Neko and her husband Jerry live in Toronto, Ontario with their dog and two cats. Everything about Neko’s life sounds perfect on the surface–a loving marriage, engaging work, fun hobbies, a close-knit family living nearby–but she’s harboring secret debt that’s causing her immense physical and emotional pain. Neko would like our help understanding how to overcome her shopping addition, which has led her to live paycheck-to-paycheck and carry a debt load on her credit card. Let’s work together to offer Neko a plan and a sense of hope for her future.

What’s a Reader Case Study?

Case Studies address financial and life dilemmas that readers of Frugalwoods send in requesting advice. Then, we (that’d be me and YOU, dear reader) read through their situation and provide advice, encouragement, insight and feedback in the comments section.

For an example, check out the last case study. Case Studies are updated by participants (at the end of the post) several months after the Case is featured. Visit this page for links to all updated Case Studies.

Can I Be A Reader Case Study?

There are four options for folks interested in receiving a holistic Frugalwoods financial consultation:

- Apply to be an on-the-blog Case Study subject here.

- Hire me for a private financial consultation here.

- Schedule an hourlong call with me here.

- Schedule a 30 minute call with me here.

→Not sure which option is right for you? Schedule a free 15-minute chat with me to learn more. Refer a friend to me here.

Please note that space is limited for all of the above and most especially for on-the-blog Case Studies. I do my best to accommodate everyone who applies, but there are a limited number of slots available each month.

The Goal Of Reader Case Studies

Reader Case Studies highlight a diverse range of financial situations, ages, ethnicities, locations, goals, careers, incomes, family compositions and more!

The Case Study series began in 2016 and, to date, there’ve been 96 Case Studies. I’ve featured folks with annual incomes ranging from $17k to $200k+ and net worths ranging from -$300k to $2.9M+.

I’ve featured single, married, partnered, divorced, child-filled and child-free households. I’ve featured gay, straight, queer, bisexual and polyamorous people. I’ve featured women, non-binary folks and men. I’ve featured transgender and cisgender people. I’ve had cat people and dog people. I’ve featured folks from the US, Australia, Canada, England, South Africa, Spain, Finland, the Netherlands, Germany and France. I’ve featured people with PhDs and people with high school diplomas. I’ve featured people in their early 20’s and people in their late 60’s. I’ve featured folks who live on farms and folks who live in New York City.

Reader Case Study Guidelines

I probably don’t need to say the following because you all are the kindest, most polite commenters on the internet, but please note that Frugalwoods is a judgement-free zone where we endeavor to help one another, not condemn.

There’s no room for rudeness here. The goal is to create a supportive environment where we all acknowledge we’re human, we’re flawed, but we choose to be here together, workshopping our money and our lives with positive, proactive suggestions and ideas.

And a disclaimer that I am not a trained financial professional and I encourage people not to make serious financial decisions based solely on what one person on the internet advises.

I encourage everyone to do their own research to determine the best course of action for their finances. I am not a financial advisor and I am not your financial advisor.

With that I’ll let Neko, today’s Case Study subject, take it from here!

Neko’s Story

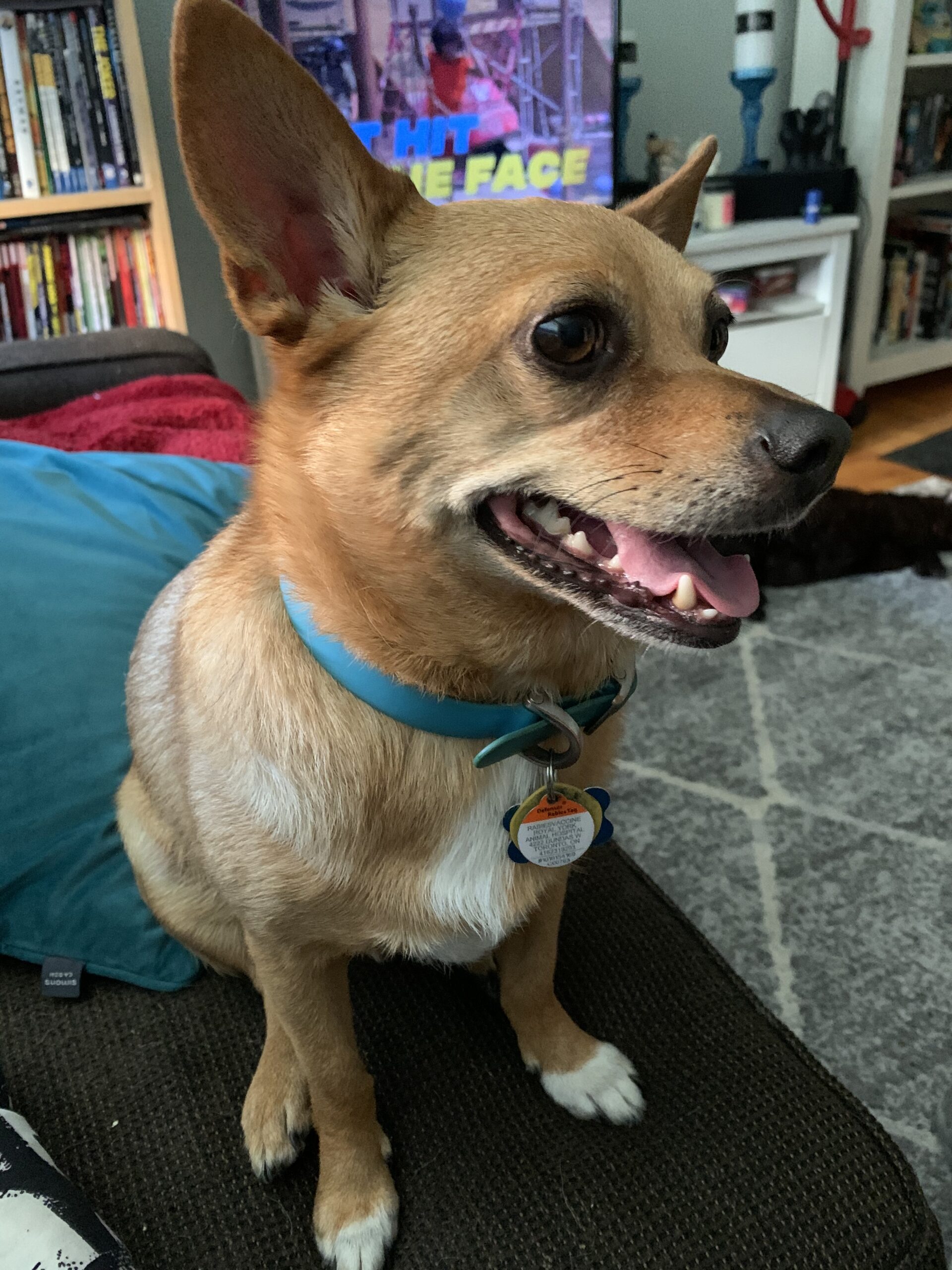

Hi Frugalwoods! My name is Neko and I’m 41 years old. My husband, Jerry, is 46. We live in the Canadian city of Toronto, Ontario in a house that’s co-owned by my uncle and dad. We have three beloved pets, Jasper our chihuahua who is 4 years old, Seth our tabby cat who is 12 years old and Willow our good luck black cat who is 18 years old. We chose a few years ago to live a childfree lifestyle and have not once looked back on that decision. We’ve been happily married for 15 years and look forward to many more years of happiness together!

Neko & Jerry’s Careers

I work full time in the head office of an industrial bakery doing invoicing, data entry, order processing and whatever other odd jobs pop up. My husband works in a home supplies warehouse doing pretty much everything from backroom stocking to front line customer service. He recently completed a forklift operation license course for free within his work, which has increased both his duties and pay. We both enjoy our work and–since we live close to both our workplaces–we enjoy the flexibility of a short commute. Another advantage is that I save money on bus fares by walking home a few nights a week. My workplace is also close to my in-laws’ home and Jasper, the chihuahua, spends the day with them while my husband and I are at work.

About 10 years ago, I was working in the spa industry as a massage therapist and waxing technician. I worked in that industry until my early 30s when I decided I wanted to change my focus to something more recession-proof. With financial help from my parents, I took some online continuing education college courses to upgrade my computer skills and become certified in the basics of business invoicing, accounts receivables and general logistics. I then found a job with a shipping firm, which led me to my current position at the industrial bakery. I have worked in this field since 2015.

