Their goal is to reach financial independence by that deadline, which is now five to eight years away. Kat would like our help determining if this is a reasonable goal and, if not, advice on what they should do to make it feasible.

What’s a Reader Case Study?

Case Studies address financial and life dilemmas that readers of Frugalwoods send in requesting advice. Then, we (that’d be me and YOU, dear reader) read through their situation and provide advice, encouragement, insight and feedback in the comments section.

For an example, check out the last case study. Case Studies are updated by participants (at the end of the post) several months after the Case is featured. Visit this page for links to all updated Case Studies.

Can I Be A Reader Case Study?

There are four options for folks interested in receiving a holistic Frugalwoods financial consultation:

- Apply to be an on-the-blog Case Study subject here.

- Hire me for a private financial consultation here.

- Schedule an hourlong call with me here.

→Not sure which option is right for you? Schedule a free 15-minute chat with me to learn more. Refer a friend to me here.

Please note that space is limited for all of the above and most especially for on-the-blog Case Studies. I do my best to accommodate everyone who applies, but there are a limited number of slots available each month.

The Goal Of Reader Case Studies

The Case Study series began in 2016 and, to date, there’ve been 102 Case Studies. I’ve featured folks with annual incomes ranging from $17k to $200k+ and net worths ranging from -$300k to $2.9M+.

I’ve featured single, married, partnered, divorced, child-filled and child-free households. I’ve featured gay, straight, queer, bisexual and polyamorous people. I’ve featured women, non-binary folks and men. I’ve featured transgender and cisgender people. I’ve had cat people and dog people. I’ve featured folks from the US, Australia, Canada, England, South Africa, Spain, Finland, the Netherlands, Germany and France. I’ve featured people with PhDs and people with high school diplomas. I’ve featured people in their early 20’s and people in their late 60’s. I’ve featured folks who live on farms and folks who live in New York City.

Reader Case Study Guidelines

I probably don’t need to say the following because you all are the kindest, most polite commenters on the internet, but please note that Frugalwoods is a judgement-free zone where we endeavor to help one another, not condemn.

There’s no room for rudeness here. The goal is to create a supportive environment where we all acknowledge we’re human, we’re flawed, but we choose to be here together, workshopping our money and our lives with positive, proactive suggestions and ideas.

And a disclaimer that I am not a trained financial professional and I encourage people not to make serious financial decisions based solely on what one person on the internet advises.

I encourage everyone to do their own research to determine the best course of action for their finances. I am not a financial advisor and I am not your financial advisor.

With that I’ll let Kat, today’s Case Study subject, take it from here!

Kat’s Story

What feels most pressing right now? What brings you to submit a Case Study?

When I initially applied for a Reader Case Study, Jay had a one-hour commute to work on top of a long work day. He was waking up at 4am and getting home between 7 and 10 pm. We’ve since moved and he now has a 20 minute commute! So, that’s one major problem solved.

The other main issue is that I would like us to be financially independent by the time Jay gets out of the military in five to eight years. I want us to have options, rather than feeling like we need to jump into new careers the moment he leaves the military. As we near this self-imposed deadline, the goal is feeling more and more daunting.

We want to take advantage of our limited time in Japan – traveling, having cultural experiences, and spending time in nature. But this conflicts with our larger goal of wanting to be financially independent.

Post-Military Life Plans

Jay would need to serve for 20 years in order to get a pension. We’re instead hoping to fund our own retirement so he does not need to stay in that long. He loves what he does, but it is draining. After he leaves the military, we will need to purchase our own healthcare. Without a pension or disability discharge, Jay won’t be eligible for VA care. He is open to serving in the reserves, which would continue his healthcare.

We are not sure where we want to settle down. Ideally, we will travel full time for a few years after Jay gets out of the military. Some states we are considering for our home base are Oregon, Washington, Montana, Vermont (or another northeastern state), and Minnesota. We’d like a progressive community near hiking trails with housing that we can afford. We would love suggestions! Our families are pretty scattered now, so we likely won’t live near most of them.

What’s the best part of your current lifestyle/routine?

I am also enjoying my free time. I’ve primarily worked as a writer in the past. I most recently worked as a kitchen assistant at a friend’s restaurant, but resigned due to our recent move. So, I’m currently between jobs, as one might say. I’m using this time to take care of all of the domestic labor and life management tasks, learn the Japanese language, spend time in nature, and read. Now that we have internet at our new house, I will try to pick up some freelance work with a former employer, but I am not yet sure how it will work out with the time zone difference between the US and Japan.

What’s the worst part of your current lifestyle/routine?

Jay’s difficult job and long work hours. What little time we have together is mostly spent resting and preparing for the next week. We’re on opposite ends of the spectrum right now – he is overworked and tired, whereas I am in need of social time and a challenge.

Where Kat Wants to be in Ten Years:

- Finances: Financially independent, living comfortably off of our investments.

- Lifestyle: Traveling often with a home base in the states. Lots of quality time together.

- Career: Enjoyable part-time work, volunteer work, homesteading, and/or a creative hobby business that we run together.

Kat & Jay’s Finances

Income

| Item | Number of paychecks per year | Gross Income Per Pay Period | Deductions Per Pay Period (with amounts) | Net Income Per Pay Period |

| Jay’s Income | 12 | $9,638 | taxes: $1,226 life and dental insurance: $43 TSP contributions: $1,864 TOTAL deductions: $3,133 |

$6,505 |

| Annual net total: | $78,048 |

Debts: $0

Assets

| Item | Amount | Interest/type of securities held/Stock ticker | Name of bank/brokerage | Expense Ratio | Account Type |

| Joint Brokerage Account | $183,256 | VTSAX, some VTIAX | Vanguard | 0.0004 | Investments |

| Thrift Savings Plan | $105,239 | C Funds | The Federal Retirement Thrift Investment Board | 0.0006 | Retirement |

| High Yield Savings Account | $40,170 | Earns 4.75% APY | CIT | emergency savings | |

| Kat Roth IRA | $26,057 | VTSAX | Vanguard | 0.0004 | Retirement |

| Jay Roth IRA | $23,041 | VTSAX | Vanguard | 0.0004 | Retirement |

| Brokerage Account | $10,044 | Mutual funds | Vanguard | 0.001 | Investments |

| Checking Account | $4,710 | Earns 0.01% APY | Chase | Checking | |

| TOTAL: | $392,517 |

Vehicles

| Vehicle make, model, year | Valued at | Mileage | Paid off? |

| 2001 Daihatsu Mira Gino | $1,800 | 87,000 | Yes |

| 2004 Mitsubishi Pajero Mini | $2,700 | 87,000 | Yes |

| Total: | $4,500 |

Expenses

| Item | Amount | Notes |

| Housing | $1,900 | rent, insurance, trash, gas, electric, water, internet (paid in yen) |

| Travel | $546 | flights, airport parking, accommodations, dog sitter, transit |

| Groceries | $459 | |

| ATM Withdrawals | $160 | Cash is still widely used in Japan. Used for attractions, events, and small restaurants. |

| Household Goods | $133 | household essentials, cleaning supplies, furniture, gardening |

| Restaurants | $121 | |

| Cell Phones | $108 | provider: SoftBank |

| Auto | $99 | Two cars and two drivers. Personal Damage Liability Insurance (PDI), Japanese Compulsory Insurance (JCI), annual road tax, toll road fees, US driver’s license renewal fees, maintenance |

| Dog Care | $71 | |

| Charitable Giving | $63 | |

| Subscriptions | $62 | Apple Music, iCloud storage, Hulu, Duolingo, Microsoft, VPN |

| Clothing & Shoes | $55 | |

| Entertainment & Hobbies | $54 | painting class, bowling, movie theater, cultural events, snorkeling and hiking gear, book club books |

| Personal Care | $51 | |

| Gasoline | $49 | |

| Health Insurance | $0 | covered as part of Jay’s compensation |

| Monthly subtotal: | $3,931 | |

| Annual total: | $47,172 |

Credit Card Strategy

| Card Name | Rewards Type? | Bank/card company |

| Capital One Quicksilver | Cash Back | Capital One |

| US Bank Cash+ | Cash Back | US Bank |

| Chase Freedom Unlimited | Cash Back | Chase |

| Chase Freedom | Cash Back | Chase |

Kat’s Questions For You:

Does it seem feasible for us to “retire” between the ages of 34-37? Or at least get out of the military at that age and both work part-time?

