Jane and her husband Joe live in the midwest with their two teenaged children and one parrot. Recently, Jane retired from her 24-year-long career as a college professor and loves the new lifestyle she’s carving out for herself. Joe works from home and the family enjoys spending a lot of time together.

Jane’s question at this juncture is whether or not she needs to return to full or part-time work at any point, or, if the couple can live on Joe’s income alone until he too retires in nine years. She’s also wondering if their asset allocation is appropriate given their ages and projected retirement timeline.

What’s a Reader Case Study?

Case Studies address financial and life dilemmas that readers of Frugalwoods send in requesting advice. Then, we (that’d be me and YOU, dear reader) read through their situation and provide advice, encouragement, insight and feedback in the comments section.

For an example, check out the last case study. Case Studies are updated by participants (at the end of the post) several months after the Case is featured. Visit this page for links to all updated Case Studies.

Can I Be A Reader Case Study?

There are four options for folks interested in receiving a holistic Frugalwoods financial consultation:

- Apply to be an on-the-blog Case Study subject here.

- Hire me for a private financial consultation here.

- Schedule an hourlong call with me here.

- Schedule a 30 minute call with me here.

→Not sure which option is right for you? Schedule a free 15-minute chat with me to learn more. Refer a friend to me here.

Please note that space is limited for all of the above and most especially for on-the-blog Case Studies. I do my best to accommodate everyone who applies, but there are a limited number of slots available each month.

The Goal Of Reader Case Studies

Reader Case Studies highlight a diverse range of financial situations, ages, ethnicities, locations, goals, careers, incomes, family compositions and more!

The Case Study series began in 2016 and, to date, there’ve been 98 Case Studies. I’ve featured folks with annual incomes ranging from $17k to $200k+ and net worths ranging from -$300k to $2.9M+.

I’ve featured single, married, partnered, divorced, child-filled and child-free households. I’ve featured gay, straight, queer, bisexual and polyamorous people. I’ve featured women, non-binary folks and men. I’ve featured transgender and cisgender people. I’ve had cat people and dog people. I’ve featured folks from the US, Australia, Canada, England, South Africa, Spain, Finland, the Netherlands, Germany and France. I’ve featured people with PhDs and people with high school diplomas. I’ve featured people in their early 20’s and people in their late 60’s. I’ve featured folks who live on farms and folks who live in New York City.

Reader Case Study Guidelines

I probably don’t need to say the following because you all are the kindest, most polite commenters on the internet, but please note that Frugalwoods is a judgement-free zone where we endeavor to help one another, not condemn.

There’s no room for rudeness here. The goal is to create a supportive environment where we all acknowledge we’re human, we’re flawed, but we choose to be here together, workshopping our money and our lives with positive, proactive suggestions and ideas.

And a disclaimer that I am not a trained financial professional and I encourage people not to make serious financial decisions based solely on what one person on the internet advises.

I encourage everyone to do their own research to determine the best course of action for their finances. I am not a financial advisor and I am not your financial advisor.

With that I’ll let Jane, today’s Case Study subject, take it from here!

Jane’s Story

What feels most pressing right now? What brings you to submit a Case Study?

We’ve followed the basic principles of the FIRE (financial independence, retire early) movement for about a decade now. We are grateful to those who introduced us to this movement and to content creators like Frugalwoods who continually teach us to challenge societal norms regarding the definition of a “good life.” I felt confident leaving my career last year when we were approaching “Coast FI” territory and it was clear my job was making it difficult for me to be the best parent I could be to my kids, one of whom has really struggled.

Right now, we need help figuring out a plan for the next 10 years.

At that point, we can access our retirement accounts and feel relatively confident with our ability to navigate our own finances. But before then, a main question is: when will I need to seek part- or full-time work, and how much will I need to bring in?

What’s the best part of your current lifestyle/routine?

I feel “on top of” my life for the first time. The house is clean, I have time to cook (which I LOVE) and take walks, and my stress level is greatly reduced. I’m currently planning and starting my vegetable garden; I love to garden and look forward to an ever-improving vegetable garden each year. I’m also taking on some home improvement projects I’ve always wanted to do and I’ve picked up a small amount of volunteer work.

I get to be a stay-at-home-parent to my high-school-aged son and a better support person to my 19-year-old daughter. Her stress level, level of functioning, and our relationship are markedly improved. I’m thankful that I can now give her the support she needs.

This is the first time in our marriage that my spouse’s career has been prioritized over mine, and I love watching him have this opportunity to grow. As a family unit, we spend most of our time together at home, hiking, playing games or taking advantage of free entertainment. I think we spend much more time as a unit than most families with kids this age, and for that I am grateful.

What’s the worst part of your current lifestyle/routine?

I’ve had a difficult time establishing a schedule that helps me feel productive. My spouse works from home, my 19-year-old doesn’t drive and is a homebody, so there are usually three of us in the house at all times. It sometimes feels like Groundhog Day. I was never a big spender, but because I’m not bringing in an income, I feel anxious about spending money.

Where Jane Wants to be in Ten Years:

- Have good health insurance.

- Maybe working a part-time job that I like, but definitely past the accrual phase of our lives.

- My husband would like to stop working at age 60 (in 9 years) if possible. A lot will depend on our health care situation.

2) Lifestyle:

- I want to be where my kids are, and possibly in the upper Midwest where my in-laws and husband’s family live.

- Although we love our current house, I look forward to a smaller home. Ideally, in 3 years we will downsize to a home that we can purchase outright with the equity we have in this home.

- Both kids out of the house with jobs and health insurance.

- I want a simple life; a big garden, cooking most meals at home, time with family.

- We like to travel some, but are good at using points and minimizing travel costs.

3) Career:

- I don’t believe I will ever re-enter academia. I could seek a job that utilizes my academic expertise at some point in the future, but it could require additional training. I’m not sure I’m interested in doing that.

- I might also be happy working a part-time job here and there, related to my cooking/gardening/home improvement interests.

- I also have a few ideas for small businesses, but I don’t even know where to start with evaluating whether those are viable options.

Jane and Joe’s Finances

Income

| Item | Number of paychecks per year | Gross Income Per Pay Period (total BEFORE all deductions) |

Deductions Per Pay Period (with amounts) | Net Income Per Pay Period (total AFTER all deductions are taken out, such as healthcare, taxes, employee parking, 401k, etc.) |

| Joe’s salary | 26 | $3,200 | $158 health and dental; $290 401K contributions; $708 taxes | $2,044 |

| Joe’s added income as musician (approximate) | 1 | $2,500 | Taxes | $1,500 |

| Annual Gross total: | $85,700 | Annual Net total: | $54,644 |

Mortgage Details

| Item | Outstanding loan balance (total amount you still owe) |

Interest Rate | Loan Period and Terms | Equity (amount you’ve paid off) | Purchase price and year |

| Mortgage | $174,679 | 2.63% | 15-year fixed-rate mortgage | Zestimate – owed = $250K ($425K-$175K) | $325; purchased in 2017 |

Debts: $0

Assets

| Item | Amount | Notes | Interest/type of securities held/Stock ticker | Name of bank/brokerage | Expense Ratio (applies to investment accounts) | Account Type |

| Jane’s 403b | $822,488 | Through the job I left; available with no penalty at age 55 if needed. | 60% large cap equity index, 19% global equity index, 16% small-mid equity, 1% core bond index | Voya | .02%, .09%, .03%, .02% | Retirement |

| Joe’s 403b | $158,013 | Rolled over from previous jobs | 100% FNILX | Fidelity | 0% | Retirement |

| Joe’s Roth IRA | $88,137 | 100% FNILX | Fidelity | 0% | Retirement | |

| Jane’s rollover IRA from a previous job | $76,243 | 97% FZROX; 3% SPAXX | Fidelity | 0% (FZROX) .1% (SPAXX) | Retirement | |

| Jane’s 457b | $69,473 | Through the job I left; available now with no penalty | 70% Large US Caps; 15% Small-Mid US Caps; 15% Non-US Stocks | Empower | .01%, .01%, .05% | Retirement |

| Savings Account | $46,308 | Our “cushion” or Emergency Fund | 100% FDRXX | Fidelity | 0.34% | Cash |

| Joe’s 401K | $14,894 | Current job; he will be fully vested in August, and currently puts in 5% with a 5% match | Prudential | Retirement | ||