Neko & Jerry’s House

Two years ago my uncle (my dad’s youngest brother) decided he wanted to move into a house as he was done with the condo lifestyle.

He and my dad approached Jerry and I with a deal:

- My dad would loan my uncle $60,000 to contribute to the down payment my uncle had ready for a house in Toronto.

- The house had been renovated to separate the main floor and the bottom floor into two independent living areas.

- Jerry and I would move into the bottom half of the house as my dad’s tenants.

- Once we have paid back the $60,000 contribution through a rental deposit of $1,500 a month, the mortgage will be re-drafted to list Jerry and I as partial owners.

- Currently, my dad and uncle own the house 50-50 and my uncle lives on the main floor.

It was definitely an adjustment to move into a house from an apartment and we are enjoying the learning curve that comes with this new experience. Having our own laundry room is the best part of our new living arrangements as I was sick of scrambling for quarters for our shared laundry facilities in our last apartment. And we have a backyard! All three of us pitch in to take care of the outdoor maintenance and Jerry and I have the freedom to redecorate/renovate our living area as we please. We set up an agreement with my dad to send him the rent payment as a bank transfer to an account he opened solely for rent payment collection.

Neko & Jerry’s Hobbies

I love to exercise and have a lot of workout equipment at home, plus I use a city-maintained outdoor gym a short walking distance from home. I also love comedy and have found an amazing improv studio where I take classes. These classes are a welcome escape for me as it allows for some unstructured fun and laughter, which also teaches communication skills. I know that my confidence and overall interpersonal skills have improved since I started studying improv. I have also made some incredible friends through improv class. My third vice is baking! Pretty much every Saturday morning I’m in the kitchen covered in flour while I mix together something yummy.

Since moving into our new house Jerry has found a new talent with gardening. He grows yummy tomatoes and peppers in our backyard and tends to some beautiful flower arrangements in the front yard. He is also handy and built a gorgeous stone pathway leading to the backyard. Together we enjoy playing basketball on the public court nearby our house and taking Jasper on long scenic walks in our neighborhood.

Overall we live a simple lifestyle and are very grateful for the support we have from both sides of our families in addition to the support we give to each other.

What feels most pressing right now? What brings you to submit a Case Study?

Let me put it this way: anyone who has watched the TLC show ‘Intervention’ knows that the show starts with a montage of the amazing things the person suffering from the addiction has done and how much he or she is loved, but then the addicted person stares blankly into the camera and admits to the truth of his or her addiction, which is ruining not only his or her life but also the lives of anyone associated with the addicted individual.

Well, I’ve done my montage of all the great things I have in my life, so that means it’s time for my big reveal:

I am addicted to online shopping and have over $9,000 in credit card debt

I’ve had this addiction for about 5 years now. It started with compulsive impulse buys whenever I was out shopping for essentials and then it moved to the online world. My biggest expense is shopping for clothes and shoes. There aren’t any triggers for my compulsive shopping, I just want to shop all the time. All I think about some days are the things I want to buy and how long it will take before I have the money or credit to buy them.

I have deliberately withheld the details of my debt from my friends and family, which only adds to my sense of shame about it.

The only motivation behind this behavior that I can identify is that I’m addicted to the feeling of anything new. There is something so satisfying about knowing that I have something brand new and that more new stuff is just around the corner. This feeling is accentuated by knowing that I can get the next new thing through the simple push of a few buttons.

My motivation for submitting a Case Study is to, for once, be honest about the mess I’ve gotten myself into and figure out if it will be better to focus all my resources into paying off my debt, or build some savings while simultaneously paying off my debt.

What’s the best part of your current lifestyle/routine?

One of the best parts of my current lifestyle is that I enjoy the work I do and get along well with my manager and coworkers. My workplace is a small business, which means that the voices of all employees are listened to and I have had my commitment rewarded with two raises over the past 3 years. I also enjoy having evenings and weekends off. I longed for a 9-5 lifestyle when I was working in the spa field, so now that I have it I am very grateful. Another good thing is that I have the advantage of living close to my family and in-laws, which means my husband and I have a lot of help or can lend help whenever a family member needs it. Having a close knit family is something that is very fulfilling to me. I also love that I’m able to incorporate exercise into my daily life by having the space at home for a mini gym, walking with Jasper or using the free outdoor gym facilities near my home.

What’s the worst part of your current lifestyle/routine?

The worst part of my current lifestyle is that, because of my debt and shopping addiction, I am always broke. I barely have enough money to last much more than 5 days after payday, which then means I turn to my credit card for spending. My debt far outweighs any potential net worth I could have and I also have no savings since I’m always dipping into what I intended to be my savings account to cover everyday expenses.

Being broke because of my addiction has made me become the very definition of living paycheck to paycheck and as such, I have no choice but to obsessively budget every dollar coming in and out of my bank account.

The cherry on top is that, thanks to many shopping websites accepting Paypal payments, I often have spent a good chunk of my paycheck a few days before I have receive it. This is because a Paypal payment will be approved right away and then take up to 3 days before it is withdrawn from my account. So if I order a new outfit on Tuesday and my payday is on Thursday, that fee will be deducted within a day of my pay hitting my bank account.

For the past few years, my mental state has been nothing short of a mess because of my spending habits. I’ve crunched the numbers of my debt and expenses time and time again until they’re nothing but abstract shapes on a computer screen.

There are the negative financial effects of debt for sure, but they are nothing compared to the emotional effects of debt by a long shot.

I remember a time when a friend was going through a divorce and he said he’s rather remember what it was like to be happily married than to remember why the relationship ended because remembering the good times was the only thing that gave him hope. This is how I feel about my debt. I prefer to remember the days of 15 years ago when I had money in the bank, was able to put down physical cash in a restaurant to cover my part of the bill, go shopping at the mall as a once-in-awhile treat (and therefore be grateful for my purchases) and was able to loan money to a friend in need because I had more than enough to go around. However, I can only avoid my truth for so long before it comes creeping back up on me.

I am constantly feeling a massive sense of shame and guilt. I feel like this isn’t the way a 40-something woman should be living. I should be able to control my impulses and understand the importance of saving for a rainy day. I should have smartened up long ago, should have found a healthier outlet for my shopping cravings, should have learned from all my past mistakes, I just should, should, should, should. I should be doing anything except what I am doing because everything I’m doing now is the wrong thing.

Neko’s Physical Health

My physical health has also suffered from my debt. During the summer of 2020 I became injured from a bad wipe out while on a run with my dog. I tripped over a rock while running at a high speed and ended up with injuries to my knee and low back, plus a bunch of deep scrapes and bruises. My mom took me to a walk-in clinic where the doctor diagnosed me with depression once I described my compulsive exercise regimes coupled with my overwhelming sense of despair. I was prescribed an antidepressant medication that I’m still taking today which is an out of pocket expense I have no choice but to budget for.

The medication has definitely calmed my mental state somewhat which helps me to get by in my day to day life. My knee and back injury have healed up with some efforts of my own though I know I could definitely benefit from seeing a chiropractor or physiotherapist to treat the ongoing pain and stiffness issues I’m having. However, the fact is those are out of pocket expenses that I can’t possibly afford as long as I have my debt hanging over my head. People have told me to look into an insurance package which would help cover healthcare expenses, though paying for insurance coverage is impossible too as that’s another monthly fee I can’t cover.

I also haven’t been to a dentist for a checkup of any kind since my early thirties and I’m about 5 years overdue on seeing an optometrist to get my prescription lenses checked and updated for the same reason I can’t see a chiro or physio- I can’t afford to because of my debt. The only reason I was able to even speak to a doctor is because standard walk-in or family doctor checkup appointments are covered by the government in Canada and therefore are not billed to the patient.

Neko’s Income

My situation is compounded by the fact that I have reached the top of my earning bracket for the type of work that I do. Any job move I could make would be a lateral move and would also most likely mean giving up the convenience of a work location I can walk to. I have dreams of pursuing higher education and completely changing my line of work, but that’s just another thing I can’t do because of my debt.