- If not, what do we need to cut back on to achieve this goal?

- What type of paid work should I pursue next? Any suggestions for timezone-flexible remote work?

- How can Jay and I better connect during times when we’re on opposite ends of the work/life balance spectrum?

Liz Frugalwoods’ Recommendations

Kat and Jay bring us an interesting Case Study today and I’m excited to dig in and see what’s possible for these two! They’ve made excellent frugal choices over the years, as evidenced by their lack of debt and impressive net worth. Let’s get right to Kat’s questions!

Kat’s Question #1: Does it seem feasible for us to “retire” between the ages of 34-37 (in 5-8 years)? Or at least get out of the military at that age and both work part-time?

This question is predicated upon how much they intend to earn, spend and invest over the next 5-8 years. Let’s take a look at where things stand now and make some projections for their future.

Asset Overview

It’s rare that I don’t have recommendations for a Case Study subject to change something about their asset allocation, but Kat and Jay hit a home run here! I don’t think I have any edits to suggest! Here’s why:

Debts: $0

Net worth: $392,517

Since they have no debt to service, all of their assets count towards their net worth. Nicely done, you two!

Investments: At Vanguard

It’s obvious Kat and Jay have done their research (and read a lot of Frugalwoods!) because their investment choices are almost exactly what I would do. They’ve selected a brokerage, Vanguard, with an excellent reputation for low-fee total market index funds. This is evident in how low the expense ratios are on all of their investments. Expense ratios are what you pay a brokerage to invest your money and, since they’re fees, you want them to be as low as possible.

They are invested aggressively in almost 100% stocks, which in my opinion makes a lot of sense since they’re young and have a number of years before they’ll be drawing down this money. In general, you want to invest aggressively when you’re young and then decrease your risk exposure as you near retirement age. The old adage in investing is high-risk=high-reward and low-risk=low reward.

Their selection of Vanguard’s VTSAX as their primary investment is also something I would do since it’s a total market index fund, which means they’re invested across the entire stock market. This reduces risk since they’re well-diversified across every sector of the market. It’s the opposite of stock-picking whereby you limit yourself to just one or two companies and really hope that they don’t tank. Investing in something like VTSAX is the epitome of not putting all of your eggs in one basket. A good plan!

Cash: In a high-yield savings account

Between their checking and savings, they have $44,880, which is WAY more than they’d need in an emergency fund. An emergency fund should be around three to six months’ worth of your spending. For Kat and Jay, this $44k is nearly what they spend in an entire year. The downsides of having so much cash are that: cash loses value (because it doesn’t keep up with inflation) and there’s an opportunity cost to not having it invested in the market. Having the majority of their cash in such a high-yield savings account mitigates those risks somewhat, but it’s still an underutilization of this money.

Technically, they should retain just six months’ worth of living expenses in cash and dump the rest into their taxable investment account.

However, given their level of investment sophistication, I have to imagine they have a reason for keeping this much in cash, but I did want to point it out. When they near the time for Jay to leave the military, they’ll want to have a good buffer of cash on hand, but since that’s at least five years away, I see no reason to sit on that much cash in the meantime. But, if they plan to buy a house in five years? This could make sense as their downpayment savings.

Let’s refer back to Kat and Jay’s ultimate ten-year goal:

Kat stated they want to be “Financially independent, living comfortably off of our investments.”

→What does that actually mean?

- No longer need to work for money;

- Have enough invested to enable a safe rate of withdrawal to cover all of your living expenses;

- Have the ability to do this until you die.

The key to making this work is actually fairly straightforward:

- You have to earn a sufficient amount of money during your early working years;

- You have to save and invest the vast majority of this money;

- You have to keep your expenses low enough to enable you to do this.

A person who makes $1M per year but also spends $1M per year will not be able to reach financial independence. That person is living paycheck to enormous paycheck. They are completely reliant upon their job to fund their lifestyle. A lay-off would be a crisis for them because, despite having a ridiculously high income, if they don’t save any of it, they have nothing to fall back on.

On the other hand, a person who (like Jay & Kat) earns $78,048 per year but only spends $47,172 annually, will be able to invest the $30,876 difference each year. This is the amazingly simple math behind FIRE (financial independence, retire early).

You have two levers here: income and expenses.

You can increase income, you can decrease expenses, you can do both.

Over time, historical models indicate that the market returns a roughly 7% annual average. Of course past performance does not promise future success, but, it’s all we have to go on. That’s why I question Kat and Jay’s overbalance on cash. While the 4.75% interest rate their cash makes in its high-yield savings account is good, history indicates that money will perform better for you in the stock market (again, a ~7% annual return on average, over many decades).

Living Off Your Investments

This means you have enough invested in the market that you’re able to withdraw a safe percentage every year to cover your living expenses. So again, but two variables: how much you spend and how much you have invested. Folks quibble about what percentage constitutes a “safe rate of withdrawal,” but the most commonly cited is 4%.

How to do this math:

4% of your investments = the amount you can withdraw to live on annually

If we look at Kat and Jay’s current full net worth of $392,517, 4% of that is $15,700 per year. Based on their current spending level of $47,172, that’s not enough for them to live on. We can do backwards math to determine how much they’d need in order to spin off $47k a year. That answer is ~$1.2M (4% of $1.2M = $48k).

While that’s the number for today, it’s tough to project into the future because there are so many unknowns in Kat and Jay’s situation, including:

- Jay’s annual salary for the next 5-8 years

- Kat’s annual salary for the next 5-8 years

- What the stock market will do over the next 5-8 years

- Their post-military stateside annual spending, which could change dramatically depending upon:

- If they’re paying for their own health insurance

- Where they decide to settle down

- If they buy a home

- How much their rent/mortgage is in the US

- Inflation

In light of that, we can’t precisely model out exactly what their financial situation will be in 5-8 years, but we can absolutely do some back-of-the-envelope math to give them a sense of direction.

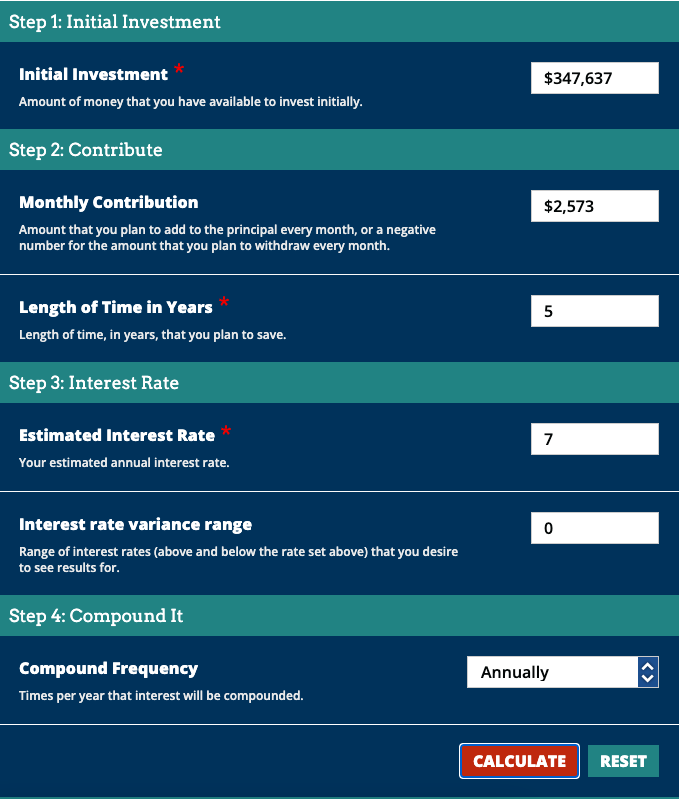

To do this, I used my favorite compound interest calculator:

I input the amount Kat and Jay currently have invested in the market ($347,637) as well as the amount they’re able to invest each month ($2,573) assuming they invest their full $30,876 annual difference between their income and expenses. I went with a flat 7% market return.

