Former travel writer Juliana and her husband Nicolas, formerly an ecotourism guide in Central America, now live in the suburbs of DC along with their baby daughter and Juliana’s parents. They’d like our help in charting the next chapter of their lives and figuring out how to balance debt repayment with building an emergency fund and investments.

Case Studies are financial and life dilemmas that a reader of Frugalwoods sends to me requesting that Frugalwoods nation weigh in. Then, Frugalwoods nation (that’s you!), reads through their situation and provides advice, encouragement, insight, and feedback in the comments section. For an example, check out last month’s case study.

I provide updates from our Case Study subjects at the bottom of each Case Study several months after a Case is featured. You all have requested an easier way to track Case Study updates and I have heard your pleas :)! Here’s list of all the Case Studies that currently have an update provided at the end of the post (and a hint that if you’re a past Case Study participant who hasn’t sent me your update yet, send it on over–your fans want to hear from you!):

- Reader Case Study: Earn More, Spend Less, Or Both? (Julie’s story, published October 2016)

- Reader Case Study: Stay Home With Baby or Return To Work? (Kelly’s story, published November 2016)

- Reader Case Study: The Case Of The Over-gifting In-Laws! (Grace’s story, published December 2016)

- Reader Case Study: Renovations and Vacations (Audrey’s story, published January 2017)

- Reader Case Study: Help Me Decide How To Pay Off $185K In Student Loans (Bridget’s story, published February 2017)

- Reader Case Study: The Grad School Dilemma (Emily’s story, published March 2017)

- Reader Case Study: Can We Buy Our Dream Home? (Jack & Elizabeth’s story, published April 2017)

- Reader Case Study: We Have A Van, Now We Need A Plan! (Florence & Anna’s story, published May 2017)

- Reader Case Study: To Buy Or Not To Buy In Sydney, Australia? (Jemma & Greg’s story, published June 2017)

- Reader Case Study: Starting From Scratch In Canada; Where Do I Go From Here? (Alison’s story, published July 2017)

- Reader Case Study: Moving To Europe From South Africa, Trying To Make Ends Meet (Clara’s story, published August 2017)

- Reader Case Study: Should We Stay (In San Francisco) Or Should We Go Now? (Melanie & Kurt’s story, published September 2017)

- Reader Case Study: Having A Quarter-Life Crisis in Nashville, TN! (Steph & Zach’s story, published October 2017)

- Reader Case Study: National Park Rangers Figuring Out Finances (The Ranger’s story, published November 2017)

- Reader Case Study: Londoners Wonder About Buying A Property (Betty & David’s story, published December 2017)

- Reader Case Study: At Age 57, It’s Not Over Yet! (Lucy’s story, published January 2018)

- Reader Case Study: From Brooklyn to LA With a Baby (the FrugalBrooklyn’s story, published February 2018)

- Reader Case Study: Debt And Dreams In Queensland, Australia (Sam & Keith’s story, published March 2018)

- Reader Case Study: Single Psychologist Saving In NYC (Lauren’s story, published April 2018)

- Reader Case Study: How A Cancer Diagnosis Changes Everything (Emily & John’s story, published May 2018)

- Reader Case Study: Should We Buy A Campground And Laundromat? (Payton & Riley’s story, published July 2018)

I probably don’t need to say the following because you all are the kindest, most polite commenters on the internet, but, please note that Frugalwoods is a judgement-free zone where we endeavor to help one another, not to condemn.

And a disclaimer that I am not a trained financial professional and I encourage people not to make serious financial decisions based solely on what one person on the internet advises. I encourage everyone to do their own research to determine the best course of action for their finances.

P.S. When you’re done reading this, head over to the Frugalwoods Facebook page to share your advice on this month’s Reader Suggestions question (hint: gobble, gobble, gobble)!

With that I’ll let Juliana, this month’s Case Study subject, take it from here!

Juliana’s Story

Hello! I’m Juliana (34), my husband is Nicolas (33), and we have a daughter who is almost six months old. We’re undecided on whether we want more kids or not. I’m a little nervous because of the complications I had with my first pregnancy, but it would be nice to give our daughter a sibling one day.

Nicolas and I met about ten years ago when I was working as a travel writer and visited Nicolas’s family’s ecotourism business in the rainforest of Central America. We’ve been married for two and a half years and live in a Virginia suburb of Washington, D.C. in a multigenerational home with my parents. My family is Latin American and this is not an unusual arrangement. It’s also a good situation for now: we get free childcare and low rent, and my parents get help with errands, cooking, and other household chores. Plus, my daughter gets lots of high-quality time with her grandparents! I had a typical suburban upbringing, and my husband grew up in the rainforest surrounded by wilderness.

My parents have pensions and–from a financial perspective–would likely be able to care for themselves into old age, but culturally, my siblings and I will probably have an active role in their care. For example, if one of my parents were to pass away, my assumption would be that the surviving parent would live with me or one of my siblings.

I want to start off by saying that this has been a tough year for us financially: I had a complicated pregnancy and birth, and we hit our $4,500 out-of-pocket insurance maximum, one of our cars needed $2,000 worth of repairs, and I was on unpaid maternity leave for over six weeks. In light of all this, our emergency fund took an almost $10,000 hit. I have to say, however, that it felt good to be able to use our savings instead of putting these unexpected expenses on credit!

Looking To The Future

As much as we appreciate being able to live with my parents, my husband and I would eventually like to live in a more rural locale on our own (my parents wouldn’t move with us). We don’t want to be too far from family for now, but love the idea of living on a small cottage/house on someone else’s farm/land to try out the idea of country living. Or more accurately, so that *I* can try out country living; my husband grew up without electricity or running water, so I think he can pretty much handle anything!

We’re not really interested in buying a place to live, but would like to be in our own (rented) place in the next few years. While I don’t HATE our current area, and there are plenty of amenities like walking trails, greenery and convenience, it’s not where I imagine living the rest of my life. Basically, I constantly have to convince myself that it’s not that bad. Anytime I’m in the woods, in the mountains, or staring out at a beautiful green field, I find myself invigorated and excited about life. My suburb, unfortunately, doesn’t inspire the same feelings, though I recognize that maybe I’m just seeking something novel not associated with my day-to-day life… because you know, “wherever you go, there you are.”

Background and Hobbies

I majored in English and, after college, spent most of my twenties working as a travel writer, barely scraping by and doing lots of travel and odd jobs, such as teaching English, writing data-driven articles and doing translations. This was great and I wouldn’t trade it, but it was a pretty broke and stressful existence. Also, I was so young and inexperienced (and, honestly, irresponsible), that I never quite figured out how to make a career out of the amazing opportunities I was given right out of college. I often regret this, but I try not to dwell on it. Nowadays, I love to read, listen to podcasts, write, create art, walk, hike, travel and simply enjoy nature. My husband and I overlap in our love of travel, walking, hiking and enjoying nature, but he’s a bit more extroverted and active, and also enjoys biking with a local group. We both like spending time with family, watching a Netflix show a couple times a week (on my parent’s plan) and visiting local (free!) attractions like the petting zoo and parks.

Juliana’s Career

I work in the public sector mental health field. This means I determine if individuals meet the agency’s criteria for services, but I don’t carry a caseload. I’m also currently working towards a masters in clinical mental health counseling. I have seven classes to go until I graduate in December 2019. I’m paying for this program out of pocket, with the hope that it will make me more marketable so that I can eventually find a well-paid part-time position in the field. I have a tendency to start a lot of things and then they don’t measure up to my expectations, so part of my motivation in finishing this graduate program is to prove to myself that I’m capable of following through with something.

I would ideally like to work 20-24 hours per week so that I can focus more on the things I love, such as writing, creating art and spending time with my daughter. I rarely dread going to work, but I’d be lying if I said that I find it extremely fulfilling: it’s a job, it pays me fairly well to do something that I think is meaningful, and it allows me free weekends, benefits, and paid time-off.

But I’m tired of the long days and the fact that I’m not pursuing my passions. I leave my house at around 8:30 in the morning, and get back until 7 p.m., so I don’t spend much time with my daughter during the week.