That being said, I know my income is more than enough to cover my necessary expenses and I also know I could be making wiser saving and investing decisions if I didn’t have my debt and addiction to deal with. I’ve looked into finding a second stream of income, however any attempt I have made of monetizing content I have posted online has turned up absolutely nothing and I’ve realized that I’m just not willing to give up my evenings or weekends for a second job like working in retail. My time outside of my full time work is spent with my husband and pets or in improv class and having that time means too much to me to give it up even temporarily.

As I’m sure many of you have figured, I can’t see a therapist to get help for my addiction because that would be another out of pocket expense I can’t afford. I’ve looked into some free online therapy groups and so far haven’t had much luck though I’m still holding out some hope I can find something soon. I managed to find a free phone-in therapy line which I have used a few times and have found somewhat helpful.

Declare Bankruptcy?

The final point I must make here is that declaring bankruptcy or a consumer proposal isn’t an option for me. I already declared bankruptcy in 2009. This was mainly to deal with debts I incurred while I was in college full time and depending on two credit cards to get by. I was discharged and had my credit report cleared 5 years later. Declaring bankruptcy again would completely trash my credit rating (not that my credit rating is great now, though if I manage to pay down my debt there will be the eventual result of it improving) and getting any kind of credit again would be next to impossible. This matters to me as I understand that having bad credit can affect me in many negative ways further down the road and my ultimate goal here is to get out of debt on my own. I know that this is a realistic goal as my debt is only from one credit card which could be paid off with some discipline, however it’s finding that discipline that is the difficult part.

Neko’s Future Career Ideas

I once heard the advice that if you feel stuck in your current situation, remember the things that interested or inspired you as a kid or teenager. Odds are these are the things that will still spark your interest today and could provide a starting point for a new direction in your life. One thing that really sparked my interest as a teenager was the field of psychology. I took a few psych courses in high school and was fascinated with the different theories of behavior both individually and within a group.

I found an old university psychology textbook of my mom’s and poured through it over a school break in my last year of high school and began to entertain the thought of being a psychiatrist. But then of course I succumbed to peer pressure and decided I needed to build a life that looked ‘cool’ to everyone else. So I pursued fine arts in college which I now know was my first in a long line of huge mistakes through my late teens through early twenties.

Lately I’ve been thinking more about my old psychiatrist dream. The first step to achieving this would be obtaining a degree in psychology. I could do this remotely while continuing to work my current job. I’ve also been thinking about going back to school in general. I could potentially upgrade my accounting skills and get the title of Accountant. This could lead to a higher paying job and I could still pursue remote school part-time.

Another route that appeals to me is taking courses–or a ‘boot camp’ training–in coding. I know people through my improv classes who took this route and it led them into the positions of website development and web traffic analysis. These types of jobs pay higher than my current position and can be done remotely. While I don’t love the idea of a remote job, I see the advantage of saving a ton of money on travel costs and I know I could benefit from anything that will save money in the long run. What appeals most to me about these types of jobs is the analysis aspect, which is also what interests me most about Psychology. I love the concept of being able to identify Pattern A, link it to Behavior B, predict it to lead to Outcome C and then analyze Final Outcome D.

Another potential avenue could be becoming an elementary school teacher. In my province there are a lot of teaching positions opening over the next few years as the generation of teachers who have held the longest running positions are retiring. There’s a big push now for younger people to pursue a degree in teaching. However, I would have to obtain a degree of some kind before I would be eligible for Teacher’s College and that would be a minimum of three years of study depending on the subject. However, I can see the long-term advantages of a position like this as it would mean steady pay and an employer retirement match.

Clearly the psychology degree option would be the most costly and take the longest. It would run for 12 terms and cost about $2,000 per term. The coding classes would run about $300 per class and run for 6 sections, so that could be completed within a year. Any of these options are a possibility and I am continuing my research into all of them.

However, before I make any type of choice about the future I know I have to get a handle on my spending and clear my debt.

Where Neko Wants to be in Ten Years:

- Finances:

- To be debt free and have a savings account with at least 6 months worth of expenses.

- Lifestyle:

- My vision of the future isn’t really that grand. I simply want some financial security and to have the cloud of debt lifted. I dream of a time in which I could take a spontaneous weekend trip with my husband or treat my family to a nice dinner out for a special occasion because I have the money in the bank to do so. I guess it just comes down to one word – Freedom. I want the freedom of being debt free and therefore able to take advantage of the opportunities that a debt free lifestyle provides.

- Career: This is one area I’m still not sure about.

Neko’s Finances

| Item | Gross Income | Deductions & Amount | Net Income |

| Neko’s net income | $2,880 | taxes $270-$300 | $2,325 |

| I don’t have any kind of insurance or benefits through my workplace as I have chosen to opt out of the plans to lessen my deductions | |||

| Monthly subtotal: | $2,325 | ||

| Annual total: | $27,900 |

Debts

| Item | Outstanding loan balance | Interest Rate | Loan Period/Payoff Terms/Your monthly required payment |

| Capital One credit card | $9,294 | 2.15% | $400-$550 per month |

Assets

| Item | Amount | Notes | Interest/type of securities held/Stock ticker | Name of bank/brokerage | Expense Ratio |

| Tax Free Savings Account | $24 | Tax free savings | Tangerine | N/A |

Expenses

| Item | Amount | Notes |

| Neko’s share of the Rent | $624 | This is transferred to my husband in chunks of $312 on every payday during the month |

| General shopping | $500 | As I have described above this is mainly spent on clothes / lingerie / shoes which is a combination of spending from my checking account and my credit card.

This ranges from $300 – $700 per month. |

| Groceries | $350 | Includes household cleaning supplies and dry kibble for all my pets |

| Personal care | $150 | Includes haircare, skincare / makeup products and non prescription sleeping pills |

| Drop in improv classes | $150 | This includes grabbing a small meal before class and each class is $25 |

| Public transit | $125 | I cut down on bus fares by walking home from work once or twice a week |

| Pet store | $100 | Includes higher quality cat litter and wet cat food for the senior cats, also includes treats / chews for Jasper |

| Smartphone | $92 | This is for my iPhone |

| Jerry’s smartphone and Mom in law’s phone | $72 | This plan includes a cheap add on for Jerry’s mom to have her own phone, the price for cable and internet is added into the rent payment that Jerry and I transfer to my dad |

| Mental Heath pills | $15.58 | I purchase both of these prescriptions in 90 day supply packs, I divided each price by 3 for the monthly cost |

| Birth control pills | $15.35 | |

| Monthly Subtotal: | $2,194 | |

| Annual Total: | $26,328 |

Neko’s Questions for You:

- Should I make whatever sacrifices necessary to pay off my debt in the shortest time frame possible? Or should I or focus on saving up an emergency fund while making smaller debt re-payments?

- Does anyone have advice on how to break a destructive addiction?

Liz Frugalwoods’ Recommendations

Neko, you’ve done a very brave and wonderful thing today. It is challenging to share our finances even when we’re in the best of circumstances and you’ve done the remarkable work of being honest and vulnerable about the struggles you’re having. You should feel proud that you’ve come face to face with your debt and are asking for help. I want to commend you for doing this and for your desire to change your relationship to spending. I am cheering you on! Let’s get to it.

The Root of the Issue: An Addiction to Compulsive Spending

While Neko’s questions are technically about a financial problem, the deeper issue here is addiction, which Neko already knows. I will certainly offer advice on how to pay off her debt; but as Neko articulated, without tools and a support system behind her, she’s likely to slide back into the cycle of debt–>payoff–>debt.

→Neko needs to tackle the root of her addiction and she needs to do this with a trained therapist.

I know that therapists cost money and I know this is why Neko hasn’t been to a therapist, but, I think it’s imperative she find one. And fast. This is one of those rare instances where I recommend that someone spend more money in order to get out of debt. Neko demonstrates a great deal of self-awareness in her writing and she is fully cognizant of the financial and mathematical problems at hand. In light of that, she needs a therapist to work with her to untangle the emotional threads binding her to this addiction. There is help out there and there is hope; Neko you can do this.

Suggestion #1: Hire a Therapist Today

I encourage Neko to find a therapist who specializing in shopping addictions/compulsive spending and has experience helping people with this specific challenge. I consider this a non-negotiable investment in Neko’s future. While yes, it might temporarily push her further into debt, it is a vital tool for Neko’s longterm success. Finding a good therapist is made all the more crucial by the fact that Neko’s physical and mental health are suffering alongside her financial health. Neko, you do not have to live this way–you can overcome this addiction, but you will need help to do so.