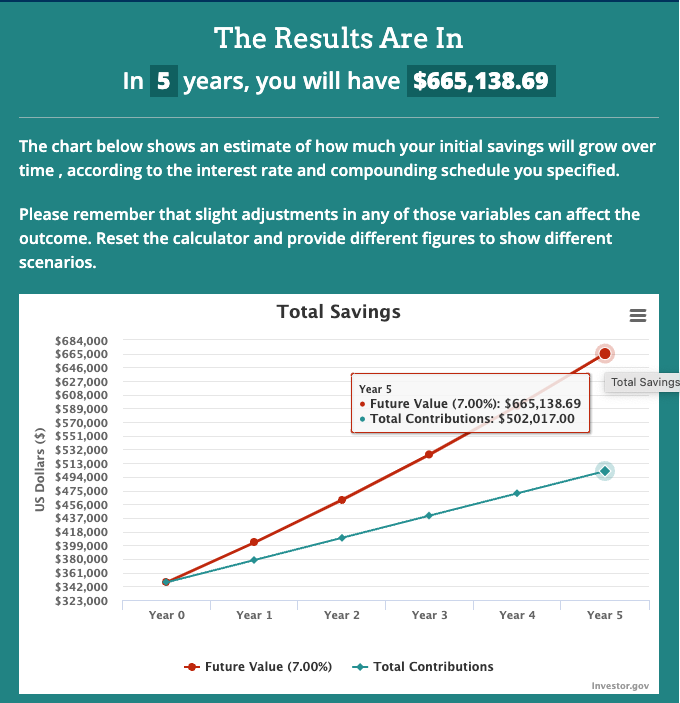

If the market returns 7% each year and Kat and Jay continue to invest $30,876 annually, they’d have ~$665k in five years. Let’s turn to our safe rate of withdrawal percentage now to see what they’d have:

4% of $665,138.69 = $26,605.54 available to spend each year

Scenario #1: Retire from the Military in Five Years and Enact “Coast FI”

While fully retiring in five years isn’t really possible with their current numbers, they could certainly have Jay leave the military and find part-time jobs that pay enough to cover their living expenses.

The idea behind Coast FI is that you no longer need your fully-loaded full-time job with retirement and benefits and instead, just need to earn enough to cover your expenses. Thus, you’re no longer investing for retirement or in your taxable investment account, but you’re also not drawing down anything from your investments. You’re letting your investments “coast” and grow until they’re substantial enough to enact a 4% withdrawal.

In this instance, your spending directly dictates how much you need to earn at your job.

What Would Happen If They Retired in Eight Years Instead?

Kat noted that their goal is 5 to 8 years, so let’s bump the timeline out three years and see what the calculator says:

With all of the same variables as above, and three years longer in the market, the picture changes dramatically:

4% of $914,086.75 = $36,563.47

This brings Kat and Jay a lot closer to their current spending level. The challenge here, again, is that we don’t know what their incomes or the market will do during this time period. However, they can utilize this calculator to determine how they’re progressing towards their goal.

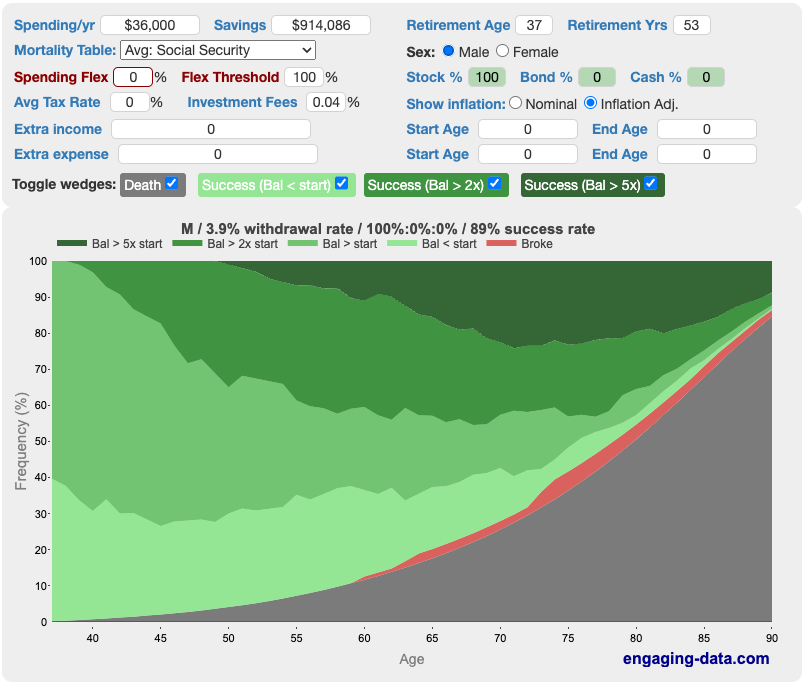

Will They Run Out Of Money Before They Die?

The next question Kat and Jay need to answer is whether or not they’d run out of money before they die. To grapple with that, I turn to the Rich, Broke or Dead? calculator, which sets out to answer just this query:

As we can see, if Jay and Kat retired at age 37 and lived to age 90, they’d have an 89% chance of not running out of money before they died. I don’t love that success rate. I personally am more comfortable with something like a 98% – 100% chance of success, but again, all of this is theoretical and we can’t know precisely what will happen.

Social Security?

Another major variable here is Social Security. Kat and Jay don’t know their anticipated Social Security payout, which could change the above calculation by quite a bit. If they’d like to do this math on their own, they can input their anticipated SS in the above calculator under the section “extra income” along with the age at which they expect to start taking SS.

Kat and Jay can figure out their anticipated Social Security benefits by following these instructions on how to retrieve their earnings tables from ssa.gov (the government’s Social Security website).

Can Kat & Jay Reach FI in 5-8 Years?

- Maintaining a good salary

- Keeping their expenses low

- Wisely and aggressively investing the difference between their income and expenses

- Avoiding debt

→If they continue on this path, they will eventually reach Financial Independence, no doubt about it.

When exactly that will be depends on a number of variables we don’t know right now, which I articulated above:

- Jay’s annual salary for the next 5-8 years

- Kat’s annual salary for the next 5-8 years

- What the stock market will do over the next 5-8 years

- Their post-military stateside annual spending, which could change dramatically depending upon:

- If they’re paying for their own health insurance

- Where they decide to settle down

- If they buy a home

- How much their rent/mortgage is in the US

- Inflation

- Their anticipated Social Security payouts

- If they’d like to do Coast FI or pursue full FIRE

Kat next asked: If we’re not on track to reach FI in 5-8 years, what do we need to cut back on to achieve this goal?