I try to spend as much time with her as possible on the weekends, but the weekends are also my time to study, run errands, tidy up, etc. My commute is 13 miles each way and it takes me about 40 minutes to get to work in the morning and 50 minutes to get home in the evening. My husband’s commute is 20 miles, but because his hours are outside of rush hour, his commute is 25 to 30 minutes each way. I don’t love my commute, but I make it tolerable by listening to lots of books on tape.

Nicolas’s Career

My husband works as a phlebotomist at a local hospital. He’s working towards his phlebotomy certification, as this will make it easier for him to work at another hospital if and when we move to a more rural location. In college, Nicolas studied nursing in Central America, but it doesn’t transfer as a nursing degree here in the U.S. We’ve had his diploma translated, but his degree is over ten years old, and he’d probably have to start over in that field. His long-term goal is to obtain a degree or certification in a higher-paying healthcare field. He’d like to go back into nursing, but we’re not sure how realistic that is, given our age, the fact that he would need to score highly on the TOEFL, and the time commitment nursing would take (most hospital nursing jobs in our area now require a four-year degree). My husband works an early morning shift and is usually home by 2:30 p.m., so working part-time isn’t as important to him, as his schedule allows him the time to pursue his hobbies (like biking) and spend time with our daughter during the week.

Future Career Aspirations

Where I currently live, I estimate I could earn around $80,000/year (my first year) as a “senior clinician” after getting my counselor’s license, with modest cost of living and merit-based increases every year after that (I think 1.5-4% annually). This would be for full-time employment, and represents an approximately $15,000 raise over what I currently make. My husband’s income is more limited. If he stays on at his current job, he’d probably max out at around $50,000/year, many years down the road. Right now, he makes $36,000 gross annually.

I’m at a bit of a crossroads career-wise. In the future, I can imagine myself doing my job on a part-time basis because it would provide a steady income and give me time to pursue my true passions, which are art and writing. I’m good at my job, I feel like I’m contributing to the greater good of the community, and I think I’m providing a needed service. Plus, I’m really not sure what other career I could pursue. When I think back on the jobs I’ve liked, I can say I enjoyed working at a winery in a beautiful setting, at a daycare where I had the opportunity to use my imagination and interact with tiny, creative minds on a daily basis, and at my local grocery store, where I’d imagine the shoppers’ inner workings and home lives.

My husband enjoys working in the healthcare field and would be happy to continue this, but his true passion was working as a travel guide with his family’s ecotourism company in Central America. He’s a naturalist who grew up in the rainforest, and he knows the name of just about every plant and bird. However, moving back to Central America isn’t really an option for us right now. We both really, really enjoyed our “freelance” lifestyles: Nicolas worked hard from December to May and would travel to upstate New York to visit family the remainder of the year. I worked enough to get by and have enough money to travel and have fun. However, now that we have a daughter and no clear vision on how we could return to our freelance lifestyles, we understand that we need stable jobs for the time being.

In our ideal world, I would love to be making my living as a writer (or at least I would love to have long mornings for writing) and Nicolas would be happy in any job that allows him to interact with and engage deeply with other people. I’ve been working on a collection of short stories here and there for several years now, but I now have much greater clarity of vision for this project, and would love it if I had more uninterrupted time to write! Right now, I wake up at around 5 a.m. a few times a week in order to write a few sentences here and there, but I tend to work better in long, uninterrupted stretches.

Together, Nicolas and I make decent money. It’s not much by D.C standards but since we live with my parents, we have a great rent and childcare situation (even this far out in the suburbs, a two-bedroom starts at around $2,000 per month and childcare for an infant is about $1,500 per month). I spent most of my twenties making under $25K a year and just barely getting by (and spending big), but I’ve had an OK income for the last five years. That being said, I feel like we should be in a better place financially. I made poor financial decisions in my twenties (student loans I didn’t need, impulse purchases, a car I didn’t really need, etc.), and ended up with about $65K in debt. I worked several jobs for a few years to pay much of that off, and my only outstanding debt now is $12,315 in student loans.

Future Financial Goals

While I’m in a better place than I was five years ago, I’m almost embarrassed at how little we have in our 401ks/long-term investments. If this Reader Case Study exercise has taught me anything, it’s that I did not have a realistic view of our finances prior to compiling everything for Mrs. Frugalwoods.

Writing down every single monthly expense gave me insight into where our money is going, and it forced me to take a hard and cringe-worthy look at how much money I’m spending on insignificant things that don’t even matter to me in the long-term. For example, I could have saved more than $20,000 over the last five years if I’d given up my coffee/soda/eating out habit.

Prior to this, I was looking at my finances through rose-colored lenses and thought we were keeping more of our income than we actually are. And in all honestly, I’m the one mostly responsible for the excess spending. My husband is frugal by nature. He indulges in a few big purchases a year (usually bike-related) but doesn’t waste money on stuff that’s not meaningful to him. I, on the other hand, avoid expensive purchases, but spend A LOT of money on small things.

Where Juliana and Nicolas Want To Be In 10 Years:

- Finances: I want to be able to work part-time, hopefully within five years.

- Being rich isn’t important to me, but we want to be able to live our lives without putting anything on credit (except for possibly a mortgage in the future). In an ideal world, I’d love to be making money from my writing, but I would settle for the pleasure of having time to write for writing’s sake. Right now, I don’t have any great longing for homeownership, but would consider it with a convincing argument. One option if we wanted a tax shelter would be to buy an affordable condo one county over and rent it out while we continue living at my parent’s house. This would be more of a long-term investment, and we could stay on with my parents for a few more years. To be honest, we don’t seem to have very clear financial goals right now.

- Lifestyle: I want more time.

- Or better said, I want more control over my time. My husband and I would love to live somewhere where we can easily access nature (such as by a trail system, park, etc.) Living in view of the mountains is a non-negotiable. We plan to stay in Virginia for at least the next 3-4 years, but after that, we’d be open to moving to upstate New York, where my husband has family. Ideally, I’d like to be close to a town with a strong sense of community. It doesn’t have to be especially quaint, but it would be nice if this town had a coffee shop, a decent library, and a biking group my husband could join. In my ideal world, I would be a published author living on a small parcel of land somewhere in the countryside. My husband and I would grow some vegetables, have a few chickens just for the fun of it, and my daughter would grow up with an intimate knowledge of the natural world. Very cliché, I know, and maybe all these longings are escapist in nature?

- Career: I’ll be honest, if I could go back, I might have chosen a different career path.

- I am finishing my masters in clinical mental health counseling because I have seven years of experience in the field and I’m at a loss for how I would get started in another field or what that field would even be! I tend to have trouble zeroing in on goals and staying motivated, especially when it comes to long-term goals. In practical terms, getting my masters would ensure that I can obtain well-paid, part-time work in this particular field in the future. I only have seven classes to go after this semester, and my program is pretty affordable and flexible, as I’m doing the online version from a brick-and-mortar school.

