Holly is a music therapist living in Virginia with her husband, Josh, their three young children, two guinea pigs and one dog. They love hiking and spending time together as a family. Josh is a stay-at-home dad, which suits their family perfectly. Holly’s question is whether or not this is sustainable from a financial perspective. They are naturally frugal and don’t spend much, but wonder if they’re saving and planning well enough for retirement. Join me as we dive into Holly and Josh’s finances to see what advice we might be able to offer!

What’s a Reader Case Study?

Case Studies address financial and life dilemmas that readers of Frugalwoods send in requesting advice. Then, we (that’d be me and YOU, dear reader) read through their situation and provide advice, encouragement, insight and feedback in the comments section.

For an example, check out the last case study. Case Studies are updated by participants (at the end of the post) several months after the Case is featured. Visit this page for links to all updated Case Studies.

Can I Be A Reader Case Study?

There are four options for folks interested in receiving a holistic Frugalwoods financial consultation:

- Apply to be an on-the-blog Case Study subject here.

- Hire me for a private financial consultation here.

- Schedule an hourlong call with me here.

- Schedule a 30 minute call with me here.

To learn more about one-on-one consultations with me, check this out.

Please note that space is limited for all of the above and most especially for on-the-blog Case Studies. I do my best to accommodate everyone who applies, but there are a limited number of slots available each month.

The Goal Of Reader Case Studies

Reader Case Studies highlight a diverse range of financial situations, ages, ethnicities, locations, goals, careers, incomes, family compositions and more!

The Case Study series began in 2016 and, to date, there’ve been 93 Case Studies. I’ve featured folks with annual incomes ranging from $17k to $200k+ and net worths ranging from -$300k to $2.9M+.

I’ve featured single, married, partnered, divorced, child-filled and child-free households. I’ve featured gay, straight, queer, bisexual and polyamorous people. I’ve featured women, non-binary folks and men. I’ve featured transgender and cisgender people. I’ve had cat people and dog people. I’ve featured folks from the US, Australia, Canada, England, South Africa, Spain, Finland, the Netherlands, Germany and France. I’ve featured people with PhDs and people with high school diplomas. I’ve featured people in their early 20’s and people in their late 60’s. I’ve featured folks who live on farms and folks who live in New York City.

Reader Case Study Guidelines

I probably don’t need to say the following because you all are the kindest, most polite commenters on the internet, but please note that Frugalwoods is a judgement-free zone where we endeavor to help one another, not condemn.

There’s no room for rudeness here. The goal is to create a supportive environment where we all acknowledge we’re human, we’re flawed, but we choose to be here together, workshopping our money and our lives with positive, proactive suggestions and ideas.

And a disclaimer that I am not a trained financial professional and I encourage people not to make serious financial decisions based solely on what one person on the internet advises.

I encourage everyone to do their own research to determine the best course of action for their finances. I am not a financial advisor and I am not your financial advisor.

With that I’ll let Holly, today’s Case Study subject, take it from here!

Holly’s Story

Hi Frugalwoods, I’m Holly, age 33, a happy hiker living in Roanoke, Virginia with my husband of 10 years, our 3 young kids, 1 dog, and 2 guinea pigs. I work as a music therapist in a state psychiatric hospital. I’m very happy with my career choice as a music therapist because it allows me to help others, play music all day, and work regular, daytime hours with benefits.

My husband Josh (age 32) has a degree in Greek and Latin but never quite figured out what he should be when he grows up, so for now he’s doing the most important work of staying home to care for our three children, who are ages 3, 6, and 8. He also works part-time in the summer as an usher for our local minor league baseball team and as a pet-sitter/dog-walker intermittently throughout the year.

Holly & Josh’s Hobbies

Josh and I love to hike and it’s a big part of why we moved to Virginia from the Midwest. We spend as much of our free time as possible exploring the mountains and are consistently in awe of God’s amazing creation.

We’re also very active in our church. I play the piano and organ, Josh is on the council, and we both sing in the church choir. Our older kids go to the local public school, and our 3-year-old goes to a private preschool three mornings per week. Our life might seem simple (boring?) to some, but for us it’s perfect.

The Simple, Good Life

As a child, my family moved from one apartment to another every few years as my super-strong and resilient single mom did an amazing job finding places she could afford. Now that I have my own family, I feel so blessed that my children have a house to call home in a nice neighborhood perfect for daily walks with our beagle. We redid our deck last year and added a small balcony off of our bedroom.

There is nothing I love more than sneaking out onto the deck to do yoga or enjoy a few quiet moments sitting on the deck furniture my husband rescued from the side of the road. Josh and I are both naturally frugal, and he does an incredible job managing our finances. I have basically no idea what our bills are (seriously, a solar salesman asked me about our electric bill and I could not even give him a ballpark guess) or how he makes our small budget work, but I am eternally grateful that he does.

What feels most pressing right now? What brings you to submit a Case Study?

My primary reason for submitting a case study is to find out if what we’re doing is actually working. When Josh first started staying home with our kids three years ago, it was because we were moving across the country and knew they’d need extra (short-term) support for the transition. Then, when our finances remained balanced and we realized how much more smoothly our home could run with him at home, we chose to continue.

The Questions:

As our youngest child approaches kindergarten in a year and a half, we wonder if Josh should continue staying home (before and after school care is still expensive) or if he should look at re-entering the work force in a more full time-ish way. If so, what should he do? He previously worked in the library and enjoyed that work, he also worked for many years as a retail supervisor and did not love that work.

Neither of our parents paid for our college educations. I was lucky enough to earn large scholarships to my small school and paid the rest out of pocket. Josh had student loans that we paid off four years ago. I’m not super inclined to save a ton of our money for our children’s educations because I believe that students invest their time and energy where they invest their money and because I don’t want to pressure them into attending college if they are interested in a different career path. Is this stupid? Should we be saving more for this anyway?

There’s also a tiny part of me that knows that the financial aid I received because my mom didn’t have a lot of money is a big part of why I was able to pay for school out of pocket. I’d hate to save a bunch of money for my kids’ educations and have that result in them having to pay more (already inflated) money for their educations.

What should we be doing with our finances that we’re not? I appreciate the advice I’ve read on Frugalwoods that it’s often better to save money than to pay off mortgage debt quicker, but it’s so hard not to want that payment to go away sooner.

What’s the best part of your current lifestyle/routine?

All of the time our family gets to spend together. I have generous benefits as a state employee and they allow me leave time to attend school programs, stay home to help when the kids are sick, and enjoy camping trips in the summer or long road trips to see our family.

What’s the worst part of your current lifestyle/routine?

As an optimist, I struggle to identify a worst part. I worry that maybe someday I’ll burn out in my work and wish I’d gone to grad school, but mostly I can’t justify the time away from our family or the financial investment right now.

Other than that, I sometimes wonder if we’re trying too hard to save money and should just spend more now on fancier experiences for our kids or vacations or something? But as a naturally frugal person, I struggle to do anything that’s “not a good deal.” Even if I knew for sure that I had more disposable income, it would be a challenge for me to dispose of it.

Where Holly Wants To Be In 10 Years:

1) Finances:

- Same place?

- We should have our mortgage halfway paid off by then.

- It would be fun to have it fully paid off, but that seems unrealistic.

2) Lifestyle:

- Same place?

- I can’t think of anything I personally want to change other than getting my kids out on bigger hiking trails since they’ll be ready to do that.

3) Career:

- Unknown.

- Right now I love what I do, and I need to stay with the state for two more years to vest my Virginia Retirement System. After that, I could potentially work in a different setting, but I don’t feel like I have to necessarily.

- In 10 years, Josh would like to be working in his dream job, and he needs help figuring out what his dream job is.