Suggestion #2: Start Attending Debtors Anonymous Meetings This Week

I strongly encourage Neko to start regularly attending Debtors Anonymous meetings. Here is a list of meetings in Toronto that are happening later this week.

Debtors Anonymous offers hope for people whose use of unsecured debt causes problems and suffering. We come to learn that compulsive debting is a spiritual problem with a spiritual solution, and we find relief by working the D.A. recovery program based on the Twelve-Step principles.

The only requirement for membership is a desire to stop incurring unsecured debt. Even if members are not in debt, they are welcome in D.A. Our Fellowship is supported solely through contributions made by members; there are no dues or fees.

Debtors Anonymous is not affiliated with any financial, legal, political, or religious entities, and we avoid controversy by not discussing outside issues. By sharing our experience, strength, and hope, and by carrying the message to those who still suffer, we find joy, clarity, and serenity as we recover together.

Debtors Anonymous offers hope for people whose use of unsecured debt causes problems and suffering in their lives and the lives of others.

Please go to a meeting this week, Neko. I had a Case Study participant in 2020 who was in the Debtors Anonymous 12 Step program and she shared her story here: Reader Case Study: Debtors Anonymous Helped This Wildlife Biologist Recover From Compulsive Spending.

Additionally, your local Debtors Anonymous group may be able to offer recommendations on therapists familiar with treating compulsive spending.

Suggestion #3: Focus on Healing Right Now

While Neko’s income is low and she outlined a number of ideas for increasing it, my sense is that an increased income would just equal increased debt.

Until Neko has effective tools for handling her addiction, I don’t think that more money is the sole solution.

I encourage Neko to focus on healing right now. I encourage her to put her energy into working with a therapist and attending Debtors Anonymous meetings. That’s going to feel like a second job and she should allow herself the grace to not worry about finding another career path right now. Right now, her job is to heal.

Suggestion #4: Cancel The Credit Card

Neko needs to cancel her credit card. She will still be responsible for paying off the entire balance (and it will still accrue interest), but she will no longer be able to use it to go further into debt.

Some credit card companies won’t let you cancel a credit card that carries a balance. If that’s the case with Neko’s card, I suggest she instead freeze the card.

→Another option is to look into a balance transfer credit card.

In this case, you transfer your credit card debt to a 0% interest card in order to pay it off without accruing more interest. If Neko does this, however, she has to commit to not spending on this new card and to closing this card as soon as the balance is paid off. Note that with most of these cards, the 0% interest is an introductory rate and the interest often skyrockets after the introductory period ends.

The goal here is to stop Neko from going further into debt. That’s the first step before we get to debt payoff.

Suggestion #5: Pay Down The Debt

Once Neko is no longer accruing debt, she should use the average of $500 per month she was spending on shopping to pay off her credit card. I made a chart below demonstrating how this pay-off could play out.

Suggestion #6: Save Up an Emergency Fund

In my opinion–and if I’m understanding Neko’s family/living situation correctly–it is less imperative for her to save up an emergency fund prior to debt payoff because:

- Her father and uncle own her home;

- She is splitting house expenses with her husband and uncle.

Thus, if she were to suddenly lose her job, I can’t imagine her family would allow her to become homeless or not have food to eat. To be clear, Neko does need her own emergency fund; however, in my observation, her need for an emergency fund isn’t as imperative as discharging her debt.

Suggestion #7: Review Expenses

Let’s take a look at Neko’s expenses to determine how she might go about paying off debt and then saving up an emergency fund. As I noted above, Neko’s income is low, but her costs (aside from the shopping) are also low!

Anytime a person wants or needs to spend less, I encourage them to define all of their expenses as Fixed, Reduceable or Discretionary:

- Fixed expenses are things you cannot change. Examples: your mortgage and debt payments.

- Reduceable expenses are necessary for human survival, but you control how much you spend on them. Examples: groceries and gas for the cars.

- Discretionary expenses are things that can be eliminated entirely. Examples: travel, haircuts, eating out.

I’ve categorized Neko’s expenses below and made suggestions on where she might be able to reduce her spending. The caveat, of course, is that only Neko knows which line items are priorities and which can be reduced. I do my best, but it’s up to Neko to decide what (and how much) is feasible for her to spend less on:

| Item | Amount | Notes | Category | Proposed New Amount | Liz’s Notes |

| Neko’s share of the Rent | $624 | This is transferred to my husband in chunks of $312 on every payday during the month | Fixed | $624 | |

| General shopping | $500 | As I have described above this is mainly spent on clothes / lingerie / shoes which is a combination of spending from my checking account and my credit card.

This ranges from $300 – $700 per month. |

Fixed (as debt pay-off) | $500 | This is now going towards debt pay-off, not shopping. |

| Groceries | $350 | Includes household cleaning supplies and dry kibble for all my pets | Reduceable | $300 | Is this split with Neko’s husband? Is the pet food cost shared? |

| Personal care | $150 | Includes haircare, skincare / makeup products and non prescription sleeping pills | Discretionary | $50 | What opportunities might there be for reductions here? |

| Drop in improv classes | $150 | This includes grabbing a small meal before class and each class is $25 | Discretionary | $150 | While this is discretionary and could be eliminated, it was clear from her write-up that improv is a crucial part of Neko’s sense of wellbeing and general mental health. I’m not inclined to suggest she eliminate something so important while she’s going through the challenging work of recovery. |

| Public transit | $125 | I cut down on bus fares by walking home from work once or twice a week | Reduceable | $100 | Does Neko’s employer offer any transportation benefits? Are there any discounts she could take advantage of? Would walking more often be an option? |

| Pet store | $100 | Includes higher quality cat litter and wet cat food for the senior cats, also includes treats / chews for Jasper | Reduceable | $75 | Any opportunities to reduce this? Is this cost split with Neko’s husband? |

| Smartphone | $92 | This is for my iPhone | Reduceable | $15 | Time to get an MVNO! Yes, Canada has them too! I suggest Neko get on this ASAP as this is low-hanging fruit! |

| Jerry’s smartphone and Mom in law’s phone | $72 | This plan includes a cheap add on for Jerry’s mom to have her own phone, the price for cable and internet is added into the rent payment that Jerry and I transfer to my dad | Fixed? | $72 | I’m confused about this expenses, but am assuming this is somehow part of their rent and utilities cost share since I don’t see any utilities listed? Electricity, etc? Correct me if I’m wrong, Neko! |

| Mental Heath pills | $15.58 | I purchase both of these prescriptions in 90 day supply packs, I divided each price by 3 for the monthly cost | Fixed | $15.58 | Very important fixed cost |

| Birth control pills | $15.35 | Fixed | $15.35 | Very important fixed cost | |

| Monthly subtotal: | $2,194 | Monthly subtotal: | $1,917 | ||

| Annual Total: | $26,328 | Annual Total: | $23,004 |

If Neko is able to make the above suggested reductions, she’ll be on track to save an extra $277 per month, which she could put either into an emergency fund or towards debt repayment.

Suggestion #8: Create and Follow a Debt Payoff Timeline

Concurrent with seeing a therapist, going to Debtors Anonymous meetings and cancelling her credit card, I suggest Neko enact one of the two below Monthly Debt Repayment Options.

→Option #1 entails Neko putting the $500 she previously spent on shopping towards paying down the credit card.

→Option #2 entails Neko putting the $500 on shopping PLUS the proposed additional savings of $277 per month towards paying down the card.