Nicolas and Juliana’s Finances

Net Income

| Item | Amount | Notes |

| Juliana monthly income | $3,100 | This is after taxes, 401k contributions, deferred compensation contributions, insurance, etc. Will go up slightly when I change insurance providers (about $85 a month increase in monthly take home), starting in January. |

| Nicolas monthly income | $2,314 | This is after taxes, 401K contributions, short-term disability, long-term disability, etc. Will probably get rid of short-term disability next year, so long as we have six months of savings, because it’s expensive (almost $100 a month, and only covers 60% of salary for six weeks). |

| Juliana tuition reimbursement | $133 | $1,600 total per year |

| Monthly Subtotal: | $5,547 | |

| Annual Total: | $66,564 |

Monthly Expenses

| Item | Amount | Notes |

| Grad school + books | $650 | I am reimbursed $1,600 per year through my job. I have three semesters to go after this semester, so I will be done in December 2019. This is my pre-reimbursement cost as I included the reimbursement above under income. |

| Rent | $500 | We live with my parents. We pay them $500 per month as a courtesy. |

| Groceries | $500 | We contribute $500 a month to groceries. The total family bill for the five of us is much more, but this is our portion. We’ve started meal prepping (inspired by the Frugalwoods) so we may be able to reduce this by $100 or so. |

| Restaurants/coffee/soda/entertainment | $500 | This is my biggest problem area and includes mostly coffee, soda (I buy from a vending machine instead of getting a 12-pack… stupid, I know), breakfast on the go, fast food, etc. My husband rarely buys food when he’s out. If not for my impulse food buys, we’d save at least $300 a month in my estimate. I’d rather go out to a nice restaurant a few times a year when friends are visiting than spend this much on stuff I can’t even remember! This also includes occasionally going to a winery/brewery with family and going to the movies or other fee-based entertainment a few times a year. |

| Vacation | $450 | Covers airfare, hotels, etc. We take approximately two trips a year to visit relatives, another two to three mini vacations close to home, and one “big” trip on our own. I guess we could cut back a little, at least for a little while… |

| Car & Transportation | $450 | Includes gas (about $180 for both cars — we live in the suburbs in a high traffic area so it would be hard to decrease this amount), car insurance ($1,200/yr) and car maintenance, registration, taxes, inspections, and repairs. We own a 2005 Subaru Legacy (105K miles) and a 2012 Honda Civic (105K miles). We don’t have the option to bike or take public transit where we live. Our 13-year-old Subaru has required $2,000 worth of work this year, and the A/C and heating system just died… I’d really like to hold onto the Subaru for a few more years because of the low mileage, but it’s getting to the point where it’s not super reliable. |

| Doctor and Pharmacy | $375 | For all three of us: co-pays, pharmacy, etc. I had a complicated pregnancy and birth, so we hit our $4,500 max out of pocket. This year I’m switching to a lower cost HMO plan with very low co-pays, so I’m hoping this will decrease in the future. I estimate it’ll be more like $50/month starting next year. |

| School Loan | $197 | I still have $12,315 left to pay. I’m not sure if I should pay this off with savings, or hold on to our savings and pay it off over the next few years. |

| Money sent abroad to family | $150 | I send my grandma $50 a month and my husband sends his family money as needed. This is something we can’t reduce or change. |

| Two Cell Phones | $108 | Sprint unlimited data/calling/text for two cell phones. We are part of the family plan and this is our portion. We’d be open to a cheaper plan as long as it has unlimited data, as we only have one computer between the two of us. Right now, both us have phones that are over three years old and starting to have some problems, so new phones are something we may need to get next year. |

| Baby stuff | $105 | Milk, wipes, diapers. Baby got a lot of hand-me-down toys, so we don’t need to purchase any toys for a while. |

| Gym Membership (Juliana) | $80 | This is expensive, but it’s the only exercise program that’s actually stuck for me, so I’d like to keep it if possible. |

| Gifts, Personal Care, Household Supplies | $75 | Shampoo, toothpaste, toilet paper, other household items, and gifts for family. |

| Clothing | $60 | Baby clothes and clothes for my husband and me. I haven’t bought clothes in years, but I go through shoes pretty quickly. Husband likes to buy a few new outfits and pairs of shoes every year. |

| Recreational Class | $50 | I usually take one “for fun” writing class a year at my local community college. |

| Misc. | $50 | For things that come up. For example, my husband is taking a phlebotomist certification test, which is $117. Occasionally we’ve had to pay to get documents translated, or pay administrative fees for documents. |

| Monthly Subtotal: | $4,300 | |

| Annual Total: | $51,600 |

Assets

| Item | Amount | Notes |

| Cash | $21,000 | I’d like to have a six month emergency fund, which would be $25,800 at our current level of monthly spending. |

| Deferred Compensation (Juliana) | $16,000 | I don’t really count this because this would be paid to me as a pension if I were to make it to retirement at my current job. It doesn’t really matter how much is in it at the end — you get paid a certain monthly amount upon retirement depending on your years of service. I put 5.5% of my salary in, and my employer contributes a certain amount, and disperses a monthly pension upon retirement (about 80% of my salary in my last two years of employment from retirement to death). If I were to leave my job, I could keep what I’ve contributed ($16,000) but would lose what my employer has contributed. At least this is my understanding. I’m considered vested at this time, so if I left, I’d keep my contributions as well as the interest accrued, but would lose the monthly pension. |

| 457 Plan (Juliana) and 401k (Nicolas) | $10,410 | Target date type funds through T Rowe. I contribute 5% per pay period, no match; Nicolas contributes 5% per pay period with an employer match (he just started contributing six months ago because before that, he was a PRN employee). I only contributed 1% the first four years of my employment and paused contributions while I was on maternity leave. We’re a bit late to the investment/401k game. |

| Total: | $45,000 |

Cars

| Car | Valued At | Notes |

| 2012 Honda Civic with 105K miles (Nicolas’ car) | $5,500 | Nicolas drives about 12,000 miles a year. I’m hoping this car lasts forever, or at least five more years. Unfortunately, due to our schedules, it would be almost impossible to downsize to one car. |

| 2005 Subaru Legacy with 105K miles (Juliana’s car) | $3,500 | I also drive about 12,000 miles a year. I hope this car lasts another two to three years, but its had some pretty expensive problems lately. The heating/AC system just died, and I’m not sure how much that will cost to fix. |

| Total: | $9,000 |

Debts

| Item | Amount | Notes |

| Juliana’s student loan | $12,315 | Unsure if I should pay this off or increase our savings/investments. Interest rate is 6.550% fixed. I currently pay $197 per month on it. This is a subsidized federal loan that’s in deferment right now (due to grad school), but I’m still making payments. |

Juliana’s Questions For You:

- When will I be able to afford to work part-time? Can I ever afford to go part-time? At my current education level, if I were to work part-time, I’d make a maximum of $28/hr (less than I make now). However, once I finish my masters degree and am a licensed professional counselor, I might be able to make $35/hr working in the public sector. *I have no interest in private practice.* I estimate that if I were to quit my full-time job and go part-time before I have my license, we would be looking at making $40,000 gross less a year, and would likely have to live on $50K net or less per year. I estimate that on the cheaper end of things, a two bedroom house with utilities within 45 minutes of my family would cost about $1,500 per month, unless we can find some sort of labor/housing exchange gig.

- I find that I often put off living in the present because I’m not currently living the exact life I’d like to be living. This question is more philosophical than financial, but how can I enjoy the present more, considering my current schedule, the fact that I don’t love my job, and that we live somewhere we don’t love? Are there things I could be doing to “prepare” for my dream rural lifestyle that would make us feel as if we’re actively working towards those goals? (for example: growing vegetables in our small garden, learning how to compost, etc.) How can my husband and I pursue our passions within the confines of our current lives?

- Once we reach our goal of replenishing our emergency fund, what should we do with our extra money? Invest more in our 401ks (my husband’s company matches; mine doesn’t)? Open an independent investment fund? Pay off my student loan? Buy an affordable and easy-to-rent condo a little further out? Start a college bank account for our baby? All of the above? Our goal is to have more financial stability, so it’s very important that we grow our nest egg, as it’s in pretty paltry shape right now!

- Is there any way we can increase our incomes? Even without reader analysis/input, I know there are definitely areas we can cut back on! Because of my long days, I’d prefer to do something flexible from home, but most of the work-from-home opportunities I see seem a little scam-y. My husband could possibly get part-time work at another hospital, but he doesn’t have a set schedule and the logistics of this might be difficult.

Mrs. Frugalwoods’ Recommendations

Juliana, congratulations! Before you read any of my advice–or the wonderful advice readers will share–you’ve already put yourself in a better financial position. As Juliana articulated, the process of compiling her complete financial picture for this Case Study was deeply illuminating:

If this Reader Case Study exercise has taught me anything, it’s that I did not have a realistic view of our finances prior to compiling everything for Mrs. Frugalwoods. Writing down every single monthly expense gave me insight into where our money is going, and it forced me to take a hard and cringe-worthy look at how much money I’m spending on insignificant things that don’t even matter to me in the long-term. For example, I could have saved more than $20,000 over the last five years if I’d given up my coffee/soda/eating out habit.