Holly & Josh’s Finances

Income

| Item | Monthly Gross Income (total BEFORE all deductions) |

Deductions & Amount | Monthly Net Income (total AFTER all deductions are taken out, such as healthcare, taxes, employee parking, 401k, etc.) |

| Holly’s Music Therapy income | $4,158 | Health and dental insurance: $61 Retirement contributions: $454 Taxes: $626 |

$3,017 |

| Josh’s MiLB Usher income (6 mo/yr) | $175 | Taxes: $25 | $150 |

| Josh’s Dog Care income | $150 | $150 | |

| Holly’s Organ Playing income | $80 | $80 | |

| Monthly subtotal: | $3,397 | ||

| Annual total: | $40,764 |

Mortgage Details

| Item | Outstanding loan balance | Interest Rate | Loan Period and Terms | Equity | Purchase price and year |

| Mortgage on primary residence | $146,882 | 3.13% | 30-year fixed-rate mortgage | $121,118 | $183k; purchased in 2019 |

Debts: $0

Assets

| Item | Amount | Notes | Interest/type of securities held/Stock ticker | Name of bank/brokerage | Expense Ratio |

| 403(b)- Holly | $28,798 | Former Job | Empower Retirement | ||

| 401(k)- Josh | $20,081 | Former Job | Merrill Lynch | ||

| VRS Hybrid Plan- Holly | $19,354 | Current Job | Virginia Retirement System | ||

| Roth IRA- Josh | $19,025 | $100/mo. | Betterment | ||

| Roth IRA- Holly | $12,456 | Betterment | |||

| Chase Checking | $6,456 | Main Account | Chase | ||

| Roth IRA- Holly | $6,139 | Started with Former Job, $133/mo. | Touchstone Investments | 0.24% | |

| Emergency Fund | $5,538 | $50/mo. | Earns 3.10% interest | SmartyPig | |

| Member One Savings | $1,665 | Secondary Local Account, cash access | “Earns” .10% dividend | MemberOne | |

| Car Insurance Pre-pay | $236 | Pre-pay savings acct. to cover next bill, $60/mo. | Earns 3.10% interest | SmartyPig | |

| Member One Checking | $234 | Secondary Local Account, cash access | MemberOne | ||

| Phone Bill Pre-pay | $121 | Pre-pay savings acct. to cover next bill, $30/mo. | Earns 3.10% interest | SmartyPig | |

| Total: | $120,103 |

Vehicles

| Vehicle make, model, year | Valued at | Mileage | Paid off? |

| 2014 Honda Odyssey | $13,000 | 80,000 | Yes |

| 2008 Honda Civic | $2,700 | 170,000 | Yes |

| Total: | $13,500 |

Expenses

| Item | Amount | Notes |

| Mortgage | $980 | ~$80 extra/mo. to make 1 additional payment per year |

| Groceries | $370 | Used Credit Card spending categories |

| Church Offerings | $300 | |

| Shopping | $292 | Used Credit Card spending categories |

| Automotive | $288 | Used Credit Card spending categories |

| Gas | $280 | Used Credit Card spending categories |

| Restaurants | $237 | Used Credit Card spending categories |

| Preschool | $150 | |

| Electric Bill | $100 | |

| Car Insurance-Allstate | $86 | Saved ahead in SmartyPig to pay upcoming 6 mo. premium |

| Entertainment | $85 | Used Credit Card spending categories |

| Mortgage (annual additional payment) | $75 | Yearly, one time additional payment, usually after tax return |

| Animal Supplies/Bills | $60 | |

| Water Bill | $51 | |

| Internet | $40 | |

| Travel | $40 | Used Credit Card spending categories |

| Health & Wellness | $33 | Used Credit Card spending categories |

| Cell Phones | $30 | We pay for 2 lines on a family plan with Holly’s mom, saved ahead in SmartyPig |

| Monthly subtotal: | $3,497 | |

| Annual total: | $41,964 |

Credit Card Strategy

| Card Name | Rewards Type? | Bank/card company |

| Chase Freedom Unlimited | 1.5% cash back on all purchases, 3% on dining | Chase Bank (affiliate link) |

Holly’s Questions for You:

- From a financial standpoint, is it feasible for Josh to remain a stay-at-home dad when our youngest child goes to kindergarten?

- If it’s not feasible for Josh to continue staying home, what should he do?

- If Josh continues to stay home, can I still retire someday? When I’m 65? Sooner?

- Should we pay off our mortgage more aggressively? Save for retirement more aggressively? Both? Something else?

- Should we be saving for our kids’ college?

Liz Frugalwoods’ Recommendations

I love Holly’s optimism and joy! It shines through in her writing that she and Josh have created a life they love! And what’s so telling is how little they spend on this life. I find their story inspirational and a salient reminder that “the good life” can be a frugal, mindful life.

Holly and Josh have what so many people struggle to attain:

- They live in a place they love

- They are grateful for their simple, joyful routines

- They engage in their hobbies often and with their children

- They enjoy a great work/life balance, which enables them to have a relatively low-stress lifestyle and plenty of time together as a family

Thank you, Holly, for reminding all of us that it’s very possible to live a very good life on very little money. And now, let’s dive in!

Holly’s Question #1: From a financial standpoint, is it feasible for Josh to remain a stay-at-home dad when our youngest child goes to kindergarten?

As I see it, the primary issue with Holly and Josh’s finances is that they’re spending $100 more than Holly earns every month. Holly reports their spending as $3,497 and their income as $3,397. This is, as I noted, a very low income for a family of five. In fact, they’re very nearly at the Federal Poverty line, which in 2023 is an annual income of $35,140 for a family of five. I say that to illustrate how fantastically well Holly and Josh are managing on such a low income.

Their spending is also very low; but, it’s not low enough. You can run a deficit for a little while, but it will eventually catch up with you when you’ve depleted your savings. In other words, it’s not a sustainable path for the longterm and it’s something Holly and Josh should work to rectify now.

To bring their spending into alignment with their income, Holly and Josh have three options:

- Reduce their expenses

- Increase their income

- Do both

The option they choose is entirely up to them. Let’s start with option #1 and an overview of where they could save more money every month. To get a sense for where reductions are possible, I first categorized all of their spending as Fixed, Reduceable or Discretionary:

- Fixed expenses are things you cannot change. Examples: your mortgage and debt payments.

- Reduceable expenses are necessary for human survival, but you control how much you spend on them. Examples: groceries and gas for the cars.

- Discretionary expenses are things that can be eliminated entirely. Examples: travel, haircuts, eating out.

Now that we know which items have leeway, I went through and assigned a “Proposed New Amount” to each line item. Only Holly and Josh know which items are priorities and which items they can reduce, but the below spreadsheet gets this exercise started for them:

| Item | Amount | Notes | Category | Proposed New Amount | Liz’s Notes |

| Mortgage | $980 | ~$80 extra/mo. to make 1 additional payment per year | Fixed/ Reduceable |

$900 | They can’t afford this extra $80 per month. |

| Groceries | $370 | Used Credit Card spending categories | Reduceable | $370 | This is so low, I’m not going to reduce it any further! |

| Church Offerings | $300 | Discretionary | $0 | This is a tough one. I understand the importance of tithing, but at this point, Holly and Josh are giving away money they simply don’t have. I encourage them to consider reducing this amount and finding other ways to give of their time and talent to their church. It does not make sense to put yourself into debt by donating money. | |

| Shopping | $292 | Used Credit Card spending categories | Reduceable | $200 | I’m not sure what this category encompasses–I encourage Holly and Josh to dig in and see what’s actually in there. |

| Automotive | $288 | Used Credit Card spending categories | Reduceable | $288 | |

| Gas | $280 | Used Credit Card spending categories | Reduceable | $280 | |

| Restaurants | $237 | Used Credit Card spending categories | Discretionary | $0 | |

| Preschool | $150 | Fixed/Reduceable | $150 | ||

| Electric Bill | $100 | Fixed/Reduceable | $100 | ||

| Car Insurance-Allstate | $86 | Saved ahead in SmartyPig to pay upcoming 6 mo. premium | Fixed/Reduceable | $86 | I encourage them to shop this around to see if there’s anything cheaper. |

| Entertainment | $85 | Used Credit Card spending categories | Discretionary | $0 | |

| Mortgage (annual additional payment) | $75 | Yearly, one time additional payment, usually after tax return | Discretionary | $0 | This is not something they can afford. |

| Animal Supplies/Bills | $60 | Fixed | $60 | ||

| Water Bill | $51 | Fixed | $51 | ||

| Internet | $40 | Fixed | $40 | ||

| Travel | $40 | Used Credit Card spending categories | Discretionary | $0 | |

| Health & Wellness | $33 | Used Credit Card spending categories | Discretionary | $20 | |

| Cell Phones | $30 | We pay for 2 lines on a family plan with Holly’s mom, saved ahead in SmartyPig | Reduceable | $30 | |

| Monthly subtotal: | $3,497 | Proposed New Monthly subtotal: | $2,575 | ||

| Annual total: | $41,964 | Proposed New Annual total: | $30,900 |

As you can see, since Holly and Josh have relatively low Fixed expenses, it would be entirely feasible for them to bring their spending under their income. It’s a pretty bare bones budget, but, it’s a template for what they could do if they want Josh to continue to serve as stay-at-home parent. If they followed this budget, they’d be on track to save an additional $9,864 per year.

