low income – for me this plays into a sense of lack of quality of life at times. I really enjoy and value experiences in life, but oftentimes there comes a financial cost to participate (e.g. gas to drive to the city to take a class, funds to pay for the class) and it’s always a struggle to prioritize what to participate in with my financial limitations. After a decade devoted to abundant work, I would really love to expand on a diversity of fun experiences on a regular basis.

Where Veronica Wants To Be in 10 Years:

- Finances:

- I’d like to be making more than double my current income. I could accomplish this with a move to either a federal position or the private sector.

- I’d like to have 20% equity (at least) in my future home and land and have additional streams of revenue coming in from investments, an art business, teaching, leasing fields, etc.

- Lifestyle:

- I’d like to be settled into my own farmhouse that I am lovingly restoring and enjoying, stewarding the land I’ve set roots in, gardening, traveling for pleasure, teaching and exhibiting my work, and continuing to work in wildlife conservation.

- Hopefully I’ll have a partner and maybe a child (although I’m not really planning on it), definitely more dogs, lots of hiking, a deep sense of community, practicing spirituality in everything I do, service work/volunteering, and following what brings me joy on a daily basis.

- Career:

- I want to continue to work with wildlife, but maybe in a different capacity. Perhaps I begin to think about dropping down to part time and increasing my art work?

- I’m unsure about that last point but I do know that I will want to have switched employers and dramatically increased my income. I am currently building my professional network here in North Carolina to increase the chances of this outcome.

Veronica’s Finances

Income

| Item | Amount | Notes |

| Veronica’s net monthly income | $2,576 | Net salary, minus the following deductions: health, disability, life, death and dismemberment, dental, vision, and other insurances, 457b contribution, 6% gross salary pension deduction, FSA contribution, and taxes |

| Estimated Monthly Annuity Payment (has not started yet) | $215 (estimate; not currently receiving) | After state and federal tax deductions |

| Monthly subtotal: | $2,791 | With estimated annuity payment |

| Annual total: | $33,492 | With estimated annuity payment |

Expenses

| Item | Amount | Notes |

| Rent | $750 | |

| Art Classes, Equipment, and Supplies Fund | $362 | This line item increases my quality of life and shouldn’t be entirely eliminated, though I realize I need to reign it in a bit |

| Auto Loan | $285 | Through SECU; this is the minimum monthly payment |

| Groceries and going out to eat | $225 | Monthly average; I very rarely go out to eat for fun, maybe a few times each year, though I’d like to increase that to at least once a month |

| Student Loan Payment | $205 | FedLoan |

| Vitamins and Supplements | $190 | Includes a very expensive non-traditional supplement that is non-negotiable for me |

| Pupper care costs | $151 | Fun things like heartworm meds, tick and flea treatment, annual vet visit, annual teeth cleaning, food and treats |

| Clothing | $148 | This was high this year due to needing to purchase several pieces of speciality field clothing and shoes (we are not employer reimbursed, but I try to sign up for pro deals with companies) and needing funeral clothing, including a coat (some of which I purchased used) |

| Electricity | $113 | Monthly average |

| Propane tank | $100 | Monthly average |

| Vehicle Fuel | $100 | Monthly average |

| Cell Phone | $80 | Through Verizon (I receive a discount through my employer) |

| Car insurance | $77 | Through Progressive |

| Outstanding debt to self (owe $285 to self, this accounting is mainly for my 12-step program) | $55 | |

| Toiletries (shampoo, conditioner, moisturizers, etc) | $45 | Monthly average |

| Miscellaneous items | $38 | Things such as new flatware, etc. that don’t lump nicely into other categories |

| iFit subscription | $36 | Non-negotiable expense |

| Travel for pleasure | $29 | Monthly average for the past year; I would love to increase this amount – I was able to go on one extremely frugal vacation this year |

| Work Food (eating out while traveling for work) | $25 | Monthly average |

| Gardening Supplies | $25 | Monthly average |

| Home Goods | $25 | Monthly average |

| New cell phone | $25 | I save this much every month towards a new cell phone |

| Emergency Pup Care Fund | $25 | I save this much every month towards an emergency fund for my dogs |

| Stout Hip Treatment Fund | $25 | I save this much every month towards a hip treatment my dog Stout will need |

| Vehicle Maintenance | $25 | Monthly average |

| Coffee | $20 | Monthly average |

| Haircuts | $20 | Monthly average |

| Charitable Donations | $19 | I hope to increase this someday |

| Pupper Care Service | $17 | When I travel for work or pleasure and can’t take the dogs with me, I pay a kid down the road $10 per day to come and take care of my fur babies; average monthly cost for the past year (this reflects that I did not do much work travel this year) |

| Professional Society Membership Dues | $17 | |

| Auto Loan Reserve | $15 | I throw in an additional $15 on my payment every month |

| Auto Registration Fee | $14 | |

| Renters Insurance | $11 | Through Progressive |

| Gift Fund: Birthdays | $10 | Monthly average. I would love to increase this someday, but thankfully my family and friends aren’t big on gift giving. |

| Gift Fund: Christmas | $10 | Monthly average. I would love to increase this someday, but thankfully my family and friends aren’t big on gift giving. |

| Amends Fund (for Debtors Anonymous) | $8 | Making financial amends as necessary for my 12-step program; average monthly amount I save – would like to increase this amount sometime in the future |

| Bank Fees | $6 | TD Bank Checking |

| Dental Supplies | $5 | Monthly average |

| Auto Inspection Fee | $2 | |

| Bank Fees | $1 | SECU Foundation |

| Bank Fees | $1 | SECU Foundation |

| Monthly subtotal: | $3,339 | |

| Annual total: | $40,068 |

Debts

| Debt | Outstanding Balance | Interest Rate | Notes |

| Federal Student Loans (I’m in the PSLF program) | $52,205 | 6.88% | I’m on an income driven repayment plan. I’m not able to cover all of the annual interest, so I pay the minimum monthly payment. If PSLF pans out, my loan will be forgiven in 7 years (2027). |

| 2011 Toyota Rav4 | $8,266 | 4.75% | I pay the minimum $285 per month; 5-year loan with 3 more years on the loan |

| Debt to self | $285 | 0% | I borrowed funds from my savings to pay off a debt and I am paying myself back. |

| Total: | $60,756 |

Assets

| Item | Amount | Notes | Interest/type of securities held | Name of bank/brokerage |

| IRA | $8,255 | Traditional IRA | year to date interest return is 12.93%, 3 years annualized is 6.14% | Edward Jones |

