What’s a Reader Case Study?

Case Studies address financial and life dilemmas that readers of Frugalwoods send in requesting advice. Then, we (that’d be me and YOU, dear reader) read through their situation and provide advice, encouragement, insight and feedback in the comments section.

For an example, check out the last case study. Case Studies are updated by participants (at the end of the post) several months after the Case is featured. Visit this page for links to all updated Case Studies.

Can I Be A Reader Case Study?

There are four options for folks interested in receiving a holistic Frugalwoods financial consultation:

- Apply to be an on-the-blog Case Study subject here.

- Hire me for a private financial consultation here.

- Schedule an hourlong call with me here.

→Not sure which option is right for you? Schedule a free 15-minute chat with me to learn more. Refer a friend to me here.

Please note that space is limited for all of the above and most especially for on-the-blog Case Studies. I do my best to accommodate everyone who applies, but there are a limited number of slots available each month.

The Goal Of Reader Case Studies

The Case Study series began in 2016 and, to date, there’ve been 100 Case Studies. I’ve featured folks with annual incomes ranging from $17k to $200k+ and net worths ranging from -$300k to $2.9M+.

I’ve featured single, married, partnered, divorced, child-filled and child-free households. I’ve featured gay, straight, queer, bisexual and polyamorous people. I’ve featured women, non-binary folks and men. I’ve featured transgender and cisgender people. I’ve had cat people and dog people. I’ve featured folks from the US, Australia, Canada, England, South Africa, Spain, Finland, the Netherlands, Germany and France. I’ve featured people with PhDs and people with high school diplomas. I’ve featured people in their early 20’s and people in their late 60’s. I’ve featured folks who live on farms and folks who live in New York City.

Reader Case Study Guidelines

I probably don’t need to say the following because you all are the kindest, most polite commenters on the internet, but please note that Frugalwoods is a judgement-free zone where we endeavor to help one another, not condemn.

There’s no room for rudeness here. The goal is to create a supportive environment where we all acknowledge we’re human, we’re flawed, but we choose to be here together, workshopping our money and our lives with positive, proactive suggestions and ideas.

And a disclaimer that I am not a trained financial professional and I encourage people not to make serious financial decisions based solely on what one person on the internet advises.

I encourage everyone to do their own research to determine the best course of action for their finances. I am not a financial advisor and I am not your financial advisor.

With that I’ll let Anna, today’s Case Study subject, take it from here!

Anna’s Story

What feels most pressing right now? What brings you to submit a Case Study?

I am completing my master’s degree in education, which is tied into my teaching licensure program. I currently have debt that I would like to have repaid in about ten years. Ideally, I’d like to repay my credit card debt even sooner. I would like to have an emergency fund, but never seem to be able to find the money to put into it. Right now, I feel underpaid for the work that I do. I feel that with no children or pets of my own, and with me looking for a higher-paying teaching job for next year, now’s the time to take charge of my finances. I’ve felt overwhelmed by the best way to approach them. I’d like to find a more cost-effective way to manage everything.

What’s the best part of your current lifestyle/routine?

I love the flexibility of being single! I love that I am able to go on short day trips on the weekends and not have to worry about baby-sitting or pet-sitting. I like not having to worry about house repairs (that’s the beauty of renting–my landlord takes care of all that!). As a teacher, I enjoy my summers off as they enable me to pursue other things. In the future, I would like to travel for extended periods of time, most likely during the summer months.

What’s the worst part of your current lifestyle/routine?

My current workplace. Over the past year, things have become toxic with changes in the school administration and an increased workload without compensation. This is taking a toll on my mental health. I am so exhausted at the end of the day (between working full-time and going to school part-time) that I do not have energy for much else, including a social life. I’m hoping that a different work environment and a different student population (such as in resource special education) will be a better fit for me. When I’m finished with graduate school in August, I’m hoping I’ll have more of a social life plus more money to pay off my debt.

Where Anna Wants to be in Ten Years:

- Finances: debt free.

- Lifestyle: similar flexibility to that of being single; however, a special someone would be nice.

- Career: well-established in the education field.

Anna’s Finances

Income

| Item | Net Amount Per Month | Notes |

| Special Education Teaching | $2,200 | Deductions:

American Fidelity Life Insurance $30, Teacher’s Retirement System $158, Medicare $25, Union Dues $35, Equitable Annuities Retirement $50, Total: $298 |

| Parental support | $700 | My parents have been very, very generous in helping me out. |

| Part-time job (in retail) | $500 | This varies by month |

| Monthly subtotal: | $3,400 | |

| Annual total: | $40,800 |

Debts

| Item | Outstanding loan balance | Interest Rate | Loan Period/Payoff Terms | Monthly required payment |

| Student Loans | $79,000 | 4% interest | 10 year teacher loan forgiveness | Not sure-I’m on the income driven repayment plan; loan payments are on hold until August. |

| Capitol One | $9,500 | 19.49% | $291; I pay $425 | |

| Chase Visa | $3,500 | 19.49% | $88; I pay $150 | |

| PayPal credit | $3,225 | 26% | $60; I pay $150 | |

| Loft store card | $2,200 | 29.24% | $72; I pay $150 | |

| Target Card | $1,850 | 27.15% | $60; I pay $150 | |

| Store Card #2 | $1,835 | 30% | $50; I pay $150 | |

| Store Card #1 | $1,120 | 30% | $50; I pay $150 | |

| Total: | $102,230 | $671; I pay $1,325 |

Assets

| Item | Amount | Notes | Interest/type of securities held | Name of bank/brokerage | Expense Ratio | Account Type |

| IRA | $6,032 | IRA account | Wells Fargo | Not Sure | Retirement Investments | |

| Workplace Retirement Account | $2,150 | Employer-sponsored retirement account | American Fidelity | Not Sure | Retirement | |

| Checking Account-Local Bank #1 | $300 | Local Bank | Not Sure | Cash | ||

| Savings Account-Local Bank #1 | $105 | Local Bank | Not Sure | Cash | ||

| Checking Account-Local Bank #2 | $100 | Local Bank | Not Sure | Cash | ||

| Savings Account-Local Bank #2 | $50 | Local Bank | Not Sure | Cash | ||

| Total: | $8,737 |

Vehicles

| Vehicle make, model, year | Valued at | Mileage | Paid off? |

| Nissan Altima 2013 | $9,000 | 130,000 | Yes |

Expenses

| Item | Amount | Notes |

| Credit Card Payments | $1,325 | |

| Groceries/Household Supplies/Classroom Supplies/Prescriptions | $700 | Varies; seems like my classroom is a never-ending expenditure |

| Rent | $525 | |

| Clothing/shoes/accessories | $200 | Some months are more than others. This is my average. |

| Electricity/gas | $150 | Differs each month; this is the average |

| Gas for car | $150 | |

| Singing lessons | $100 | |

| Internet | $63 | Monthly Amount |

| Dance classes | $60 | |

| Restaurants | $50 | Includes coffee shops |

| Subscriptions (Hulu, Disney +, Discovery +, HBO Max) | $50 | |

| Haircuts/color | $40 | Average each month; I recently learned how to cut and color my hair. I go to the salon every other month. |

| Medical co-pays and prescription medication | $40 | Yearly Average |

| Gym membership | $31 | |

| Renter’s Insurance-State Farm | $9 | Rental Insurance |

| Cell Phone-Verizon | $0 | I’m under my parents’ plan; they pay it for now. |

| Car Insurance-State Farm | $0 | I’m under my parents’ plan; they pay it for now. |

| Monthly subtotal: | $3,493 | |

| Annual total: | $41,916 |

Anna’s Questions for you:

- What are the most cost-effective ways for me to manage my finances?

- What non-teaching areas in education can former teachers enter into?

Liz Frugalwoods’ Recommendations

Income Vs. Expenses

As I’m fond of saying, there are only two major variables in our financial lives: what comes in and what goes out. These are the two variables we can most easily adjust and in Anna’s case, I suggest she focus on both variables.

Income

Anna noted she’ll be completing her master’s degree and then will look for a better-paying job. That sounds like an excellent plan. She’s correct that she’s just not being paid enough–and especially not enough for the important, challenging work she does. I’ve said it before and I’ll say it again: WE SHOULD PAY TEACHERS MORE. Teachers do one of the hardest jobs under some of the toughest circumstances and they are not paid enough. Full stop. Since Anna’s already in process on finding a higher income, let’s turn our attention to variable #2.

Expenses

Lucky for Anna, she has very low fixed expenses!

Anytime a person wants to spend less, I encourage them to define all of their expenses as Fixed, Reduceable or Discretionary:

- Fixed expenses are things you cannot change. Examples: your mortgage and debt payments.

- Reduceable expenses are necessary for human survival, but you control how much you spend on them. Examples: groceries, gas for the car, utilities.

- Discretionary expenses are things that can be eliminated entirely. Examples: travel, haircuts, eating out.