It is NOT EASY to pull together all the material a Case Study requires and I’m in awe every single month of the determination that Case Study subjects display in assembling all of their numbers for us. If you’re wondering where start with improving your financial life, start here. Start with putting the following into a spreadsheet, exactly as Juliana did above:

- Your net income: This means the after-tax dollar amount you take home every month, NOT your gross income.

- Your monthly expenses: You can’t guess on this one. As Juliana sagely noted, it’s easy to underestimate what you spend every month. Use an expense tracking service–I use and recommend Personal Capital, which is free–or write down every dollar religiously.

- Your debts with interest rates: include the total amount you owe on any cars, homes, credit cards, student loans, etc. List ALL debts and sort them according to interest rate.

- Your assets: retirement accounts (401ks, 403bs, etc), investments, savings, checking accounts, cash under your mattress.

Knowing all of the above, and having it all written down in one place, can produce a transformational shift in how you think about your money. Once you write it all down per the above, it’s no longer a mysterious, terrifying force–it’s a simple question of numbers and math. I find that looking at your finances as just that–numbers–removes a lot of the emotion, fear, and anxiety that we allow our money to generate. Juliana highlighted the tremendous importance of knowing your full financial picture and I’m grateful to her for sharing how revelatory this exercise was. Kudos to Juliana for already being in better financial shape! I am excited for you!!

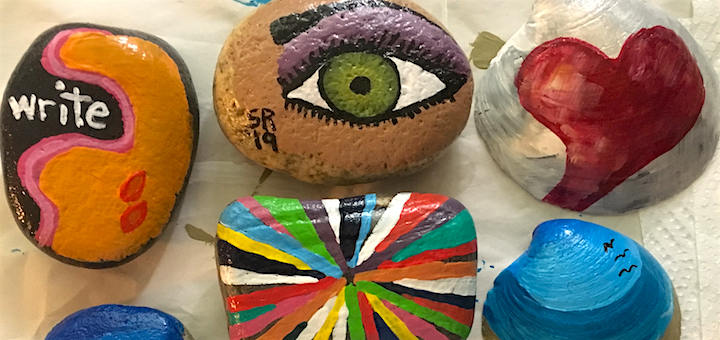

Also, I have to say that Juliana’s photos are AMAZING. They are, hands down, the most beautiful photos I’ve ever received for a Case Study. Truly, Juliana has a gift for photography and I’m grateful to her for sharing these incredible shots with us.

Savings Accounts Side Note

One of the easiest ways to optimize your money is to keep it in a high-interest savings account. With these accounts, interest works in YOUR favor (as opposed to the interest rates on debt, which work against you). Having money in a no (or low) interest savings account is a waste of resources because your money is sitting there doing nothing. Don’t let your money be lazy! Make it work for you! And now, enjoy some explanatory math:

- Let’s say you have $5,000 in a savings account that earns 0% interest. In a year’s time, your $5,000 will still be… $5,000.

- Let’s say you instead put that $5,000 into an American Express Personal Savings account that–as of this writing–earns 1.70% in interest. In one year, your $5,000 will have increased to $5,085.67. That means you earned $85.67 just by having your money in a high-interest account.

And you didn’t have to do anything! I’m a big fan of earning money while doing nothing. I mean, is anybody not a fan of that? Apparently so, because anyone who uses a low (or no) interest savings account is NOT making money while doing nothing. Don’t be that person. Be the person who earns money while sleeping. Rack up the interest and prosper. More about high-interest savings accounts, as well as the ones I recommend, here: The Best High Interest Rate Online Savings Accounts.

Stay Put And Save $$$$ !!!!!

Juliana and Nicolas have a wonderful situation going on right now with her parents and I urge them to stay put and save up! Given their goals, their financial position, and their desire to move in the future, I think they should view the next five years or so as their time to ramp their savings rate up through the ROOF! I love both the familial closeness as well as the financial boon of living with Juliana’s parents and, at present, this means they’re not paying for:

- Market-rate rent

- Utilities

- Home maintenance/repair/upkeep/security deposit to a landlord

- Homeowner’s or renter’s insurance

- Daycare

In the absence of these standard (often exorbitant) expenses, Juliana and Nicolas are in the unique position of being able to save at a ridiculously high rate, despite having fairly modest incomes for the DC area. This is great news! Juliana is well aware of this as she has priced out rents and daycare costs for their area and, as she noted, these two costs alone–rent and daycare–would gobble up at least $3,500 per month, which is a good deal of their take-home pay.

In light of their low rent and free childcare, I highly recommend they consider staying with Juliana’s parents until their daughter is in kindergarten. Also, as Juliana noted, in addition to being free childcare, it’s childcare provided by loving grandparents, which no amount of money could every replace.

Furthermore, I encourage Juliana and Nicolas to consider their plans regarding having more children. Juliana noted that they’re currently undecided–which is very reasonable considering their first is a mere six months old–but a double daycare bill would, at this point, decimate their income. On top of the costs, there are also major logistical considerations with taking kids to and from daycare, in addition to sick days and holidays. All that to say, free, loving, in-home childcare is every parents’ dream (or at least, it’s certainly mine!).

Given this financial reality, if Juliana’s parents are amenable, I think it’s wise for Juliana and Nicolas to continue living with them until their youngest child is in school. The other reason to do this is so that they can save up enough money to enable their goals. Let’s take a look at how!

Juliana and Nicolas’s Expenses

Woohoo! This is an exciting expense review because Juliana already knows there’s a lot of room for them to save and, as noted above, they are mercifully absent a lot of fixed monthly expenses. I also want to point out that Juliana should not beat herself up. I know she did the calculation that she could’ve saved $20K more if she’d stopped buying coffee/soda/food out and, while I commend her for doing that reckoning, I don’t want to her to dwell on it. It’s in the past and we are not worried about it! We are going to work together today to focus on what Juliana and Nicolas can proactively do going forward. Full steam ahead, friends!

In every single Case Study, I like to point out that what you choose to save or not save is a very personal decision. Cutting every last expense is NOT the right answer for everyone and I am NOT an advocate for making yourself miserable in the process of achieving financial stability. I AM an advocate for values-based, goal-oriented spending. I think it’s important to assess whether all of your expenses bring you fulfillment and a good return on your investment.

I think it’s also important to question if your rate of savings will help you to achieve your long-term goals. But what you spend on? That’s a very personal choice and one you have to make for yourself. My job is to point out areas where you might be able to save, but only you can decide if that level of savings is right for you. If you’re struggling with where to save more and how to map out a longterm financial plan, I encourage you to take my free 31-day Uber Frugal Month Challenge.

Ok, with that said, let’s take a look at potential savings for Juliana and Nicolas:

| Item | Current Amount | Mrs. FW’s Notes | Proposed New Amount | Amount Saved |

| Grad school + books | $650 | Fixed expense; no change | $650 | $0 |

| Rent | $500 | Fixed expense; no change | $500 | $0 |

| Groceries | $500 | Juliana posited that they might be able to reduce this by $100 and I strongly encourage her to do that. I also recognize that, since she and Nicolas are contributing towards the whole household’s meals, this might not be easily adjustable and they might need to consider it as part of their “rent.” However, I encourage them to make an effort at reducing this to the extent that it won’t cause friction with her parents. | $400 | $100 |

| Restaurants/coffee/soda/entertainment | $500 | Alrighty, this is the category most eligible for intense savings! Juliana said that she’d rather go out for a nice meal every now and then as opposed to frittering away cash in this category. To that end, I encourage her to eliminate all but $50/month from this. That should allow for those special meals, but eliminate all the drips and drabs throughout the month. | $50 | $450 |

| Vacation | $450 | I hear that travel is a passion for Juliana and Nicolas. However. $5,400 per year on travel is pretty high and this one is largely a question of how quickly and how seriously they want to reach their goals. This could be an easy way to save $450 per month, or, they could decide that this is a crucial element of their lives and that they’d rather postpone goals in order to continue traveling every year. No wrong answer, just different options. | $0 | $450 |

| Car & Transportation | $450 | Fixed expense; no change | $450 | $0 |

| Doctor and Pharmacy | $375 | Juliana noted this is likely to be $50/month starting in January as this was mostly due to her complicated pregnancy and birth | $50 | $325 |

| School Loan | $197 | Pay this off in full (see my notes below for more details) | $0 | $197 |

| Money sent abroad to family | $150 | Fixed expense; no change | $150 | $0 |

| Two Cell Phones | $108 | Check out BOOM, Ting, Republic Wireless and other MVNO providers. Juliana and Nicolas should be able to find something that’s circa $20 each per month. DC-area readers, please let us know what you suggest! | $40 | $68 |

| Baby stuff | $105 | I think there’s an opportunity to reduce this category. I encourage Juliana and Nicolas to source their daughter’s gear, clothes, and toys used through garage sales, Craigslist, thrift stores, swap meets, Facebook buy/sell groups, their local Buy Nothing group, and friends with older kids. More on that here.