| Savings Account 1 | $7,707 | I keep funds for spending categories that I will eventually spend in here | 0.05% interest | TD Bank |

| Savings Account 4 | $7,527 | I keep funds for spending categories that I will eventually spend in here | 0.75% interest | SECU; I don’t use these accounts for regular checking and savings because they don’t have a mechanism set up to transfer between banks, which will be important until I complete administering mom’s estate |

| Pension | $4,504 | 6% state required pension deduction | Holding account until vestment in 2023 | whatever the state pension system uses |

| Savings Account 2 | $3,143 | I keep funds for spending categories that I will eventually spend in here | 0.05% interest | TD Bank |

| Savings Account 3 | $1,830 | I keep funds for spending categories that I will eventually spend in here | 0.05% interest | TD Bank |

| 457b Account | $1,709 | Retirement account, offered by my employer | Pre-tax deduction, year to date interest return is 19.31% (I contribute $125 per month, employer does not offer matching) | Prudential |

| Checking Account 2 | $1,298 | I keep funds for spending categories that I will eventually spend in here plus a small reserve for eventual use in paying off my vehicle loan | 0.25% interest | SECU; I don’t use these accounts for regular checking and savings because they don’t have a mechanism set up to transfer between banks, which will be important until I complete administering mom’s estate |

| Checking Account 1 | $107 | I do not keep excess funds in this account and all funds in this account are spent in full each pay cycle | 0% interest | TD Bank |

| Total: | $36,080 |

Future Inheritance (from Veronica’s mother)

Note: all of these totals are estimates as the estate is still being disbursed

| Item | Amount | Notes | More notes |

| House Sale Proceeds | $179,880.87 | The house is sold and this amount is locked in a trust account until probate clears it. A portion of this will be paid by the trust (along with portions of the other beneficiaries sums) for capital gains taxes. I have an accountant working on what the basis of capital gains will be. | Not sure how to invest these funds once they come my way. |

| Beneficiary IRA Account | $77,000 | Estimated total amount; I will have to take a required annual disbursement, but I don’t yet know the amount | This is with Pershing, but I will likely transfer it to Edward Jones |

| J&J Stock Shares | $15,000 | This is an estimated amount. We are going through a share recovery process currently and this will likely take the longest to resolve for the estate | With Computershare. Not sure if I have the option to keep my half as shares or if the estate has to divest. If it’s an option to keep shares, I may want to do that given that J&J stock prices have not dropped much with all the legal settlements |

| Leftover financial holdings | $12,500 | This amount is TBD and could range from $0 to $25k, so I split the difference for this exercise | |

| Estimated Total: | $284,380.87 | This is an estimated amount and I will not receive all of it at once. Some will be paid out over a number of years. |

Veronica’s Questions For You:

-

A gorgeous photograph by Veronica What should I do to increase my income in the immediate future?

- I need to increase my income by at least $763 per month in order to break even (this is without including my monthly annuity payment, which I haven’t received yet and don’t know the exact amount; the estimate is $215)

- What are options for work-from-home part-time gigs? I feel lost on this one!

- What is the maximum monthly amount I should pay on my student loan to maximize the income tax benefit?

- This assumes I would utilize a portion of my inheritance to cover these increased payments.

- I realize that I need to consult an accountant about this and about the monthly annuity income and potential annual IRA disbursement.

- How should I invest the investable portion of my inheritance to generate additional funds to help make a down payment on a home and land in the next few years?

- Ideally, this would also generate funds for home renovations/restoration. Should I bother with any down payment considering I’d qualify for a USDA loan?

- What’s a good amount to have allocated as a fund for immediate home fixes after purchase? I estimate based on current market rates that 30 acres with a house could cost $250k-$350k in the areas I’m interested in.

- I’m currently unpartnered, so I am operating under the assumption that I will also be unpartnered at that time and will be reliant on my income only. My current income would be insufficient to pay that level of mortgage and I would like a large lot of land.

-

The backyard of the farmhouse Veronica rents What portion of my investable inheritance should I put into retirement savings?

- My employer doesn’t offer any matching funds. Currently I contribute what I can afford each month, which is $125 to my 457b account.

- Should I sell my eventual J&J stock shares and reinvest those funds?

- If so, how should I reinvest?

- In my current job, 6% of my gross monthly income is deducted pre-tax for eventual investment into the state pension system.

- These funds will be vested in 2023, around the time I might be ready to make an employer switch. If I make the switch prior to being vested, I would receive those funds as a lump payment. If I do make the switch prior to being vested, how should I use that money?

- How should I deal with paying off my vehicle loan, which is through a credit union and has a low interest rate?

- Any advice on how to sell art on consignment or how to do exhibitions? Or how to get into teaching art classes and workshops?

Mrs. Frugalwoods’ Recommendations

I want to thank Veronica for sharing her story with us because she touches on a number of challenging topics with honesty and insight. I’m grateful for her perspective on Debtors Anonymous and thrilled that she’s had so much success through that program. Veronica is able to move forward right now because she has acknowledged her challenges and sought help.

Without this self-reflection and willingness to heal, she wouldn’t be able to dream about a different future for herself and her dogs. If you think you might benefit from the Debtors Anonymous program, you can find more information here.

I congratulate Veronica for her strength and am thankful for her story, since I imagine it will resonate with a lot of people. I also want to express my condolences to Veronica on the death of her mother and also the long journey she went on as her mother’s caretaker. Veronica’s mom was lucky to have two devoted daughters and I’m sorry that she’s no longer with them. With that said, let’s dive into her specific questions.

Veronica’s Question #1: What should I do to increase my income?

Now that Veronica is no longer receiving a stipend for serving as her mother’s caretaker, she’s facing a $763 deficit between her income and expenses every month. We’ll tackle this shortfall from both angles, starting with her income. Veronica is spot on that she needs to find a better paying job. She’s a highly qualified specialist and she noted that she’s networking across the state in order to suss out a better job. I encourage her to accelerate her timeline on this.

Since Veronica plans to leave her current job at some point anyway, I encourage her to more aggressively investigate the two options she mentioned: a move to the private sector or the federal government. Her current position does not pay her enough to enable her dream of buying a house and land. Furthermore, I’m not seeing a side hustle that would generate enough income to adequately make up for her low salary. She’s totally right that she could start earning a bit more on the side, but it seems to me this would be missing the bigger picture of her finding a better paying job in her profession.

What about the pension plan vesting?

Veronica’s current position has a pension that she won’t vest in until 2023; however, her employer isn’t contributing anything to this pension and Veronica noted that upon her resignation, she’ll receive all the money she’s put in as a lump sum. From that perspective–unless I’m missing something major–there’s no financial incentive or reason for Veronica to stay at this job until she’s vested.