- Income

- Expenses

If Kat finds a job that works with their lifestyle, that would certainly speed up their progress towards FI. But, as it stands, if they’re willing to extend their timeline and have Jay work longer, she doesn’t need to get a job. It’s really all about how aggressive they want to be with these two variables.

If their ultimate priority is to reach full FIRE in 5-8 years, then Kat needs to find the highest-paying job she can, they both need to work as many hours as they can be paid for and they need to cut their spending to the bone.

That’s the extreme version and it’s but one option. The other options all fall somewhere in between. There’s no right or wrong here, it’s just a question of what they want most:

- Do they want work/life balance now and a longer timeline to FI?

- Or, do they want to work nonstop for the next 5-8 years in order to fully retire in their 30s?

Kat’s Question #3: What type of paid work should I pursue next? Any suggestions for timezone-flexible remote work?

I don’t know exactly what Kat’s work history is, but she mentioned she’s been a writer in the past. In my experience as a freelance writer for various magazines and online publications, this is a completely timezone-flexible job. The client doesn’t care what time of day you’re writing at, they just wants the piece delivered by deadline.

Freelance writing doesn’t pay very well, but it could be something for Kat to explore as an add-on to another job. Since she doesn’t need the benefits of a full-time position, she could cobble together a number of freelance gigs. That being said, if she did find a US-based employer with a matching 401k/403b retirement plan, that would certainly help with their FIRE math.

At present, Kat is not eligible to contribute to her own IRA since she doesn’t have earned income; but, she could look into opening a spousal IRA.

Kat’s Question #4: How can Jay and I better connect during times when we’re on opposite ends of the work/life balance spectrum?

It’s so hard to feel at odds with your spouse’s schedule and energy level. I wonder if they’ve considered establishing an evenings/weekends schedule that would enable them to both get what they need from their time together?

Additionally, Kat noted that a lot of their time together is used to prepare for the next week. If she’s not working, I wonder if she might consider shifting all of that prep work to during the weekdays when Jay is at work? Laundry, house cleaning, errands, meal prep, etc could all take place while Jay’s at work so that the weekends are reserved exclusively for free/leisure time together.

Summary

- Keep doing what you’re doing. You will reach FIRE eventually if you continue on this path.

- Determine how important the 5-8 year FIRE timeline is:

- If FIRE-ing ASAP is the priority, Kat needs to get a well-paying job, you need to cut your spending to the bone and shovel money into your investments.

- If Coast FI in a few years is appealing, consider what part-time jobs you might both enjoy working to cover your expenses.

- There are infinite possibilities here and you should feel confident that you have the basis to support whichever path you choose.

- Take a look at how much cash you have on hand and ensure that it makes sense with your timeline for leaving the military, buying a house, etc.

- Consider shifting all prep/household work to the weekdays to reserve the weekends for free/leisure time.

- Consider creating a weekend schedule that ensures both of you are getting what you need from your downtime together.

Ok Frugalwoods nation, what advice do you have for Kat? We’ll both reply to comments, so please feel free to ask questions!

Would you like your own Case Study to appear here on Frugalwoods? Apply to be an on-the-blog Case Study subject here. Hire me for a private financial consultation here. Schedule an hourlong or 30-minute call with me, refer a friend to me here, schedule a free 15-minute call to learn more or email me with questions ([email protected]).

This book could be an additional resource. https://www.amazon.com/Military-Guide-Financial-Independence-Retirement/dp/1570233195. Consider the reserves for a few years.

Submarine veteran Doug Nordman (this book’s author) is a long-time well-respected contributor in the FIRE space, and an early military viewpoint within the whole movement (from 2002). Seek out more of his work. I think his earliest blog efforts are no longer visible, but I’ve not gone looking in the past several years.

Thank you!

Wow, these two are in a fantastic spot for a 29 and 28 year old couple. No doubt but they will be very successful with their goals.

One very small quibble with the 4% guideline. That was meant to fund a 30 year retirement. Since this couple is so young, they would probably want to use 3% max for their calculations of what kind of income their nest egg could provide for them.

Check out this article about the problem with 4% rule https://www.madfientist.com/discretionary-withdrawal-strategy/

It is possible to use 4% or even higher withdrawal rate for a longer retirement since the money will have a longer time to grow. The article will at least get you to think outside the box on the 4% rule.

Others say that people could even do a 5% withdrawal rate if they’re okay with being flexible when the markets trend downwards. (See for example the Madfientist’s blogpost: https://www.madfientist.com/discretionary-withdrawal-strategy/ )

There’s an awful lot of discussion out there on withdrawal rates (and I would say that Kat and Jay, and others interested in early retirement, should read up on it). But 3% definitely is a bit on the too-careful side. It would require the average person to work about four to five years longer to accumulate that much more (assuming 7% growth of the money that they already have and a 25-40% savings rate). That’s an awfully long time to not start enjoying your freedom if it probably only means that you will die even richer.

I recently read this Madfientist post and it really got me thinking! We’ve gained nothing, if not flexibility, over our eight years together.

Congratulations, Kat and Jay and thanks for sharing! One thing I would encourage is to make sure Jay is evaluated for VA disability, no matter what discharge personnel say, once he has separated from the Marines. My husband was in the Army and when he was discharged he was told he didn’t qualify for anything; 10 years later we are learning that was incorrect. It never hurts to ask and be evaluated. It’s still an unknown but something to consider if he decides not to pursue the reserves once he separates from the Marines. We have been working with an agency in our county that helps Veterans with service connection so once you’re back stateside try to find a Veterans Service Commission who should be able to connect you with a Benefits Advocate. I hope you get to enjoy some forest bathing while you’re in Japan! I’m hoping to visit one day 🙂

I found this a bit confusing myself. My partner was in the Navy for 7 years and he gets VA medical benefits. He has to pay for his medication, but that cost is based on income. Everything else is covered by VA except dental.

Just to clear up my comment. I am speaking just of our personal experience. I would not qualify for any benefits and other then medical benefits and VA Mortgage, he does not qualify for other benefits that people who stay the full 20 years.

Hi Lauren! We’ll definitely look into that. Someone to explain the benefits would be great. Seems others are saying they did not serve for 20 and are receiving health benefits.

Yes, my husband was active duty AF for 4 years and he has VA healthcare benefits for life.

Hi Kat!

I am also a Marine Corp spouse and have discovered Military credit card Travel hacking to cover a lot of our travel expenses. We also love to travel and it has helped tremendously! Many great credit card’s annual fees are waived for us and give us tremendous value to use toward travel.

Hi Maribel! Which cards are your favorite?

Spouse of a retired Marine Corps officer chiming in: for lodging during travels we use the Armed Forces Vacation Club. They are basically timeshare condos that are released to eligible military members for a weekly flat rate fee.

Many cards, including the AmEx Platinum, waive the (hefty) annual fee for active duty military members, but you can still take advantage of all the perks. I’m a DoD civilian, and am jealous when I travel with my military co-workers.

It would be worth running the numbers on staying in for 20 years to get the pension, as well as (potentially) him deploying to a higher-risk deployment for a year, which comes with a number of potential investment opportunities as well as pay bonuses.

Great job on your savings! As someone who retired with a pension, I would try to get through to the 20 year mark to get a pension as a source of the income to FIRE or coast. You can’t guarantee that. as you age, that you will be work to able to make up the difference by working if the market drops or your expenses are high. I did mental health counselling & that was a major stressors for people without a pension trying to survive until they got to 65 to get taxpayer paid pensions. (Canada). Hopefully the next posting would be better. Health insurance is an expense that is only going to get more costly for one thing.

Healthcare is a major consideration for us. I appreciate everyone sharing how much they spend on healthcare to give me a better idea.