| Jane’s Roth IRA | $13,900 | 100% FZROX | Fidelity | 0% | Retirement | |

| Checking Account | $4,249 | Busey | Cash | |||

| Total: | $1,293,705 |

Vehicles

| Vehicle make, model, year | Valued at | Mileage | Paid off? |

| Toyota Highlander 2010 | $8,700 | 210,000 | yes |

| Honda Fit 2007 | $2,500 | 199,000 | yes |

| Total: | $11,200 |

Expenses

| Item | Amount | Notes |

| Mortgage with Escrow (including insurance) | $2,265 | approaching $1K in principle per month |

| Groceries | $700 | includes household supplies |

| Health care costs (to get to deductible) | $400 | |

| Car expenses | $375 | $200/mo for gas and $175 for maintenance or saving for new car |

| Water/Sewer/Trash | $250 | Avg per month. Something is wrong with our water bills; they are exorbitant. We are working to figure out why. |

| Electric (reduced rate b/c partially solar) & Gas | $214 | avg per month |

| Eating out | $200 | |

| Son’s Sports Team | $169 | monthly |

| Solar (solar sharing through NexAmp) | $155 | avg per month |

| Travel | $150 | travel expenses not covered by rewards points; domestic trip this year |

| Clothing | $120 | |

| Gifts and Holidays | $100 | |

| Auto insurance (State Farm) | $75 | 2 drivers only currently, will add one driver in June. Full coverage on both vehicles. $900/year |

| Cell phones (4 lines with Mint) | $65 | 4 lines with the MVNO Mint Mobile |

| Haircuts | $60 | cut for Jane and Joe every other month, less often for kids, who wear their hair long |

| Entertainment | $50 | event tickets |

| sprinkler system | $19 | Monthly; turn on and off once per year = $236 |

| Membership | $19 | botanical garden ($225) |

| Pet expenses | $18 | For the parrot |

| Subscription: Spotify | $10 | monthly |

| Monthly subtotal: | $5,414 | |

| Annual total: | $64,965 |

Anticipated Social Security

| Item | Monthly Amount | Year and age you’ll begin taking SS |

| Joe’s anticipated Social Security | $2,344 | at 67, in 2038 |

| Jane will not be eligible for SS because she did not pay in for most recent job (20 yrs) and due to the Windfall Elimination Provision (WEP) | $0 | Note that this is really confusing to a lot of people, but I’ve done a lot of research on it and talked to the SSA, and I am quite confident this is true. It’s unusual for university faculty not to pay into SS, but that was the case in my university system. I don’t know the exact amount, but I’d have to pay a substantial amount into SS between now and retirement age in order to not be subject to the WEP. |

| Annual total: | $28,128 |

Credit Card Strategy

| Card Name | Rewards Type? | Bank/card company |

| Capital One Venture (Jane) | Travel | Capital One |

| Capital One Venture (Joe) | Travel | Capital One |

Jane’s Questions For You:

1) When I left my career, I felt confident in our goal to “coast FI”; my husband would continue to work and I would stay home for at least a year and then figure out what was next. But that one-year mark will be upon us very soon.

- How can I figure out when I need to go back to work and how much I’d need to make?

- To what extent will my age and employment gap be a problem as my time away from work lengthens?

- Note that I probably can’t go back to work full-time for at least another year as my daughter needs more time and attention to get to a place where she’s thriving.

3) How does one begin to explore self-employment?

- My ideas:

- Seeking out clients for whom I could cook (I already cook dinner every night…why not cook the same for an extra family or two?)

- Creating a website of homeschool-related content

- Trying to do some consulting related to my academic areas of expertise and… many other ideas!

4) How do we use what we know about our financial situation to inform our choice of insurance plans?

- My husband has a ton of options available through his employer and we went with the cheapest option that includes an HSA because I thought that’s what FIRE folks did.

- However, I’m not sure this is the right choice as we’re not in a place to utilize the HSA as an investment vehicle and we have a really large deductible.

5) What do we do with our “cushion” of cash that we’re planning to use to supplement my spouse’s income for us to live on?

- It’s currently not earning any interest.

- Note that the cushion serves as our Emergency Fund, and we have two other places from which we can draw without penalty (my 457 and both of our Roth IRA’s–principal only).

6) Should our retirement accounts be moving away from equities, given our age? I realize there are many opinions on this, but I’d love to hear yours and what the hive mind thinks.

Liz Frugalwoods’ Recommendations

I’m delighted to have Jane and Joe as today’s Case Study!

Jane’s Question #1: When do I need to go back to work and how much do I need to earn?

This depends on how much Jane and Joe want/need to spend every month. At present, their monthly spending outstrips their income; but, that’s something they could change if they wanted to. If Jane would prefer not to go back to work–and to instead devote her time to her kids and potentially pursuing self-employment–all they need to do is bring their spending into alignment with Joe’s salary.

Current Annual Expenses ($64,965) – Current Annual Income ($54,644) = $10,321 deficit

Let’s take a look at Jane and Joe’s expenses to see if we can close this gap. Anytime a person wants to spend less, I encourage them to define all of their expenses as Fixed, Reduceable or Discretionary:

- Fixed expenses are things you cannot change. Examples: your mortgage and debt payments.

- Reduceable expenses are necessary for human survival, but you control how much you spend on them. Examples: groceries, utilities and gas for the car.

- Discretionary expenses are things that can be eliminated entirely. Examples: travel, haircuts, eating out.

To stay within Joe’s salary, they’d need to limit their spending to a maximum of $4,553.66 per month. I categorized Jane and Joe’s expenses and came up with the below proposed plan of how they could accomplish this:

| Item | Amount | Notes | Category | Proposed New Amount |

| Mortgage with Escrow (including insurance) | $2,265 | approaching $1K in principle per month | Fixed | $2,265 |

| Groceries | $700 | includes household supplies | Reduceable | $600 |

| Health care costs (to get to deductible) | $400 | Fixed (I assume?) | $400 | |

| Car expenses | $375 | $200/mo for gas and $175 for maintenance or saving for new car | Reduceable | $275 |

| Water/Sewer/Trash | $250 | Avg per month. Something is wrong with our water bills; they are exorbitant. We are working to figure out why. | Reduceable | $175 |

| Electric (reduced rate b/c partially solar) & Gas | $214 | avg per month | Reduceable | $200 |

| Eating out | $200 | Discretionary | $50 | |

| Son’s Sports Team | $169 | monthly | Discretionary | $169 |

| Solar (solar sharing through NexAmp) | $155 | avg per month | Reduceable (I assume?) | $100 |

| Travel | $150 | travel expenses not covered by rewards points; domestic trip this year | Discretionary | $25 |

| Clothing | $120 | Discretionary | $20 | |

| Gifts and Holidays | $100 | Discretionary | $10 | |

| Auto insurance (State Farm) | $75 | 2 drivers only currently, will add one driver in June. Full coverage on both vehicles. $900/year | Reduceable | $75 |

| Cell phones (4 lines with Mint) | $65 | 4 lines with the MVNO Mint Mobile | Fixed. Way to go on using a cheap MVNO!!!! | $65 |

| Haircuts | $60 | Cut for Jane and Joe every other month, less often for kids, who wear their hair long | Discretionary | $10 |

| Entertainment | $50 | event tickets | Discretionary | $10 |

| sprinkler system | $19 | Monthly; turn on and off once per year = $236 | Fixed (I assume?) | $19 |

| Membership | $19 | botanical garden ($225) | Discretionary | $19 |

| Pet expenses | $18 | For the parrot | Fixed | $18 |

| Subscription: Spotify | $10 | monthly | Discretionary | $10 |

| Monthly subtotal: | $5,414 | Monthly subtotal: | $4,515 | |

| Annual total: | $64,965 | Annual total: | $54,180 |

Luckily, Jane and Joe have relatively low Fixed expenses, which means it’s fully within their power to reduce the Reduceable and Discretionary items to fit within Joe’s take-home pay. Woohoo! Whether they want to reduce/eliminate these items is totally up to them, but it is technically possible for them to live on Joe’s salary alone–and to live well!

Additionally, Jane noted that they intend to downsize homes in ~3 years and potentially buy a smaller home outright. That would be a major game-changer since their biggest expense–by far–is their $2,265 mortgage payment.

Thus, it becomes a question of personal preference and priorities:

- Would Jane rather go back to work in order to maintain their current spending level?