What about the PSLF?

Since Veronica works for state government, she’s enrolled in the Public Service Student Loan Forgiveness Program (PSLF), and her loans are on track to be forgiven in seven years. If she moves to the private sector, she would no longer be eligible for the program. If she moves to the federal government, she likely would still be eligible.

However, since her current position is so low paying, I don’t see much benefit in remaining solely for the PSLF benefit, especially since her loans are not all that significant (at $52k they’re not nothing, but they’re not astronomical either) and her interest rate (6.88%) is on the higher side for student loans. I think moving to a higher-paying position would end up a net positive over the potential benefit of loan forgiveness in seven years. I say this particularly in light of the bad press PSLF is getting for not forgiving loans that should be eligible for forgiveness. I also think it might make sense for Veronica to instead wipe her loans out with some of her inheritance (more on that in a moment).

All that to say, if it were me, I wouldn’t stay in the job just for the pension vesting and potential PSLF loan forgiveness. And instead of shuffling around side hustles, I suggest Veronica focus her efforts on finding a higher-paying position in her field.

The Rest Of Veronica’s Questions: The Inheritance and Buying a Home

Let’s discuss the inheritance first. I am not a lawyer, a financial professional or an accountant, so it’s good Veronica is working with lawyers and accountants on the execution of her mother’s estate. What I can discuss are ideas of what Veronica might do with the money after it lands in her bank account.

Inherited asset #1: cash from the sale of her mother’s home.

One note for Veronica to discuss with her accountant: upon death, the basis for capital gains taxes should be reset, which means Veronica would only owe taxes on any appreciation the house experienced between the time her mother passed and the house sold.

She shouldn’t (as far as I understand it) owe capital gains taxes on the full appreciation of the house (appreciation that occurred from the time her mother purchased it to now). This is actually a good loophole for passing assets along to heirs!

Whatever the capital gains taxes shake out to be, Veronica stands to inherit a large lump sum of cash from the sale of the house. Given Veronica’s goal-oriented nature, her treatment through Debtor’ Anonymous, and the fact that this’ll be a lot of money coming in all at once, I suggest she consider doing the following with this cash:

- Pay off her student loans in full. We can quibble about the mathematical efficacy of doing this versus waiting to see if PSLF comes through, or, Veronica could just get this monkey off her back. I don’t love the interest rate on her student loans and I think it might give Veronica some peace of mind to be rid of these. (inheritance of $170K – student loan balance of $52,205 = $117,795 remaining)

- Pay off her car loan. Just get it out of her hair and out of her life. (remaining inheritance of $117,795 – $8,266 = $109,529)

- Replay her debt to self. This would be the remaining inheritance of $109,529 – $285 = $109,244

While this is an estimate–since we don’t know the capital gains tax total–this scenario would most likely leave Veronica with over $100k in cash leftover. I strongly recommend she wipe out these debts and feel confident about starting her 40’s completely and totally DEBT FREE. This would frees her from the mental strife of PSLF and the frustration of carrying a car loan. This is a gift from her mother to wipe the slate clean.

Maintain A Robust Emergency Fund

After Veronica pays off all of her debt, I encourage her to maintain her robust emergency fund. Given her past proclivities for slipping into debt, her well-funded emergency fund provides her with a much-needed backstop and buffer against any future debt.

- Veronica spends $3,339/month, which means she should target an emergency fund in the range of $10,017 (three months of spending) to $20,034 (six months worth).

- Veronica already has $21,613 saved up, so she is golden on her emergency fund!

An emergency fund should be kept in an easily-accessible bank account, such as a high-interest checking or savings account, NOT in investments, retirement funds, or cars/houses/expensive china. An emergency fund is money you can access immediately in an emergency. The general rule of thumb is to have three to six months’ worth of expenses in your emergency fund, meaning three to six months worth of what you spend every month. This is why it’s so important to track your expenses–I use and recommend the free expense tracker from Personal Capital. If you’d like to know more about how Personal Capital works, check out my full review.

The Many and Sundry Cash Accounts of Veronica

Aside from her retirement savings, Veronica has a whopping six different checking and savings accounts. I wonder if Veronica might consider consolidating these six accounts into one, or perhaps two, accounts? Unless she has specific reasons to keep her money spread out across all these different accounts, I would find it more manageable to consolidate.

Additionally, I strongly encourage Veronica to move her cash into a high-interest, fee-free savings account. Veronica is unfortunately using the exact type of accounts I don’t recommend: low interest rate accounts that charge a fee. Not only is Veronica missing out on interest, she’s paying for the privilege of using these subpar accounts! Save yourself, Veronica!

If Veronica decided to move her money over to, for example, an American Express Personal Savings account that–as of this writing–earns 1.70% in interest, in one year, her $21,613 will increase to $21,980.42. That means she’d earn $367.42 in one year JUST by having her money in a high-interest account! See this post for details on which banks I recommend for high interest savings accounts.

Here’s the rundown of Veronica’s cash accounts:

| Item | Amount | Notes | Interest rate | Name of bank/brokerage |

| Savings Account 1 | $7,707 | I keep funds for spending categories that I will eventually spend in here | 0.05% interest | TD Bank |

| Savings Account 4 | $7,527 | I keep funds for spending categories that I will eventually spend in here | 0.75% interest | SECU; I don’t use these accounts for regular checking and savings because they don’t have a mechanism set up to transfer between banks, which will be important until I complete administering mom’s estate |

| Savings Account 2 | $3,143 | I keep funds for spending categories that I will eventually spend in here | 0.05% interest | TD Bank |

| Savings Account 3 | $1,830 | I keep funds for spending categories that I will eventually spend in here | 0.05% interest | TD Bank |

| Checking Account 2 | $1,298 | I keep funds for spending categories that I will eventually spend in here plus a small reserve for eventual use in paying off my vehicle loan | 0.25% interest | SECU; I don’t use these accounts for regular checking and savings because they don’t have a mechanism set up to transfer between banks, which will be important until I complete administering mom’s estate |

| Checking Account 1 | $107 | I do not keep excess funds in this account and all funds in this account are spent in full each pay cycle | 0% interest | TD Bank |

| Total in cash savings: | $21,613 |

The Rest Of Veronica’s Inheritance

Since the estate is still being finalized, we unfortunately don’t have the final numbers on the rest of Veronica’s inheritance. But for our purposes today, that’s ok. I’m going to give Veronica the broad strokes of what might make sense to do with this money once it comes her way.