It looks like you forgot to factor in their TSP contribution? That is a significant portion of their monthly investments.

Yes, another ~ $24,000 per year!

Tough case study that a lot of mid grade officers find themselves in. Honestly, it seems more about lifestyle design than finances. I say this because I found myself chasing FIRE post military career and definitely achieving the FI, but not wanting the RE once I was there. Instead a part time job at first, then later 2 different government positions in Europe ultimately offered my family and I the best balance for work and life we could have ever hoped for. . It’s easy to fixate on the numbers but I would really encourage you to dig into the daily aspects of living somewhere that are most fulfilling. For example, commuting by bike, easy train and airport access, plentiful hiking trails, nice cafes and access to the city made our location a perfect fit. The place we initially settled into in the US after returning from overseas isn’t what we thought it would be either. Definitely read Doug Nordmans Military Guide if you haven’t already. He really gets at the heart of this issue well

You’re speaking my language! We’ve begun researching places we think we’d like to “settle” down. Ultimately, I just want more time together doing the things we love to do.

I think it’s always tough for military spouses, whichever nationality they may be. It’s very tricky to try and get a career stable and progressing with all of the moving around. Even hot-ticket professions don’t benefit from being moved about, often on short notice, quite regularly to places where opportunities are limited / there maybe language barriers and so on. I suspect that when the time comes that you do settle back in the States, your own ideas for a career path, be it very part-time or not, will exponentially increase, just because of more interesting feasible opportunities. Given that you are clearly someone who is intelligent and thoughtful, with various ideas / plenty of energy, it may easily be that you actively want to work a couple of days each week or equivalent at that point. Jay may also want that, once he’s had a bit of time to decompress and relax a little. It’s so hard to look into a crystal ball and know for sure, but I think that the idea of a business that you run together is a good one, something to build and invest in, though those are often more-than-full time, at least initially!

As someone who retired early and had a husband who was forced to retire early at 59, I can tell you that healthcare is an enormous expenditure if you have to self fund. We are healthy 63 year olds and ended up needing surgery for previous sports injuries(not something that could wait until Medicare). We pay $1200 a month for insurance with a $14k deductible. Since our income from pensions and a small business is just above the limit to get a discount, it is a struggle to keep up with the cost of health care, especially when you need to fund surgeries or other health issues that are not anticipated. I know it is difficult to have a taxing job(we each had very taxing careers with three kids), but you are young and will still be young if you stay with the military for 20 years. Good job on your investments-seems like you both are thinking about this with a clear head. Best of Luck!

Nice to see someone from the same geographic region as me. I don’t really have much to add to what Liz has said. I think the two of you are doing great and have bought yourself a lot of freedom, at least financially. As a company grade officer at III MEF your husband likely has many years of busy workdays ahead of him. I am curious how you keep your travel budget so low. You are living at a location that is a gateway for a lot of destinations. I am looking for tips on budget travel while living in Japan.

Hi Donald! We actually aren’t great budget travelers. We’re trying to take about 5-6 short trips per year. We would love to travel more, but Jay hasn’t been able to take a lot of time off at this station. We mostly travel within Japan, which has kept flight costs down. We also take advantage of public transit, eat at konbinis, and our favorite activities of sightseeing and hiking are mostly free.

You have done an amazing job and we know that serving in the Marines is not an easy lifestyle.. I commend you for taking the time to learn a new language and if it is possible, we hope it will help you with your future employment. IMO it may be unrealistic to FIRE before age 55, especially with the high inflation we have seen since January of 2021, and planning for a consistent 7% asset may not work long term. It could be done living in a van and having no rent or mortgage payments, as the home prices and energy costs may continue to increase until we have better leadership in Washington DC that understands the damage that our 32 trillion dollars in our national debt has caused.

Counterpoint to those saying stay in until retirement… that can be a good option but military life comes with a lot of injury risk that can impede your happiness and opportunities to travel, etc. long-term. My husband (former Army officer) is 35 and had an injury that causes him pain on a daily basis and has already required two surgeries with more expected as he ages. If you love it (or are at least content with the job) that’s one thing, but I would not suggest staying in solely for the pension.

The wear and tear on the body is high! At 28, Jay already has severe back and knee pain.

Long-time lurker, first-time poster here!

As a fellow military officer, I just wanted to highlight the amazing earned benefit that is military retirement. If Jay is 29/captain, that means he probably has about 8 years in. If their desire is to be FIRE (and no longer in the Marine Corps) by age 37, he would have 16 years in. That’s just 4 years short of military retirement. Let’s look at what they are giving up to separate from military service at 16 years:

– A lieutenant colonel who retires at 20 years would make about $5,000 (in today’s dollars) per month in retirement pay. Reversing the 4% rule Mrs. Frugalwoods cites would equate this pension to a $1.5M annuity

– Military retired healthcare isn’t completely free like it was for our grandparents generation, but annual enrollment costs for a family of two is about $700 (again, in today’s dollars). Compare that to $12,000 per year for an average family of two 40-year olds. Sure, co-pays are more for retired military than we were used to while on active duty, but still cheaper than healthcare through a private plan! Similarly great benefits for dental and vision.

– Not to mention the myriad little benefits that add up over time…use of the on-base grocery store, discounted tickets to theme parks & shows, cheap life insurance, etc.

– Many states waive income taxes partially/fully for military retirees

Bottom line: If they can stick it out until 20 years (yes, military life is hard…but rewarding, too), the government will pay them a nice nest egg for the rest of their lives.

I agree with everyone who recommends your husband stay in until retirement. I got out as a Captain at 8 years and even though I had a well paying career, there is no pension and healthcare was not covered when I quit working. My husband and my father both retired after 20 and 30 years and they were able to live a good life with travel and cheap healthcare. My mother had very expensive medical conditions (cancer, aneurysm, cancer again) and the bills showed over 100k, but they did not have to pay anything because of Tricare for life and Medicare covering everything. When you are at the 8-10 year mark you really want to get out and not have the pressures that the military job can have. But looking back there have been many times I wish I had stayed in. At 29 you think that age 50-60 is so far away but now that I am that age you realize how fast time really flies. As someone else mentioned if this assignment is not a good one, you can work at getting transferred somewhere else. Good luck.

I can’t second this enough. Jay is CRAZY to be leaving the pension on the table.

At the bare minimum I implore him to join the reserves upon exiting active duty and finish his 20 that way. In fact the reserves are kind of the perfect complement to a FIRE life – it’s nearly-free, high-quality healthcare and the option to make a six-figure paycheck for as much or as little as he wants.

For context on what I mean here – as a reservist the bare minimum obligation is two weeks of training a year and one weekend a month of ‘drill’ (though in reality it can be a lot more flexible than this depending on your unit / community – e.g. one week a quarter, or one month a year), but there are tons of opportunities to go on longer periods of active duty from 30 days to years at a time – all while making your cushy O3-O5 salary and BAH. Maybe you want a lifestyle where you only work 6 months of the year, or every other year, or maybe you want to save up for a big home renovation without digging into your savings – the reserves can make that happen! (I promise I’m not a recruiter)

The only caveat to reserve retirement is that it wouldn’t start until he was between 57-60, as opposed to if he remains active for the full 20 it would start immediately upon his retirement from duty – and of course it would be somewhat prorated to the amount of time spent on active duty. So in this example if we assume he’s got 10 years in active and then finishes off the remaining 10 on the reserve side, his pension amount would be a bit less (maybe 20 – 40%) depending on how much time he spent on active duty orders during the 10 years as a reservist (there’s a whole points system which I won’t go into detail on here).

He doesn’t have to stay USMC either – the other branch reserve components would be happy to take him in. He could even likely redesignate into a different field.