There’s no “right” or “wrong” answer here. Rather, it’s a question of what Holly and Josh value most.

- Do they value the things they’re currently spending money on?

- Or are they willing to cut some of their expenses in order to facilitate the wonderful situation of having a stay-at-home parent?

- The only wrong answer is to continue spending more than they make. Aside from that, it’s in their hands to decide.

Holly’s Question #2: If it’s not feasible for Josh to continue staying home, what should he do?

This is something only Josh can answer. I think it’s going to require a deep conversation between Holly and Josh about what they value in their current lifestyle and how that would change if he went back to work. As I just outlined, it is financially possible for Josh to continue in the important role of stay-at-home parent; but, it will require an even greater level of frugality than they’re currently practicing.

→It’s also true that no decision has to be final.

Holly and Josh could try implementing the uber frugal budget outlined above and see how it feels.

- Is it reasonable for them?

- Or is it just too restrictive?

Josh could also get a job and they could asses how that feels. If Josh were to start working, they should evaluate:

- How much they’ll pay in before/after school care

- How they’ll handle kid sick days, school vacations, school half-days, and summer vacation

- How much Josh will need to spend on gas to commute to his job

- Any other impacts to their budget created by Josh working.

- For example: will there be less time to prepare meals and thus an increase in costs for prepared foods/take-out?

Another thought is for Josh to get a job that aligns with the kids’ schedules… in other words, a job at their school. Having the same hours, commute and vacations as the kids would alleviate a lot of the scheduling stress of having two working parents. Schools are often hiring for a range of positions–custodians, administrators, substitute teachers, teacher’s aides, and of course teachers themselves. This is definitely something to consider since it might enable them to maintain much of their current fabulous family life balance. Substitute teaching in particular would be very flexible. Certainly not lucrative, but flexible! Since Holly’s job provides the family’s insurance, Josh has the flexibility to take a part-time position that likely wouldn’t come with benefits.

Holly’s Question #3: If Josh continues to stay home, can I still retire someday? When I’m 65? Sooner?

1) Research Holly’s Pension!

What jumped out at me is that Holly is a state employee and has a pension. This is something for Holly to dig into and research ASAP. If Holly is guaranteed a state pension after a specified number of years of service, that dramatically improves their retirement outlook. A pension is kind of like the holy grail of retirement because–with some pensions–it’s guaranteed income for the rest of your life. Of course, pension systems can default, but state and federal pensions are generally more reliable than private companies. All that to say, Holly should get the handbook, ask a lot of questions and figure out the precise terms of her pension.

Setting the pension aside, Holly might also qualify for Social Security. However, this is something to research since some pensions preclude you from taking Social Security. Holly should also investigate if her employer offers any other retirement plans, such as a 457.

2) Retirement Investments: $86,499

Between their various 401ks, 403bs and IRAs, Holly and Josh have socked away an impressive $86,499 in retirement! They should feel really proud of this! Saving so much on such a low income is commendable. Let’s see how this stacks up against Fidelity’s Retirement Rule of Thumb:

Aim to save at least 1x your salary by 30, 3x by 40, 6x by 50, 8x by 60, and 10x by 67.

Since they’re in their early 30’s, we’ll go with 2x their income, which would be $81,528 ($40,764 x 2). Woohoo! That means Holly and Josh are right on track. The caveat, of course, is that this would entail they continue to keep their expenses very low.

To answer Holly’s question, if she and Josh are comfortable with keeping their expenses low throughout their lifetime, they’ll be fine. Plus, since their income is so low, they’re very likely to qualify for generous subsidies on things like health insurance through the Affordable Care Act.

→Again, the wild card is the pension. Knowing what that provides should give Holly and Josh even greater peace of mind. But, if they’re able to continue investing for retirement and don’t touch that money until they retire, they should be just fine.

Holly’s Question #4: Should we pay off our mortgage more aggressively? Save for retirement more aggressively? Both? Something else?

In short, NOPE on the mortgage. Holly and Josh actually need to stop paying extra on their mortgage as it’s causing them to spend more than they earn each month. There’s no world in which that calculation makes sense. And I want them to understand that having a mortgage is not a bad thing. It’s actually a good thing for a number of reasons:

- If your mortgage has a low, fixed interest rate–which Holly and Josh’s does at 3.13%–your money will be better utilized elsewhere:

- The stock market (where Josh and Holly’s retirement accounts are invested) returns a historical average of 7% annually. This does not mean 7% every year, but 7% on average over time. Of course past performance does not guarantee future success, but in the absence of a crystal ball, it’s all we’ve got to go on…

- 7% is greater than 3.13%, which means their money would be better leveraged in the stock market (aka in their retirement investments).

- In other words, it’s an opportunity cost to pay off a fixed, low interest rate mortgage.

- A house is an illiquid asset:

- If you use all of your extra cash to pay off your mortgage, you’re stuck with a large, immoveable asset.

- Sure, you can sell the house, but then you need to pay to live somewhere else.

- Remember:

- You cannot use a paid-off house to buy groceries

- You cannot use a paid-off house to pay medical bills

- Having all of your money tied up in a house means that your investments are not diversified:

- You’re putting all of your financial eggs in one basket and a house is not guaranteed to appreciate.

- A mortgage is an excellent hedge against inflation:

- Inflation is when money becomes less valuable and the neat thing about a mortgage is that it’s denominated in the dollars you originally paid for the house and so, over time, as inflation increases (hello, right now!), the money you’re using to pay off your mortgage is “cheaper.”

- Look no further than the current skyrocketing mortgage interest rates to understand why Holly and Josh’s 3.13% is so attractive.

→Paying off a mortgage might feel good psychologically, but it very often is not mathematically or financially prudent.

Asset Overview

To answer Holly’s question about what they should do with any extra money, let’s run through the rest of their assets.

Remember, the #1 job for any extra money is to get their expenses in alignment with their income.

- Cash: $14,249

Your cash equals your emergency fund and your emergency fund is your buffer from debt:

- An emergency fund should cover 3 to 6 months’ worth of your spending.

- At Holly and Josh’s current monthly spend rate of $3,497, they should target an emergency fund of $10,491 to $20,982:

- This means the $14k they have in cash is right on target. Woohoo, well done!

Your emergency fund is there for you if:

- You unexpectedly lose your job

- Something horrible goes wrong with your house that needs to be fixed ASAP

- Your car breaks down and must be repaired

- You’re hit with an unexpected medical bill

- Your dog gets quilled by a porcupine and has to go to the emergency vet

As you can see, an emergency fund is not for EXPECTED expenses, such as:

- Routine maintenance on a car, such as oil changes and brake pads

- Anticipated home repairs, such as boiler servicing/chimney sweeping

- Planned medical expenses

An emergency fund’s reason for existence is to prevent you from sliding into debt should the unforeseen happen. It’s your own personal safety net.

→Since an emergency fund is calibrated on what you spend every month, the less you spend, the less you need to save up.

This is also why it’s so critical to track your spending every month. If you don’t know what you spend, you won’t know how much you need to save. I use and recommend the free expense tracking service from Personal Capital (affiliate link).

Why So Many Accounts?

My only quibble with Holly and Josh’s cash position is their SIX different accounts. If it’s meaningful to them to have this many accounts, then stick with it. But from my perspective, it’s confusing and adds a lot of extra admin work. If it were me, I would move all $14k into one high-yield savings account. The fact that some of their cash isn’t earning interest is untenable. They need to leverage every penny they can to make their budget work.

For example, as of this writing, the American Express Personal Savings account earns a whopping 3.50% in interest (affiliate link). This means in one year, their $14,249 would earn $499 in interest!

Credit Card Strategy

Holly and Josh get an A+ on their credit card strategy. They have the Chase Freedom, which is a no-fee, cash-back card, which is brilliant. Cash-back cards are the easiest rewards to get and use because you know you’re going to use cash. Travel rewards are nice, but not everyone travels enough to utilize them fully. Most importantly, Holly and Josh pay their card off IN FULL every month. Very well done here!