- Would Jane rather reduce the family’s expenses in order to live on Joe’s salary alone and thus not need to go ever back to work?

Of course there are also plenty of in-between options–such as part-time work or partial expense reductions–that the family should also consider.

But Wait, This Budget Wouldn’t Include Any Savings!

Let’s take a look at the rest of their assets to ensure they’ll be ok not saving anything beyond Joe’s 401k contributions.

Asset Rundown

1) Cash: $50,557

Between their two cash accounts, the couple has $50,557 in cash. Well done! The only downside is that this is technically an overbalance of cash. What do I mean by that? Isn’t more cash always better?!? Well, yay and nay.

→The biggest downside to keeping so much money in cash is the opportunity cost.

Having this much cash only makes sense if:

- You intend to quit your jobs and not immediately find another;

- You have major expenses planned for the near-term, such as: buying a house, buying a car, a significant HOA assessment, etc.

Outside of these two scenarios, it becomes a massive opportunity cost linked with the fact that your cash is losing value every day since it is not keeping up with inflation.

While is can feel instinctively “safe” to hold onto a lot of cash, there’s a danger to doing so. When you’re overbalanced on cash, you’re missing out on the potential investment returns you’d enjoy if your money was instead invested in, for example, the stock market.

How Much Should They Keep In Cash?

Your cash equals your emergency fund and your emergency fund is your buffer from debt:

- An emergency fund should cover (at minimum) 3 to 6 months’ worth of your spending.

- At Jane and Joe’s current monthly spend rate of $5,414, they should target having an emergency fund of $16,242 to $32,484.

- If they decide to reduce their spending to live on Joe’s salary, their emergency fund can commensurately reduce to somewhere between $13,545 and $27,090.

All that being said, if they would rather keep this money in cash (and understand the risks to doing so), they can. Point here is that they don’t need to save up any more cash, which is why I’m comfortable suggesting the above budget that entails them spending all of Joe’s salary.

What To Do With This Cash

→At the very, very least, they should move this cash into a high-yield savings account that’ll earn them interest. There are many accounts out there offering great interest rates right now.

For example, as of this writing, the American Express Personal Savings account earns a whopping 3.90% in interest (affiliate link). This means that in one year, their $50,557 would earn $1,972 in interest!

Depending on what they decide to do in terms of Jane’s retirement, they can also consider short to medium term investment options, such as CDs, Money Market Accounts, and Government Bonds. With all types of investments, you’re looking to maximize your return, but ensure that the time horizon works for your plans. It’s kind of like a ladder or hierarchy of options:

- At the most accessible end are high-yield savings accounts because you can withdraw your money at any time, in any amount and with no penalty.

- At the least accessible end are retirement investments because you have to be age 59.5 before you can withdraw your money without penalty.

- In the middle are short and medium-term investment options, which can make a lot of sense if you anticipate needing this money in, say, three years in order to buy a new car.

2) Retirement: $1,243,148

Jane and Joe have a grand total of $1.2M between their various retirement accounts, which is fantastic.

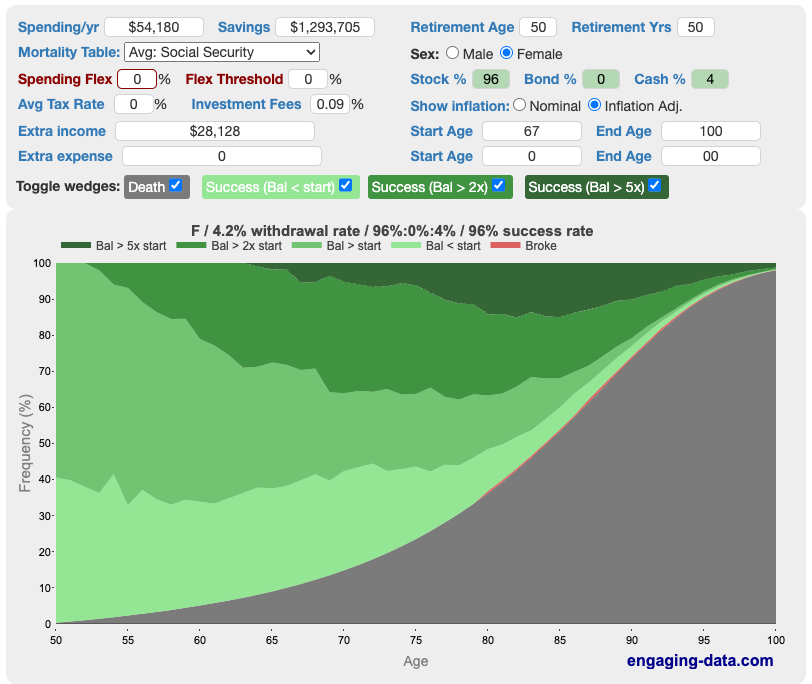

For fun, I ran a calculation through Engaging Data’s Rich, Broke or Dead calculator to see what would happen if Joe also fully retired tomorrow:

What we see here is that if Joe were to join Jane in retirement tomorrow, the couple has a 96% chance of success (in other words, of not running out of money before they die). That’s a pretty good chance of success!

This success rate is based on the variables of:

- Joe and Jane reducing their annual spending to a maximum of $54,180.

- Both of them retiring at age 50 and living to age 100

- Their current asset allocation of 96% stocks and 4% cash

- Joe beginning to take Social Security at age 67 at (an inflation-adjusted) $28,128 per year

- Jane not receiving any Social Security

- Neither of them working another day in their lives

In light of that, I’d say they’re in great shape! There are some caveats to this calculation, but it should give them the confidence that they have plenty of money invested for retirement and that, if they’re willing to reduce their spending, Jane doesn’t need to go back to work (and neither does Joe!).

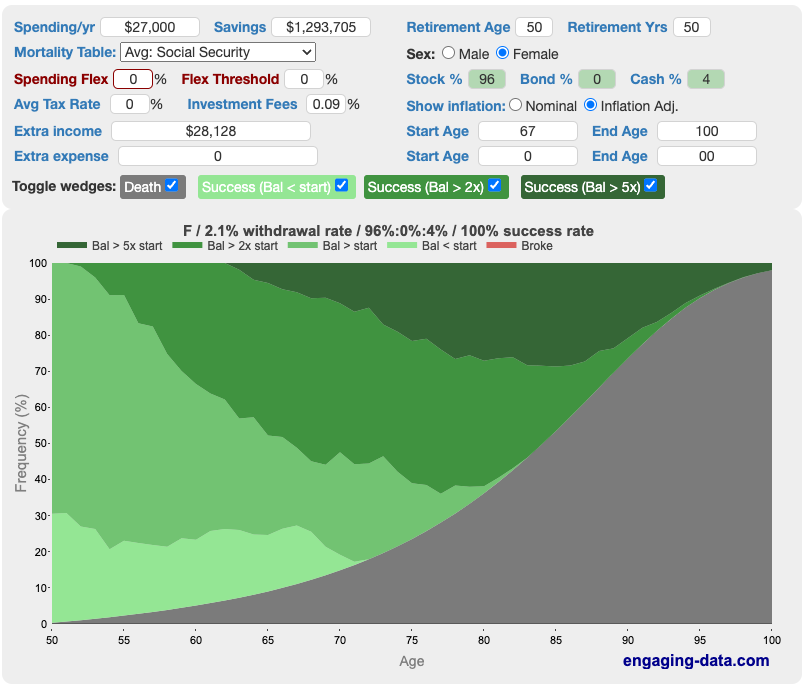

I’ll also point out that, if they reduce their spending even further–for example when they downside and eliminate their large mortgage payment–their success rate increases to 100%:

-

- They currently spend 27180 annually on their mortgage payment

- Without that, their annual spending could dip to a meagre $27,000!!!

Here’s the chart:

But Wait, Isn’t Most of Their Money Tied Up In Retirement Accounts?!?

Well, yes and also no. Jane and Joe have a lovely medley of accounts and they’re all governed by slightly different rules.

1) Jane’s 457b: $69,473

Note that you do pay taxes on your withdrawals, but this is usually fine because–presumably–by the time you’re withdrawing the money, you’re retired and thus, your income and tax rate are lower.

2) Jane and Joe’s combined Roth IRAs: $102,037

According to Charles Schwab, here are the rules for withdrawing prior to age 59.5:

You can withdraw contributions you made to your Roth IRA anytime, tax- and penalty-free. However, you may have to pay taxes and penalties on earnings in your Roth IRA.