Can’t tell you how many disenchanted O3s I’ve met throw away the equivalent of $1,000,000 or more by hard-quitting out of the military without thinking about reserves.

Hi Dan! The reserves is definitely on our radar. It’s flexibility we crave.

My husband was in the Air Force for 20 years. Gets a monthly pension, but best of all , we get healthcare forever. We are in are late 50’s. I still work full time, but has medical issues and was able to retire (from the VA too). If you can stay in for the full 20 years you will never regret it. Medical insurance is vital. Best wishes to a fellow military family.

I think that taking time and being more relaxed about what sort of employment you choose after Jay gets out of the service is definitely doable, but as far as permanent FIRE, I see a huge issue: The life-income / drawdown estimate is based on 100% investment in stocks (I’m assuming that means an average 8% return?) You can NOT rely on drawdowns of aggressive investments to fund your lifestyle. Pulling your living expenses from volatile investments when the market is down will deplete your principal, and thereby future earning potential, in the blink of an eye. This is something of a catch-22; you can’t rely on those investments to fund your lifestyle on a daily basis and still retain adequate principal, but moving your money to less volatile investments also means a reduced ROI.

Edited to add: at the least, you need a balanced portfolio that allows you to choose whether to draw from stocks or fixed value investments, based on market conditions.

Hi Kib! I’ll definitely be adding bonds into the mix soonish.

As others have said, the best advice I can give is definitely STAY IN for 20 years. I’m about to retire from the military this year with 24 years (I definitely would have left at 20 if I didn’t have kids). They will have a good pension to live off of for the rest of his life as well as free medical for the rest of both of your lives (well ~40$/month). If he doesn’t feel he can stay in the Marines that long, maybe consider an interservice transfer to a different service. Also, the wife should get a job ASAP even if it’s low paying. That money will add up over time and she should continue to contribute until she finds an ideal job. They’ve done a great job so far.

I have a general question for Liz and any others who want to chime in! My family, like Kat and Jay, has investments in a total stock market index fund. We have gotten feedback that this is way too heavily weighted toward technology businesses. I’m wondering what your response to this feedback would be! Thanks!

Personally, I wouldn’t worry about it, but I am a “set it and forget it” Boglehead. We are heavy in VTSAX, but since VTSAX it is a reflection of the total stock market, you technically aren’t tilting towards anything. VTSAX is simply a reflection of the US market as a whole. And if you buy into some kind of specialty fund or overweight into other sectors somehow to counteract the tech, you would be trying to outperform the market, which could end up either going well or badly.

I am not sure why that is an issue? It is weighted towards Technology companies because they are a dominant industry right now. An index changes over time so if these industries became less dominant the ratio would change. If all the technology companies failed at once then we would have bigger issues and what fund you were in would be the least of your problems.

As far as remote work, can you look at some US based companies that offer jobs globally? I used to work for amazon while living in Europe and now I work remotely for a global chemical company and have coworkers all around the world. I’d get on linked in and look for remote work.

This is awesome! I like how Mrs. FW recommended getting all of those other things done during the week so you all can enjoy your time together. When the time is precious it is good to spend it on what really matters to you.

I know the rough estimate of an emergency fund of 6 months of household expenses. However, should there be additional money set aside for catastrophies? While I am still earning my typical salary I recently got hit with a large and unexpected medical expense and then a week later had to get a new transmission.

This young couple appear to be totally focused on the future and not enjoying where they are today. I think it is wonderful that they have been so careful with saving and thoughtful about their finances. But i would advise them to use some of that money to travel and experience as many countries as they can while they are abroad. And spend more time together. Plan for the future, sure, but make the most of the opportunities available right now. I wish them all the best.

I second this so hard! A nice balance is in order. My father in law worked like a DOG. All to enjoy it “soon” and when he early retired all the medical issues came. Now despite being verrrry FI from all that hard work he will never see the Amazon. Knees won’t hold up. Pulmonologist wouldn’t want him there. Now the MIL has orthopedic issues.

When you are healthy you are wealthy. I think we all lose sight of that. And no amount of money can give healthy, impeded mobility, ect. Loosen up you two 🙂

Hi Bea! From your mouth to my husband’s ears! We’ve been to 10 countries and 30 US states. All of the photos above are from the past year. Travel is our biggest spending priority. He unfortunately can’t carve out much time in his current demanding role… hence the desire to “retire” and be more flexible. It’s awesome we’re abroad, but that actually means it’s a higher tempo station. Quite the catch.

i am not a military guy but have several friends who retired after 20. also many people with that direct experience are chiming in that to serve 16 and not 20 would be leaving a MASSIVE benefit on the table. you have such great habits and have been winning so much financially you will win either way. obviously a 2nd income by kat of even $15-20,000/year adds up quickly.

trying to predict life 10-15 years in advance is folly. stick to your already amazing habits and you will be fine.

on a personal note, i slowed down to working 5-10 hours a week at age 50 and have the luxury of owning a business that i can work as much or little as i want. i missed working more. i did not realize how much i enjoy work and providing for my family. i have tons of friends in their 50’s and the amount who skillfully retire is few no matter the net worth. so many people in the FIRE movement hyper focus about fully retiring vs altering existing work or creating new types of work that serve you. focus on excellence and quality of life now and continue to contribute and create after full time service. quality and type of work & work/life balance is wildly underrated and retirement is vastly overrated for the majority of people

Hi Eric! That’s what we’re aiming for – a better balance. Whatever that ends up looking like 🙂

An important consideration for the next 5-8 years is going to be the cost of living relative to the BAH that Jay is authorized in a given area. In our experience as a military family, living overseas offered a few years with a very high savings right, but the OHA was much more generous than BAH stateside. Take home pay is lower and housing takes a larger proportion of our monthly income, reducing our savings rate.

So the savings rate for them now may not be indicative of the next 5-8 years without very conscious decisions around housing and Kay’s employment.

Hi Nan! We’ve strangely had the opposite experience. We were able to save more stateside due to the BAH (for our small apartments) and the job opportunities for me. It’s definitely hard to make any plans in this lifestyle!

They’ve done an excellent job! Not much to add to their already solid footing, but as an FIRE-since-38 myself…

1) Not to be grim so much as pragmatic, but travel while you’re young and can move around easily. Travel only gets more expensive, climate change is destroying places at a rapid pace; see it while you can and it’s there.

2) After some time off after achieving FIRE (almost a decade ago), we’ve also ended up working part-time, just not all the time. We haven’t touched our savings. It’s amazing how many opportunities open up when you have time not working in formal employment to build new skills, and people start to hear about it.

3) Health insurance costs and offerings vary tremendously by state, since each state implements and funds their state healthcare marketplaces separately. The differences are substantial enough that healthcare marketplaces are something to consider in deciding where to move. It’s also key to read up on income levels and the federal subsidy (which does shift depending on federal politics, sadly). In California (where we live), keeping our earned income low enough — and with our low costs, still high-for-us (in the vicinity of ~$75k/year) — meant we qualified for subsidies that brought our monthly premiums down to $50-$100/month for both of us. In addition, monthly health insurance premiums are fully tax deductible if you are self-employed. This REALLY changes your total outlay. Good luck and congratulations!

Hi Steph! I totally agree. I’m starting to research healthcare costs now, so I really appreciate you sharing this!

As a retired USAF family, I thank you for your service. Completing and retiring after 20 years of service was probably the best life decision we could have made. Why? Lifelong health insurance coverage! Although not free, the annual premium is around $600. Yes, the ANNUAL premium is $600. This in addition to your retirement check that starts immediately at retirement and lasts your entire life is an unbeatable deal. Life in the military is certainly challenging but we are leaps and bounds ahead of our non-military pears. Good luck with wherever life brings you.