Here are my notes on cheap diapers/wipes/supplies: |

$75 | $30 |

| Gym Membership (Juliana) | $80 | Juliana’ gym membership and recreational writing class are things that only she knows the true value of. If these are important to her–and it sounds like they are–she should keep them and look to make deeper cuts in other areas. | $80 | $0 |

| Gifts, Personal Care, Household Supplies | $75 | I’d keep a close eye on this and see if there are generic/cheaper versions of personal care and household supplies. I’d also encourage them to be judicious in their gift giving and try, if possible, to set reasonable dollar limits for their family members. | $50 | $25 |

| Clothing | $60 | Time for a clothes-buying ban! If baby needs clothes, go the used/hand-me-down route. More here. | $0 | $60 |

| Recreational Class | $50 | See notes next to “gym membership” | $50 | $0 |

| Misc. | $50 | Fixed expense; no change | $50 | $0 |

| Current Monthly Subtotal: | $4,300 | Proposed New Monthly Subtotal: | $2,595 | $1,705 |

| Current Annual Total: | $51,600 | Proposed New Annual Total: | $31,140 | $20,460 |

From the potential savings I outlined, Juliana and Nicolas could be on track to save $20,460 MORE per year. They’re already doing a fantastic job of saving $1,247 per month–also known as $14,964 per year–which is phenomenal. If they made all of the above listed reductions, they’d save an astounding $35,424 IN A SINGLE YEAR. WOW. That means by the time their daughter enters kindergarten in five years–and they contemplate a move and a reduction in Juliana’s work hours–they could have a nest egg of $177,120 saved up. And that’s assuming they see no increase in their salaries during that time period.

Each and every one of these expenses is something Juliana and Nicolas will need to make a values-based decision about. I hope that this exercise has at least opened up Juliana’s mind to the incredible possibilities they have if they choose to dramatically reduce their spending. Her desire to work part-time seems much more feasible if they’re able to make these changes and save at such a high rate.

Increasing Income?

The other end of this equation is, of course, increasing one’s income. Juliana knows this and asked how she and Nicolas might increase their incomes, but it seems to me they’re already doing everything possible in this arena.

Juliana is completing her master’s, which will clearly translate into a higher salary, and Nicolas is working his way up at the hospital. I don’t see any value–at this point–in bifurcating their time and energy any further.

A human can only do so much in a 24-hour period! Juliana is already maxing herself out with working full-time and going to school, so my advice would be to soldier on with finishing her degree and then immediately parlay that into a higher salary.

Asset Allocation

“Asset allocation” is just a fancy term for “how you use your money.” I love that Juliana and Nicolas have carefully saved up an emergency fund and I also love that they’re contributing to their retirement accounts! Given my love of emergency funds, Juliana will probably be shocked to hear my next piece of advice:

Use your emergency fund to pay off your student loan in full, right now.

I’m making this somewhat unorthodox suggestion for several reasons:

- Juliana has a robust $21,000 in her emergency fund and her student loan is only $12,315. That means she’ll still have $8,685 in cash after paying off her loan, which would cover her family for a solid two months.

- Juliana’s student loan has a 6.55% interest rate, which isn’t astronomical but isn’t low either. From my perspective, there’s no reason to pay such a high interest rate when you have the cash on hand to eliminate this debt.

- Since Juliana and Nicolas live with Juliana’s parents, their exposure to risk is minimized. If they lived on their own and owned their own home, I might be more hesitant to recommend utilizing their emergency fund in this way. However, since they’re not going to be evicted if something catastrophic happens and they can’t pay rent, I recommend they deploy their cash more wisely at this point.

- Once this loan is eliminated, Juliana and Nicolas will be DEBT FREE! HOORAY! And they’ll save the $197/month that they’re currently paying on her loan, which make it all the easier to build their emergency fund back up.

- I think that Juliana and Nicolas have a lot of room to reduce their expenses (as detailed above), which means they won’t need such a large emergency fund. If they make all of the reductions I suggest, their monthly spending will be slashed down to $2,595, which means they’d only need $15,570 for six months’ worth of expenses. If they have $8,685 in their emergency fund after paying off the loan in full, they’ll need to save another $6,885 to get back up to a six months’ stash, which–if they start saving $1,701 MORE per month, coupled with their current monthly savings of $1,247 ($2,948 saved per month total)–it would take them a mere two months to save up.

- In conclusion, pay off the student loan ASAP.

This segues nicely into Juliana’s question about what they should do with their money once they’ve: 1) paid off her student loan; and 2) saved up an emergency fund.

Juliana is SPOT ON here because she is already doing the top steps I advise:

- Track your expenses religiously. Know exactly what you’re spending every month. If you’re not tracking your spending, you can sign-up for the free service Personal Capital, which is what I use and recommend for expense tracking (affiliate link). If you’d like to know more about how Personal Capital works, check out my full review.

- Pay off high interest debt. List all of your debts in a spreadsheet and sort by interest rate. Prioritize paying them off in order of highest interest rate first.

- Build an emergency fund. An emergency fund should be kept in an easily-accessible bank account, such as a checking or savings account, NOT in investments, retirement funds, or cars/houses/expensive china. An emergency fund is cash money you can access immediately in an emergency. I recommend saving three to six months’ worth of expenses (meaning three to six months worth of what you spend every month, which is why it’s important to do #1: track your expenses).

- Contribute to retirement accounts. Especially if your employer matches your contributions, putting money into a 401k or 403b is a no-brainer. Here’s more on why: 401ks Are Your Friend: Demystifying Personal Finance Part 3.

- Start investing! Investing in the stock market is how you grow your wealth. Without this crucial step, you won’t reap the advantages of compounding interest and you’re unlikely to build your net worth in a meaningful way. I use and recommend investing in low-fee index funds through the brokerages of Fidelity or Vanguard. I personally use Fidelity (I primarily own FSTVX), but Vanguard offers a similar product. You can do this yourself (it’s just like any other form of online banking) and there are more details here: For the Love of Frugal Hound, Manage Your Money Yourself! (by following The Simple Path to Wealth).

- Explore other options for investing in order to achieve diversification. After completing steps 1-5, you should continue investing in your low-fee index funds (and rebalancing them) on a regular basis (I recommend automating this process) and you can also start to look around for diversification options. This might include, for example, real estate. Mr. FW and I rent out our home in Cambridge, MA for a profit. Renting a property can be a fabulous financial decision and it can also be an absolutely abysmal one. It depends on many factors, including the rate of return you’d receive. For more on renting out properties, I recommend the site BiggerPockets, which discusses real estate investing.

- Analyze your income. Concurrent with all of this should be an analysis of your net income (that means the dollar amount you bring home every month, minus taxes and any other withholdings). In some cases, the best route to financial stability will be to increase your income while also lowering your expenses. Income is the crucial second piece to this equation and, the more you make, the more you can save. That’s just a solid math fact.

Juliana and Nicolas will soon be at step #5. And honestly, this is the step at which things get more complicated and dependent upon your individual plans, goals, income level, age, and tolerance for risk. Numbers 1-5 are pretty much universally applicable and appropriate (with some rare exceptions) for just about everyone.