Thus, Jane and Joe could withdraw the contributions they’ve made to their Roth IRAs, without penalty, at any time.

3) Jane’s IRA: $76,243

If more cash is needed, Jane can consider a backdoor Roth IRA strategy whereby you convert a traditional IRA into a Roth. This can be a very high tax event, so tread carefully.

How Would This Work?

Based on the low annual expense estimates above, this should carry them through to age 59.5, at which time they can begin withdrawing from their 401k and 403bs without penalties.

- Let’s say they wait for Joe to retire until they’ve downsized and eliminated their mortgage payment, bringing their annual expenses to $27k.

- They first spend down their excess $50,557 in cash (above their emergency fund, which at that point would need to be in the range of $6,750 to $13,500, which leaves $37,057), which’ll cover their expenses for 1.37 years.

- Then, they begin spending down Jane’s $69,473 457b, which’ll cover their expenses for another 2.57 years.

- We’re now at ~4 years, which means the couple is at least 54 (potentially older depending on when Joe retires).

- They can now look at withdrawing their contributions to their $178,280 in IRAs.

- And this amount will actually be a lot more since Jane should rollover her old 403b (which has $822,488 in it) into an IRA.

→I want to be clear that this is very “back of the envelope” math since we’re not taking a lot of variable factors into account. But, I hope that this points Jane and Joe in the right direction for future research if this is something they want to consider.

The Importance Of Diversifying Your Assets

- They currently have all of their investments in retirement-specific vehicles.

- 100% of these are invested in equities (with the exception of 1% of Jane’s 403b in bonds)

Both of these are good things to do–and to be clear, Jane and Joe have done an A+ job of selecting funds with very low expense ratios!

However, this falls under a “putting all of your eggs in one basket” investment approach. As with most things in life, diversification is a good thing. The easiest and most straightforward way for them to diversify would be to put money into a taxable investment account, which is invested in the stock market, but is not retirement-specific. With a taxable account, you’re not beholden to the rules governing retirement accounts.

In contrast to retirement vehicles (such as 401k, 403bs, IRAs, etc), taxable accounts:

- Have no limit on how much you can put into them

- Have no restrictions on when you can withdraw the money

- Are taxed (hence their name)

- Since they’re not through an employer, you can invest them in whatever you want (stock, bonds, ETFs)

- Do not have any required minimum distributions (RMDs), which means you can leave your money invested for as long as you want

→Since there are advantages and disadvantages to retirement and taxable accounts, it’s a good idea to have both.

They operate in different ways and thus can serve you in different ways and different situations. Forbes has this easy-to-understand article on taxable investment accounts if you’d like to learn more

When should you open a taxable investment accounts?

If you’ve already:

- Paid off all high-interest debt

- Saved up a fully-funded emergency fund (held in a checking or savings account)

- Maxed out all possible retirement accounts

- Don’t need this cash in the near future for a major purchase (such as a house)

Then… you can consider opening a taxable investment account!

I outlined above why you don’t want to keep massive amounts of cash on hand, and our last Case Study detailed short and medium-term investments to consider, such as: CDs, Treasury Bonds and Money Market Accounts. So today, let’s talk about this other, longer-term investment option: the taxable account. I can feel your enthusiasm already!!!

Where and How Do I Open A Taxable Investment Account?

- Choose a brokerage:

- This is the place through which you invest your money. For example: Fidelity, Vanguard and Charles Schwab are all brokerages.

- If you already have accounts (such as your 401k) with a brokerage, it’ll be easiest to open a taxable investment account with them.

- However, you want to first ensure that the brokerage you select offers low-fee funds.

- Choose what you want to invest your money in:

- Things to consider when choosing what to invest in:

- Your risk tolerance. Investing in the stock market is inherently risky. Would you be more comfortable with lower-risk, lower-reward options, such as bonds? Or higher-risk, higher-reward options, such as stocks?

- Your age. How soon are you anticipating withdrawing a percentage this money? As discussed in this Case Study, many experts consider 4% to be a safe rate of withdrawal.

- The fees associated with the funds you’re considering. High fees (called “expense ratios”) will eat away at your money over the years. DO NOT do that to yourself! For reference, the following three brokerages and funds are considered to be low-fee investment options:

- Fidelity’s Total Market Index Fund (FSKAX) has an expense ratio of 0.015%

- Charles Schwab’s Total Market Index Fund (SWTSX) has an expense ratio of 0.03%

- Vanguard’s Total Market Index Fund (VTSAX) has an expense ratio of 0.04%

- Wondering how to find a fund’s expense ratio? Check out the tutorial in this Case Study.

- Things to consider when choosing what to invest in:

Should I invest in individual stocks or total market index funds?

For me personally, I prefer a total market, low-fee index fund that matches my asset allocation needs and risk tolerance. The reason is that, in general, investing in a total market index fund gives you the broadest possible exposure to the stock market (as well as the lowest fees).

→In a total market index fund, you’re essentially invested in a teensy bit of every single company in the stock market, which gives you a ton of diversity.

If one company–or even one sector–tanks, your entire portfolio isn’t toast. It’s the “not putting all of your eggs in one basket” version of investing. It’s what I do, it’s what the vast majority of FIRE folks do and, best of all, it’s very, very easy to implement and maintain.

In addition to total market index funds, many folks like to have some of their portfolio in something like a total bond ETF, because bonds are a lower-risk (although also lower-reward) investment vehicle.

Is it Wise to Invest in Individual Stocks?

In my opinion, absolutely not. Why? because if that one company goes down, your investment plummets. If Apple or Amazon or Netflix or whoever has a bad quarter, you have a bad quarter. If you are instead invested across the entire stock market, companies can go bankrupt and your portfolio will still bob along with the broader stock market. Investing in an individual stock is “putting all of your eggs in one basket.”

I consider investing in individual stocks to be a hobby, not a financial strategy. If you really enjoy day trading and want to do it for fun, go right ahead! But I wouldn’t do it with money I need. In my opinion, it’s not much safer than going to a casino.

When Should You Use Your Taxable Investments?

I realize this is a lot to try and cover in one post, so I highly recommend the book, The Simple Path to Wealth: Your Road Map to Financial Independence And a Rich, Free Life, by: JL Collins, for anyone interested in deepening their knowledge around investing. It’s well-written and easy to understand.

This leads us very nicely (almost like I planned it… ) into:

Jane’s Question #6: Should our retirement accounts be moving away from equities, given our age? I realize there are many opinions on this, but I’d love to hear yours and what the hive mind thinks.

Let’s begin at the very beginning

What’s An Equity?

Equities, in this context, are the same as stocks. If you own stocks/equities, you own a piece of a company. As I noted above, stocks are generally considered to be more aggressive, but more rewarding. Conversely, bonds are considered to be less aggressive, but less rewarding.

It’s like a sliding scale of risk vs. reward. You, the investor, have to decide where you want to be on this scale.

- When you’re young and have many years before retirement, you want to be very aggressive in your investing. The idea being that you’ll be able to ride out the inevitable ups and downs of the stock market since it’ll be many decades before you need to withdraw any of this money.

- Then, as you near retirement, you want to titrate your risk/aggression to ensure that you don’t lose money if the market experiences a dip just prior to your retirement.

HOWEVER, as with all things, there are differing opinions on the wisdom of reducing risk (and consequently reward) in a portfolio as you age.

Vanguard has this nice chart, which allows you to search all of their funds according to risk level. As you’ll see, there are a number of different bonds and money market accounts one can choose from.

Similarly, Fidelity has this very helpful site outlining their various funds by risk level. It lets you look at different constructions of funds in a sample portfolio according to their risk level. As I noted above, diversification is good, which you’ll see reflected in Fidelity’s model portfolios. The most conservative portfolio they model includes a lot of bonds and their most aggressive has all stocks and no bonds. Then, there are a bunch of sample portfolios in between.

What Should Jane Do?

I’ll reiterate that diversity is a good thing. I personally am not 100% in domestic index funds because I like to play the field. I’ve got some international index funds (which you can buy right through your handy, dandy brokerage), I’ve got some bonds, I’ve got it all–even one solitary Bitcoin! The idea, here again, is to spread out the risk and not depend solely on one source or sector.

Rollover The Old 403b

Jane should also look into rolling over her old 403b into an IRA so that she can have full control over the funds she’s invested in.