Let’s take a look at how Anna’s expenses break down between those three categories as well as my proposed new spending amounts:

| Item | Amount | Notes | Category | Proposed New Amount | Liz’s Notes |

| Credit Card Payments | $1,325 | Fixed | $1,325 | We’ll discuss this in a moment. | |

| Groceries/Household Supplies/Classroom Supplies/Prescriptions | $700 | Varies; seems like my classroom is a never-ending expenditure | Reduceable | $450 | I suggest Anna break out these categories so she can get a better sense of what she’s actually spending in each. This is a pretty big catch-all at this point. |

| Rent | $525 | Fixed | $525 | This is so nice and low!! Wohoo! | |

| Clothing/shoes/accessories | $200 | Some months are more than others. This is my average. | Discretionary | $0 | This needs to be eliminated while Anna’s working towards her goals of being debt-free and having an emergency fund. |

| Electricity/gas | $150 | Differs each month; this is the average | Reduceable | $65 | This reduction won’t be easy, but I encourage Anna to investigate energy saving around her home. One method is to use a killowatt monitor to see which appliances are using the most electricity. Many public libraries have them available to borrow. |

| Gas for car | $150 | Reduceable | $65 | ||

| Singing lessons | $100 | Discretionary | $0 | This needs to be eliminated while Anna’s working towards her goals of being debt-free and having an emergency fund. | |

| Internet | $63 | Monthly Amount | Fixed | $63 | |

| Dance classes | $60 | Discretionary | $0 | This needs to be eliminated while Anna’s working towards her goals of being debt-free and having an emergency fund. | |

| Restaurants | $50 | Includes coffee shops | Discretionary | $0 | This needs to be eliminated while Anna’s working towards her goals of being debt-free and having an emergency fund. |

| Subscriptions (Hulu, Disney +, Discovery +, HBO Max) | $50 | Discretionary | $0 | This needs to be eliminated while Anna’s working towards her goals of being debt-free and having an emergency fund. | |

| Haircuts/color | $40 | Average each month; I recently learned how to cut and color my hair. I go to the salon every other month. | Discretionary | $0 | This needs to be eliminated while Anna’s working towards her goals of being debt-free and having an emergency fund. |

| Co-Pays and prescription medications | $40 | Yearly Average | Fixed | $40 | |

| Gym membership | $31 | Discretionary | $0 | This needs to be eliminated while Anna’s working towards her goals of being debt-free and having an emergency fund. | |

| Renter’s Insurance-State Farm | $9 | Rental Insurance | Fixed | $9 | |

| Cell Phone-Verizon | $0 | I’m under my parents’ plan; they pay it for now. | Fixed | $0 | If Anna goes off her parents’ plan in the future, she should get onto an MVNO, which’ll cost her ~$15 a month. |

| Car Insurance-State Farm | $0 | I’m under my parents’ plan; they pay it for now. | Fixed | $0 | |

| Current Monthly subtotal: | $3,493 | Proposed Monthly subtotal: | $2,542 | ||

| Current Annual total: | $41,916 | Proposed Annual total: | $30,504 |

What I’ve proposed here is a very austere, bare bones budget and I’m not saying it’s going to be fun. However, at Anna’s current income level, and with the amount of debt she has, this is her only option. One outlet Anna might consider is the age-old tactic of barter and trade. For example: could she offer to staff the desk at the dance studio in exchange for free classes? Could she clean her voice teacher’s house in exchange for free lessons? Could she tutor her hair stylist’s kid in exchange for free haircuts? The possibilities are endless! Check out this post for a whole host of ideas: How Barter and Trade Enhances Frugality and Community

This Can Be Temporary

Anna can consider adding luxuries back in once she:

- Pays off all of her high-interest credit card debt

- Saves up an emergency fund

- Can easily afford her monthly student loan repayments

- Increases her retirement contributions

- Finds a higher-paying job

- Is able to stop receiving financial support from her parents in the form of cash, car insurance and cell hone coverage (unless this is a longterm arrangement with her parents)

Debt Payoff Plan

Let’s turn our attention to what Anna should do with the extra money she’s going to save every month. The worst thing about debts are their interest rates. Every month that you don’t pay off high-interest debt, you slip further and further into debt. Anna needs to stop this downward spiral as soon as possible because it has the power to balloon into something worse. The interest rates on her credit cards are eye-wateringly high and I strongly encourage her to focus all of her financial energy on paying them off.

Since interest rates are the real killer with debt, I’ve sorted Anna’s debts according to their interest rate:

| Item | Outstanding loan balance | Interest Rate (highest first) | Loan Period/Payoff Terms | Monthly required payment |

| Store Card #1 | $1,120 | 30% | $50; I pay $150 | |

| Store Card #2 | $1,835 | 30% | $50; I pay $150 | |

| Loft store card | $2,200 | 29.24% | $72; I pay $150 | |

| Target Card | $1,850 | 27.15% | $60; I pay $150 | |

| PayPal credit | $3,225 | 26% | $60; I pay $150 | |

| Chase Visa | $3,500 | 19.49% | $88; I pay $150 | |

| Capitol One | $9,500 | 19.49% | $291; I pay $425 | |

| Student Loans | $79,000 | 4% | 10 year teacher loan forgiveness | Not sure-I’m on the income driven repayment plan; loan payments are on hold until August. |

| Total: | $102,230 | $671; I pay $1,325 |

I suggest that Anna start at the top of the list–with the 30% interest rate debts–and work her way down, paying them off in interest-rate order.