I’ve included the interest rate accrual for both of these options.

| Month and Year | Monthly Debt Repayment Option 1: The $500 previously spent on the card |

Monthly Debt Repayment Option 2: The $500 previously spent on the card + the $277 in additional savings per month |

Option 1 Credit Card Monthly Interest Accrual (Rate of 2.15%) | Option 1 Debt Balance | Option 2 Credit Card Monthly Interest Accrual (Rate of 2.15%) | Option 2 Debt Balance |

| May 2023 | $500 | $777 | $199.82 | $8,993.82 | $199.82 | $8,716.82 |

| June 2023 | $500 | $777 | $193.37 | $8,687.19 | $187.41 | $8,127.23 |

| July 2023 | $500 | $777 | $186.77 | $8,373.96 | $174.74 | $7,524.97 |

| August 2023 | $500 | $777 | $180.04 | $8,054.00 | $161.79 | $6,909.75 |

| September 2023 | $500 | $777 |

$173.16 |

$7,727.16 | $148.56 | $6,281.31 |

| October 2023 | $500 | $777 |

$166.13 |

$7,393.29 |

$135.05 | $5,639.36 |

| November 2023 | $500 | $777 |

$158.96 |

$7,052.25 |

$121.25 | $4,983.61 |

| December 2023 | $500 | $777 |

$151.62 |

$6,703.87 |

$107.15 | $4,313.76 |

| January 2024 | $500 | $777 |

$144.13 |

$6,348.01 |

$92.75 | $3,629.50 |

| February 2024 | $500 | $777 |

$136.48 |

$5,984.49 |

$78.03 | $2,930.54 |

| March 2024 | $500 | $777 |

$128.67 |

$5,613.16 |

$63.01 | $2,216.54 |

| April 2024 | $500 | $777 |

$120.68 |

$5,233.84 |

$47.66 | $1,487.20 |

| May 2024 | $500 | $777 |

$112.53 |

$4,846.37 |

$31.97 | $742.17 |

| June 2024 | $500 | $777 | $104.20 | $4,450.56 | $15.96 | PAID OFF! |

| July 2024 | $500 | $777 | $95.69 | $4,046.25 | ||

| August 2024 | $500 | $777 | $86.99 | $3,633.24 | ||

| September 2024 | $500 | $777 | $78.11 | $3,211.36 | ||

| October 2024 | $500 | $777 | $69.04 | $2,780.40 | ||

| November 2024 | $500 | $777 | $59.78 | $2,340.18 | ||

| December 2024 | $500 | $777 | $50.31 | $1,890.50 | ||

| January 2025 | $500 | $777 | $40.65 | $1,431.14 | ||

| February 2025 | $500 | $777 | $30.77 | $961.91 | ||

| March 2025 | $500 | $777 | $20.68 | $482.59 | ||

| April 2025 | $500 | $777 | $10.38 | PAID OFF! |

As we can see, with Option 1 ($500 per month), Neko’s debt will be fully paid off in just over two years in April 2025. With Option 2 ($777 per month), her debt will be obliterated in just over one year, in June 2024.

→Neko, that is really soon!!!!

I hope that seeing how quickly she can be debt-free gives Neko hope and shows her how well within reach this goal really is! This is not an insurmountable amount of debt. This is something Neko can do, and pretty quickly too!!!!!!

Suggestion #9: Invest for Retirement

Once Neko has:

- Paid off her debt (and committed to never going into debt again)

- And saved up a full emergency fund, which should be three to six months’ worth of her expenses…

She can turn her attention to investing for her retirement. I also encourage her to pay for the health and dental care she’s been deferring. The above debt payoff schedule is a quick one and it will take perseverance to follow. But once that debt is gone? Neko can focus on these other important priorities.

Summary:

- Find a therapist who specializes in compulsive spending and book an appointment ASAP.

- Begin attending Debtors Anonymous meetings this week. Commit to going regularly.

- Cancel or freeze your credit card ASAP so that you cannot go any further into debt. Explore the possibility of a balance transfer to a 0% interest rate card.

- Review the above suggested expense reductions and determine where it will be possible for you to save more.

- If you are able to save more every month, follow the Option 2 debt repayment schedule, starting next month (May 2023).

- If you are not able to save more every month, follow the Option 1 debt repayment schedule, starting next month (May 2023).

- Once your debt is paid off, save up an emergency fund of three to six months’ worth of your spending.

- Once that’s done, put money towards your deferred health and dental care and begin researching your retirement investment options.

- Know that you are not alone on this journey. There are many other folks out there with these same struggles. That is why Debtors Anonymous exists and that is why you need to attend their meetings.

- Keep us posted on your journey–I know that we are all cheering for you. All of Frugalwoods wants the very best for you!

Ok Frugalwoods nation, what advice do you have for Neko? We’ll both reply to comments, so please feel free to ask questions!

Would you like your own Case Study to appear here on Frugalwoods? Apply to be an on-the-blog Case Study subject here. Hire me for a private financial consultation here. Schedule an hourlong or 30-minute call with me here, refer a friend to me here, or email me with questions ([email protected]).

Wondering about hiring me for a consultation? Grab 15 minutes on my calendar for free to discuss!

Once frozen, I would set that credit card to autopay. Delete the card info from your phone and laptop! You can become a debit card user or cash instead. Literally put the physical card away in a hard-to-reach place. Remember- you totally CAN do this. You pay your housing payment every month, right?? This is going to be the same thing- it’s a bill now and you’ve successfully paid bills for decades. I’d also suggest unsubscribing from any sale emails and consider doing a purge of your social media to remove any accounts that trigger you to shop. Set really firm boundaries to set yourself up for success. Really think about what triggers you- it’s so clear you want to stop, but if you don’t figure out the trigger, it’s going to be harder. Willpower alone is never enough for ANYONE. PS I also struggle daily with an urge to shop online for clothes! My biggest trigger is feeling bad about my looks- I spot a new grey hair or see an old pre-kids picture of my body… and my immediate response is to add to cart. Instead, I’ve identified replacement activities that make me feel better- moving my body (like a walk or a workout, or even just scheduling a workout) or doing a face mask. It’s related to the underlying bad feeling I’ve had, but it is productive and not destructive. GOOD LUCK!

Thank you so much for your response and supportive words. I will respond to everyone here!

I have cut up my credit card and have removed the card info from many retail websites. I am taking to heart what you have said here about identitfying triggers. This is something that I know I need to identify though I haven’t been able to clearly pinpoint anything yet.

Thank you for sharing your experiences and for taking the time to repond.

I have a couple thoughts, based on working with patients who have gambling addictions. and offer them in the hopes that they may aid your healing journey. You have some very good first steps toward recovery. First, depression and behavioral addictions often travel together. We have found, from past clinical work and research, that moderate or higher intensity cardiovascular exercise is *the best* single depression intervention. Clinically, we have seen that other interventions (medications, therapy) and exercise multiple the benefits of each other. I strongly encourage you to increase your exercise frequency, walking works well as long as it does not increase any pain from your exercise accident. Second, I strongly encourage you to drop the credit card and possibly any access to cash/checking/other spending sources. Many of our patients find that pre-paid and refillable gift cards (possibly refilled by a family member who knows what you are facing or automatically after paychecks arrive) to specific, necessary vendors–grocery store, pharmacy, others?– strongly helps. Anything that you and your family can do to make acting on the addiction as difficult as possible will aid recovery. It gives you some time between the onset of the urge and the addictive behavior during which you have an opportunity to disrupt the addictions pattern. Third, finding a community support group is very important. If DA does not match your needs, you may also want to consider SMART or Dharma Recovery. The key component for any such group is the social support. Fourth, I hope you can find an excellent therapist to help you with this. I wish you the best on your recovery journey.

Thank you for your supportive words.

Walking is an activity I enjoy and having my dog gives me many excuses to walk places. I have found that my head feels more clear after a long walk. I plan to get back into running once the weather in my area improves a bit more, keep your fingers crossed for me that I won’t experience another fall.

I will look into your suggestion of using prepaid gift cards for shopping, I think this is a good method for using Amazon.

I commend you Neko for seeking help and sharing your story. There is no shame in admitting your addiction and getting support is the first step. I agree with everything that was already shared and think that a cash envelope system (or prepaid gift card system) is likely the best way for you to move forward with your spending. I know there are pre-paid reloadable visa gift cards out there that would enable you to purchase necessities online that you cannot find in store. I know there are lot of cash envelope-type systems out there and youtube/tik tok videos out there for them that can give you motivation to commit. Good luck on everything! You can do this.

Thank you for your kind any supportive words.

I have found that YouTube is a good reasource for finanacial tips and budgeting, plus there is the bonus distraction of cute cat videos!

I am looking into both the prepaid gift card and cash envelope systems.

Neko, you sound absolutely lovely. I understand the impulse buy thing. It’s getting too easy to order stuff online. My suggestion is twofold:

1. Create friction that makes it harder for you to browse/shop. You can add an extension to your phone and computer that blocks certain sites completely or after a short time. You can delete all your payment methods so if you really want something, you have to physically get your credit card and put it in. The idea is to make mindless shopping harder for yourself.