Here’s how to do that:

- Call the brokerage (or do it online) that currently holds the 403b to ask about doing a “direct rollover” into a traditional IRA at another brokerage. Since Jane and Joe already have a lot of accounts with Fidelity, I assume that’s where she’ll want to put it.

- You’re likely not going to want to roll this into a Roth IRA because you’d then have to pay taxes on the full amount all in this calendar year (assuming that this 403b is not a Roth). If it is a Roth, it can only be rolled into a Roth.

- The new brokerage (Fidelity) will want to know what you want to invest your rollover IRA in.

I like this article explaining rollovers: Your Guide to 401(k) and IRA Rollovers.

Summary:

- Determine their top priority:

- If Jane wants to remain retired, she absolutely can. The family can reduce their spending to allow them to live easily on Joe’s salary.

- If Jane wants to return to work, she absolutely should.

- If Joe also wants to retire right now, he could!

- In this instance, the family would need to reduce their spending and also research some of the retirement vehicle-to-cash conversions I outlined above.

- This math gets even easier when they downsize and eliminate their large mortgage payment.

- They’d also need to research what their state offers for health insurance through the Affordable Care Act. The ACA is not a boogeyman and it’s a totally fine way to get your health insurance. It is, after all, what I do for my family. The challenge is that it is governed by each state and, as such, the costs and subsidies vary wildly by state. They can research this through their state’s ACA website.

- Look into diversifying their investments, potentially to lower-risk, lower reward avenues, such as bonds. Also consider opening a taxable investment account to give them more flexibility.

- Decide what to do with their enormous cash cushion:

- If Joe wants to retire now, they could use this to cover living expenses for awhile (and thus avoid withdrawing anything from their investments). If they go this route, they should move this money into a high-yield savings account so that they’re at least earning interest on it.

- If they don’t intend to use this money in the near future, they should look into a more profitable option for everything above their emergency fund, such as:

- Opening a taxable investment account

- Opening a short-term investment vehicle, such as a CD

Ok Frugalwoods nation, what advice do you have for Jane? We’ll both reply to comments, so please feel free to ask questions!

Would you like your own Case Study to appear here on Frugalwoods? Apply to be an on-the-blog Case Study subject here. Hire me for a private financial consultation here. Schedule an hourlong or 30-minute call with me here, refer a friend to me here, or email me with questions ([email protected]).

Totally agree with reducing the auto insurance. We don’t carry full coverage on our vehicles after they have a lot of miles. If you are in an accident, you have enough saved that you could replace the vehicle with a dependable used.

Just wondering if therapy has been explored. Just wondering if anxiety and adjustment is fueling the concerns. You look in great shape financially.

Best wishes and nice work getting to this point!

Thank you! Full coverage only costs about $100/year extra per car, so we’ve stuck with it. But it does seem a bit ridiculous given the age of our cars.

I have seen a therapist a few times, but more so do trauma related to previous job. Since I wrote in, I’ve been tracking our $ using YNAB, and it’s realistic helped my anxiety.

Congrats to Jane and her family! A question I have (for myself) but is raised by Jane’s case study: how to you account for future age-related increases in spending? How do you estimate that and factor that in? Thinking of my (extremely healthy) mom, she’s encountered things like a hip replacement and the PT you need afterward, major home repairs to her paid off house, down the road maybe in home help or nursing care, etc. I have trouble understanding how one factors that into their future calculations using current spending levels?

I would suggest making a plan to transition into more bond funds. When the market is doing well, equities certainly make you more, but as you approach retirement, you need to protect your gains with bonds. ( diversification again. ) Generally, speaking, in a downturn, bonds tend to lose much less. Just be sure the funds have very low expense ratios.

Good luck with everything!

Thanks for the advice and well-wishes!

Hi Emily, of course we can’t know for sure what our future expenses will be. We do know, however, that our biggest expense, housing, will be greatly reduced in the next 3-5 years. We’ve decided we’d rather assume we’ll have enough (which we think is likely) rather than trying to cover every “what if” scenario. I think everyone has to figure out what makes them able to sleep at night, and we’re comfortable with this.

Sounds right to me, Jane. I’m forever thinking people have some magic vault of knowledge I don’t have! Good luck with these transitions!

I just wanted to touch on her business ideas. She has three interesting ideas (the cooking for others definitely made me stop and think! In a good way.)

I homeschool my son, so I’m wondering if she has experience with homeschooling to help with her content idea. Homeschool is surprisingly different from typical public/private school, so if she’s not already familiar, I definitely recommend spending time getting to know homeschool families, culture, needs.

Hi Stephanie,

Yes—I did homeschool our daughter for part of high school. I was really frustrated by the lack of centralized resources. I still stay active on some homeschool FB groups, and I see several needs I think I could address with a well-designed website. But this idea is still very unformed.

If you have specific resources, you could post them on Teachers Pay Teachers. Just another option that may be lower lift than putting together and maintaining a website.

Jane, I really enjoyed reading your case study. In fact, it bore a very strong resemblance to me! I am 25 and looking down the path you have taken. I just finished my first year in a PhD program with the goal of becoming a professor.

However, I’ve been reflecting on this path. Family is my first priority. My husband and I are looking to have kids in the next couple of years, and we would like to homeschool them. Our main goal is to end up back in the Shenandoah Valley, homeschool our kids, etc. I am realizing that my investment in my PhD and the degree itself may actually hinder that primary goal.

My question is, when you look back, what is the advice you would give to your younger self? Do you think academia was conducive to your values or hurtful? The part where you said “it was clear my job was making it difficult for me to be the best parent I could be to my kids.” This is my big fear.

If that answer is too personal please don’t hesitate to email me instead.

Hi Madeleine,

Congratulations on finishing the first year of your PhD program! Grad school was SO hard but so intellectually stimulating ! I have so much to say, but I’ll point out a few things:

a) Whether you will be able to choose where you want to live will depend on how competitive academic jobs are in your field, as universities only hire faculty when they have an opening, and even then they often have very specific ideas of the type of scholar they seek. Academic jobs are really competitive in my field (50-100 applicants per position), so I had to take the best job I was offered after finishing school and then go back on the market 4 years later to move to a more desirable (near family) location and job.

b) The flexibility of academic jobs is excellent, but the workload is heavy. (My mentor always said you could work any 60 hours per week you wanted.). My husband stayed home with our kids until both were in school, which really let me focus on getting tenure and getting my career off to a good start.

c) Part of the burnout I felt, and my overworked-ness, was the job, but part of it was me. While you’re in grad school, learn to set boundaries, to find a work-life balance, and to really investigate what you want your career and life to look like (though it sounds like you’re already on this path!).

d)Universities and departments vary widely in their expectations and culture. Spend as much time talking to faculty from different universities as you can—try to get a sense of what their jobs and work-life balance are like.

Bring a professor was a rewarding job and I don’t regret it for a second. You get to be around smart and interesting colleagues, and eager and creative young people, and there’s a lot of autonomy and flexibility. The flexibility makes it easier for parents in some ways (school dropoff/pickup) but at the end of the day it’s still a full-time (plus) job.

I should note that I took a partial leave of absence to homeschool my daughter through part of high school …it wouldn’t have been possible for me to homeschool and work full-time.

I hope this is helpful. Best to you!

Kudos on your savings.

Ally and Discover bank offer similar high yield savings accounts, you don’t have to use American Express (though nothing against them).

I assume a “new” vehicle will need to be purchased in the future as both current vehicles have ~200,000 miles on them.

If the children continue to live at home and are employed maybe they could pay a bit of rent to help the family finances.

Was definitely thinking about a new vehicle. That is a big expense and it’s hard to find lower cost vehicles. 🙁 Plus some of their expenses are increasing for insurance, college, etc.

Just wanted to note that when they (like most people) pay off the mortgage, the monthly payment won’t go to $0. It might become an annual payment, but they will still have to pay property taxes and homeowner’s insurance, which are currently part of their mortgage payment/escrow. Jane notes that their principal is approaching $1000, so I take that to mean that the remainder of their monthly payment is equal to tax + insurance… so they would really only save about $12,000/year if they paid off the mortgage. Not saying it’s not still something to consider — just that the numbers aren’t quite as pretty as they might initially appear!

I was wondering about this too! I was so confused as to why the amount of principle was so low compared to the amount of the payment and the tiny interest rate. Great catch.