If she’s able to follow the above bare bones budget I outlined, she’ll have an additional $858 to put towards debt repayment with each month. That’s $3,400 of income – $2,542 in expenses.

Stop Overpaying On All Seven Debts

If she makes the minimum monthly required payment on debts #2-7, she’ll pay $621 per month instead of the $1,325 she paying right now across all seven debts.

Here’s What I want Anna to do Starting Next Month

Month 1 of Anna’s Debt Payoff Journey:

- Pay the minimum required $621 across debts #2-7

- Put all other money into paying off debt #1:

- The $858 from reducing her expenses

- The $704 that was going into debts #2-7

- That gives her $1,562 to put towards debt #1, which will MORE than pay it off in ONE SINGLE MONTH!

Now we move onto debt #2 (which, reminder, is the debt with the next highest interest rate):

Month 2 of Anna’s Debt Payoff:

- Pay the minimum required $571 across the debts #3-7

- Put all other money into paying off debt #2:

- The $858 from reducing her expenses

- The $754 that was going into debts #1 and #3-7

- The $150 that went toward paying off debt #1

- That gives her $1,762 to put towards debt #2, which (coupled with the leftover savings from month #1) should pay off debt #2 in ONE SINGLE MONTH!

Now we’re at month 3 and Anna has already paid off two of her debts!

Cancel The Credit Cards

Another key element of this debt payoff strategy is that Anna must avoid taking on more debt. To facilitate that, I suggest Anna cancel each credit card after she pays it off. She needs to get out of the cycle of living above her means and funding her lifestyle with credit card debt. Cancelling the cards–and not opening more–will enable her to restrict her spending to the money she actually has. I recommend she move to paying for everything with cash, check or debt card.

Student Loans

I’m less concerned about Anna’s student loans because the interest rate is so low. My question here is whether or not Anna has explored the Public Service Loan Forgiveness (PSLF) program? This program forgives federal student loans after a specified number of payments if your employer qualifies for the program (which most public school teachers do).

If she doesn’t qualify for PSLF, Anna should plan to pay her student loans off according to schedule. If she comes into a huge chunk of money, she can throw it at the loans. But if her income stays relatively consistent, she can plan to just pay these off on schedule. The caveat is the interest rate. If her loans have a fixed interest rate, that’s great as it means the rate will never change. If, however, her loans have a variable interest rate, it’s possible the rate will increase dramatically in the future. If that were to happen, Anna would want to put more money into paying them off as quickly as possible since, again, high interest rates are the real killer.

Emergency Fund

→An emergency fund should cover 3 to 6 months’ worth of your spending.

At Anna’s current monthly spend rate of $3,493, she should target an emergency fund of $10,479 to $20,958. However, since an emergency fund is calibrated on what you spend every month, the less you spend, the less you need to save up. If Anna moves to the proposed barebones budget of $2,542 per month in order to pay off her debt ASAP, she can target an emergency fund more in the range of $7,626 to $15,252.

Your emergency fund is there for you if:

- You unexpectedly lose your job

- Something horrible goes wrong with your house that needs to be fixed ASAP

- Your car breaks down and must be repaired

- You’re hit with an unexpected medical bill

- Your dog gets quilled by a porcupine and has to go to the emergency vet

An emergency fund is not for EXPECTED expenses, such as:

- Routine maintenance on a car, such as oil changes and brake pads

- Anticipated home repairs, such as boiler servicing/chimney sweeping

- Planned medical expenses

An emergency fund’s reason for existence is to prevent you from sliding into debt should the unforeseen happen. It’s your own personal safety net. It’s also why it’s so critical to track your spending every month. If you don’t know what you spend, you won’t know how much you need to save. I use and recommend the free expense tracking service from Empower (affiliate link).

How To Build An Emergency Fund

- She’s a renter, so she’s not on the hook for house repairs and maintenance

- She’s single and has no kids, so there’s no one relying on her financially

- She doesn’t have any pets, so there’s no possibility of unexpected vet expenses

- She has a stable job with consistent income

- Her parents are evidently nearby and able to help her out financially

Given all of these factors, I’m less concerned with her lack of emergency fund than with her debt’s interest rates. She still needs to save up more money, but if it were me, I’d prioritize wiping out those high-interest debts.

Asset Overview

Let’s take a look at what Anna has saved and invested.

1) Cash: $550

As noted above, Anna is off to good start with her emergency fund. In addition to saving more money, I recommend she consolidate her four different accounts into two:

- a high-yield savings account (keep the majority of the money in here)

- a local checking account

Anna needs to take advantage of every possible benefit and a high-yield savings account will give her much-needed interest. For example, as of this writing, the American Express Personal Savings account earns a whopping 4.00% in interest.