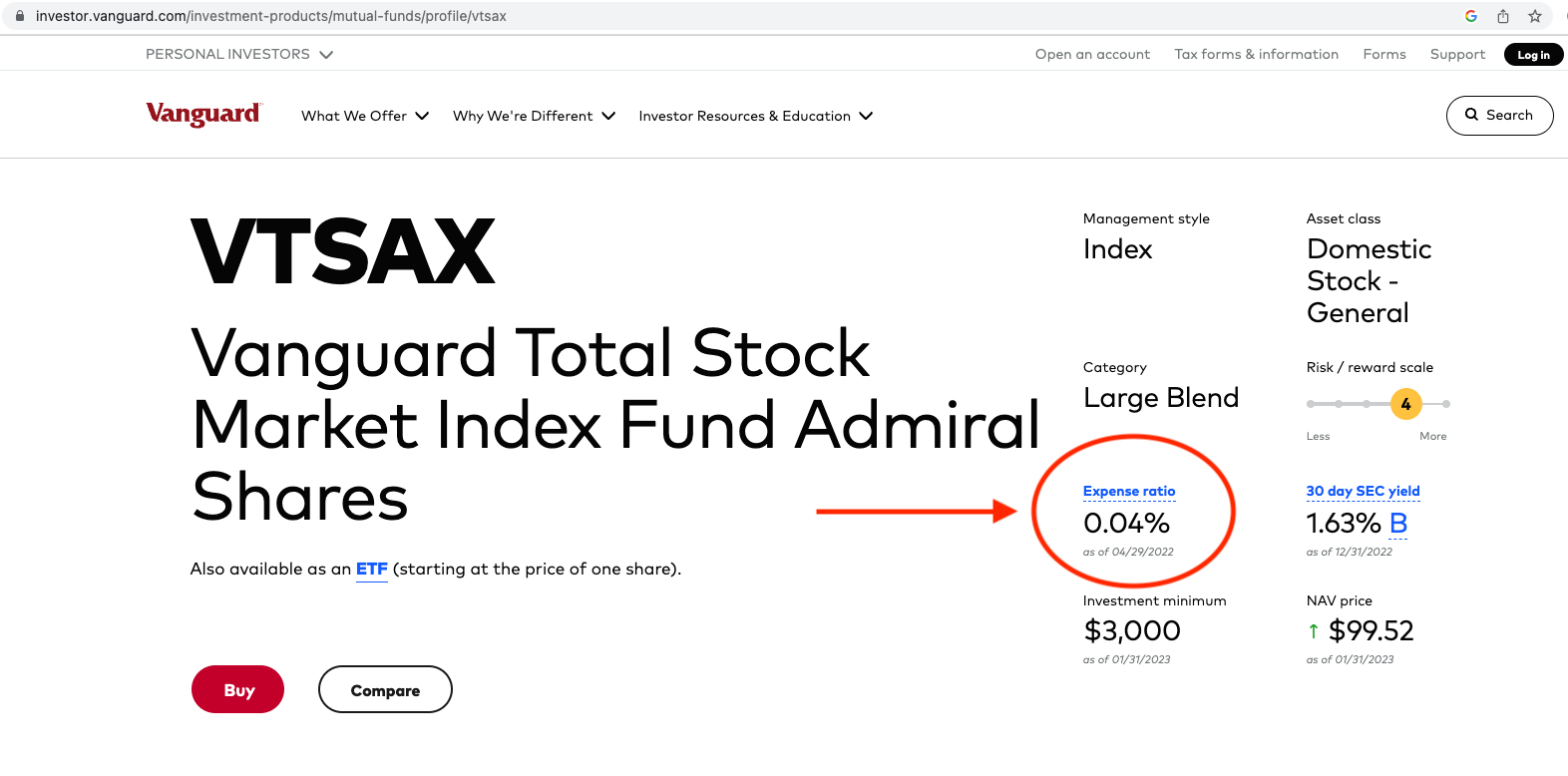

Find Your Expense Ratios

Something missing from Holly and Josh’s assets spreadsheet are the expense ratios on their retirement investment accounts. This is a critical bit of data that they need to look into for each of their accounts. Expense ratios are the percentage you pay to the brokerage for investing your money and, as they are fees, you want them to be as low as possible.

As Forbes explains:

“An expense ratio is an annual fee charged to investors who own mutual funds and exchange-traded funds (ETFs). High expense ratios can drastically reduce your potential returns over the long term, making it imperative for long-term investors to select mutual funds and ETFs with reasonable expense ratios.”

In light of their importance to Holly and Josh’s overall long-term financial health, I encourage them to locate the expense ratios for all of their retirement investments. And, to keep them in mind if they ever decide to invest in taxable investments.

I’ll use Vanguard’s total market low-fee index fund, VTSAX, as an example of how to find an expense ratio. You’re going to like this because it’s a three-step process:

- Google the stock ticker (in this case I typed in “VTSAX”)

- Go to the fund overview page

- Look at the expense ratio.

Screenshot below for reference:

And done! Woohoo! To give you a sense of whether or not your investments have reasonable expense ratios, the following three funds are considered to have low expense ratios:

- Fidelity’s Total Market Index Fund (FSKAX) has an expense ratio of 0.015%

- Charles Schwab’s Total Market Index Fund (SWTSX) has an expense ratio of 0.03%

- Vanguard’s Total Market Index Fund (VTSAX) has an expense ratio of 0.04%

You can also use this calculator from Bank Rate to determine what you will pay in fees over the lifetime of your investments, based on their expense ratios. If you find that your investments have high expense ratios, it is WELL worth your time to investigate moving to lower-fee funds.

For their Roth IRAs, at the very least Holly will want to move hers out of Touchstone Investments as 0.24% is WAY too high of an expense ratio. With their 401ks/403bs from former jobs, it will likely make the most sense to roll them into IRAs so that Holly and Josh can select their own brokerage and low-fee funds.

Holly’s Question #5: Should we be saving for our kids’ college?

Nope. At Holly and Josh’s current income level, there’s just no room for them to save for college. But that’s ok. If their income remains low, the kids should qualify for all sorts of needs-based assistance. Additionally, it’s crucial to remember that this is a “put your own oxygen mask on first” scenario. While you want to provide for your children, you must provide for your own retirement.

Kids can take out loans for school but you cannot take out loans for retirement. The scenario you want to avoid is that you pay for your kids’ college and then have to move in with them in your old age because you didn’t save enough for retirement. I’m not saying that’s going to happen to Holly and Josh—that’s just my standard cautionary tale around saving for college.

And, saving into their retirement accounts won’t affect their kids’ financial aid prospects for college as retirement vehicles (401ks, IRAs, etc) aren’t considered by the FAFSA. So, no worries there!

→With any extra money, Holly and Josh can consider maxing out their contributions to their Roth IRAs.

A Roth IRA is:

- A retirement account that’s post-tax

- That means you pay taxes on the money you put into a Roth IRA, but you don’t pay taxes when you withdraw the money in retirement.

- A Roth IRA grows tax free.

- You need to be age 59.5 before you can withdraw money penalty-free (although there are exceptions).

In 2023, the IRS-set contribution limit to an IRA is $6,500 ($7,500 if you’re age 50 or older). That means Holly and Josh could contribute a combined $13,000 to their Roth IRAs each year.

Not So Fast… First, Save For A New Car!

However, before Holy and Josh consider contributing more to their Roth IRAs, they should save up for a new-to-them car. Their 2008 Honda Civic in particular might not have much longer to live. I’d start squirreling away money for that now so that they’re able to pay cash for a used vehicle when the time comes.

Summary

-

Henry and Cooper Review the “Proposed New Amount” expense spreadsheet to determine where you can reduce your spending:

- It is not tenable to continue spending more than you earn.

- Stop paying extra on your mortgage every month.

- In terms of Josh getting a job outside of the house, consider what you value about his role versus your expenses:

- Explore if a position at the kids’ school might provide the best of both worlds.

- Calculate any increased costs associated with Josh working outside of the home.

- Remember that no decision is final and you can try out the reduced budget first to see how it feels.

- Research Holly’s pension ASAP and determine whether or not either/both of you will be eligible for Social Security.