I’m very interested in how they are living overseas with a Vanguard account in America. We are planning to move to Australia soon and I’m wondering whether we should open a Vanguard account here in America before we go so we have an option to invest directly in America. I know Australia has their own platforms but America really offers such low fees in comparison. But then I don’t know how that works with taxation and living abroad and accessing the money if we choose to live in Australia indefinitely.

Hi Leonora! We’re living abroad under SOFA (Status of Forces Agreement) and are still fully US citizens so we can keep our US accounts. If you maintain your citizenship status, you can maintain your accounts.

Have you heard of Squared Away? It is a virtual assistant service that focused on hiring spouses of active service members. It could be a good option for Kat while she figures out how she wants to proceed.

Ohhh looking it up now, thank you! 🙂

I like the advice from the ex and current military folks. Staying in 20 years seems prudent — almost all work is hard and stressful, not just military. That’s just life. But his job pays more than twice what I make at 63! It’s nothing to sneeze at.

Meanwhile, could Kat teach or tutor English? I would think there is demand and you might be able to make a decent hourly rate. Good luck!

My son is a Navy officer, been in 10 years, about to promote to 04. He plans to stay in for 20 years for all the reasons already listed by previous posters. Grit your teeth, stay in for 20, get the pension. These next few years are a great time to research your post-military living options and perhaps purchase a house in that area or near one of your relatives who could property manage for you. Use it as a rental. Even if you never live in it, you can build equity while still in the military and eventually have an additional stream of income.

I see people saying they don’t qualify for the VA. I’ll be the first to admit I have only three examples to guide me, and rules may have changed, but:

My husband served only 4 years in the Navy and got an honorable discharge. He entered at the very, very end of the Vietnam era but was not even remotely close to Vietnam – he was stateside for all but six or so months, then went to Europe on a carrier. After his service, he developed Type I (juvenile) diabetes.

He was told for decades that he would never qualify for the VA healthcare so we shouldered all his medical costs ourselves and didn’t even try to apply for the VA. Then we found out an older man, who served in the Navy but didn’t retire from the service, was using the VA for healthcare. Then our brother-in-law, who served in the Army four years both stateside and in Okinawa during the Vietnam Era, but was never in Vietnam or combat, got VA healthcare. We applied in 2014 and my husband was accepted. He had to pay some co-pays for doctors, hospital and drugs, but some things were still free to him, even though he was in the group that pays the most out of pocket. The money we could have saved on his diabetic treatment in the decades before he got VA care – literally thousands and thousands of dollars – is huge.

Things may have changed since 2014, but I would strongly suggest checking into the VA healthcare. Speak to a VSO or a Patient Advocate. The form to apply is on the VA website.

However, as others have pointed out, staying in seems impossible now, but you will be so close in 8 years – it just doesn’t make sense to walk away and leave that on the table. A young woman I know is 37 – her husband retires from the army in less than 2 years. They’ve bought a nice home and are making plans for a future of maybe part-time work and time to travel and enjoy their pup. They say it was absolutely worth staying till retirement!

Hi JD! We’ll definitely keep looking into the health benefits. And thank you for your perspective!

Great job!

I’d also recommend checking out this podcaster/and his book (https://militarymoneymanual.com/), sincefrugal travel is a top goal.

Thank you!

Just here as a dissenter. I left my job a few years short of realizing the required amount for the pension, and I have zero regrets. There are always other paths, and sometimes it’s worth a change of course if you really don’t want to stay on your current one. Sure, it’s a few more years, but you can spend those years doing something else, and perhaps earn more or you’d be willing to work a little longer in exchange for the switch. Maybe you find something in the government or another employer that honors the years served. The benefits of the military are tremendous, but the benefits of living an intentional life while being financially prudent are even better.

Thank you for sharing! I feel this sentiment deeply.

They are contributing an additional $1,864 per month to Jay’s TSP from his gross earnings before arriving at his net income. This will significantly increase their net worth over the next 5-8 years. I believe a recalculation needs performed to include this.

Yep, and it gets a decent match too!

I am and veteran, served from 1993 until 2004, and I get all my care through the VA (I have no disability). They send me a letter yearly that counts as my health coverage for taxes and I pay a 15$ copay for primary care visits and 30$ or 50$copays for specialty visits and imaging with no monthly premium. I am very happy with my care.

Interesting! I am still a little confused by the VA website. That would be great if he gets some healthcare coverage.

First, this couple is in AMAZING shape for their ages! Kudos to you both for your hard work and for finding, and following, a FI lifestyle at such a young age. I’d like to counter the “stay in 20 more years”….I recently left a career (at 50) when we had reached “coach FI”. I could have stayed in 5 more years to get lifetime health insurance. Do we pay more for insurance now than I’d hoped? Yes :(. Do I regret leaving my career? Absolutely not. You can’t plan for every “what if?”, and if the numbers work for you and you know it’s time to leave, you should do so. It’s scary, but you are clearly the kind of people who are working to make an informed decision. Best to you both!

Hi Janie! Thank you! And thank you for sharing your experience – I appreciate your perspective 🙂

Hi – I resonated with your comment regarding self-funding your retirement rather than putting in 20 years for a pension. I too made the skip the pension choice and I’m really glad that I did. A number of friends who stayed for the full 20 years to receive their pension/healthcare were pretty miserable. I liked having the freedom of self-funding my retirement and it has been very doable to figure out how to get there. One thing I’ve not focused enough on at various points in the FIRE journey is life at present and enjoying now.

I’ve also been in the situation of not working at times and at very different energy levels than a working partner during those stretches – it’s tricky. There were just alot of your story that were similar to my experience. I think as you get a part-time job going maybe things will feel a little better. It feels good to cross that FIRE threshold while working alongside a partner rather than have it revolve around hitting a certain mark in one partner’s career. I’ve liked heading in the general direction of FIRE without being stuck finishing out one person’s career path for a pension – and doing what works year by year along the way for each partner. If you’d ever want to chat by email that would be fun.

Good luck!

Hi LB! “…the freedom of self-funding my retirement…” That’s exactly what I am aiming for! We’ve moved a lot and every year looks different, so I’m definitely rolling with the punches, enjoying the ride.

I would suggest that he stay in to get his 20 before retiring. Then they can both fully retire with ease. In the meantime maybe she can do more to help him be less tired. With him bringing in a salary like that plus a pension that would bring in millions before he dies she should be doing everything around the house to make things as easy for him as possible. Hopefully his work load will decrease with his next promotion. That is obviously not a sure thing but it is worth considering. That would make it easier to go the full 20.

No worries on that front – I am taking care of the domestic duties for now as he’s working 16 hour days. When I was working full-time and taking Master’s courses, he was in a training course and had more free time, so he did most of the housework. We’ve got a good balance there.

Unfortunately, I can’t imagine his workload lessening as he pins Major or Lt. Col – I would never get to see him 🙁

I would say that over the next couple of years, Kat, you could focus on building your skills and career to get to work options for you to do parttime when you are FI / almost FI. I don’t know what that job (or entrepreneurial option?) is, that also depends on your interests and skills. You might need to do a course or get a certification in some way, but this could be a good time to explore those options and work towards it. I imagine that if a couple of years from now Jay quits the military, it would be awesome if you have the capabilities to easily and flexibly earn some income to pay at least part of your expenses. I could imagine becoming a tax preparer, building IT skills, or building and expanding creative skills.

Personally, I’ve reached FI at age 43 and I have found that I want to keep working parttime. That is also what I’m doing now. Looking back, I should not have been in such a rush to reach FI. I could have downshifted earlier (and enjoy more free time). I would have gotten to full FI status slightly later, but with more fun and less stress along the way.