1. Buy a Home and Land

Veronica can approach this goal in a number of different ways and I want to point out that there isn’t really a right or wrong way to do this. I encourage her to consider her own spending tendencies in making this decision.

Option one: Liquidate all of her inheritance (to the extent possible) and purchase a property with cash.

The upside with this option is that her monthly expenses would be low since she’d have no mortgage, she wouldn’t be tempted to spend the inheritance irresponsibly, and she’d be in her dream home and land. This approach would also allow her to continue living completely debt-free.

The downside to this approach is that she’d likely be missing out on potential gains if she instead invested this money in the market and got a fixed, low interest rate mortgage. Additionally, a house (and especially a rural home with land) is a terrifically illiquid asset: it’s very hard to turn a paid-for house into cash. This could be a challenge if Veronica gets a fixer-upper and needs a lot of cash on hand to renovate/repair. However, if she’s able to find a higher-paying job, that concern might be mitigated.

Option two: Explore a USDA loan option for a mortgage and contrast it with the option of using some of the inheritance for a downpayment.

The advantages and disadvantages of this option are the inverse of option number one. Veronica could (potentially) get a super low, fixed interest rate mortgage and invest the remainder of the inheritance in the stock market and realize gains (over many decades of remaining invested). However, she’d also have a monthly mortgage payment, which would increase her monthly expenses. On the other hand, since all of her money wouldn’t be tied up in her home, she’d have much more flexibility and options on how to allocate her resources.

Option three: Investigate alternative housing scenarios.

Since Veronica noted she feels isolated in her current rural location, I wonder if she’s considered exploring alternative housing options, such as cooperatives, buying a property with a friend/relative, or serving as the longterm caretaker of a historical property/rural vacation home for a family.

‘These ideas might not appeal to Veronica, or, they might be a way for her to accomplish two things at once: living on a big piece of land with lowered costs and less isolation. One thing for Veronica to keep top of mind in her search is property tax. If she buys a large parcel of land, she should look into land conversation tax breaks that might be available (we’re enrolled in such a program here in Vermont, which decreases our tax burden.

That being said, we own a lot of land so our taxes are still significant).

Option four: Continue renting.

Veronica made a brief mention of her possible interest in having a partner and/or children at some point in the future. Depending upon how serious she is about this aspect of her lifestyle, she might want to wait on the purchase of a home. If a future partner lives elsewhere, Veronica’s purchased home might not suit both of their work locations, commutes, lifestyles, etc. Furthermore, if there are children in the picture, the type/size/location of the home might drastically change from what Veronica envisions now.

However, if Veronica is not interested/serious about finding a partner/having children, she can discount this option. I just wanted to mention how dramatically one’s life can change if one has kids or a partner.

Veronica’s Investing Questions

After Veronica pays off her debt and she decides how she wants to pursue purchasing a home and land, she is correct that the next step is to invest the remainder of her inheritance (as well as any other extra cash she has lying around, such as a lump sum from her current pension). She is further correct that the best way to invest will likely be a mix of traditional retirement accounts and taxable investments. I want to reiterate that I am not a financial professional and that this does not constitute formal financial advice; rather, this is my opinion.

1. Retirement Accounts

Formal retirement accounts include employer-sponsored plans such as 401ks, 403bs, and 457s. If Veronica moves to an employer offering a retirement plan with a match, that’ll be the no-brainer place for her to invest for retirement. She should contribute enough to this plan to qualify for her employer’s matching funds.

If Veronica’s employer does not offer a matching plan, she should investigate either contributing to a non-matching employer-sponsored plan (which is what she’s currently doing with her 457b) or, increasing her contributions to her IRA.

2. Taxable Investments

After saving for retirement, Veronica can explore putting some of her money into taxable investments. This basically means investing her money in the stock market, but not through retirement accounts (which are also invested in the stock market).

I encourage Veronica (and anyone else interested) to read through the “Taxable Investments” section of the post, How We Manage Our Money: Behind The Scenes of The Frugalwoods Family Accounts, as it provides the most comprehensive answer to Veronica’s investing questions.

In summary, if it were me, I probably would not retain all J&J shares because that’s a very un-diversified position. If J&J’s stock plummeted (and never fully recovered), Veronica would never see that money again. Conversely, if she invested in something more diversified like a total market index fund, she’d weather downturns more easily. Investing in a single company is like putting all of your eggs in one basket: it might be totally fine or you might lose every single egg you have. In general, one of the most straightforward ways to invest is in a low-fee total market index fund.

Veronica’s Spending

The issue with Veronica’s monthly expenses is that, at present, her salary doesn’t cover them. If she continues spending at her current level ($3,339) she’ll be spending $763 more than she earns ($2,576) every month. As discussed above, I think the focus for Veronica should be finding a higher-paying job. However, until that happens, she’d be wise to reduce her expenses so that she’s at least breaking even every month and not dipping into her savings. Since her financial situation will improve once her inheritance comes through, she can consider these reductions in spending temporary and intended to keep her stable until she finds a higher-paying job and/or receives the inheritance.

In every Case Study, I like to point out that what you choose to save or not save is a very personal decision. Cutting every last expense is NOT the right answer for everyone and I am NOT an advocate for making yourself miserable in the process of achieving financial stability. I am an advocate for values-based, goal-oriented spending. I think it’s important to assess whether all of your expenses bring you fulfillment and a good return on your investment.

In order to effectively review your expenses, you need to know what you’re spending. Luckily, there are free online programs designed to do this for you. I use and recommend Personal Capital, which offers free expense tracking (affiliate link). You can write your expenses down in a notebook, you can create your own spending spreadsheets, you can use an online program–whatever you do, keep track of what you spend every month. If you’d like to know more about how Personal Capital works, check out my full review.

I love that Veronica listed annual spending averages in each category. This is a phenomenal way to track expenses because it gives you the most realistic picture of what you spend each month. It’s not realistic to assume that what you spent in, say, December 2019 is what you’ll spend every single month of the year. While some expenses are fixed from month to month (such as rent/mortgage payments), most of us experience fluctuations in most other categories, such as: travel, dining out, groceries, healthcare, gifts, entertainment, pets, utilities…. you get the picture.