- Consider consolidating the six cash accounts into one high-yield account.

- Start saving for a new-to-you car since the 2008 Honda Civic might not be long for this world.

- Locate the expense ratios for all of your retirement investments:

- Move to lower-fee funds if needed

- Consider rolling your old 401ks/403bs into IRAs so that you can control the funds they’re invested in

- Check out the book, The Simple Path to Wealth by JL Collins, for an investing 101 primer (affiliate link)

- After getting your spending into alignment with your income and saving up for a new-to-you car, consider putting any extra money into your Roth IRAs.

- Feel very proud of the wonderful life you’ve created and keep us posted on what you do next!

Ok Frugalwoods nation, what advice do you have for Holly? We’ll both reply to comments, so please feel free to ask questions!

Would you like your own Case Study to appear here on Frugalwoods? Apply to be an on-the-blog Case Study subject here. Hire me for a private financial consultation here. Schedule an hourlong or 30-minute call with me here, refer a friend to me here, or email me with questions ([email protected]).

A lot of these financial analysis assessments discuss saving for college. I think this concept needs to be reevaluated.

College has gotten to be way too expensive and is now a POOR return on investment. A liberal arts degree does not translate into a high income, and often advanced degrees don’t, either. It seems to me now it is BETTER to accept a lower paying job, which isn’t even the case anymore relative to a college degree, be in the work force four years longer, and not have student loans and possibly be in a lower tax bracket and pay less in taxes. Those folks are often ahead when it comes to income than professionals with student loan payments and in a higher tax bracket.

I suppose an engineering degree is still worth it. Not much else. If you wish to pursue advanced education, make it technical and learn a trade to become a plumber or electrician.

Some technical degrees still pay well and are good returns on investment. Finance. Engineering. IT. Paying less in taxes is not really that advantageous if your income is lower.

I agree that avoiding debt and being strategic about majors is good, but according to the most recent BLS data, people over 25 with a 4 year degree make 64% more than people over 25 with a high school diploma and 39% more than people over 25 with a 2 year degree. Beyond engineering, there’s also fields like nursing, accounting, even teaching in some circumstances, that can provide a healthy return on investment, especially if you attend state school.

https://www.bls.gov/emp/chart-unemployment-earnings-education.htm

Claire, I’ve been to more job interviews where the employer was very turned off by my degree – it made me “overqualified” and they didn’t want to hire me. I do think that degrees are still necessary for medical, legal, and a few other fields. However, people who have no interest in those fields, should not be pressured to attend college anyway. A lot of us grew up hearing the “Go to college or you’ll be flipping burgers!” threats.

While individual circumstances can certainly vary, we have robust national level data that college graduates have higher earnings and lower unemployment rates than people without college degrees. I wouldn’t go to college if I was interested in pursuing jobs that did not require a college degree, but in general you will earn more with a college degree.

I’m genuinely curious what jobs you are applying for that are turned off by a degree? Every job I’ve applied for after the age of 22 has required a college degree. Can you share some examples please?

Yes, I think the key phrase is “avoiding debt.” As someone who graduated with a liberal arts degree and student loans, I would never advise most people to go into debt for college.

Growing up (in a family on the lower end of middle class, but not poor), I understood there was no money for college. I qualified for aid, but still graduated with plenty of student debt. It took me years – more than a decade, in fact – to pay it off. Like many young adults, my financial literacy was quite low.

I think going into debt for college is so foolish, unless you’re strategic about your major and and well informed about your job prospects after graduation. It does make sense that people with degrees make more than people without, but I think there are many other factors that go into that. For example, are people with undergraduate degrees more likely to come from families that value education, and thus have connections, understand how to negotiate and move up the ladder, etc.? No doubt plenty of jobs require a college degree – I’m just not convinced that the degree itself is responsible for higher earnings across the board.

Anyway, I wish I could talk some sense into my 18-year-old self. I would have taken part-time classes at a community college while working, or taken a couple of years off to save money, or even gone into the military… with the goal of graduating debt-free.

A Roth IRA is also a great savings option because if you needed to use a bit for college expenses (and are in the position to do so at that point / have found out your pension is GREAT fingers crossed haha) you can do so without penalty.

This statement is the opposite of true. Despite the increased costs of college, the returns to a college degree have increased and you are much worse off not having a post-high school degree than in the past. This is because the returns to a college degree have increased while the income for people who don’t have post-high school degrees has decreased. (The returns to technical 2 year degrees have also increased.) Even people who work in jobs that don’t require a college degree get paid more than the people who don’t have college degrees in the same jobs.

I’m a PhD economist and I’ve been to lots of talks from economists who study these topics, including conferences devoted just to income inequality. David Autor has some good videos on the topic on youtube from places he’s given talks if you don’t believe me.

That said, one shouldn’t borrow too much for college– high income people should be saving for it. Low income people should apply broadly to get good financial aid and both groups should consider community colleges.

Also, it boggles my mind the people who say just become a skilled trade as if that’s somehow easier than going to college? These jobs require post high school education, apprenticeships, and certifications. You don’t just graduate high school able to do plumbing or electric work. And the people who really do well also run their own small businesses, which is non-trivial.

Thank you! So many people think the earnings gap between high school graduates and college graduates is shrinking when it isn’t. And that doesn’t even count the fact that college grad jobs tend to have a more pleasant work environment.

I think that ultimately the decision to go to college is one that rests not in the parents but in the children and it’s really hard to know when your child is between the ages of 3 and 8 years old what kind of educational experiences they will want and need in the next 10 to 15 years.

This is frankly false and you’ve posted this here before. Please stop spouting this.

It’s not “frankly false” – it’s an opinion that you disagree with. People are allowed to make comments that you disagree with.

MrBojangles, I agree! College is often a poor return on investment. Most degrees are not special anymore, because too many people have them. Employers care more about work history, experience, and references.

This is why people really should care about their minimum wage job at a fast food restaurant or grocery store. Chances are, if you worked there for a while, had a good attitude, and were dependable, you will impress a future employer more. I’ve known people in their teens/early 20s who were lazy and careless at their part-time jobs, because “I’m going to college! I’m going to have a DEGREE!” They think the degree will guarantee their dream lifestyle.

This is such a small mindset, I’m floored. Be poor so you don’t have to pay as much in taxes? I just can’t wrap my brain around that. As for college, most good paying jobs that are not physically demanding require a college degree.

I like your balanced range of options for this family. I’m strongly of the personal opinion that children benefit greatly from at least one at home parent- which tips the scales for what I would choose for myself if this were my life. That said,however, since they will be sending all3 kids to school,and the Dad already works part time at petcare, why not expand that a bit as the kids are on a full school schedule? It means extra income,and the best part about it is the flexible hours,so he can still do all the ‘stay at home’ stuff too!

I know that was my thought too! I think it can be quite lucrative and super flexible which is nice.

Maybe Josh could find a part time work from home job.

Ally Bank is now paying 3.6% on savings accounts, a bit more than AMEX.

I also wondered about expanding his pet care work, but share the recommendations to look at school jobs like para professional, cafeteria worker, etc. the benefit there is also that you share the days off from school with the kids – for example our district has a half day off nearly every month which we always have to figure out care for.

Finally hello to sweet Pam and Latte from our Guinea pigs S’more and Oreo!

Thanks for the suggestion, and especially thank you for the guinea pig greeting!

Could Josh do substitute teaching? My town pays pretty well for this.

I was going to suggest this as well! Working in the schools allows you to keep the same (or close) hours and vacation schedule as your kids. Subbing gives a lot of flexibility and can often lead to a permanent sub (building sub) position.

Triple Ditto! I think it would be a great way for Josh to experiment and see if this is a field he enjoys.

I feel like I’m not seeing a category of my own chart, which is save-to-spend for what I call “unpleasant spending” (that is, it’s necessary, it’s not a catastrophic surprise, and it’s nothing that’s going to fill your heart with joy, except that you have the money to pay it). Perhaps this is what the “shopping” category is? Our house is constantly in need of general maintenance which is not anything I’d draw down my emergency savings for. There are expenses to cut the grass, to paint the woodwork, to replace various filters and so on (and on and on, and the older a house gets the more there is). Same would go for a lot of miscellaneous things like a vet bill, medical co-pays and so on. There’s only so far frugality can stretch before it’s sub-standard living.