2) Retirement: $8,182

Next up:

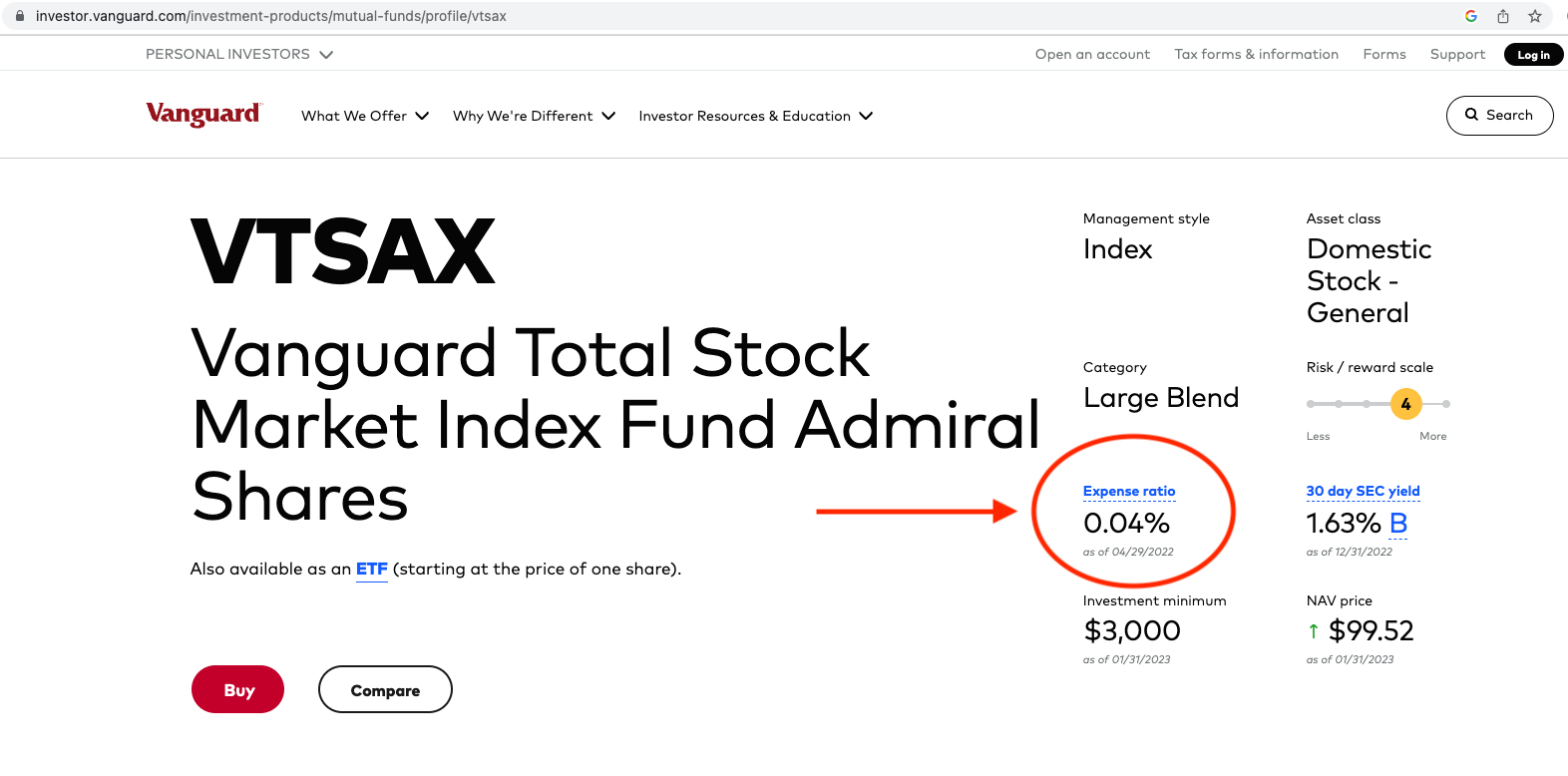

→Find Your Expense Ratios

Something missing from Anna’s spreadsheet are the expense ratios for these investments. Expense ratios are the percentage you pay to the brokerage for investing your money and, since they’re fees, you want them to be as low as possible.

In light of their importance to her overall long-term financial health, I encourage Anna to locate the expense ratios for both of her retirement investments. I’ll use Vanguard’s total market low-fee index fund (VTSAX) as an example of how to find an expense ratio.

You’re going to like this because it’s a three-step process:

1. Google the stock ticker (in this case I typed in “VTSAX”)

2. Go to the fund overview page

3. Look at the expense ratio

Screenshot below for reference:

- Fidelity’s Total Market Index Fund (FSKAX) has an expense ratio of 0.015%

- Charles Schwab’s Total Market Index Fund (SWTSX) has an expense ratio of 0.03%

- Vanguard’s Total Market Index Fund (VTSAX) has an expense ratio of 0.04%

What To Do If You Find High Expense Ratios

Anna’s IRA is completely under her control, which means she can select what brokerage this is kept at as well as the funds it is invested in. I highly recommend the book, The Simple Path to Wealth: Your Road Map to Financial Independence And a Rich, Free Life, by: JL Collins, for anyone interested in deepening their knowledge around investing. It’s well-written and easy to understand.