Here are some ideas on how Veronica might spend $763 less every month so that she can break even:

| Item | Current Amount | Mrs. FW’s Notes | Proposed New Amount | Amount Saved |

| Rent | $750 | Fixed expense; no change | $750 | $0 |

| Art Classes, Equipment, and Supplies Fund | $362 | I recommend Veronica put this spending on hold just for the short term. | $0 | $362 |

| Auto Loan | $285 | Fixed expense; no change, UNTIL Veronica receives the cash from the house sale and can pay this loan off in full. Once that happens, she can add other expenses back into her budget. | $285 | $0 |

| Groceries and going out to eat | $225 | Seems quite reasonable to me. If Veronica thinks she can save more, go for it, but this seem quite low to me already. | $225 | $0 |

| Student Loan Payment | $205 | Fixed expense; no change, UNTIL Veronica receives the cash from the house sale and can pay this loan off in full. Once that happens, she can add other expenses back into her budget. | $205 | $0 |

| Vitamins and Supplements | $190 | Veronica said that this expense is non-negotiable, so we’ll try to find savings in other areas. | $190 | $0 |

| Pupper care costs | $151 | I assume this is a fairly non-negotiable expense since keeping pups healthy is a priority! | $151 | $0 |

| Clothing | $148 | I recommend Veronica put this spending on hold just for the short term. | $0 | $148 |

| Electricity | $113 | Fixed expense; no change | $113 | $0 |

| Propane tank | $100 | Fixed expense; no change | $100 | $0 |

| Vehicle Fuel | $100 | Veronica–do you receive mileage reimbursement from your employer for work trips? | $100 | $0 |

| Cell Phone | $80 | I recommend Veronica switch to a much cheaper MVNO cell service provider ASAP. I use the MVNO Ting and pay around $15 or less per month (affiliate link).

MVNOs resell wireless service at discounted rates (but it’s the same service). MVNOs are basically the TJ Maxx of cell phone service. If you’re not using an MVNO, check out this post to see if you can make the switch. The savings are tremendous. |

$15 | $65 |

| Car insurance | $77 | Fixed expense; no change | $77 | $0 |

| Outstanding debt to self (owe $285 to self, this accounting is mainly for my 12-step program) | $55 | Veronica–is it possible to put this on hold in order to break even every month? | $0 | $55 |

| Toiletries (shampoo, conditioner, moisturizers, etc) | $45 | Fixed expense; no change | $45 | $0 |

| Miscellaneous items | $38 | I recommend Veronica put this spending on hold just for the short term. | $0 | $38 |

| iFit subscription | $36 | Veronica said that this expense is non-negotiable, so we’ll try to find savings in other areas. | $36 | $0 |

| Travel for pleasure | $29 | I recommend Veronica put this spending on hold just for the short term. | $0 | $29 |

| Work Food (eating out while traveling for work) | $25 | Veronica–is it possible to be reimbursed by your employer for this expense? | $25 | $0 |

| Gardening Supplies | $25 | I recommend Veronica put this spending on hold just for the short term. | $0 | $25 |

| Home Goods | $25 | I recommend Veronica put this spending on hold just for the short term. | $0 | $25 |

| New cell phone | $25 | I recommend Veronica put this savings on hold for the short term. | $0 | $25 |

| Emergency Pup Care Fund | $25 | I recommend Veronica put this savings on hold for the short term. | $0 | $25 |

| Stout Hip Treatment Fund | $25 | I recommend Veronica put this savings on hold for the short term. | $0 | $25 |

| Vehicle Maintenance | $25 | Fixed expense; no change | $25 | $0 |

| Coffee | $20 | I recommend Veronica put this spending on hold just for the short term. | $0 | $20 |

| Haircuts | $20 | I recommend Veronica put this spending on hold just for the short term. | $0 | $20 |

| Charitable Donations | $19 | I recommend Veronica put this spending on hold just for the short term. | $0 | $19 |

| Pupper Care Service | $17 | Fixed expense; no change | $17 | $0 |

| Professional Society Membership Dues | $17 | Veronica–is it possible to be reimbursed by your employer for this expense? | $17 | $0 |

| Auto Loan Reserve | $15 | I recommend Veronica put this savings on hold for the short term. | $0 | $15 |

| Auto Registration Fee | $14 | Fixed expense; no change | $14 | $0 |

| Renters Insurance | $11 | Fixed expense; no change | $11 | $0 |

| Gift Fund: Birthdays | $10 | I recommend Veronica put this savings on hold for the short term. | $0 | $10 |

| Gift Fund: Christmas | $10 | I recommend Veronica put this savings on hold for the short term. | $0 | $10 |

| Amends Fund (for Debtors Anonymous) | $8 | Veronica–is it possible to put this on hold in order to break even every month? | $0 | $8 |

| Bank Fees | $6 | I recommend Veronica switch to a bank that offers a high interest rate and that doesn’t charge a fee. See this post for details on which banks I recommend. | $0 | $6 |

| Dental Supplies | $5 | Fixed expense; no change | $5 | $0 |

| Auto Inspection Fee | $2 | Fixed expense; no change | $2 | $0 |

| Bank Fees | $1 | I recommend Veronica switch to a bank that offers a high interest rate and that doesn’t charge a fee. See this post for details on which banks I recommend | $0 | $1 |

| Bank Fees | $1 | I recommend Veronica switch to a bank that offers a high interest rate and that doesn’t charge a fee. See this post for details on which banks I recommend. | $0 | $1 |

| Monthly subtotal: | $3,339 | Proposed new monthly subtotal: | $2,408 | $932 |

| Annual total: | $40,068 | Proposed new annual total: | $28,896 | $11,184 |

I realize these are deep cuts to things Veronica values; however, I envision this as a short-term, stop gap plan until: 1) Veronica’s inheritance comes through; and 2) she finds a better paying job. The goal for Veronica right now, today is to ensure she stays afloat and doesn’t spend more than she makes. Plus, I overshot the break-even goal of saving $763 per month so that Veronica can adjust these amounts to better reflect her priorities and preferences.

Credit Cards

I think Veronica is spot on in her assessment that she shouldn’t use credit cards. Given her history of credit card debt, and her participation in Debtors Anonymous, I think she’s very wise to recognize this about herself. This is a great illustration of the fact that different financial approaches work for different people. What works for me isn’t necessarily going to work for Veronica and what works for Veronica isn’t necessarily going to work for you.

One of the most important elements of financial literacy is knowing yourself and knowing what sort of money plan you’ll be able to stick to for the long-term. If you are a person who can use credit cards responsibly, then I highly recommend them. If you’re a person who can’t? No shame, no blame, just don’t have a credit card. If you’d like to know more about how I manage my money, check out: How We Manage Our Money: Behind The Scenes of The Frugalwoods Family Accounts.

For more on my credit card strategy, check out The Frugalwoods Guide to a Simple, Yet Rewarding, Credit Card Experience. I also wrote this guide on how to find the best credit card for you.