I also don’t trust my credit card breakdown to give me a realistic picture of what I’m actually buying, especially not if I’m looking to trim expenses.

My weigh in here: Holly and Josh are living a beautiful life and they’re really trying hard to do the right thing with money, and that’s wonderful, they’re really on track for the kind of mindful, thoughtful living I wish more people wanted. But if they want security in their future and flexibility to deal with life’s changes that will invariably occur over time, they’re going to need more income.

I second this x1,000 — you said it better than I could!

I’m going to ask Josh to comment with clarification. In the case study, I touched on my own ignorance to our finances, including that I had no idea we spend more than we make each month? I think there may be a piece missing although I’m not sure what. It may be that he didn’t factor in the large tax return we receive annually. We’ve talked about changing my withholdings to have this available as income throughout the year but have always felt nervous changing it too much since the last thing we want to do is have an unexpected tax bill. I will say that we have been able to save for large expenses (building our deck last year, a recent family trip to a wedding that included airfare, etc.) and have not been in debt since paying off Josh’s student loans a few years ago, so I know there has to be a piece missing.

I can feel so much love for your husband, in the way you talk about him in the case study, and this is gret. But this : “”I touched on my own ignorance to our finances”” has me worried for you and for any woman in the same boat. Having knowledge of your own finances is crucial, happily married or not. What if you separate one day? What if he suddenly pass away? These are very sad scenarios but they can happen. You owe it to yourself – and your kids, if they ever need you to step in and take control financially speaking – to gain knowledge of your finances.

I agree! I’m in the opposite boat where I do most of the finances, but I make my husband sit down with me once a month after kiddo bedtime to review spending/decisions that need to be made etc. We try to make it fun with a little food treat while we do it, but I always tell him ‘what if I die? you need to at least have some level of awareness.’ That along with an oh-so-morbid ‘death folder’ with updated passwords etc.

I run our finances, too, but I have regular “meetings” with my husband to be sure he is not left floundering if I should drop dead. We also have a death folder…Having seen a widowed friend struggle, I consider it being a responsible partner to have my husband have enough knowledge to get through those first few shocking months if I die.

This really stood out to me too. Both partners should have equal access to information about the finances, even if one person takes the lead on managing everything. I think it’s great that Holly is asking these questions and trying to better understand her family’s financial position, that really the only way you can be confident about making decisions that are best for your entire family.

We are 76 now and I have always managed our finances. I have everything written down so if I pass first, my husband has all passwords and contact info.

I have put $ in a savings account at our bank (earning nothing) so he will have instant access without waiting for other $ to be available. I do run everything by him but he has no interest. He ran a business for 50 years and got his fill during that time. He’s happy not to have the responsibility.

A strong ditto on the above comments after watching two friends struggle when their spouses passed away because they didn’t know where all their money was held. Both partners should fully understand the household expenses and bill payment plan even if they don’t actively manage things each month. Some hopefully constructive suggestions: You have a lot of bank accounts as Mrs. Frugalwoods pointed out. Would you also save service fees by reducing this to one or two accounts? With more accounts also comes the temptation to move money around to cover payments without actually paying anything down. We keep a basic spreadsheet which lists all our bank accounts #s, investment account #s, insurance policy info, utility bill accounts etc. which is updated every year (passwords kept separate and secure). If one of us ever died, the other person has all the details at their finger tips to continue managing the household finances. Thanks for sharing your lovely family’s story!

Thank you all for this advice. I’ve always known that I “should” know more about our finances, but I also see it as a huge source of stress. When I managed my own money, I had 1 account and 1 credit card, paid it each month, and that was all. We got married right out of college and I have always seen it as a luxury that I don’t have to deal with finances (although Josh always checks big things with me first).

All of your kind advice has made me realize we need to schedule regular family finance meetings, and yes, there definitely has to be a treat involved.

We are in a very similar financial situation. I stay home, my husband is in ministry, and we have 4 kids. We don’t let his employer withhold fed or state income tax. Only SS/medicare and city taxes. We never owe taxes because of the kids. The Earned Income Credit more than covers our taxes. You can run a couple pretend scenarios through a tax website, but I just about promise that you don’t need to have taxes withheld. You’re better off having that money in hand every month. Double check your state and local tax rates. Our state mimics the fed – our income is too low to owe taxes. But the city takes a flat 2.5% no matter what you make. So we have that withheld.

If you’re paid every two weeks instead of monthly, you’d have two extra paychecks a year, which you might not have accounted for in your monthly income?

In searching for his dream job, I would encourage Josh to maintain his family flexibility by seeking out various odd-jobs. Socialize at the local chamber of commerce and/or economic development group, see what others are doing and what services they are missing. You may be able to earn high rates for short stints of work. There are plenty of articles describing dog-walkers who make great money. Once you find the overlap between your enjoyment and community need, make it into a small part-time business. This way you stay in control of how much time you spend and how much money you earn. If you’re having fun at work you never know, you might grow something big. A friend and I started a rainwater collection company for fun, and two years later it’s a big business. We like to push ourselves to grow things, but at any point we could have said nah, we are good for the year.

I know it might make financial sense to cut out the tithe, but I wouldn’t touch that. That may be the very reason they are able to stretch their money.

Agreed!! Kudos for making the sacrifice even when you don’t have an overabundance of money. That’s faith.

Foolish

Amen

That is magical thinking. Spending $300 a month they can’t afford is NOT keeping them in the black, and is in fact contributing to their overspending. They haven’t been stretching their money, they have been overspending and not realizing it because they lend the government a big chunk of change every year interest free in exchange for a refund come April.

One piece of advice I have for Holly is to get involved in, or at least know their house expenses and bills (she mentioned she has no clue what the home bills cost). This is so important in you both being able to track and know your family expenses, but also for your “safety”. During the height of COVID I had more than 1 friend suffer because their spouse fell very ill and was also the one who paid all of the house bills, knew the account logins for the bills they paid online etc…. My husband and I keep a spreadsheet together of the house bills, monthly cost, and any account login information in the event that something could happen to one of us. It’s like your own insurance policy to ensure either parent can keep the house running in the event of an unplanned disaster.

I second the idea that Josh look into work within the school system so he can have the same hours as the kids. If he finds he likes working with children, many states have short programs where a person with a 4 year college degree can train for a year or so to be a licensed teacher.

Also, does he have any interest in “upcycling” furniture for resale? (also do you all have place where something could be painted away from the pet hair?).

I think trying out being a substitute teacher is a great idea! Just keep in mind that being a full time classroom teacher is a different beast altogether though – teaching is a very stressful, time-consuming job. If you’re looking to maintain the current work-life balance that your family has found, I wouldn’t consider becoming a licensed teacher. (I’m saying this as a teacher who is about to spend the upcoming weekend grading.) Also keep in mind that the hours for classroom teachers aren’t the same as the hours for students. For example, when kids have days off or half days, we often have required faculty meetings or professional training. Besides random faculty meetings throughout the school year, I start a week before my students do, and I end over a week after after them. And I’m obviously required to come to school before they do and stay after they go home. I’m not saying that these policies are wrong (professional growth is important, and I do like my job!) but all of these things create stress around childcare for my family. My husband fortunately has a fairly flexible job, but teaching is actually often pretty problematic re: childcare because my hours are really rigid.

Substitute teaching is very different though because it doesn’t involve lesson planning, grading, or professional growth. It doesn’t pay very well, but it’s very flexible and low-stress (if you’re comfortable supervising large groups of kids, anyway). I spent some time as a substitute teacher, and it could be a great fit if you like working with kids. If you’re looking to maintain a good work-life balance though, becoming a full-time licensed teacher isn’t a good way to do it.

This is a bit of a tangent, but I’d be interested in reading a Frugalwoods article about the electric vehicle aftermarket. We currently drive a 2006 Accord, which is still going strong, but we are also saving up to buy a newer car with more up-to-date safety features (backup camera, etc.) before our now-10-year-old starts driving. We’d love to get an electric vehicle because my husband would mainly drive it to/from work and could charge it there.

I second this! I would also be interested in the electric vehicle aftermarket and gaining some perspective from readers here.