Pension Plan?

Most public school teachers have some sort of pension plan through the state. Anna didn’t mention having one, so she should do some digging to determine if she has access to a pension. She can start with her HR department or teacher’s union rep.

Life Insurance?

I noted that Anna has a pre-tax deduction for life insurance and I’m wondering why? Typically, life insurance is for people with dependents. In other words, life insurance is important for a family where the death of a parent would leave the remaining parent and children without sufficient income. Life insurance is not typically recommended for folks who are single and without dependents. Anna’s not paying a huge amount of money for this each month, but it’s still money that could instead go towards her priorities of paying off debt, building an emergency fund and saving for retirement.

Summary:

Reduce spending ASAP in order to funnel more money into debt pay-off.

- Stop overpaying on all seven debts and instead focus on paying off the debts one at a time, in order of highest interest rate first.

- Once the first debt is paid off, put your money towards paying off the next highest-interest rate debt and so on until all are paid off. Continue to pay the minimum required monthly payment on all debts.

- Cancel each credit card once it is paid off.

- Do not take on more debt.

- Consolidate your cash accounts into a high-yield savings account.

- Once all of these debts are paid off, Anna can start to build an emergency fund that’s 3-6 months’ worth of her expenses.

- Once the debts are paid off and an emergency fund is saved, Anna should increase her retirement contributions.

- Locate the expense ratios on her two retirement investments. Change brokerages/funds if the fees are high.

- A few things to research:

- Does Anna have a pension plan?

- Can she cancel the life insurance?

- Does she qualify for PSLF student loan repayment?

- What opportunities does she have for increasing her income?

Ok Frugalwoods nation, what advice do you have for Anna? We’ll both reply to comments, so please feel free to ask questions!

Would you like your own Case Study to appear here on Frugalwoods? Apply to be an on-the-blog Case Study subject here. Hire me for a private financial consultation here. Schedule an hourlong or 30-minute call with me, refer a friend to me here, schedule a free 15-minute call to learn more or email me with questions ([email protected]).

A fellow teacher! Anna, going to school while working is not easy but you’re doing great!

A few answers to Mrs. F’s questions:

1. She does have a pension, Anna mentions this in her paycheck deductions: “Teacher’s Retirement System $158” — but she didn’t count it as a retirement account/asset (which she should!).

3. And she also mentioned “ten year teacher forgiveness” for her loans, which is PSLF (just not using the technical terminology). So A+ to Anna given how few of my colleagues even know about it 😬

that’s so sad they don’t know about it! I was a long-time teacher before becoming an attorney, and my student loans were forgiven a few months ago. WHAT A RELIEF. I’ve spent all my adult life in service which I never could have done without it.

One other thing that might be worth it for Anna to look into is a balance transfer credit card. They often have a small fee to transfer your balances, like 3%, but then can give you a 0% APR for 18+ months. Anna could still be laser focused on paying the debt down, but it might be helpful for simplicity to have fewer cards to worry about, and to stem the bleeding in terms of the amount of interest she’s paying each month. However, this may not be an option if she has a super low credit score.

This is risky because part of the debt payoff process is the addressing the behaviors that you got you there in the first place. Anna will have a lot of soul searching to do to identify her triggers and feeling the highs of paying off each card helps offset the lows that come with backing off the spending.

Walnut I completely agree with you.

She could roll over just some of the credit cards she can pay off in say 6 months. Consolidate those payments and, maybe, do it again once those are paid off

I agree. If I were her I might just move that largest 9500 credit card onto a lower interest rate, since it will be 6 months before she can pay it off. Debt snowballing the rest will give her momentum, so by the time she is ready to tackle the large card she will be in the groove. I’m quite concerned though that in the middle of paying off this debt she is going to have her student loan payments starting again.

I think this is a good option only if her debt was from necessity and not consumer spending. I have a friend who told me about this for her debt but then she just accumulated more consumer debt. Sometimes you have to feel the burn to learn from your mistakes, and I think here that is knowing how much interest you’re paying on that principle.

First, thankful for you Anna – for the work you do – it’s important.

Vidalia, I agree with your thought on the credit card debt being transferred to a card with a lower or no interest rate for a period of time if at all possible. A 20-30% annual interest rate is crushing. On $20,000 that’s over $4000 a year or $333 a month – extra cash that could be used to pay off the debt if the rate was lower. I wish credit cards came with a big warning that actually provided more detail on what that abstract interest rate niumber looks like when applied to actual expenditures.

Hi Anna! I just wanted to wish you the best on your financial journey and say thank you for your work as a special ed teacher. I have a son who goes to a school for children with special needs (after a very rocky start in public school), and having all special ed teachers has improved his school experience a million times. Add me to the list of people who think all teachers – and special ed teachers in particular – really should be paid in a way that actually reflects their value to society.