2. Figure out what you get out of shopping that’s missing in your life. I racked up credit card debt at some points in my life because I felt like I had no control or to make myself feel better when I was unhappy. Ultimately, ditching the shopping opened me up to reflecting about the kind of life I want for myself. It was scary at first, but I’m much happier now. I changed jobs, ended an unfulfilling relationship and started focusing on myself more. Maybe there’s an area in your life that needs similar attention. Is there a deferred dream you maybe forgot about? Maybe it’s stress or anxiety that requires attention? Is it possible you have ADHD? One of the hallmarks of ADHD is impulsivity that can manifest itself in compulsive shopping, risky behaviors and more. If you have ADHD, medication may be a good option. Therapy that focuses on developing good skills is also important.

I have a few other practical suggestions about habits:

1. Get into selling used stuff. Go through what you have and see if you can sell things on Marketplace and so on. I get the same rush of dopamine from selling stuff that I used to get from buying things and it’s super nice cause I put all that money away in savings.

2. Write things down by hand. I don’t know why, but keeping a paper budget and track of my spending in writing helps me feel more connected to my finances. It’s a weird thing, but maybe you’re the same?

3. When I want something, I try to figure out if I can get it for free by doing surveys or using a rebate app like upside. You collect money there very slowly, but I’ve used that to “save up” free gift cards for something I wanted. Last year, I got myself a knife sharpener for free, for example. I keep a running list of the things I want and when I get a free gift card, I’ll buy whatever it is. It’s really slowed me down, but also made the act of collecting free cash a game. It gives me the same kind of satisfaction I used to get from mindless shopping.

I know you must be feeling anxious and helpless with the debt. You’re not alone. Please be kind to yourself in this process. It’s not easy.

Thank you for your kind and supportive words. You have also asked some very poignant questions.

I think that for me the shopping is a way of making to up to myself all the things I didn’t have when I was a kid / teen. I was a selfish and ungrateful kid who always had to have IT and I remember very clearly feeling as though I was ‘lesser than’ by having to do without. I know logically now that this was not true at all (I lived a very priveleged childhood with parents who made a lot of sacrifices for me and my sister) but I think I am holing onto that ‘I have to have IT’ mentality. Plus I do genuinely enjoy the creativity that different fashion and makeup can provide. However, all things come at a price and in the end all these things are exactly that, just things.

I will follow your sugestion of writing out the budget by hand as I agree that the handwritten method feels more ‘real’. I guess that is a left over effect of being part of one of the last generations who learned cursive writing in school. :p

When you say you were a “selfish and ungrateful kid who always had to have “IT” is that your voice or is it how a parent or someone else spoke to you? What I mean is it can be a genuinely hard experience being on the poorer end of a richer place, there can be a lot of whispered or unspoken judgements, social exclusions, etc. If any of that was at play it’s ok to own those feelings, even if it was not on the same order of magnitude as going hungry. Speaking as a former hand-me-down wearing private school kid whose parents made a lot of sacrifices, but I do get a little twitchy to shop when my self esteem if feeling a bit shaky. I will also say I genuinely take pride in mending and repairing clothing, so sometimes fixing something to be nice again scratches the itch, as does going through my current items and picking out something a bit neglected to wear more

This is fantastic advice from Layla, and I concur with it all as someone who’s struggled with much of the same as Neko (and clearly many others). Good luck to you, Neko. I can tell that you’re going to do this—and well. You’re going to feel so great about yourself too. I’m proud of you already!

Wishing you the best of luck Neko. It’s clear from the case study that you are in a lot of pain, and I really hope that you are able to find relief through debtors anonymous and therapy.

Its normal for our brains to seek pleasure and avoid pain, and I think your shopping has been part of that pattern. So one way to reframe is to look at that as something that emerged as a way for your brain to do what is natural to it- but in a way that is ultimately harmful to your well being. So now you need to learn new ways to give your brain pleasure, ease and relief without relying on the click of.buy now for a dopamine rush. I suggest writing a list of things that make you feel good that are free and posting that wherever you may be tempted to shop- qt your desk, at home, on your phone lock screen etc. So when you get the impulse, you can pick an activity instead.

I also recommend inner child work as well- the compulsion to treat yourself is very much an impulse and rather than talking to yourself with harshness (why can’t I be more disciplined, I always make bad choices etc), imagine yourself as a small child who is struggling- who just wants the “treat” now and doesn’t understand why they can’t have it- and speak to them with compassion and kindness. You would want to protect a child from doing something self destructive but you wouldn’t do it in a mean way, right? Bc that wouldn’t be helpful. I’ve found that exercise to be very healing when I can be self critical and negative.

Practically speaking, I have 2 more suggestions: call or go into the bank to discuss your options for the credit card. When we were in a bad situation with a balance we couldn’t pay, due to medical issues, I called and arranged for monthly autopayments and got a 1% interest rate. I would explore that over a Balance transfer since there’s no temptation to open a new card. Second is to explore browser blocking shopping sites so you’re not tempted to see things.

The pleasure/pain thing made me thing of a book I just read that you might enjoy, Neko: Dopamine Nation. It’s by a psychiatrist who focuses on addiction and it’s about finding balance in an ultra-indulgent world. She’s got interesting stories and a great practical approach to interrupting dopamine-seeking behaviors. Might be worth a look!

I will check out that book, thank you! I am always a sucker for a good read.

I thought that book was eye opening as well. Readily available for free from the library digital collections.

Thank you for your kind and supportive words.

Any negotiations with my credit card interest / balance aren’t an option unfortunately because my interest is already low. I’m not sure about a balance transfer card but it is something I will look into.

The inner child work is something which is intriguing to me. I have been trying to soften my inner critic and focus on solutions instead of reminding myself of my mistakes. There is a lot of good advice here!

Thank you for your productive suggestions.

I strongly agree with the advice to cut up the credit card and stop using it completely. Don’t even have the temptation there. When payday comes, make the rent and the debt payment, and be super mindful about what’s left, to only spend that and nothing more.

I believe in you. 🙂

Thank you for your kind and supportive words.

My credit card is cut up and I have removed it from the retailer websites I frequent.

I admit it was hard to cut it up but it a way it was somewhat of a relief. I destroyed the tool that was aiding in my self destruction.

Or maybe I’m just being too dramatic ;P

Read a great book: Affluenza and break away from material acquisition, see it as a spiritual move and earth empowering. I know this sounds flakey -but in the book you can read cases and see the futility in it. Also its a good dive for a future therapist! Good Luck and take all the practical advice above as its already been said.

Agreed. Great book. ‘Your Money or your Life’ was also an influential book for my financial journey vis a vis consumerism.

Fellow Canadian here. I live about an hour west of Neko. Thanks for bravely sharing your story. Kudos to all the work you’re doing.

I also wonder if watching old “Til Debt do Us Part’ episodes, easily found on YouTube, might offer food for thought. The show is Canadian and focuses on the financial journeys of families and couple coping with a range of financial issues. Neko might find some practical tips, but also inspiration and a sense of “community,” – that she’s not alone in all of this, other’s have been there and emerged happy and successful.

All the best Neko.

Gail VazOxlade is a real Canadian financial icon, and she tells it pretty straight up! The shows are very old now, but I still watch them for tips and tricks.

I agree that Gail is a financial icon, I have read her book. I will see if I can find any of her shows on Youtube.

I loved that show. Gail was straight forward and didn’t put up with excuses.

She helped many people.

Thank you for your kind and supportive words.

I checked out the book Affluenza on Amazon. It looks very interesting! Instead of buying the book I will see first if I can check it out of the library.

If your library doesn’t have it, see if they offer interlibrary loan — they can usually get it from another library!

The thing with CC’s is this: In teh cash money world you take out , say 200 a week or bi weekly. When that is spent on incidentals like gas, objects & food you will SEE your money and SEE how close to being empty before your payday comes.. Then you postpone purchases until pay day – live low for 2 -3 days.

Wilt a CC its just swipe swipe swipe and then in 1.5 month massive bill. You never know where you are. That’s why they design the payments that way.

Its a trap! Oh sure you can peep at a balance with an app or what have you.. but how many do that?

Cash is physical and in your hand.. you watch your roll peel off and you feel it and you SEE it…

That is all true about credit cards and no one knows that truth better than me. I find that using debit is easier to track than credit as I am somewhat scared of carrying a lot of cash. I had my wallet stolen some years ago which meant a bunch of cash missing that I knew I wouldn’t ever see again. With debit cards there is more security.