Summary:

- Today: reduce expenses by at least $763 per month for the short term, so that she’s not spending more than she earns every month.

- Once the cash from the sale of her mother’s house comes through, follow the debt pay-off strategy outlined above and research the possibility of investing in low-fee, total market index funds and increasing her retirement savings.

- Search for a higher-paying job.

- Once the rest of her inheritance is ironed out, and she’s settled on a new job and new region, do research into determining how to proceed with purchasing a home and land (buying in cash, a USDA loan, a traditional mortgage, etc.).

- After the above are accomplished, increase her retirement investments, either through an employer-sponsored plan or an individual plan. This will also be the time to consider increasing her taxable investments.

Ok Frugalwoods nation, what advice would you give to Veronica? She and I will both reply to comments, so please feel free to ask any clarifying questions!

Would you like your own case study to appear here on Frugalwoods? Email me ([email protected]) your brief story and we’ll talk

Got to say, buying real estate would not be my first choice for someone with a low income and a compulsive spending habit. Do you have a plan for keeping up with the property tax, repairs, maintenance, and misc. household expenses that come with owning property? Especially rural property? Considering that you’ve moved around a lot and don’t seem to really feel a connection with the place you’re in now, continuing to rent for at least 5 years seems like the better choice. I don’t want to see you in a place where you’ve spent all your inheritance on debt repayment and real estate and are left with not enough to pay regular bills.

I would be inclined to take most of the estate and put it in the hands of a financial advisor. Yes, they charge fees and would not be something I would recommend for most people, but when a person who is 1) not used to managing a lot of money, and 2) inclined to spend recklessly comes into a large lump sum, it tends to disappear very quickly. A financial advisor wouldn’t prevent poor spending decisions, but having one would perhaps make those bad decisions harder to make. Basically, think a little less about your “””dreams””” and more about how to get an income, both from the inheritance and work, that will ensure you can pay the bills.

A federal job, although hard to find, might be a great option for you: it’s predictable, stable, and you could stay in PSLF.

Veronica here!

Thank you so much for your thoughtful feedback 🙂 It may not have been clear in the narrative, but my plan is to keep renting for the time being until I can source a better paying job and find an appropriate place to set down some real roots. I guess my inquiry could have been split into two major categories for better clarity: the here and now and how to deal with that, and the longer-term plans. Home buying squarely falls into longer-term plans for me. But since I will need to make decisions on what to do with the funds that will be coming to me sooner than I plan to take actions on those plans, I have to consider them now.

I think you’re spot on with consulting a financial advisor – I just spoke with one earlier this week and will be having a follow-up session soon. It’s a huge chunk of money to manage and while I don’t trust my own decision making ability with management of this size of funds, I do feel like I have a well spring of guidance to dip into. Especially the commentariat here! I’m really grateful for all the feedback given 🙂

I think a financial advisor could be a great asset in this situation. Just make sure you’re hiring a fee-only fiduciary. Do not work with someone who isn’t a fiduciary!

As a psychologist who works in finance, amen to Mrs. F’s comment. Check and see if Garrett Financial Network has any representatives nearby. Barring that consider if you can get a fee only plan from someone affiliated with Charles Schwab or Vanguard. Ask if anything being recommended in any way locks up your money or has a “back end charge”. As you like taking courses, look into a quality NON SALES oriented course on personal finance you can take. The University of Georgia, Kansas State, and Texas Tech all have fine financial planning degree programs. See if there are any graduates practicing nearby who are fiduciaries. Generally, though not always, someone with a CFP, is a good bet. Don’t feel pressured to “ put that money to work” to soon. You are experiencing a ground shifting financial event. Go through it thoughtfully. Great Luck.

“Don’t feel pressured to “ put that money to work” to soon. You are experiencing a ground shifting financial event. Go through it thoughtfully.” I couldn’t agree more and I really appreciate the reminder here. It can be really easy to slip into panic over what to do and forget that doing nothing is also an option for a while. It’s very easy to project out into the future and ignore what’s happening in the here and now. Engaging in exercises like the Reader Case Study are really helpful for me because I can feel like I’m being proactive while simultaneously biding time until a holistic answer takes shape. I appreciate the suggestions on Garrett Financial Network and looking for recent graduates, though it makes me nervous to spend that level of funds on advice despite knowing it could be advantageous, at least right now. I will also have to work with my DA program fellows on whether or not to invest in a financial advisor and also how to deal with the large financial changes that I’m experiencing. Thank you!

Veronica, a little follow up. I have been managing folks money for 20 years now. And I combine my psychology background with my finance and investment skill. I’m a much better psychologist than money manager. During the 20 years of overseeing folks money I have had probably a handful of clients who came into life changing windfalls. Most not all have gone through that money rather quickly. Witness a later comment by someone suggesting you “ lock up the money “ in some sort of term deposit. Mrs. F has also described high yield money market funds or bank deposits in one of her posts. Both of these ideas may be worthy options during your wise”do nothing “ option status.

A subsequent post has cited Ameriprise where her mother has been happy for 20 years. In all likelihood that arrangement was that Mom, has an arrangement where her fee is a percentage of money under management. As she notes the most important aspect is the “fit” and communication between Mom and advisor. Great advice. You can get this type of arrangement at Scwabb and Vanguard as well with a lower fee for money under management. Given that this is all going to be new to you and your obvious awareness of your challenge seen from your attendance at DA. Again, go slow. Learn your options. Take time to think how you want to use your windfall. With good advice and planning these funds can provide a current and growing source of income to augment and support your exciting life choices.

There is a growing field called Financial Therapy. I’m not yet sure about it. However, you might google it and see if any free on line advice is applicable. They hope to address the interface of emotions and money. Brand new field, so be careful. As an aside, I wasn’t necessarily recommending a “new” grad of those programs, just that the programs seem solid and might be a way of vetting candidates. Anyway, again. Great Luck, take your time. Use your supports. Be aware as well grief takes a long time. As so often said in previous posts, your Mom and sister were so fortunate to have you walk that difficult time with them. Take care of yourself.

Paul

Yes!!

With some companies like Ameriprise, the financial advisors are not paid by you, but by the company on their performance. My mom has been using the same advisor for years (going on 20) and that is how he is paid. What you have to do is ask a lot of questions and not just go with the first one because it says financial advisor by their name. It’s like a doctor/patient relationship except with money. If you don’t like what he or she says you can find another. But, you both need to have an understanding about what you want.