I’m the owner of two EVs and depending on your use case, they can work out great! The sticker price is high but cost to own can be very low. I own a 2016 Kia Soul EV (125 miles of range, bought for $11k in Jan 2020) and love it. My second car is a 2020 Nissan Leaf S Plus (230 miles of range) which I actually am considering selling to Carmax. We use the Soul as my husband’s daily driver, we can haul just about anything in it, and it has performed flawlessly for us. My electricity costs come out to about $1560 right now over the last 3.5 years for both cars) due to a few subscription plans I belong to. We are apartment dwellers and rely soley on public charging. The Leaf is an okay car, not especially loaded with tech but does have blind spot warnings. We both prefer the size and driving position of the Soul. That being said, there are LOTS of options for EVs out there – some glorified golf carts and some big luxury cars. Definitely recommend checking out the Chevy Bolt before it’s gone. Cheers!

p.s. All this being said, I’ve been car-free and a one-car family in the past and I’d love to get down to just (1) car again. Insurance has gone way up for us in the last few years too, so that has eaten up some of the gas savings.

Going to put my name in for this topic, too. We are starting to discuss/save for replacement vehicles and would like our next one to be all electric.

Congrats Holly/Josh on what you have accomplished so far. You guys remind me a bit of my wife and I when we were that age. My wife was the primary stay at home parent and that worked great for us when the were young OR when they started some sports activities as they got older. We did transition to her working more as the kids got older but with a very flexible job – and I think that is the key for Josh. There are tons of job opportunities today that may work to fit your schedule as a few of the others have commented on – can he get in the same public school district and either sub teach or work the cafeteria or an aid of some sort. We had friends that did that as there kids went to school and it seemed the schedules aligned up perfectly. OR there are many flex/gig jobs now that pay very well and each $ earned now is extra income since your already doing great.

Related to the finances I agree that you may have a few too many accts and maybe find one that is paying a decent rate (amex) we use Capital one and has similar rates. The big thing is limit the number of accts (easier to manage. Also really agree relate to your mortgage – in today’s terms you have a great interest rate and if your planning on staying there just keep making monthly payment and put the extra cash elsewhere. Also agree on your thinking for college costs and how that whole (Have to go to college) mentality is evolving and I think even by the time your kids are that age will have changed even more. One of our kids took the skilled trade route (electrician) and he is loving it and the other kid was able to earn a significant amount through scholarships and paid some himself (Which I think helps them take the schooling a bit more serious) – and if go the college route if possible get a specialized degree (engineering/Nursing/Accounting, etcc).

Great job again and the main thing you will look back on is not the $ you made during the time you raised your family but the “time” you spent and memories you will make. Sometimes w two parents working two demanding full time jobs life becomes a blur….

One final thing is find out about that pension – that is a fantastic position to be in – there are not many pension jobs left out there and with the state sounds like may be a stable one. Don’t underestimate the impact of that over the long haul and especially if they offer medical coverage once you retire

Thank you for articulating this so well. When I didn’t have so much disposable time with my family, I didn’t know how much it mattered. Now that I have it, I know I’d regret it if the choices we make sacrifice memories for money.

I love the idea of Josh starting with working at the school, substitute teaching if possible. With a background in Greek and Latin this could be a stepping stone to teaching down the road. Maybe Josh will find he loves teaching! I worry that if Josh doesn’t work for an extended period it will difficult to not only find a job but get into a field that fulfills him. I really recommend they think about the future when the kids are older and how Josh envisions that future. My husband dropped of of the work force in the Great Recession and has been a fabulous “house husband” while I worked an excellent, high paying stressful job. For me it has been a perfect situation. But it took a toll on his self esteem and sense of self worth as a man that I failed to recognize. We’re good now, but wanted to throw this out for food for thought. And congratulations on the fantastic savings you have along with no debt!

“And, saving into their retirement accounts won’t affect their kids’ financial aid prospects for college as retirement vehicles (401ks, IRAs, etc) aren’t considered by the FAFSA. So, no worries there!”

Actually, in the years that you are filling out the FAFSA for college, one of the questions asks how much are your voluntary retirement contributions. So the FAFSA calculator does take into account how much you are choosing to save, because those contributions during the college years are considered to be voluntary and thus part of the parents’ contribution towards paying for college instead.

I don’t remember ever being asked this on the FAFSA although I do have my data imported from the IRS so I suppose it’s possible that they pull it from there.

I find the remark about the 2008 Civic a bit funny as we have been searching for a used sedan recently. We would be thrilled to find their exact car with that mileage for only $2700, and would expect it to run for 5-10 more years (yes, with older vehicle maintenance issues popping up, but Hondas and Toyotas are known for longevity!) In reality those vehicles are selling in the $5k range!!!

Josh and Holly, you’re doing great! We have a lot in common 🙂 Best wishes as you make decisions for the future!

I agree about the 2008 Civic. My husbands aunt frequently boasts about the fact that she’s still driving her 1994 Civic – a manual transmission she drives up and down the hills of San Francisco, no less. I am a strong believer that both Hondas and Toyotas can last forever (or nearly) if you take care of them.

For what it’s worth I have a 2004 Civic that is still going strong. Hondas last, in my experience.

Their car may last another 5-10 years, but it will probably take them 5 years to save up to buy their next car with cash. Maybe instead of putting an extra $80 a month towards their mortgage, they can save that towards their next car. A car loan would definitely be a higher rate than their mortgage.

My husband’s commuter is a 1996 Civic – 270K miles – and has been reliable and inexpensive to maintain. We have a pot of funds set aside when it bites the dust but coming to drive this car has been both a blessing and a wise decision.

As nice as it is, the largest expense after the mortgage seems to be the church contribution…. I hate to ask but I think that needs to be cut….

I agree that some more income would be helpful, especially for car and house repairs and maintenance. I disagree with frugalwoods’ recommendation to stop giving to your church because I understand and have definitely experienced God’s blessings through obedience in this area. I do not expect people who don’t have the same beliefs to agree, but God owns everything and it’s not too much to give back a portion of that and God does provide.

But if your kids are all eventually going away to school I would think your husband could find some more income earning opportunities.

My husband and I have been very frugal but having some margin really helps. I do like the ideas on comments already about having him work in the school. He could probably get a para educator or sub position too since he has a degree.

Giving money one simply does not have is not sensible. If they simply reduced the giving, so maybe $200 or even $150, rather than $300, that would be a big boost and wipe out the deficit in their current credit/debit situation. I find it hard to believe that any religious institution would want its members to impoverish themselves. Giving what one can, generously, in time and money, surely is the idea?

Agree with you here, for sure!

beautifully said! i agree!

💕

I did not read anywhere that Ms Frugalwoods recommended that they stop giving to their church. She correctly pointed out that it is discretionary. I know of many who give large sums to their churches and have suffered devastating losses and vice versa. I hope Holly and Josh give to support the church’s work, not because they will receive some “blessing” in return. Reducing this amount, if necessary, will not incur God’s wrath. Best to everyone. 🙏🏼

Julie, I totally agree! They can cut a small amount in other areas (or earn a little more) and easily balance their budget. No need to stop tithing.

Marcus by Goldman Sachs currently has their high yield savings account at 3.75%, which is where I keep my EF.

I’d say that if they took a bit of a middle path with the discretionary spending / reduceable items, that might be a less-painful way to streamline their budget. The tithing is the obvious one here, but even if they halved the amount, they’d still be donating quite generously, and have wiped the deficit completely.

As for whether Josh should work, I’d say that once the littlest goes to school, Josh should strongly consider librarian-type roles that he might be equipped / qualified for, since he’s done this work before, enjoys it, and it might be possible to get a role that ties in with school terms, or possibly a part time role, at least to start with, while he edges back into professional working life – he’s done an outstanding job so far, probably saved the family huge amounts, and that is a very tough thing to look at giving up, but children grow, and in their financial circumstances, another income stream, even a reasonably modest one, is a valuable thing. If I were him, I’d look at short (free, ideally) courses to ease him back into the sort of work he wants to do and make it a goal to be in a role once the youngest is at school.

Reducing their mortgage overpayments and putting that cash towards their next car is the other thing I’d definitely do.

They have an enviable life, long may it continue!

I just wanted to say that it was really refreshing to read a case study of a young family with children surviving on one modest income. Very relatable! Thank you for sharing. How do you accomplish that low grocery budget as a family of 5?! I’m curious if the spending within the “shopping” category could include a fair amount or grocery items.