What should they do?

Investing in low-fee index funds (as discussed in step #5 above) could be very appropriate for Juliana and Nicolas, given their ages and asset levels. However, if they plan to buy a home in the near future, this might not make sense. Why? Because you don’t want to invest money that you’re likely to need in the near future. The idea behind investing–and the way to grow wealth–is to remain invested in the market for many decades.

Pulling money in and out of investments is unlikely to net the type of returns the stock market has historically delivered. So, if Juliana and Nicolas envision themselves buying a home in the coming years, they’ll likely want to save their downpayment up as cash. However, as I’ve written many times, home ownership is not necessarily a financial slam dunk nor always a wise idea. And so, if Juliana and Nicolas decide they want to be longterm renters, investing in the market becomes a much clearer yes.

What about saving for college?

Juliana asked specifically if they should begin saving for their daughter’s college education and my response is probably, maybe. Here’s the thing: you can take out loans to pay for college, but you cannot take out loans to fund your retirement. It’s very much a “put your own oxygen mask on first” type of situation. Parents need to ensure their own retirement is solid before starting to save for their kids’ higher education. However, their baby is young and their retirement savings are underway, so it will probably make sense for them to create a separate account intended as a college fund for their daughter. 529s can be a good idea as contributions are sometimes tax advantages (you don’t get a federal tax deduction, just a state tax deduction in some states), but this is really dependent upon your income tax rate and the laws governing your state. Juliana and Nicolas should certainly do more research into 529s and decide if that might be right for them.

What about buying a condo to rent out?

I have no idea on this one. Owning a rental property is so heavily location-dependent that I really can’t advise on whether or not this is a good idea. Juliana and Nicolas can research this and look at:

- Purchase prices in the area

- If the condo is in a home owners’ association, what the rules are governing rental units

- The likelihood that their mortgage interest rate will be higher if they’re not buying the condo as their primary residence

- The likelihood of missing out on the capital gains tax exclusion if they sell the condo without having lived in it for a specified number of years

- The rental prices in the area and whether or not these typically include things like utilities, snow removal, trash, etc.

- Whether or not they’d hire a property manager and the price this would be. If they don’t plan to hire a property manager, assess their DIY skills–can they re-plumb a toilet? Fix a leaky sink? etc etc etc (truly, repairs are endless in homes… )

- Calculations for a robust fund to cover vacancy, maintenance, repairs, etc

- The caliber of tenants in the area and how likely evictions or vacancies are

- Landlord/tenant laws in their state

This is a cursory list and I encourage Juliana and Nicolas to do more research. My hunch is that, unless they want to actually live in this condo, this isn’t going to be a fabulous financial decision and that they’d be better off investing in low-fee index funds. But, I can’t know this without the answers to all of the above considerations.

Goal Planning Time!

Juliana and Nicolas articulated a pretty clear vision for their future: her working part-time and them living in a more rural location. Fortunately, given their ability to save mega bucks over the next few years, I think both of these goals are within reach.

Another factor in their favor is that both of their careers are portable and in demand. It seems likely they’d be able to find good jobs in a rural location (often very tough to do) as long as there’s a hospital/medical center nearby.

Plus, I think relocating to a lower cost of living area would bode well for them since they’re never going to make enough to cope with housing prices in DC, but, in a rural area, they could do very well.

One caution I have is that, at this stage, Juliana and Nicolas are enjoying the wonderful benefit of having family nearby to play a role in raising their daughter. When considering this move away from family, I encourage Juliana and Nicolas to reflect on all of the financial and ancillary benefits of living close to family when you have young children. Since I don’t have any family nearby, I’m particularly attuned to this and I consider it to be the only major downside of where we live. This isn’t to say they shouldn’t move, just that they should take this into consideration.

Scout Out Locations

This is the fun part! Juliana and Nicolas should get to work on scouting out potential locations for their move. Juliana identified upstate New York as a strong possibility and I love that Nicolas has family there–that could really make it a win-win. In lieu of other vacations for the foreseeable future, I encourage them to scope out possible towns in upstate New York. They could rent an AirBnB, stay awhile, get a good sense of the community, check out housing prices, and determine where they might work. I imagine their criteria will narrow down possible candidates since they’re interested in:

- A vibrant little community with a downtown

- Near a medical center/hospital

- Low cost of living

- Close to nature

Fortunately, the Northeast is rife with these types of little towns, although I will caution that the cuter the downtown, the more expensive the housing prices. But, coming from the DC market, Juliana and Nicolas are likely to find somewhere that ticks all these boxes and has a lower priced housing market. I know that Juliana isn’t all that interested in buying a place, however, renting isn’t always possible in rural locations. They’ll just have to see what the market is like in the areas they’re interested in.

Why Not Central America?

It sounds like Juliana and Nicolas are set on staying in the US, but, her repeated mentions of how much they both loved their freelance lives made me wonder why they’re not considering returning to Central America to do ecotourism with Nicolas’ family.

There could be many factors that make this untenable, but it strikes me that they were both happiest when living a simpler, less expensive life. Just throwing that out there in case there’s any room for them to consider this option.

Why Not Private Practice?

Again, Juliana clearly stated that she doesn’t want to do private practice, but I have to ask why not?

This is certainly an area where she could craft a very flexible, part-time schedule and make much more than she does at present. Just something for her to consider.

Be Confident!

I was surprised to hear Juliana say that she feels like she doesn’t stick to goals and that she thinks they should be in better financial shape. We can all stand to be better about sticking to goals and managing our money–that’s sort of a universal given–but Juliana needs to give herself more credit. She and Nicolas are in excellent financial shape–and have the opporunity to catapult themselves into tremendous financial shape. Plus, she paid off $63,000 in debt!!! That is REMARKABLE!!!! And she’s getting her master’s degree while working full-time!!! And being a mom! Come on, Juliana, pat yourself on the back! These are all incredible accomplishments and I don’t want Juliana to feel anything but proud and confident about her future. She and Nicolas are doing really well and, if they can buckle down and save, they’ll be in an enviable financial position.

Passions vs. Making Money

An echo throughout Juliana’s story is the fact that she and Nicolas aren’t doing what they’re passionate about in their daily jobs. They seem to both like their jobs, but don’t love them. And I’m here to say: that is ok. Your life is not over if what you do is not immensely personally fulfilling every day. I know it may come as a surprise to hear me say this because I am an advocate for doing what you love every single day.

However, sometimes the best we can do is work that we find meaningful–even if we don’t absolutely love it–and carve out time to pursue our passions in the off hours. This is how Frugalwoods was born. I continued to work my 9 to 5, while nurturing an impossible-seeming dream of making my living as a full-time writer (which is what I do now, although I’m more like a part-time writer and full-time parent). There’s no magic bullet to propel Juliana into the life she wants, but there are incremental steps she and Nicolas can take–starting today–to get there.

What I find remarkable is that Juliana knows what she wants out of life. I can’t tell you how many people ask me how they can discern that for themselves (and I tried to write about it here, but it’s a tough thing to do) and I have no good answer for them. Juliana knows herself well, and she’s nurturing her passion for writing WHILE going to school AND working full-time AND being a parent. If she can manage all of that, then I have absolutely no doubt that she’ll become a writer some day.

I do think that part-time work will be financially possible for her in the future–again, if they’re able to lower their spending and move to a lower cost of living location. Juliana and Nicolas are in the midst of what I call the slog. I’ve done it. Many people have done it. It’s when you buckle down, keep working, finish your degree, save a ton of money, and research where you want to go next. You can do this, Juliana, and in five years, in ten years? You will be so glad that you did the slog.

Summary

In summary, here’s what I advise Juliana and Nicolas to do:

- Pay off Juliana’s student loan in full, immediately.

- Make a plan for how they want to decrease their monthly spending, starting now, and enact those changes. ASAP. If it feels too overwhelming to make these changes right before the holidays, then Juliana and Nicolas should take my free Uber Frugal Month Challenge with the group in January.