Noted! We do live in an area with very high property taxes, but our next home will be in an area with lower taxes.

Great job!!

My advice…

Both of your vehicles are up there in mileage, so you might need cars sooner than you think. And that includes cars for your one or both of your children.

You might want to go ahead and start working a part-time job, something that you love, to start saving for this car fund. This business venture might require some of your emergency cash. (Contracts written, supplies, etc.)

You can contact the Small Business Development Center in your area, which is usually associated with a university. They give free business advice, paid for by your tax dollars. They will help you iron out all of the details for one, or several, of the ideas that you are already considering. I used them when I opened my optometry practice in the new town that I moved to. They helped me write business plans, obtain loans, and get my employer, identification number, etc.

If you will learn how to lay tile, replace ceiling fans, paint perfect lines between the wall and the ceiling, and beautify people’s front stoops, you will be busier than you want to be! But again… You will probably want a rudimentary contract for those projects. And you may want to hire an assistant. This would be a great way for your daughter to make some money and acquire independence as your helper.

My mother pays someone to cook for her twice a week. I’m sure there are many older people in your area who would also love your cooking!

You are doing fabulously! My husband and I both retired at the age of 53 and our schedules have filled up quickly. Do what you love. Life is short!

Yeah as soon as i saw the mileage i was thinking “gonna need a new car soon”.

But considering they are literally millionaires, not a big deal!

Thanks for the great suggestions and well-wishes!

I’ve had a Honda Civic LX for 17 years and it has around 156k miles. My husband always says that if the engine goes it might be worth it to consider buying a new engine and have it put in, which would be cheaper than buying a whole new car. Since we’ve put so much money into maintaining this car, I think that’s a good idea. I think the max cost would be 3k? Even at 5k, it would still be cheaper than another vehicle. Just a thought! Great job on saving, you guys are financial goals for me and my husband!! 🙂

Just want to add one more thing to my comment above. Make sure you take time to exercise and strengthen your body. You might want to use the money from your side jobs to join the gym associated with your local Hospital. How well you take care of your body now will determine how well you age. My mother has learned this the hard way.

Hi Jane. Did not see you list your academic expertise. I know when I reached FI, I was burnt out in my engineering profession, so I looked for PT work in my hobby interests. After a few years of FI and soft retirement I discovered that the best way I could contribute to my family’s income was the intersection of my professional expertise + hobby interests..ie I PT work less and comand higher fees. If you would care to share your academic expertise, I bet this community would help you with ideas! Best of luck to you and yours. RJ

Question for Mrs. Frugalwoods: You write about the value of diversifying your assets by having a taxable brokerage account, but then write that people shouldn’t invest in taxable accounts until they can max out their retirement contributions. What about people who don’t make enough to max out their retirement accounts? Should they ever direct a portion of their retirement savings away from a retirement account and toward taxable for the sake of diversifying? For example, maxing out our 401Ks and IRAs would be 35% of our pre-tax income. I know some of your readers can do that easily, but – with taxes, health insurance, medical expenses, childcare, etc. – we can’t quite swing it. Let’s say we are saving 25% of our income right now. Would there be any benefit of doing 20% in retirement and 5% in taxable vs. all 25% in retirement? I know we really need to meet with a financial advisor, but I’m just curious what you think.

This is my question as well! Especially for an early retiree who may need non-retirement fund income for a number of years, seems like it might make sense to put money toward a taxable account even before, say, maxing out a Roth IRA (if you’re not able to do both).

I have seen other FIRE adherents talk about contributing to at least employer match in a 401k before investing in a taxable brokerage account. This allows you to receive your full compensation from your employer and also diversify the types of accounts that you’re investing in. I found a blog post by Tanja Hester (Our Next Life) about calculating how much you need to save in different accounts for each phase of your retirement. For my estimates I came up with one savings goal for the years before 59.5 and another savings goal for the years after that.

The amount/percentage of savings for each person will vary depending on their total income, expenses, age, amount already saved, etc. For someone who is over 50 with a large amount saved in traditional retirement accounts they may direct all additional investments (after employer match) to a taxable brokerage account over the remaining savings years. A younger person may direct a small percentage or even delay putting money into a taxable brokerage until they’ve reached a specific savings or income level.

Affirming that if you’re a public school teacher in a state that doesn’t pay into social security, you don’t get any social security benefit until your SS benefit is larger than your state public pension benefit, and then you would get the difference. (Prior to the windfall elimination program, teachers would benefit from the progressivity of SS because from SS’s viewpoint they were poor since they’d only paid in a small amount to SS and needed a larger percent of their income replaced.)

My husband is a teacher. In our state teachers do not pay into SS, so there is no circumstance in which he will get SS (he has taught his whole career and has never had a job that pays into SS). Some people have had or will have non teaching jobs in which they HAVE paid into SS and then they might be eligible for SS, but there’s still the WEP/GPO to deal with.

Same!

I didn’t see any mention of a pension for her. Generally those who don’t pay into social security have a government pension instead, which may be a significant source of future income. The statement that she won’t receive any social security due to WEP or GPO is another clue that there is a pension in her future (unless it was cashed out and paid into her 403b as a lump sum).

I agree the family is in pretty good shape financially. Though I’d personally be reluctant to suggest that he retire now with a $2,200 monthly mortgage payment still in place. Congratulations on your accomplishments and I hope you enjoy the lower stress life going forward.

My 403b is considered a pension under the WEP. I don’t fully understand why, but maybe it’s because the 403b is one of a few options, including a traditional state pension (which I did not choose to take).

If both retire early, they need to consider how to obtain health insurance for themselves and their children. Individual plans are hideously expensive. Everyone talks about the health insurance marketplace (Obamacare) but when I did the research there was a lot that didn’t get covered for hospital type emergencies and ongoing care. So grateful for Medicare.

I have been on ACA for health insurance for most of the last decade and have gotten a great subsidy and all the coverage I needed. If they only need to withdraw enough to get around $50K in MAGI then they will get a decent subsidy and maybe even a little cost sharing. They would have to research that themselves based on their unique position but it should be manageable. For some of us, Medicare will be a big increase in medical costs.

We went on ACA plans for a while when I became a contract employee. While the premiums were a bit more expensive than what I was previously paying through my work (about $150 more per month for our family plan) the coverage was excellent even with an HSA eligible plan. MUCH, MUCH better coverage than my old work plan. I was very grateful for the ACA. (I’m also in New York State which may prioritize the quality more than other states.)

I thought I would share my health insurance costs to add to your potential monthly expenses. My husband is on Medicare but I am not, but am eligible in 6 months. I work a part time job without health insurance benefits. I am self insured, currently paying $1800 per month for myself and my 19 year child. Since my husband still works, making good money, we are not eligible for an Obamacare subsidy. I think the income ceiling to get a subsidy is a bit over $50,000. You would need to carefully consider the cost of insuring your entire family, should your husband choose to retire early. While healthcare costs are deductible, they are still a big annual cost.

Their current income to spending ratio is not as bad as posted. There is no way they are paying $708 in taxes on $3200 per paycheck of income for a couple filing jointly with a dependent. That would be over 22% in taxes for a total of over $18K/yr. His income put their top tax bracket at 12% then they get a big deduction for having a dependent. They probably don’t pay more than $5K/yr in taxes after all is settled at tax time. That gives them enough to cover their expenses on just his income. Even without that I don’t think she needs to go back to work at all if she doesn’t want to. She has amassed almost a million in savings so I would say she did her part. He could continue working until she reaches age 55 when she is able to withdraw from her main savings penalty free. Unless he is planning to work until 60 because he is eligible for a pension at that age there is no reason he needs to work that long. Nothing wrong with her starting a small business if she really wants something to keep her busy or for him to work to 60 if he likes his job but there should be no NEED for them to work that long.

Thanks for the insights. His paychecks have health insurance and 401K taken out. Also, this is our first year without 2 incomes, so we might need to adjust witholdings?

Congrats on being in a good place and downshifting. A few questions and suggestions com to my mind.

I do not see anything in here about college for children. Are your kids planning on college? Are you planning on paying? Are they going into the military or community college system? Do you have tuition benefits from your former job?

I know for my family, saving for college has been a significant line item in our budget.

Seconding the suggestions for exercise for you and therapy for your daughter.