I would also love to hear more about how Holly and Josh make that grocery budget work for a family of 5 with today’s rising grocery prices. Maybe Josh and Holly should start a blog and share their meal planning tips, among other things. I’d read it!

Paraeducator would be a great job! We love the paras at our school and the place could not run without them. You don’t need a Master’s and you don’t have the added stress of everything that comes with being a teacher. My mom was a teacher before I came into the work, took a sabbatical, and then worked as para after I started kindergarten. She worked as one for 20 years, semi-retired for the benefits, and then substitute taught for extra cash in retirement, on her terms and time schedule, of course. My neighbor across the street does the same thing.

Was coming here to say the same thing. Friends of mine went this route – she was stay-at-home mom until youngest in school FT, then mom became a para. It worked great for their frugal, meaningful life.

Josh might be able to offer her services as a Latin or Greek tutor.

I live in south Florida. Dedicated equestrian children come here to train in the winter. Because of their training schedule, they are homeschooled or tutored. A friend earned at least $50 an hour tutoring in Latin. If there is a horsey set training near them in Virginia, it might be something to look into.

Tutoring Latin in person or on line via zoom could be really lucrative. Many private high schools still require Latin. Also, look into being an AP Latin tutor. Hourly rates are $50-$100 per hour. There are many online tutoring companies John could look into. Most of the students will want to meet in the evening or on weekends when Holly could watch the kids.

Curious why the vehicles total wasn’t just the sum of the value of the 2 cars listed — just a typo? I also wasn’t sure if some of the expenses were accurate — eg it looked like the extra mortgage payment appeared in two lines, and expenses were culled from the credit card statement so maybe not an accurate picture over full year? It seems like if their spending is outpacing their income they’d have credit card debt or know they were drawing down on savings?

Anyway, sounds like you have a wonderful family and life and I hope you’re able to either trim a bit more or bring in some more income to make it fully sustainable.

We have almost the same car situation as Holly’s family (a 2007 Civic with 205k miles which is our commuting vehicle and a 2012 Odyssey with 110k miles which is our family vehicle), so I’ll comment here.

We’re expecting to be able to run our Civic over 250k miles, possibly even to 300k, but there will be maintenance costs to doing that. I talked this through with some folks lately, and the goal is to maximize lifetime cost per mile. Maintenance coat will go up as the car ages, but as long as these remain reasonable and the car remains reliable, that’s what to work to maximize. So, we’re hanging on to our older cars, while still saving for their eventual replacement. We’re also saving up for maintenance that is much higher than Holly’s current spending. AAA recommends planning for $600 per year on average, which means Holly should aim for the higher end of they plan to keep their current cars, more like $1K.

I have a 2002 Toyota Tundra that I thought would run forever, but the mechanic has told me it’s time to let go. Repairs needed now will cost nearly $10,000 and he noted that it will start getting very difficult to get some replacement parts going forward (he just had an experience with a computer for a 2000 vehicle that took three months and a hacker to make work). It’s been such a wonderful vehicle for 21 years, but I’m glad I saved up enough money to purchase a vehicle now. One just never knows, even with super reliable vehicles.

Not shilling for them but if your car is cosmetically nice, Carmax pays a lot for used cars. They just have to start, lol,

Same! We only recently replaced our 2005 Sienna with a 2022 Pacifica eHybrid. We still have our 2010 Fit, which we rarely drive but it costs so little to maintain and insure we have kept it. On the rare occasions we need it, we are glad to have it.

There are times for dream jobs, and there are times for taking a job you like well enough that fits your family’s needs. Especially since Josh doesn’t know what his dream job is, when the youngest goes to school is a great time for him to start a good enough job. I agree that the kids’ school would be an ideal place to work, potentially in admin, library, or some kind of education-adjacent position if he doesn’t feel teaching is the right fit. There may even be part-time positions.

It would provide an on-ramp back into the workforce, hours conducive to continuing to be the primary childcare, and an opportunity to see a number of roles that could give insight into what he ultimately wants to do. It also very importantly would give him credit for either a pension or social security. A state government pension is great, but that without social security from either partner is likely going to be far too little to retire on. If Josh has the credits for a reasonable social security payment or his own pension then it will be much more doable.

Just wanted to add a comment re: Holly wondering whether she should get another degree. I’ve also had very low budget to work with, applying for jobs that kept telling me, “if only you had an MBA,” etc. So, I finally went and got my MBA (had to take out loans). Now? My MBA has not helped me one bit in getting new or better jobs, and I’ve got a lot of school debt. I’ve always been pro-education, altho I will stand by this: unless you are incredibly specialized (e.g. doctors, lawyers, etc.), a Bachelors degree is def worth it, a Masters not so much, IMHO.

I think the idea of Josh looking into jobs at the school district is spot on. I had a friend whose mom did this as the kids went to school full-time, and she did everything–library aid, lunchroom worker, and school bus driver! I asked her about this as an adult, and she said the best gig was the bus driver because she always got to go on the field trips. The school would need drivers to get to the location, and she got to be one of the volunteer parents. If your district has buses, I think this would be a fantastic option. Substitute teaching and library aid also seem like great options that could expand into more hours as the kids get older and more independent.

Best of luck! It sounds like you have a beautiful life carved out for your family in a place you love.

Hi Holly and Josh! Thanks for sharing your wonderful life with us. I felt, reading through, that there was a bit of a disconnect – one big question was whether Josh can continue to stay home, but the 10 year plan included Josh working his dream job (whatever that turns out to be). These are not mutually exclusive propositions, but if the long-term plan is for Josh to be fully engaged in the workforce, the foundations need to be laid now, before he’s been out for too long.

I also don’t see “Josh works” and “Josh stays at home so the kids don’t need before/after care” as mutually exclusive scenarios. Why can’t Josh get a part-time job once the youngest is in kindergarten? There are many remote positions out there that didn’t exist before the pandemic and these often allow employees to work around a flexible and changing schedule. Alternatively, working for himself (freelancing, etc.) would also give that needed flexibility, particularly if he could choose to take on less work during the summers. The school district jobs are a good starting point (although note that these aren’t helpful when your kids are sick), but I’d definitely encourage Josh to think about what he could do from home with a computer and control over his working hours.

I also want to highlight the ‘soft’ skills that Josh probably has, given his background in Ancient Greek and Latin (I have the same background and teach these languages). It’s not at all easy to complete a degree with such a concentration. Josh probably has a real feel for languages, an exceptional grasp of grammar, a wide vocabulary, as well as the other ‘soft’ skills that you develop with a liberal arts degree – critical thinking, analytical writing, etc. I’m quite sure that Josh could pivot into some sort of freelance writing gig if that was something he was interested in doing. Technical writing? Grant/funding applications? Website content? Company newsletters? What things does Josh like? I’m sure there are places online looking for freelance writers to produce content about those subjects.

Building a career like this would take time (and a lot of online content-production work is borderline exploitative), but Josh has time and even small gigs to start would make a difference to the family’s financial status given how little room there is in their budget. As he developed a portfolio, more work would follow. I don’t think it would hurt Josh to try lots of different things over the next couple of years to see what he likes. The important thing is to keep his resume active.

Another possible option, depending on how many years Josh has in each language, and how good he was, would be online tutoring in Greek/Latin for university students (or high school – we still have some high schools which teach Latin) – doing it over Zoom would let you work with anyone. Again, not likely to be financially lucrative (at least at first) but something you could control your hours and charge a high hourly rate.

I know it feels hard to imagine when you’re in the thick of raising kids, but they will grow up. In a decade your youngest will be 13 – ready for high school, and Josh will only be 42! My 11-year-old walks home from school by himself, makes his own snack, does his homework, etc. I’m at home, but I am still able to work after he gets in the door – my work day doesn’t end at 3.10 like it used to. There will be heaps of time left in Josh’s working life for a second act if he feels he wants to take on a more intensive job at that point. But he will really struggle to even get a foot in the door if he hasn’t been doing something in the meantime.

I would also recommend, once Josh has tried out a few things, and when you have a bit of extra money in the budget, that Josh sees a careers coach to help him narrow down what he’s looking for in a ‘dream’ job. For me, nothing outweighs my ability to control my own time (both for my family responsibilities and for my own mental health) and I’ve intentionally stayed in a career that is not as financially lucrative because it gives me that essential flexibility.