- Save up a robust three to six month emergency fund.

- Research 529s and other college savings vehicles for their daughter. Open an account.

- Juliana should finish her master’s degree, increase her salary, and then investigate part-time options, through either her current position or in private practice.

- Determine if they plan to purchase a home in the next 5-10 years. If so, continue saving (at a high rate) into a savings account to save up a down payment.

- If home ownership is not in their plans, open up a low-fee index fund investment account through either Fidelity or Vanguard.

- Research towns they might want to move to. Visit, scope out the community, determine where they might work, investigate school districts, and gather data on housing prices.

- Continue living with Juliana’s parents–at least until their daughter is in kindergarten–to avoid paying exorbitant daycare fees.

- Decide where they want to live and move there!

Ok Frugalwoods nation, what advice would you give to Juliana? She and I will both reply to comments, so please feel free to ask any clarifying questions!

Would you like your own case study to appear here on Frugalwoods? Email me ([email protected]) your brief story and we’ll talk.

Update from Juliana on 2/13/20:

Since the case study was published, we have:

-Bought a low-mileage, four-year-old Camry for about 11k, and we were able to pay for this in cash.

-Sold our beloved Subaru for $3.2k after realizing the maintenance was getting too expensive and unpredictable for us.

-We were able to pay for my graduate degree completely in cash (20K). This means that I’m eligible now for a modest raise, and my work has actually gotten more interesting.

-Paid off the remainder of my student loan (about 10k)

-We are contributing regularly to a 529 college fund for my daughter, and have asked relatives to donate to that in lieu of gifts for her birthday and Christmas, as she has plenty of toys and doesn’t care about gifts yet.Between paying for school, paying a off my student loan, buying a new (to us) car, and some (very expensive) dental work my husband had to get, we now only have about 7k in savings, BUT we are completely debt free and optimistic that we’ll be able to start saving at a higher rate very soon.

Now that I’m done with school, my plan is to start contributing to my 457k at a higher rate (dropped my contributions to 1% while in school). We’ve been able to accomplish many of these goals because we live with my parents and only contribute about $1,000 for rent and groceries, and they’ve been very supportive in helping us out with childcare, and letting us stay as long as we want.

We also took the advice we received from Ms. Frugalwoods and the comment section to heart and implemented a lot of the suggestions. We still aren’t sure if we are going to rent or buy, but are leaning towards renting in the near-ish future because we can’t really afford the kind of home we’d want. Although this will be more expensive than staying with my parents, I think it’s time for us to be on our own as a family. I still struggle with spending money on things like coffee, lunch, etc., and know I need to get better about this, but overall, it feels great to pay for things in cash and be debt free.

We are definitely not at the point where I can even think about working part-time, as my husband still hasn’t figured out the whole nursing thing, but, I’m hopeful that in the next 4-5 years this could become a possibility, and I’ll be able to focus on my writing and seeing my daughter a little bit more.

-Juliana

I think a crucial missing point here is that both of the cars they own are aging, with one becoming increasingly unreliable. I’d suggest that – after paying off that student loan debt in full – they create a second “pot” of money where they contribute that former student loan payment to building up secondary savings for a new car/car maintenance. This way they’ll have a separate pot of money – not the emergency fund – dedicated to taking care of expensive repairs or perhaps saving up for a used car that’s more reliable.

Thank you for bringing this up, Michelle! I totally overlooked the car situation in my recommendations! I agree with your suggestion–after paying off the student loan they can begin to save towards either repairs on their current vehicles or buying a used car.

Michelle, think you are right. We just put 700 more into our Subaru after the ac/heating died. Fingers crossed it will last another six months or even year, but it’s no fun putting so much money into an aging car!

Yeah, at a certain point, you have to cut your losses with elder cars. I’d look into selling the Subaru (you can likely get something for it) and then buying a new-to-you used car.

Thanks for sharing your story, Juliana!

I think that working part-time is a great idea. However, I do believe that you and your family will be much better off financially if you continue to work full-time for at least the next 5 years or so to pay off debt and save money for a house.

I know you don’t think about home ownership right now. But as your baby grows and your family expands, you will need the extra space. I wouldn’t buy a condo for now since t’s difficult to manage a property from a distance and you need more time to beef up your cash reserves. Once you pay off your student loans, you can begin maxing out your 401k(s) and save up for a house.

I’d also cut expenses in the following categories: restaurants, vacation, car insurance, pay off student loans, and recreational class. I know there’s a reason why you’re spending money in these categories, but prioritization is key here.

Best of luck!

Thanks! I actually made a commitment to stop buying coffees, sodas and mediocre meals out since I started putting this together for Mrs. Frugalwoods….the first two weeks were tough, not going to lie, but it’s gotten easier now, and I do t really miss this stuff anymore! We are open to home ownership. The area we live in has pretty stable housing prices, which means housing is expensive, but it generally appreciates in a steady manner. I think for now though, it’s not one of our front and center goals!

Regarding cell phones:

-I prefer to buy older models of phones on ebay or amazon (right now I have an iPhone SE I bought last year for I think $150, which isn’t cheap, but it’s not $1000)

-Some companies give small discounts for certain providers

-You may not need unlimited data because you can be on wifi with smart phones too (and when I get close to my data limits I turn off data, so that I have to deliberately turn it on versus just mindlessly wasting it)

Regarding travel:

-One way to decrease vacation costs would be to vacation close to areas you want to live someday. Upstate New York can be beautiful and doesn’t require flights to get to.

Thanks for sharing!

Love the idea of vacationing close to where we’d like to live. Our trips to upstate NY right now are kind of must dos, since all of my husband’s US family is there, but I think we can at least be smarter about how we travel! Right now we tend to see our roadtrips and vacations as free for alls when it comes to eating out and spending freely.

I would definitely need to work on my husband with the limited data, but may be worth considering. We are still part of the family plan, so we’d need to see how our “defecting” would impact other family members!

Would you be willing to consider some options that might help frugalize your road trips and vacations? (And please feel free to ignore them if you’re already doing these!)

My husband and I love eating out and exploring food when we travel, but part of the way we do that now is by going to local markets or grocery stores and making some meals on the go. Typically, we’ll plan to eat out one meal a day and do breakfast and lunch/dinner with groceries instead. This dramatically cuts our food costs and gives us better options than the food court of whatever place we’re driving through or visiting. (And many attractions have locations where you can eat picnic lunches!)

We also tend to stay in house rentals (like Airbnb) instead of hotels when we travel since it gives us access to a kitchen and longer-term food storage. Otherwise, we bring a cooler and buy ice to keep perishables cold. (We recently camped around Kauai and made at least half of our meals from the cooler we brought as a carry-on!)

Finally, if you’re open to credit cards, travel rewards and bonuses can help pay for some of the vacations. If you know that you fly a particular airline every year, you might consider getting their credit card to earn miles and pay for your flights. Otherwise, there are many great cards (like Chase Sapphire and AMEX) that let you earn generic points that you can redeem with or transfer to partner chains.

Travelling is a passion of mine, and finding ways to reduce our expenses while on the road allows me to save money, take advantage of deals when they come up, or add in another trip if there’s money leftover!

Lisa, all good suggestions. I think fir us, part of the problem when we travel is that we see it as an opportunity to spend freely and go out to eat a ton, so there is definitely room for improvement there!

I am on a family plan with Cricket Wireless. I made my mom get off her ATT plan that was hundreds of dollars a month and sign up with me for this one. I pay $100 for 4 lines with 4 gb of data and I never get near the data limit. The deal with cricket family plans is every person you add takes $10 off the starting price of $40, so my line was $40, wife was $30, mom was $20, step-dad was $10, and they even let you add a 5th line for $0 for father-in-law, so $100/5 means we each pay $20 a month. The data limit might not work for everyone but it is worth looking into.

Cricket works on the AT&T network and has a great family plan – $100/month for 4 phones with unlimited voice, text, and data. It would cut the cost for you two and your parents by more than half without reducing your data usage.