I agree, work with a financial advisor. Personally, I would pay off the car loan and student loans in full. ($200/month is $2,400 a year and $24,000 in 10 years which, if the forgiveness falls through, now you’ve paid the $24k and still owe $50k? Forget it!) The extra $500 a month will be super helpful. I agree with parking it in a high interest bank account until you have some time to evaluate what your priority goals are. You’ve gotten a lot of great advice!

I’m so sorry about the passing of your mom. I watched my own mom be the main caretaker for my grandmother for over a year before she passed, and caretaking has to be one of the hardest jobs there is! I hope you’re finding peace and support as you grieve your loss.

Since we went down to just one income a few years ago so I could stay at home with our kids, we have also known all too well the plight of having to live paycheck to paycheck—it’s only been recently, after several raises, that we’re finally able to breathe a little easier because we can start saving again. It’s exhausting to feel like you’re having to tread water all the time! I agree with Mrs. Frugalwoods that a job change would be the best way to go, as well as using the inheritance to become debt-free. I feel like the only way I could rest easy at night all those years we had the littlest of margins every month was because we didn’t have debt payments (other than our house) to worry about.

As far as side income from photography, have you looked into Smugmug? I just have their Power plan because I just do work for clients (rather than selling prints), but if you have a good-size portfolio and can build up a presence on social media or through some other means, you could look into doing their Portfolio plan, which will allow you to sell image and video downloads, as well as prints of your work. It’s $180 a year for that plan, so you would definitely have to weigh if it would be worth it to you, but it might be a possible way to bring in a side income. Also, you might consider starting to do some client work, such as taking photographs for local animal shelters, outdoor rec companies, etc. (And if you do photography of people, even easier to find clients!)

Photography can be a tricky field to make an income in, but if the market around you isn’t too saturated with photographers, it might be easier to get your foot in.

I wish you all the best!

Thank you, Torrie! The support here has been such a beautiful outpouring to receive!

I haven’t tried SmugMug, but I’m going to look into it. And thank you for suggesting looking into doing some client work too! Do you work under contracts with clients? Are there resources I can reference when it comes to rates to charge for just starting out? I don’t really enjoy working with people unless it’s doing candid photography. I’ve done some portrait work in the past and found it… draining. Sounds like I have some research to do!

I’m with you—the posed session are super training, and not my favorite (though I will still take a few on, esp if I know the people). I actually specialize more in lifestyle/documentary photography myself, with an emphasis on doing birth stories and lifestyle newborn shoots. You can also look into working directly with companies though–I would think outdoor sporting goods companies or something in your case. You would probably want to draw up your own contract working with clients, though some bigger companies would probably have their own, too. The best way to research what rates you should start at is to find a local photographers’ group (I joined one on Facebook) and then look at the different members’ photography websites and go from there. Good luck!

Veronica, are you selling your earrings on Etsy? I think you should. The shell earrings are super cute!

Agreed!

I like them also. Please list the link if you sell your jewelry online.

Thanks, y’all! I used to sell on Etsy a long time ago, but found it to be a lot of work for not nearly enough return. I might look into trying it out again once I’m done administering my mom’s estate. 🙂

Just a quick point. Have you considered Etsy? Love the earrings, where can I buy them?

Thanks, Leigh! I used to sell on Etsy a long time ago, but not currently. I’m on instagram @lupino.jewelry, feel free to DM me there 🙂

I’m so sorry for your loss. I’m also 40 and just lost my Dad suddenly in May. Based on my experience I recommend not persuing buying anything for a while as you go through grief. When my Dad first died, I had all sorts of grand dreams of what I would do with the inheritance because I was trying to cheer myself up and live my life, but as time passes I realize I’m really sad and questioning life. I’m thinking the best use of some of my money might be therapy. I know you are a completely different person, but I just wanted to share my experience.

My condolences on the loss of your mother. I agree with Sarah that you should wait a bit to make decisions on how to spend the inheritance. When we inherited a good chunk of money from my father-in-law we sat on it for at least six months before finalizing decisions. Ultimately we paid off our mortgage and car loan and renovated the kitchen and invested the rest. Paying off the car loan and mortgage was an emotional decision for peace of mind. The interest rates were low much lower than yours and most people would’ve suggested investing the entire amount.

I love my renovated kitchen but I regret that I went a bit overboard (spent 67 k) because there were a lot of funds available. Overall though we spent less than 25% of the money on the reno.

You have a lot of dreams and creative pursuits. As you enter your 40s this can sometimes be a time of wanting to redirect your life, particularly in your career. You are going to have to narrow your focus and decide what you really want because some of these dreams are in opposition to others.

Since this is a time of great change in your life I recommend you continue renting as well. Once you get your career decided upon you can look at buying. With $50,000 student loan’s that could be forgiven would be hard for me too Not factor that into my job decision. So I waffle on whether or not you should pay that one off with the inheritance.

One other thing I want to say about an inheritance. We felt a great need to honour what our father would have wanted us to do with the money. That is part of the factor for paying off mortgage and debt. But try as much as you can to make a responsible choice that is also best for you.

I’m so sorry for your loss, Sara.

Hi Sara, I’m so sorry about the loss of your dad. It really is so hard to experience. It can be really easy to slip into fantasy! I had a lot of fantasy thoughts for a bit after mom’s passing, thankfully since I’m in DA I’m aware that’s my addition talking in my head. Grief therapy has been good for me, it’s helped me have a safe place to process. I’ve found myself questioning my life as well, going through a big loss really brings life into focus. A hospice counselor gave me great advice right after mom passed, she told me to not make any big decisions or make any big changes for a year after mom’s passing. I see this time as an information gathering period and a time to practice patience and focus on the work I need to do (therapy, dealing with current financial struggles). I don’t even need to make a decision when that year hits, but at least I’d have gotten a holistic view of my options in the meantime. I wish you a lot of peace in your grief process.

Have you considered putting most of the money in a 1 year CD? So that then you won’t be able to touch it for awhile while you are still processing.

This is a great idea! I’ve been thinking about taking a portion for a home down payment, which I wouldn’t want to tie up in long term investments, but also wouldn’t want as cash in hand. I think you just gave me the solution to that quandary!

I know a number of wildlife biologists here in rural Pennsylvania. Until I met them, I was not aware of the many options for employment in that field. I do wonder if limiting your job search to North Carolina is wise. It would seem that anywhere in the Eastern US/Appalachia would be a possibility, as the habitats are similar. Although you may be emotionally tied to NC, is it limiting you too much?