I appreciate your honest take on the credit card phenomenon.

That sounds super stressful having your wallet stolen, but I wonder if, even assuming a stolen wallet every few years, may be a better financial situation than using cc’s

Here are a few comments. I am currently halfway through paying off a large credit card debt, and I have found a way which works for me. You will have to find the way that works best for you. I got myself into the debt through not having enough savings to cover emergencies, so I had to use my credit card; and I added to the debt by going on excessive spending sprees to alleviate stress and yes, I can relate to how having something “new” helped me feel better for awhile, and also would fantasize about the purchase before and after, when stressed or bored. I, too, work a less than well-fitting office job — it’s one I can do well, I make “enough” money at it, but it’s not a thrilling job and to be honest, kind of boring and dead end.

Here’s what I decided to do last August, which is a plan that is working out very well for me so far:

1) I had a high interest credit card, paying about $100 interest a month which was part of my minimum payment. I transferred my balance to a 0% interest for 15 months card. This pressures me to pay it off in 15 months, and also there is a trick and danger to this — you cannot spend even a penny on this transferred balance card, or it is subject to even higher interest. So this card is parked in my dresser drawer and it is ONLY for debt payoff and I am sure that is not making the bank happy, but it is working for me.

2) I did NOT cancel my other credit card (which now has a zero balance) because cancelled cards affect your credit rating negatively; I have also “parked” this card and do not use it.

3) I realized I needed to have a savings cushion so that I would not need to charge anything — so my plan has been to add automatically once a week to my savings account. Most of my money goes to the debt payoff, but a decent portion goes to savings.

4) I made myself several spreadsheets to track spending carefully, to plan out spending in as great detail as possible over the debt payoff period, and I check my bank balance as close to daily as I can, to make sure I am on track. I am shifting my fantasizing about the shopping, to fantasizing about the debt going down and the savings going up, and concentrate on the good feelings I get from being debt free and having a savings cushion — though this will not happen until December this year. Each month that goes by, I see the debt going down and the savings going up, and my stress eases because I can see this is working (it is not just theoretical).

5) I have stopped spending impulsively because I have told myself if I stick to this plan, I will have $xxxx by the end of this year, and then I will be “permitted” to spend again “if I want to, and if it is in my budget.” I am finding that I can change these habits — I avoid looking at the websites and catalogs, and the ads that pop up in my feed. I am also planning in advance (but months from now, not days from now) to possibly buy more clothing. But I’m also enjoying the clothing I have, and I tell myself that even though being in debt is the price I have paid for this, in some ways it is nice to have these nice things to “get me through” this debt payoff period.

6) the other thing I started doing was overcoming my shame and embarrassment of the debt — or what I mean is keeping it hidden from others. If someone asks me to meet up for a drink, I will be up front and ask for a cheaper place, or I’ll say “drink only — no dinner — I’m a bit tight at the moment, paying off a debt.” Honestly, everyone understands, and they all say things like “good for you!” I don’t know if you can tell your own family or not, but secrets like this can eat away at you. If you are maybe already midway through your debt payoff like I am, and can see that it is working, then say something — you’d be surprised how many other people are going through something similar.

7) I live in the U.S.so I’m not sure how it works in Canada, but I agree that therapy would help you, and perhaps there is a counselor who charges a sliding fee scale, rather than the full amount?

Good luck to you! Once you plot all this out on paper or a spreadsheet, you will find the combination of savings/debt payoff that works for you. Plan a couple scenarios and then start working your plan. The first couple months might be the hardest. Be kind to yourself, and if you have any setbacks, just get yourself right back on your plan as soon as possible — maybe you can return any impulse buys if they still have tags on them? Remind yourself of the things you want to do with your savings, once you have it, and figure out when that will be. As each day goes by, you will be getting closer and closer to your goal. You can do it!

Thank you for your kind and supportive words.

“But I’m also enjoying the clothing I have, and I tell myself that even though being in debt is the price I have paid for this, in some ways it is nice to have these nice things to “get me through” this debt payoff period.” -this line of yours hit me very hard. I know that the hardest part of going on a debt payoff / shopping ban will be giving up the satisfaction of snagging something newand stylish to wear. I have been afraid that this impulse will be too much to resist. However, the way you worded the above line is going to become a mantra for me. It is true that I have loved everything that I have bought up untill this point and I am now beginning to think that reminding myself of that love and satisfaction will be enough to get me through those tough mental days.

I agree with the commenters above who talked about making it harder to shop or buy online. Things that you can do when you don’t feel a strong compulsion that help prevent one those urges. This could look like closing your PayPal or logging out and not saving any credit card information anywhere. I have found accountability to be really key and have in the past asked a trusted friend to change my passwords and not tell me. Even just telling someone when you engage in those behaviors can be really helpful. Shame drives so much of it that there is freedom on telling someone and owning it and knowing that you are going to tell them you engaged in that behavior. I would start going to debtor’s anonymous ASAP! I also agree on finding a therapist. This is something that you cannot afford not to do. Long term seeing a therapist will save you money by addressing the root of the problem. Caring for your mental health is so important and it sounds like that is a challenge. Sometimes therapists will have interns who see people for low fees or pro Bono. When reading your story I was struck by your feeling of shame. Brene Brown is a shame and vulnerability researcher who has been incredibly helpful in my own journey. She has Ted talk on YouTube that I think you would like. You may also be able to check out books from your library on mental health and shopping addiction. This is a hard road but I know that you can do it. Maybe one day you can fullfil your dream of going into psychology by using it for your own healing and then being able to guide and walk alongside others through this same process.

Thank you for your kind and supportive words and also thank you for your many suggestions.

I have started looking into the Debtors Anonymous group meetings today and it turns out that they have an office nearby my improv studio. So maybe thats a sign?? Lol. I have heard of Brene Brown though have yet to experience any of her work, you have motivated me to search out her Ted talks. I will also close my Paypal account or at least remove all my account information from it so it will be difficult to use again.

As far as a therapist goes I am looking into a few options. I guess it’s a good thing that I’m finally feeling apprehensive about spending money on something.

Thank you again for your wise words!

Check to see if you qualify for Trillium to have your drugs covered. It is income based on what your husband makes too so you may or may not be covered. Get on a wait list for a therapist covered by OHIP & attend a support program in the mean time. Look into cheaper options for dental care such as U of T or dental assistant or hygiene programs (Seneca has one). You would have to do at least a Masters in Psychology to get a job-same to teach. Another option is a Mental Health & Addictions program at a community college & then you would qualify as a Peer Support Worker due to your mental health & addictions diagnosis. Not always well paid though unless you can get a job attached to a hospital.

Thank you for your kind and informed suggestions.

Unfortunatley I am not eligble for Trillium based on my combined income with my husband and the college dental programs have a 2/3 year wait list for patients. So that option will have to wait for now.

Thank you as well for your insights into the programs I have mentioned. I admit that many of these may just be a pipe dream for now though I guess never say never?

Neko, thank you for sharing your story. You are at war with yourself. My advice is to engage in self-talk the way you would talk to your husband or best friend. There is so much shame here… I should… if only…why can’t I?… and if you pretend that you are talking to a best friend, most of that judgemental talk will go away. This technique/shift in perspective has changed my life and I hear so clearly that you want to change yours. All the best to you.

Thank you for your kind and supportive words.

Changing the thing between our ears is definitely tough but not impossible. I am trying every day to put myself on a Fixing mindset instead of a Guilt mindset.

Even baby steps are still steps forward, right?

Could not agree more that the first step is healing, and that hiring a therapist is worth every cent.

Many compulsive shoppers find the book To Buy or Not to Buy by Dr April Lynn Benson to be a helpful tool (in addition to, not as a substitute for, therapy). She’s a psychologist who specialized in compulsive shopping, and the book is comprehensive and thoughtful.

It’s very brave to confront issues like this one. Wishing Neko the best with the journey forward.

Thank you for your kind and supportive words.

I will look for that book both because it sounds informative and also because I am an avid reader.

Do you and your husband split the cost of your birth control medication?

Excellent point!

I wish I could give a thousand thumbs up for this comment!

+1!

No we do not split this cost. I hadn’t ever thought to even ask him about it. Thank you for this suggestion!