That sounds like a great deal. I had cricket before, and was happy with it. Do you know if you can take your current phone with you when you change plans? I’m thinking that if we had to buy new phones, we might end up not saving as much.

I recently switched from Verizon to Xfinity mobile, and I was able to take my phone with me. I think this is not a problem anymore.

I use Cricket. As long as your phone is unlocked and compatible, you can bring your own phone. Here’s the site to check compatibility: https://www.cricketwireless.com/cell-phones/bring-your-phone.html

My grandmother moved in with my parents when I was just nine months old and still lives with them now, thirty years later. Having her there as an extra adult growing up was such a special experience, and now she’s helping my mom take care of my son once a week. Multigenerational households aren’t for everyone, but it was a really great for my family. Now we live a twenty minute drive away from them and it feels FAR.

We also have one child and are likely done – know that onlies can be pretty freaking awesome too 🙂

Thanks Angela! I also lived with my grandmother growing up and have great memories!

Hi Juliana – you’re doing great! Just a thought (from a fellow NOVA resident working in healthcare), has your husband looked into going back to Nova (Annandale campus I believe) to get a nursing degree? I know most of the local health care organization provide decent tuition reimbursement and since you will be in the area for several more years, it’s very doable for him to get his nursing associates in that amount of time. A nursing degree would open tons of possible short-term ‘travel jobs’ that pay quite well and might give you more budget margin to work part-time where ever you decide to settle.

Yes, we are looking into NOVA. They have a lot of great healthcare careers, and his job reimburses about 5k. We just need to work on the TOEFL and making sure he has all the requirements to apply! Also, decide if he’s going to go into nursing or another healthcare career.

That’s what I was thinking. What if your husband got an ASN degree care of his healthcare employer after you finish your masters? There are a lot of ASN to BSN on-line options as well, giving him flexibility should he want to continue to the bachelors degree level. The demand for nurses is huge. Plus, once your daughter is in college (trust me, it goes fast) he would be able to take travel nursing jobs all over the country and in some international locations.

Ohh, I hadn’t given thought to the online option for converting his ASN to a BSN, but that could work really well, since he already works at a hospital that seems to be supportive!

Echoing the comment that your photos are beautiful! Maybe selling them on a stock photo site could be a passive way to learn a little side income? https://workwithus.gettyimages.com/en

Thank you for the compliment! I love taking pictures but had never considered selling them. These are all iPhone pics though, so they don’t enlarge well!

It’s probably not going to net you more money right away, but because you work in mental health and you have a history as a writer, you might consider looking into a public relations position. As a communications/PR/outreach specialist or director, you will spend a lot of time writing stories, taking photos and doing video. If this is a passion for you, it might be worth the switch. If you could find a director position, you may be able to increase your pay as well, and we often hire directors straight from a media background. My bosses have mostly been former TV news anchors and former print journalists (I work as a Communications Specialist for a school district). You may also be able to find part time work now copywriting or in a few years, after getting some experience in PR, consulting.

That said, financially, it sounds like finishing your current degree provides an excellent opportunity financially to continue in your career field and work part time at a reasonable salary.

Stephanie, that’s something I will look into!

two things I’d suggest:

Aldi has the BEST diapers, and they are cheaper than Costco, BJ’s and Wal-mart. Just make sure you buy in the largest box they have (and buy a few, as sometimes they’re out of stock). Same with their wipes, cheap and good and fragrance-free. For formula though, Costco was by and far the cheapest per ounce, especially when they had crazy sales where you could buy online. Aldi wasn’t a bad 2nd place though, and they’re great for everything kiddo.

Also, I worry about your husband’s career path. I know we’re not there yet, but phlebotomist robots already exist and they are very accurate at getting blood, especially in hard-to-find-blood-vessels patients. He still has some years, but I would worry about a future in a career where automation can take over. With considerations like that, it might be smart to look at schooling, especially if there are adult nursing programs that take his life/work experience into consideration so he gets a few credits finished without taking classes. Community colleges also offer great, affordable 2 year programs that can transfer to a 4-year degree. There are not enough men in nursing, and especially being a man of color, he may be able to qualify for scholarship programs. And the nice thing about nursing, for people who don’t mind off-schedules, is per diem nurses can make good money, as long as health insurance isn’t a need. I know when my son was in the NICU and when I was previously on hospital bedrest, I met a lot of friendly per diem nurses who loved the work (all females, some moms) because they could get a lot of shifts when they needed the money, but take some time off when they didn’t. It’s all hard work, but if he’s up for it, it might be worth it.

I recommend saving for a car as others suggested. I also recommend Mint Mobile, especially if you have overseas family. They have fair international rates, and if you have the money upfront, you pay $20 a month for 5 gb of data. Mint uses the T-Mobile network, so as long as you get good T-mobile reception where you live/work, it should be fine. I would avoid looking for a phone plan with unlimited data, and instead buy a second computer. You can get a cheap chrome book for $200 (or even less used), and that is a one-time cost. Then you don’t need your phones for streaming and social media except on the go.

Also, many local hospitals will offer free or very low cost tuition to become a nurse. My mom did this – she got a CNA and then they completely paid for her nursing degree. She just had to agree to stay with them for 2 years after she got her degree. A nurse receives a lot more compensation than a phlebotomist, too.

As you get experience and work your way through the nursing assistant certificates and get experience, you will also have a greater advantage in securing a higher-paying position over someone who only went to school but doesn’t have any experience. About 5 years after getting her RN, my mom is now a director of nursing at a healthcare facility – all because of her free nursing degree and experience as an CNA/LPN/RN path!

Thank you Tara! Good suggestions. I think he has some anxiety/fears about going back to school, so we need to sit down and come up with a doable plan. Honestly, if could go back, I may have done nursing as well because it’s so in-need and flexible!

That’s pretty impressive on your mom’s part. It sounds like a lot of the advice is pointing us toward my husband pursuing the nursing degree. I think we will sit down this weekend and map things out.

Thank you Tara! Good suggestions. I think he has some anxiety/fears about going back to school, so we need to sit down and come up with a doable plan!

1. I love that Mrs. Frugalwoods discusses the SLOG. Having a written goal and timeline keeps that manageable.

2. Juliana: I live <2 hours' south of you (Richmond, VA). Clearly, our housing market is entirely different, but a good way to get in snippets of your "ideal life" while in the SLOG is long weekend camping/hiking trips to the mountains. VA State parks have much nicer amenities than the national parks (fyi). Douthat is a personal favorite (and, an easy drive if you can hop on 66-81 once you're out of NOVA). Mrs. Frugalwoods also escaped to the Blue Ridge while in D.C.

Thank you Lauren, I’ve always wanted to check our Douthat. May e we will make it out Memorial Day trip. Richmond is also a great place. My brother loved there fir a while, and really enjoyed it. I think I just need to get my head around the fact that there will be a slog, and I can still enjoy my life while I’m in it! I tend to want instant gratification, so I think it’s all about acceptance right now, and acknowledging there are certain things I need to do so that when we take the jump into our “ideal lives,” we can do so without the burden of debt or financial stress!

Well, if you need an accountabilibuddy, I’m also in the slog and 35 years old. I make good $, but am catching up and am on the last year of my MBA. I, too, wasted ten years of saving (that had zero to do with chasing my passion. I was living the life my former spouse wanted). ANYWHO, I’m sure Mrs. FW could hook up our emails if interested.

Thanks Lauren! That would be great!

I want int on the accountabilibuddy!!

I am 34 turning 35 in March and not a fan of the slog… i want to quit working every 3 months. No lie.

I could benefit from Juliana by trying to figure out my ideal life… at least you’re working towards something. Working towards a ? makes the slog that much harder….

I go through the same thing…I start fantasizing about quitting my job and moving somewhere far away every few months, especially in winter. I’m just trying to remember that if I do that right now, before I have everything in place, I’ll probably just be in a worse place emotionally and financially…I’m so bad at the slog though! I’ll try to contact you via your blog!

I wonder if you and your husband should look into all the details of him returning to school for a nursing degree sooner than later? Actual costs, hours of courses and whether he could work part time as well, nearby school, etc etc.