My wildlife biologist friends work at the Corps of Engineers, State Game Commission, and several educational/outreach organizations. Networking through wildlife conferences, speaking at same, and perhaps publishing articles either in professional journals or even in small local newsletters (e.g., Audubon Society, other special interest community organizations) might also help with your network expansion and open up new possibilities.

As you look in the larger region, you may find opportunities closer to college towns, or smaller cities, which would also help with the sense of isolation you feel.

Good luck with this. I applaud what you have done thus far and do hope that you can continue to make more positive changes.

I second state jobs in PA. My FIL works for PennDot and has had COLA increases and such over time and gets decent benefits. I imagine it would be the same for park jobs here too.

Thanks, Beth! Yes to all of this, all solid advice that I currently partake in. NC is an amazingly biodiverse state and in researching where in the eastern US I could work, I found NC had the most employment opportunities and the most dynamic research taking place in the eastern US. That’s a huge appeal as a specialist and a researcher. Thankfully, I’m in a good position to be very choosy about my next employment situation/position and should the “perfect” job come open in another state that would be food for thought.

Thank you for sharing your story with us, Veronica. My condolences on the loss of your mother — may her memory be a blessing.

I am strongly seconding to RUN not walk away from TD Bank. I had TD in undergrad and while the “college checking account” was all right, all their accounts for adults have excessive fees and insufficient interest.

I’ve had good luck with Ally Bank and I also recommend looking into Excite Credit Union. Credit unions in general are wonderful because they are 100% owned by the people with money in them so they are beholden to you, not the shareholders. Both Ally Bank and Excite Credit Union are entirely online which could be helpful for someone who travels a lot and can’t be guaranteed that their particular brick-and-mortar bank or credit union will be in a particular area. It also means that they tend to have higher interest rates than brick-and-mortar banks and CUs.

I love Ally bank and have been using them for a number of years. My checking is currently earning .1% interest and my savings accounts are 1.6%. It’s easy to open multiple accounts if you like to separate out your savings (I have ones for taxes & insurance, my emergency fund, etc.) They also reimburse you automatically for ATM fees, up to $9/month; you can deposit checks through their app; it’s easy to switch your money over to money market accounts if those start earning more interest than a savings account in the future; free online bill pay to the extent where some of my bills (gas & electric) are so automatic that Ally gets the info for me and just sends me an email saying when and how much they’re going to pay. I don’t have to tell them every month 🙂

I was going to recommend Ally as well. Note that they just started offering buckets so you can assign your money within one account to multiple categories. I understand this can be really helpful with budgeting (dog savings versus emergency savings, etc.) so if that’s the main motivation for having multiple accounts, consider switching to one high interest savings account with Ally and use the bucket feature. I also love Goodbudget (both app and website) for envelope budgeting. Sounds like you likely already have a good system established through your DA program, but it’s another option for seeing your money virtually in different places while maintaining one account. FYI, I do also have a normal checking and savings account and it’s very easy to transfer money back and forth from Ally.

Thanks Stephanie and Jen for this additional information about Ally bank, sounds like I need to take a look at them as a banking option!

Thank you – I cannot wait to get away from TD… When I set up my accounts there, I was living in a state with branches (which was necessary for guardianship account management), then I moved to a state without branches. I’ve stayed simply because I had the guardianship accounts set up there as well and now the trust account and soon the estate account. Once probate clears everything I am going to be switching banks for all my accounts. Thanks for the recommendations, I’ll be doing some research into better banking options!

Super inspiring case study! I love your jewelry Veronica so pretty! Would definitely buy them if for sale. Thanks for sharing your beautiful and touching story.

One of the things I took away from your case study is that you have a lot of goals and (at least right now) not the money to support them all. I think both you and Mrs. Frugalwoods described some good options and paths to get there, but I also wonder if you might consider reflection and prioritization of your goals? For example, you want to have more dogs, but if you had to choose between more dogs and say, the ability to afford your jewelry making supplies, which would you rather have in your life? If you find a farmhouse to restore that you love that you can’t afford while also affording your other hobbies, but you could if you gave them up, would this be worth it? It sounds like you love your job and I am envious of that, so while I agree in the need to increase your income, I don’t know… from what you wrote I don’t see you being happy working for an energy company from the glimpse that I got here. I agree with Mrs. Frugalwoods about using the inheritance to wipe out your loans – it will save you money in the long term and be a huge load off mentally and monthly!

No real suggestions about online side-hustles – I’ll be following along as well for that!

This case study speaks to me, as both my husband and I have moved around extensively for low paying, wildlife related jobs and used to live in rural central NC (ahhh, the cheap rent!!) with a long term dream to buy land and move to the mountains. The field is hard and highly competitive, but one of the huge benefits is truly loving the work you get to do. So many folks cannot believe that we could get paid to do what we love (hike, wildlife “watching”, paddle, etc). Rather than be so quick to change employers, I’d suggest the reader explore what their long term goals for their career are. We decided that since we love the work we get to do, we’d rather continue working longer with lower paying jobs working for organizations that we value contributing to, than go an alternative route to higher pay (such as an energy company, consulting firm, etc). But that is up to everyone to decide on their own and there are some great consulting firms out there! Additionally, the reader seems interested in having time for alternative activities, and has such a flexible arrangement with work that a job change to a more high demanding organization that focuses on billable hours vs. flexible government workload might be a huge negative for the readers life. If I were in the shoes of the reader, I’d use the inheritance as you outlined to pay off all debts ASAP. Then, I’d park that remaining $100k into a high interest savings account that is not linked to your regular checking account while you explore your long term dreams for a few years. With those loans gone and such a low cost of housing, I’d focus on decreasing monthly spending where you can to thrive on your lower income, flexible job that you love, while continuing to job hunt in mountainous areas (Texas A&M job board is great!). Then, when the time strikes with the perfect federal or state position (non-profits like TNC, The Wilderness Society, etc are also excellent – they pay competitively, have flexible schedules and often have better leave and retirement benefits that state/federal agencies) in the mountains, explore housing options. Perhaps at that time with no debts and a higher permanent income it will make sense to take advantage of a mortgage to buy the property you love and at that point you could invest the rest of your inheritance money (that has been making safe interest over the years) to catch up for the years that you’ve missed saving for retirement. Or maybe, the area you move will have such low costs of rent that it makes sense to rent a small place long term close to your new office while using some of your inheritance to buy land in cash nearby in the mountains for timber, farming, small cabin, etc (a personal scenario we always dreamed of). Or maybe you’ve met a partner and that has changed the location you want to settle down in. Good luck in whatever you end up deciding and thanks for working to protect and conserve wildlife! 🙂