So perhaps what I see for you is that in a few years when Jay quits the military you will have an extremely solid financial base, and hopefully you both will have plenty of options to do enjoyable part time work, maybe just for part of the year, and enjoy the rest of your time. Your income will cover your expenses or you will need to take say $5k-$10k from savings every year, but still your assets will keep growing until you’re at some point fully FI. You will not care so much anyway because life is fun and adaptable to your wants and needs already, even when you aren’t fully FI yet.

Finally, an out-of-the-box option: you might explore whether either of you has the option to become a citizen of a nation that has a more affordable healthcare system than the US. Maybe you can apply because a parent or a grandparent had a certain nationality. Or maybe you can apply on your own merits (for example because you bring specific talents, or money, to the table). The world’s your oyster.

Hi Petra! Thanks for sharing. I am actually slowly working on a Master’s degree. Teaching part-time is one of my many ideas for post-FI life.

Sorry Mrs. Frugalwoods but your 3-6 months emergency is outdated. In today’s world, 8 months is cutting it close and 12 months is much more realistic. Sure, most could get “a job” in no time but “a job” may come nowhere near covering existing expenses. The $44K in cash should remain right where it is.

Or… they could be more employable than you are. Or they will make do with what they have more easily than you can. Perhaps you have children who depend on you – they do not.

I am highly employable – IT people are always in demand. Children are on their own, financially stable and have more than 6 months in emergency funds.

And right now they are young – talk to people in their 50s or even early 60s who lose their jobs. Most will tell you it is a nightmare to find a job. “Overqualified” or “expect too much in salary”. Nothing wrong with investing but fixed/minimal living expenses are just that.

According to the graph, wouldn’t they only have like a 10% chance of not being broke if they live till 90?

Hi everyone! Thank you so much for your input.

I want to clarify two points I wasn’t clear on:

– I do all of the domestic labor and errands during the week. Not on weekends. By prepping for the week, I meant that Jay is doing work related activities and personal care. Our weekends are otherwise free (if he’s home). But he’s often exhausted due to the long work days, business trips, field exercises, etc. And I can’t do anything about that… other than help us “retire” early! 🙂

– I’ve worked for an income for the past decade. I actually entered our marriage with more money. I’ve only been out of work for a few months, and I am actively job seeking. Many military spouses are un/underemployed. I’ve sacrificed a lot to support Jay’s career. I am contributing the best I can.

I think it’s amazing what you’ve accomplished together in such a short time and at such a young age! I hope you find a new job where you currently are that is fun and rewarding (also monetary 🙂 ) and I hope you two can enjoy the fruits of your labors really soon.

Hi Liz! Thank you for taking the time to do this case study! It’s definitely given me some realistic expectations.

It’s my understanding a “spousal IRA” is jargon for continuing to contribute to a non-working spouse’s IRA, so long as you file your taxes as married filing jointly and earn at least the contribution amount for both (so, at least $13,000). Am I totally off base on that? Do any tax experts know? Have I angered the tax gods? Thanks!

Your husband will qualify for VA healthcare benefits as a veteran – he doesn’t need to retire or have disability. Retirees qualify for tricare for life for themselves and all beneficiaries, but any veteran can access the VA healthcare system.

You guys are doing great! I had a question for you about your Vanguard investments. I’m also an ex-pat and a few years ago I went into a deep dive of index funds and it seemed like it wasn’t possible to buy/own Vanguard as an American abroad. There were some workarounds, but they seemed overly complicated for the amount of money that I had to invest at the time. How do you guys do it? Did you find a loophole? Thanks!

You guys are doing an awesome job, your decisions have been outstanding and you should be great if you continue the path you are on. Your case study generated a lot of activity which is always good. I wish you well in your endeavors. Kudos to you both.

Kat you and Jay are doing great. Congratulations!

You didn’t mention Jay’s total time in service or if he is prior enlisted. If Jay enjoys his job and the military he may really want to consider staying in until he has his full 20 years in to get the pension. If he does get out early then he may want to consider joining the reserves to get his 20 and a reserve pension. If he really doesn’t like what he does or doesn’t care for the military lifestyle then he should resign his commission and get out. Remember an active duty pension begins when he retires and you and he will have health care too. A reserve pension doesn’t begin until age 60 (gray area retiree) and Tricare doesn’t start until age 60.

For travel start using MAC flights space A travel. You do have to be somewhat flexible and should have funds to cover a last minute ticket if you can’t get a flight and have to make a travel deadline to get back. Best when active duty/retired active. If reserve/reserve retired I think the age thing comes into play again.

When you are stateside again, always ask if a military discount is offered when eating out, reserving hotels, etc. They really vary even within the same company/locations. Ask for military discount when booking flights too.

Having a career when your spouse is military is challenging. Most spouses end up with jobs not careers and not being stateside must make it a lot worse. I would try to find something on base just to have something to do and to bring in more income to put towards your future options. My husband went to Japan a year unaccompanied because we just could not afford 3 years of me not working straight out of school with students loans at the time for both of us.

If you are not using all your housing allowance, save it.

Consider reading The Military Money Manual.

Keep up the good work. You are doing great. Take care.

Wife of a USMCR(ret.) Marine and mom of two (one trying for PLC/OCS and one at a service academy)

Kat you guys are doing really well so far and you’re getting a lot of sound advice and perspective but there is a specific type of advice I think you’re looking for and I’m not sure you’re getting it: advice/ perspective from someone who got out of the military before 20 years and still managed to find great happiness and success even without that mythical 20+ year retirement package. Yes the 20 year thing is great if you can make it. Few in the military do. Personally I am about to get out after 14 years of active duty and most people I talk to say I’m crazy to walk away from the deal where you give 20 or more of your best, youthful years to the military and in return they pave the rest of your road ahead with silver. Problem for me is that my job is crazy stressful and I’m burning fumes. If I keep going, FIRE won’t be much fun with the health problem accumulation trajectory I’m currently on. I don’t know if that is relateable to you or not, but what I’m saying is that priority #1 is to live long enough to be able to worry about what happens when you get older.

Priority #2 is to nurture the health of your relationship. When I got to my most recent assignment, the Chief engineer, Commanding Officer, and Executive Officer were all going through divorces. And all were on track for a 20 year retirement. So what I’m saying is that if your present situation threatens your relationship then do something about it. Or don’t, but just know that military life can be somewhere between hard to fatal on relationships.

If somehow you can make it 20+ years in the military with good health and a happy relationship then awesome, do it, listen to all the other commenters on here. If not then think hard about what you truly want from life.

I’ll be getting out of active duty end of this year and I’ll be the test case for someone who tries to be wildly successful without the silver parachute of a military retirement. I’m aiming for a life of gold anyhow so it’s all good.

By the way….about priority #3….FIRE….yeah create some side income, remote work, blog about being an overseas military spouse and build a community around that…do something, anything. Whatever you can contribute to the bottom line will make FIRE more quickly attainable. You guys have access to some amazing benefits, GI Bill, VA home loan program….you can get into real estate investing with a VA loan by buying a 2, 3 or 4 unit place and living in one unit and renting out the remaining units. That’s just one of many examples of side gigs that military people have better access to than most people.

Finallly: good luck! You’re doing so much right already so keep it up!

Hi Bryan! I really appreciate your perspective. People clearly think we’re crazy, too! We’re only at 6 years and Jay was never on the 20 year path anyway. I guess I didn’t make that clear in my post. It’s either FIRE or new careers, not 14 more years in the military. It has definitely been a tough lifestyle for our relationship, for his health, and for my career trajectory, but we’re making it work. I did have an interview yesterday. I’ve learned to be VERY flexible and know that there’s always a new opportunity around the corner.