I have a few considerations.

1. I see the Emergency Fund, and I wonder if part of that could be used to pay down the credit card balances even quicker. Anna probably might be able to ask for a short-term loan form her parents, if an emergency presents. The ROI on the savings balance is significantly than she would gain in eliminating interest expenses. This would allow those funds to be actively improving her financial situation.

2. I agree that the debt is the biggest issue because of the excessive interest rates. I would suggest investigating a consolidation loan. The hope is that maybe she will be able to find a lower interest rate. This would accelerate her paying off of her balances.

3. If Anna were to go the consolidation loan way, she may get an even better interest rate if her parents co-signed on the loan. This could also motivate her to pay the balance off as quickly as possible.

4. Often times retirement plans do allow for the owner to borrow against the funds in their account. Again, this is a way Anna can use her own assets to the fullest. It appears the interest rate to be much lower than the interest rates of her current debt. (https://www.investopedia.com/ask/answers/09/401k-loan.asp) If she was able to borrow the full amount, it appears that would cover her four highest interest rate cards. With the lower interest rate and paying the minimum payment due initially, she could then focus on the other interest rate cards and paying them off one at a time as quickly as possible (as recommended by Liz). The only consideration may be whether or not she will be changing employers which may result in her having to pay the loan back early.

As someone who once was straddled by high balance (fortunately relatively low interest rate) debt, I wish you the best in the road ahead. Celebrate yourself along the way. You may even want to create a visual for tracking your progress. It may be the daily reminder one needs to stay the course.

I don’t think any of these are wise decisions, especially #3 and #4. Parents should never compromise their own financial stability to help a child with credit card debt due to the risk that they may be on the hook for unpaid debt. They may also be past their earning years and be dependant on a fixed income. It also does not give Anna the ability to independently slay her own financial dragon and feel the amazing success of doing so! Borrowing against her retirement is also a step back in my opinion.

Another fellow teacher here. Spending on our classrooms is a pernicious expectation from school districts that don’t pay us enough. I’ve (mostly) stopped that; is hard I know! It’s up to your employer to give you the tools you need to do your job.

I wholeheartedly agree; especially with her extremely low salary. I was heartbroken for her when I saw what she makes as a teacher.

I’m an educator too in rural Illinois. Anna, does your school district have an education foundation? Mine does and educators can apply for grants to help with projects/expenses for their classrooms. I’m sorry to hear about your stressful environment. Special educators/ teachers in general do not make enough money for all they do for their students. I work with special needs students as a related service and I see how people like you make a difference. Congratulations on working on your masters.

I came here to say this. It is very difficult to do but you said it well.

Another fellow teacher here, and I completely agree! Your salary is what you rightfully earn for your work. It is not meant to supplement public education.

Yes this stood out to me too, so underpaid for a job that requires years of education and yet spending on the classroom. Breaks my heart to see teachers in this position. Have you heard of Donors Choose? Teachers make posts on there about what they need for their classrooms and then people make (tax deductible) donations to get it for them. Might be worth a try: https://www.donorschoose.org/about

For those in a position to donate, it’s a great way for your donation to have an immediate impact on the next generation.

Donors choose takes time. You have to write the proposal list it and then hope it gets funded. Sometimes these things get funded right away sometimes it will not be funded for weeks or months (or not at all) so if it’s something you need right away it’s not a great option.

Even though it’s not great for immediate needs and you’re not likely to get something right away (asking for books for Black history month in January or February means you’ll likely use them next year, not this one), it could still be useful for taking the edge off for predictable needs or later term wants.

It’s the summer and she should know what she’s likely to run out of every year. So even if it’s not great for first semester needs it’s a good time to think ahead—do you always need pencils/paper/kleenex/snacks/prizes before the second semester? Are there bigger ticket items that you could do something with second semester?

What I like about Donors Choose idea is that it adds a skill, essentially grant-writing, to her skill-set. If she wants to transition from the classroom, a successful pitch might interest future employers. It´s work, but there´s an additional pay-off.

I’m glad to hear teachers say this, because I wanted to, but I’m not a teacher! Honestly, if all teachers banded together and refused to buy items for their classroom out of their own pocket, then the school district and ideally the governments that fund them would have to bone up!

Cyndi…Amen…as a just retired school librarian I found it appalling how much teachers pay of their own money to make their classrooms”a more inviting educational environment”. It’s ridiculous and we need to stop…I am so tired of the expectation because it’s for the kids…

I 100000000% agree. It is completely bananapants-unacceptable that you should spend $1 of your paltry income on your classroom, or that you should feel that without doing that, your students are suffering. That’s appalling and must end, today and forthwith. You’re already underpaid. This is actually so wrong, and of course they hide behind ”oh but it’s your choice” when in reality, it isn’t and you are being emotionally blackmailed, more or less. That must stop. Really. If you do nothing else, you must please prioritise your own finances over making life cheaper for your employer.