One other thought — would he consider getting a vasectomy since you don’t want to have kids?

My husband didn’t want to “alter his body” until I explained to him how many years I’d been altering my body with birth control medication, and he finally agreed to get the snip this year.

Just a thought! You are not solely responsible for birth control.

Best of luck to you 🙂

this! have the vasectomy discussion with your husband! are the altered hormones and birth control contributing to your depression? I’m in US with private insurance and it is covered in full.

Hi Neko, fellow Canadian here who has also struggled with debt, shopping for a dopamine boost, and had to do a consumer proposal. I’ve also been clinically depressed more than once in my life, and I’m now in my 50s. Lastly, I’ve done 12 step meetings myself. For me, they were the wrong solution and made me suicidally depressed, as I felt there was a lot of covert shaming (the LAST thing I needed), and it didn’t alleviate the issue that drove my own addiction. By all means try Debtors Anonymous, as it’s free (sort of – ideally you’ll still chip in a buck or two when they pass the bucket) and will help you get started, but if it feels like the wrong fit, that’s okay, and never mind what the DA converts say.

On to happier suggestions – if you can’t afford therapy or medications or dentistry, that tells me you don’t have benefits, which in Canada is a terrible shame. Take the first steps to start tackling this, yes, but please, start looking for a job that offers benefits! Larger companies often have EFAP (Employee and Family Assistance Programs) that can offer free short-term counselling for issues like debt, and often longer-term counselling for issues like depression. Your doctor may also be able to refer you to some kind of help such as through CAMH, with no cost to you.

I respectfully suggest that you hold off on changing careers for the time being. Going back to school will put you deeper in debt. Also, and only you can answer this for yourself, I’m wondering if perhaps a career change right now seems more like another shiny thing to distract you from the difficult feelings you’re currently experiencing. Regardless, I suggest that you wait for now. Get your debt sorted out first, and then decide if you still want to do this.

And there’s nothing to stop you from doing volunteer work in the meantime, such as on suicide or rape crisis lines. These can provide valuable experience, which you may need to have before you can apply for certain programs, such as getting a Master’s degree in counselling. And they may have the added bonus of making you feel better about yourself, which is a common bonus of philanthropy and volunteer work. Any time spent volunteering for any good cause will probably boost your mental state, which in turn will make it easier to break your addiction.

Also, I strongly recommend exploring Cognitive Behavioural Therapy (CBT) as a way to cope with the desire to buy when your support systems aren’t available, and to uncover the roots of your addiction. Addiction, in my experience and from what I’ve read, isn’t something that appears out of nowhere for no reason. It’s typically a numbing behaviour. While you are getting your professional support systems in place, you could begin journalling to explore these feelings, or even just logging when you feel the urge to buy. Often there’s a trigger, though we may not be aware of it until we try more rigorous self-observation. For me, it was thinking about my ex-boyfriend, and that grief and loss. Keep in mind, too, that some of your shopping is very likely to numb the pain of being in debt from shopping!

Treat yourself with compassion, Neko. Talk to yourself with the loving words and acts you would give to a sick friend. And you are sick, in a way – and I say this with compassion, not judgement – your mental health is struggling. But I know that you can get through this, because you were strong and brave enough to take the step and reach out for help in a very public way. Good for you. You can do this! I wish you the very best of luck, and ultimate success.

That’s an interesting perspective and solid advice. Thanks for sharing.

Dear Neko

First thing I would do, apart from the freezing of your credit card and all the other wonderful advice that has already been given, is to have a real heart to heart with your husband, so you get someone close to you, that can give you the support that you need, when you are tempted. Trust me I know how easy it is to just spend, spend, spend. However I have solved my problem by really weighing up the cost of the purchase against the opportunities lost that the purchase will mean. So if you are looking at a pair of shoes online and really fancy buying them, then look in your wardrobe, ask yourself: why do I need these ? Then next you need realize that your life won’t be any happier for buying them, on the contrary you will be longer away from the security of having a debt free life, savings and peace of mind. Try to embrace the free things in life, they are often experiences make you happier than the quick dopamine rush you get from shopping. I used to spend when I was bored, so make sure that you are occupied all the time and put the phone away whenever you can, it all comes down to not giving yourself the opportunity to spend. Good luck with it, I am sure you will conquer the spending urge cause you have taken the first step of acknowledging that you have a problem.

There are many good books on CBT for addiction which might be at your local library. Dopamine Nation is a good one on addiction. You get a Dopamine hit from shopping which keeps you coming back to it . You might consider asking about a different medication to address your depression and addiction.

Neko, you have taken an amazing and brave first step. Liz’s recommendation to focus on recovery right now is spot on. My only add is that the savings of $277 a month could go to hiring a therapist. Depending on the cost you could do biweekly sessions if weekly is too expensive.

Your motivation and drive are so high. I know you can do this and once you’ve paid off the debt your next career move may become more clear. I wish you all the best!

Neko, I think you sound like a wonderful person. Our addictions do not define who we are and it seems like you are being awfully hard on yourself. If you have a friend who you feel will support you if you reveal your problem, you may want to tell that person what you are going through. This is not a substitute for therapy but sometimes it can really help to have a friend understand the issue and who absolutely loves you anyway. This is not necessarily someone like your husband or parents; sometimes people who have a personal stake in your financial well being are not the best people to talk to. I have had several friends come to me in desperation when their finances were spinning out of control and it is much easier to provide both practical help and unconditional support when the person who is struggling is someone you love but whose financial future does not directly affect your own.

I was going through the comments to see if anyone had already commented on adding the cost of therapy to Liz’s proposed budget and see that Faith noticed that omission as well. I suspect that Neko will need the help of a professional to be able to stop shopping.

I preface my next comment with the statement that I know absolutely nothing about Canadian health care and insurance. Once Neko has the names of a couple of therapists (as Liz suggested, DA might be an excellent place to ask for a few names), she might want to see if her employer’s health insurance would cover therapy with any of the recommended therapists. If so, it might make sense for her to add health insurance to her budget sooner rather than later. I know people in the states who have found themselves with crushing debt due to gaps in their health insurance and being uninsured seems quite risky to me. Most insurance in the states will cover therapy with therapists who accept their insurance, at least for a certain period of time or a certain dollar amount. If the cost of insurance is not much more than what she would otherwise pay for the therapist, Neko may want to look at adding employer subsidized health insurance to her budget. This would slow down her debt repayment but I feel that therapy is a wonderful use of Neko’s money right now. If therapy would not be covered by health insurance, pay for the therapy anyway.

Finally, I suggest staying away the internet, social media, and other advertisement heavy platforms as much as possible. There is an entire industry based on convincing us that we “need” whatever is being sold. I find it easier to avoid temptation than to resist it. Also, if you need to have a physical credit card for actual emergencies (such as an emergency vet bill), freeze the card in a large block of ice in your freezer (yes, I mean this literally). In a true emergency, you can thaw the card but this takes quite a while so impulse purchases are quite difficult to make!

Good luck and congratulations on beginning your journey to financial freedom.

I know this is so mission as well and it really frustrated me because therapy is often very expensive.

I don’t know how things work in Canada but where I live it’s over $100 a session.

You could easily to spend that $500 a month on therapy if you were doing weekly sessions. Given that Liz has some experience working with the therapist I’m disappointed she did not add that into the budget

A suggestion I have, after reading your story and seeing that you wish for surprise trips with your husband or taking your family out to dinner is to make a list of local parks… Especially some you haven’t been to yet. Pick one on a weekend and go! You could take a picnic or just go for a walk with your husband and dog. We do this and it gives a nice feeling of going somewhere new and is something to look forward to and talk about, but it is free. We have found some nice parks and walking trails that I didn’t even know existed before. I like “collections” so crossing another off our list and adding photos to my phone photo album of the places we go makes me happy.

Hello Neko,

Fellow recovering (recovered?) shopping addict and Canadian here! I also had a fairly serious addiction to online shopping. Unfortunately, compulsive consumerism is normalized and even celebrated in our culture, which makes it more difficult for others to take it seriously. The “treat yourself” message is pretty pervasive. I’ve gone through cycles of being in the grips of my addiction and then long no-buy periods, but started up again during 2020 as a way to comfort myself. It was then I realized how much of a problem this was, which led to my seeking out a number of resources. I now consider myself as “cured” as a former addict could possibly be.