For me, this proposed budget would run too lean and I would look for work so I could have money for tennis balls, yoga classes, running shoes, concerts, a new iPad if needed, etc.

Work: consider leveraging your experience as a college professor and charging a lot as a tutor, essay reader, etc. for high school students.

We’re in good shape for the kids’ college, so we didn’t include it here. My daughter does work hard on her mental health and I’ve been getting better at focusing on my physical health…I do appreciate the suggestions!

Two areas that raise questions: 1. The next vehicle, and possibly two of them. 2. Is there any potential college plans for either child, and if so, plans for you to pay at least some of that cost.

You guys have done an amazing job, Jane! A few tweaks will make the day-to-day income more secure. I would definitely pursue part-time work, at whatever point you feel ready, doing something you love (that cooking possibility sounds like a strong interest point). That will shore up your income for unexpected expenses. Also take a look at the health insurance options in your state. There may be something better available for less money.

Bravo!

Thanks, Nancy! College is covered for both kids. A new vehicle is definitely in our future, but we’re hoping to hold out for a few years as neither of us has a commute.

Jane, would you be open to working as an adjunct professor at your former college? This would bring in some income & you may only need to work a couple of days a week.

You guys are killing it! Congratulations!

Not interested in adjunct work…typically pays only about $3K per course and for that I’d rather try something new 😉! But tutoring might be an option.

Ally Bank is now paying .0415 for Money Market Accts. That would be a good place to park their cash, and it is available any time.

I am also confused about no pension?

See above.

Really interesting case study ( I am also a female academic), I would suggest Jane’s income potential leveraging off her professional experience is likely to be significant but completely understand that alternatives might be much more attractive. I am UK based and can make side income by undertaking reviewing/guest lecturer activities (for overseas institutions), examining ( at UK Institute different to my main employer), and could take on part-time teaching or supervision of students. One option here is we have several remote/evening universities (eg the OU) that specialise in mature students. The part time teaching staff work fully remotely and on a flexible schedule.

Best of luck

Hi Effie,

Interesting to see a few academics here! I am not really interested in part-time teaching gigs because of the low pay (doesn’t seem worth it to me). I have considered that in a few years I could look into visiting professorships as a way to see the country.

Great case study, but I just a quick skimming! I missed captures on each picture though :-(. Is that a cake in one photo?! If so, what kind?

I’m going to save this study for a more thorough reading later because it’s very close to our situation. We are super close in age (+/-2 years). We have HS teens too. I’m also a SAHM after being laid off last year without missing corporate life AT ALL and hoping to never go back. My spouse would like to quit as soon as our younger child graduates HS (so in 3-5 years).

Sorry, I didn’t read the above comments, but I have a few of questions:

– Won’t Jane qualify for any pension as a professor or did I miss this important information?

– I don’t understant SS when people don’t pay in, so I’m curious here. Could Jane qualify for a half of Joe’s SS after he files for his SS benefit? I kind of imagined that their situation would be similar to a SAHM who NEVER worked and hence never paid SS taxes or do spouses who work and NOT pay SS taxes get penalized and don’t qualify to claim 50% of their spouse’s SS benefit?

– Would Jane qualify for Joe’s 100% SS survivor benefit if he predeceases her?

– I didn’t see much written about one child who’s 100% at home though a young adult. Unless there are special needs involved, does the child have intentions to become idepenendent or begin college?

– Could you divulge the state they live in?

Their finances are doing great as long as clowns in Washington don’t do anything too crazy and the hard work savings of everyone start tumbling (I’m not referring to recessions or usual market forces here).

Oh yeah, having a productive schedule at home is a bit of a challenge to me too as if I’ve become very slow. But then I reflect of contributing 100% energy to my corp. work and then attempting to contribute the same energy to the domestic life left me exhausted almost constantly. Now I feel much better and strive not to be too hard on myself. I earned it after 20+ years of hard work. It’s especially wonderful that I can exercise in the mornings after all are out of the house and I don’t need to rush anywhere after my show. I appreciate and pray it continues like that because life can sometimes change in a blink of an eye.

I was looking at that as well, and wondering where the pension from the WEP was. It could be that it is deferred until 65, in which case it should be counted like social security. If it had to be cashed out in order to retire this early, then that is a real pity. In that circumstance I would probably try to take FMLA or a sabbatical for awhile to avoid losing the pension. In just 2-3 years the kids may be out of the house and working could feel a lot easier.

I would plan on getting a new car when one of their kids gets their license. So that the teenager can drive the old car. Much easier to learn to drive on something that doesn’t matter if it gets scratched up.

Hi S&M,

-That is a cake we made during quarantine based on a Christina Tosi online class–it was definitely worth it if you’re interested in baking! -Although I have a 403b, it’s somehow considered a pension in the eyes of the government (maybe because I had the option of either the 403b OR the state pension?). Nonetheless, I will NOT be able to draw off my husband’s SS and unless I get a REALLY high paying job in the future, won’t qualify for SS b/c of the WEP (even though I paid in while faculty at a different university for a few years early in my career).

-Our young adult who lives at home does have some special needs. We suspect she will live at home for several years at least before (hopefully) launching.

-YES to the “contributing the same energy to the domestic life”. By dinner time, I’m often exhausted from all of my “little projects” 😉

Thanks!

My husband fell under the WEP also. The folks at our local SS office and those on the phone were clueless about the WEP. We were told so many different things by several people. Finally a financial planner told us he could get half of my SS amount each month. And that is what he gets. Better than nothing. We have been happily retired for several years.

Hi Nancy,

I was told otherwise (about half the SS). I definitely need to look into that!

Jane

+1 I agree this is worth researching more. A few more articles that may help:

https://www.weareteachers.com/collect-pension-social-security/

https://www.ssa.gov/benefits/retirement/planner/gpo-calc.html

This is not related to the question but can the font (for comments) be darker as in true black? Its very hard to read because it appears grey on a white background.

Thank you!

agree!!

Agree, I’m also having trouble reading it

Yes! And the comments are a super small font size as well. I always read them at 110% and it’s still not a great experience

Two quick comments (sorry if already mentioned). If the driver you are adding in June is your teenage son, your car insurance cost is going to increase significantly. And it sounds like you have a leak in your sprinkler system (exorbitant water bill.)

Agreed, my husband and I added our teen driver and his vehicle (a 2010 accord with 100,000 mi) and it DOUBLED our policy for the past two years

Hi Greta,

-I’ve looked into the cost to add our son, and it’s actually not too bad. This is a perk of driving ancient cars!

Jane

A friend of mine has a side hustle of prepping individual meals for a number of regular customers (typically workday lunches). She makes 3 different meals each week (everyone gets the same set of meals). She makes about 100 meals a week and spends Sundays cooking. It could certainly be done on a smaller scale. She has two boys who help her with chopping, etc. Her customers pick up their meals on Sunday evenings.

Hi MaryP,

That’s SO inspiring!

Jane

There was someone that did similar in my area and had success with it, my stepmom bought meals from her pretty regularly before retiring! Instead of each customer getting the exact same meals, she would publish a menu the week before with the options for the upcoming week (usually 3-4 selections) and then you had until a certain day to place your order (if I recall correctly she sent the menu out Monday or Tuesday, orders were due by Thursday and you received the meals on Monday or Tuesday of the next week). These were done more as family style meals versus individual meal preps, but I think either way could work. I think there is benefit to not having too large a menu to prepare but also giving the customers some flexibility. Personally I think the flexibility part is crucial – for example I HATE peppers. If there were 3 meals for the week and it was an all or nothing package…. I would skip the week entirely if one included peppers! But if I could buy just the other 2 I likely still would. Just food for thought! I think this service is a great idea.

I think the “trick” is to find your niche. That could be affluent working people, the elderly, workday lunches or other niches I’m not thinking about.

As pointed out in the article, accelerating house payments would be a good idea. Especially given volatile market returns right now and their age and approaching retirement. Benefits include not paying more in interest than they would if they pay off on the loan’s original schedule, owning their house outright and reducing that expense, and having a guaranteed return on that money equal to the loan’s interest rate.

I disagree with this advice. Given their extremely low interest rate and the significant amount of room they still have to add to their retirement accounts, their dollars are better spent increasing their retirement contributions and giving themselves flexibility later down the line.

In some ways this case study is very close to my life–same age, career, and we even owned the same car (the 2007 Fit)! And that latter point is my only suggestion: do not expect that you will get $2500 in trade-in value for that Fit. We just traded ours in and, despite it being in good condition, the dealer would only offer us $500 with the intention of scrapping it for parts. We sold it privately for $1200, but that is half the blue book value for this vehicle.

It seems clear that you need to primarily focus your attention on your children for the next few years to help them launch. With the financial analysis showing that you are presently @ a 10K loss/year, a part-time job would eliminate your concern about a job gap & shore up family expenses @ the same time.

FI does not require RE. You & your husband have the option to continue part-time or full-time work for many years, opportunities to contribute to both retirement plans & taxable investments for many years, & push SS to the maximum of 70 to fully maximize monthly benefits. Food for thought.

Looking more closely @ assets, is it possible for Jane to convert her rollover IRA into her Roth IRA? Mrs. Frugalwoods also discussed this option.

Most of their retirement plans (403b, 401k & traditional IRAs) will be taxable in retirement. Roth IRAs are the best thing since sliced bread as they are non-taxable in retirement. Perhaps this could be a strategy once Jane’s cash flow is boosted with a part-time job, in order to cover the cost of extra taxes to do the conversion over the next few years. Again, food for thought.

I love these reader stories and loved reading about theirs as they are well and truly doing the right thing. Being a stay at home parent is a very valuable career and even though their kids are late teens one in school and one out of school you are needed to be around even more even though they would have you believe they are confident young adults who can make decisions on their own. I love that you are going to get into the veggie gardening as it is such a joyful thing to do and when you pick home grown lettuce or herbs honestly it brings great happiness and so healthy without pesticides. Family dynamics have certainly changed over the last few years due to “C” with more people working from home. My friend is a stay at home Mum and used to have the house to herself and now her husband and 19 year old are at home all the time. It certainly is different having the place to yourself to potter, cook, clean and grow veggies and then the family coming home to dinner. As for working part time could you do “consulting work” in your field of expertise or create an online course for an area that you are always teaching/doing. You mentioned you have a mortgage, not sure what your interest rates are and if you have access to open an “offset account” for your cash. So if your mortgage is $175,000 and then the “offset” account has $50,000 in it your interest calculations are only based on $125,000 all the while having your cash available to take out should an emergency happen. Alternatively if your bank doesn’t do an offset account can you put the money into the mortgage that has a “redraw facility” so essentially it’s the same thing your loan is reduced but you can still pull out the money. You would have to see if there are any penalties for putting the money in and taking it out. Downsizing and owing a home outright is a great idea when the time comes. Loved reading your story. Kathy, Brisbane, Australia

(Apologies if this posts in duplicate) I can’t believe I’m going to say this, but I actually disagree with Mrs. Frugalwoods?? Specifically, about where to put new contributions + how to diversify them. More below:

1) A ‘backdoor IRA’ isn’t the same as converting an old traditional IRA to a Roth IRA today. A backdoor IRA is within the same contribution year and is *not* a taxable event. Since you can no longer contribute to your 403b and you’re well below the income threshold for Roth IRA contributions, I don’t see any need to backdoor here.

2) If you need to bridge the gap before your 403b is available, I would put your $ in the Roth IRAs since you can withdraw contributions penalty-free. You each have $7,500 of space, since you are 50+ and can contribute to a spousal IRA since you don’t have earned income, but Joe does.

3) Since you only have 5 years of gap-bridging, the 401k is still valuable tax-advantaged space. Assuming Joe is 50+, he can contribute up to $30,000/year. I strongly recommend using up your tax-advantaged space first before considering a taxable account, both for the tax benefits but also for the simplicity it provides. You can also read about the Roth Conversion Ladder, which again avoids taxable events.

4) As many commenters have already pointed out, you’re due for new cars soon, plus you may have moving and healthcare costs. As such, I would not touch your cash reserves – it will help you SWAN (Sleep Well at Night).

5) I strongly agree with your thought to move away from the HDHP + HSA to a PPO with an FSA. While this will lower Joe’s take-home, it will reduce a huge line-item in your expenses and allow you to purchase lots of items (including OTC) with pre-tax dollars.

6) My biggest disagreement with Mrs. FW is that the diversification of account type = / = asset allocation diversification. This should be happening inside the tax-advantaged accounts, most especially because you can buy/sell within your 403b/401k/IRA without a tax bill (unlike a taxable). I recommend moving Joe’s 403b and Jane’s rollover IRA to closer to 65% stocks / 35% bonds. (You can accomplish this asset allocation shift in the Roth IRAs by just making new contributions Bonds.) I recommend reading about the Bogleheads 3-fund portfolio, plus folks on the forum can give you good advice if you post a portfolio review.

7) From my research, you should still be entitled to take spousal Social Security off Joe’s employment record. There will be a WEP reduction, but it shouldn’t be $0. Given the lifetime value, I recommend digging in a bit further.

Next steps summary:

*Sell portion of FNILX in 403b and FZROX in Rollover IRA and buy FTBFX (Total Bond Fund)

*Research Social Security

*Max out Roth IRAs for 2023

*If possible, contribute more to Joe’s 401k

*During open enrollment, switch to PPO with FSA

Best of luck!

Sarah

Thanks for the detailed suggestions, Sarah!

I agree with all this advice, except contributing more to Joe’s 401k. I would only do up to the match, as you’re doing now, and put any remaining savings into Roth IRAs or the emergency fund. Actually, I’d vote for the emergency fund first b/c you may want to bump up your savings for new cars.

If it were me, I’d focus on your asset allocation ASAP. Being in 99% stocks is very risky! Eventually getting to 65/35 would be great. You might also check if consolidating any of the retirement accounts is possible for easier management.

Is your estate planning/beneficiary info all up to date? That’s important for you guys.

Thank you for sharing your lives in this case study! I found it very inspiring to read a story where the wife’s career was put first, and then you switched.

I think you should have some type of part time work, even a “hobby” that brings in an income. You are only 50 with possibly that many more years to live. You have done a great job, but you have a large mortgage payment and spend 10K more a year than earned. Maybe once this house is sold and you downsize, to a paid off house, that would be the time to fully retire. You have worked hard, and deserve to cut back, but just find something that you enjoy that can bring in some money.

I think one big issue with whether or not Jane’s husband can retire earlier than their 9 year plan is the teenaged children. Children can stay on a parent’s health insurance until age 26. The financial calculator didn’t take into account higher expenses for healthcare if Jane’s husband retired earlier than planned. We are FI, I am RE. DH’s work plan involves retiring by the time our youngest turns 26, depending on whether or not they have health insurance through an employer prior to that. Now, our situation may be a little different, as DH’s employer pays 100% of our healthcare premiums, so we only have copays and deductibles. DH will be nearly 58 if he works all the way to the 26th birthday, which seems likely based on educational goals.

What is the plan to pay for higher education? We chose to gift our children their undergrad tuition; our oldest just graduated and our youngest has another year. Both want to go to grad school. We decided that the way we can help with that is allowing them to live at home — they will need to choose programs that cover their tuition. The oldest is applying to PhD programs and is certain to get a fully funded position. The youngest wants to get a Masters and will possibly be able to get a TA position as the local state school they attend doesn’t offer PhDs and thus doesn’t limit teaching assistantships to PhD candidates. Another plus is that graduate students don’t have their financial aid calculated based on parental income and investments. But regardless, we will most likely be providing living expenses. If someone had told me when they were teenagers that we would still have them living at home into their mid-to-late 20s I would have scoffed, but it’s just the reality in a HCOL area with housing shortages and high rents — I’ve seen this be true even for my friends whose children didn’t choose university educations. Will Jane be able to downsize the family home if the children are still living with them?

As for generating extra income, I would look for something that provides good profit for the amount of time it takes to earn it. I cook every night and I would not be a paid cook for other people. There isn’t enough profit after considering the price of ingredients and the amount of time needed. However, I am also a good baker, and bake a smashing sourdough sandwich loaf that many people have offered to pay for. Bread isn’t super hands on, and the ingredients per loaf are low compared to how much people will pay for it. Where I live, there is plenty of sourdough available at farmers markets, but no one bothers with a soft sourdough sandwich loaf. I’m not going to pursue this (cottage food laws would require my pets not have access to my kitchen, which doesn’t work for where the door is), but offer it up as a suggestion. I also knew a teenaged girl who baked bread as a business when she was a young teenager, and she made enough money to buy herself a nice used car when she turned 16.