One thought I had is around Anna’s part time job. Is it possible to find (or create) a different job that could bring in a higher income? Maybe tutoring could offer a higher wage/hr.

I’m willing to bet that a part time job in retail is resulting in more spending than income at the end of the day. Stepping back from fashion will be a key psychological side of paying off this debt. It’s not just about getting out of debt – it’s about staying out.

I agree! Special Ed teachers can (likely) dress pretty casually and not particularly stylishly. If she’s working retail, especially if in a clothing store, expectations may be different.

I haven’t seen anyone mention that YouTube has lots and lots of free exercise videos. Between YouTube and walking, I no longer need a gym membership.

Highly recommend fitnessblenders.com!

Providing respite care is an option. My partner and I paid a special-ed teacher we knew to just be with our child so we could go for a hike, do grocery shopping, etc. We were immensely grateful to them and also loved giving them some financial support.

This is a GREAT idea!

I was going to suggest tutoring as well. In my area in the NE, reading and math tutoring pays about $30 an hour, or as high as $75 or more an hour if certified in something like Orton Gillingham.

Hi Anna! Kudos to you for working to get your financial situation in order. One education – adjacent field you might consider is school psychology. In Illinois, four state universities, offer this degree…SIUE, NIU, ISU, and EIU. There is a shortage of school psychologists in the state and the pay is good (I believe it’s over 60 K starting ). At any of those schools, you can likely get a tuition waiver and small stipend if you get accepted. The caveat is that they are 2 years of full-time study (note: you’d have to leave full-time employment) and then a one-year (poorly) paid internship. So you would have to calculate whether the salary payoff is worth taking two years of nearly no income coming in. You should also, of course, investigate how this would affect your potential for student loan repayment. Note that I would only recommend this, if you can be excepted into a program with a full tuition waiver, and if you are sure, this is a field you would enjoy. Best to you!

For the classroom expenses I suggest looking up how to open up an Amazon wish list for the next school year. She doesn’t get paid enough to spend any money on the classroom (not that any teacher should have to)

Also Donors Choose.

Also Adopt a Classroom. I give to that every September, adopting one project in my community.

Donors choose takes time. If you need something right away you wouldn’t list it on donors shoes because it can take weeks or months to get funded.

Yep, stick a link on the bottom of your email signature, so parents of your students know to check there. And, do a monthly email to your admin as to what classroom supplies you are needing. If a student needs materials, it’s part of their IEP and the district is legally required to be providing it. Not you.

Sorry if this is a dumb question, but why not recommend that Anna take a personal loan and use that to pay off the credit card debts, or consolidate the debts into a loan with a smaller interest rate? Is that not a good solution when someone has a lot of smaller debts with high interest rates?

Thanks for sharing, Anna! I am also 35, though married, and my husband is going into Social Work, which is another under-appreciated field of work. It’s helpful to see how one can live well and still have beautiful vocations on a modest budget!

That makes sense to me as long as she closes or stops using the cards, and assuming she can get a personal loan at a decent interest rate.

I don’t know if she would qualify for a personal loan. Her debt is high and her income is lowish.

You’ve got this, Anna! Given your parent’s current financial support, it may be worth exploring whether they would be able and willing to give you a loan to pay off your credit cards at a lower interest rate. It could potentially benefit both of you and keep the money in the family rather than going to the credit card companies.

I may have missed it, but I didn’t see any suggestions to call up each credit card and just ask for lower rates. If she has been good about payments it may just take asking, even if they only lower it temporarily. I would try that before consolidation. (Then reorder the new rates from highest to lowest.)

I am a little concerned about cutting *all* exercise options. Health and energy are so important and not everybody can just decide to go jogging.

Seems important to find out what the student loan repayment amount is going to be before getting the first bill.

I’m also concerned with cutting out the exercise. Yes, I know it can be done for free, but you can’t replace the social aspect of it. The $31 for the gym is so reasonable I’d try to slash it out of the catchall food/ household.

You might want to check out local walking groups, hiking groups, etc. Also, could you volunteer at your gym in exchange for using the facility?

Love your suggestions! I would add for Anna to look at 0% offers to transfer maybe the Chase Visa and Capital One, while working on the highest interest rate cards. It would save a ton in interest.

I’d also probably not cut the gym membership. That is fairly reasonably priced, and I would imagine she might need an outlet to relieve stress after working such an intense job like teaching.

You got this, Anna! And congrats on the masters degree!

I am flabbergasted at how low your income is and how much interest rates you pay.

Take down theses debt asap, also don’t spend on your classroom. With should it be your burden. Put yourself at number one, at least for a while.

How much income increase do you expect post master?

And have you considered working private? Wealthy people hired special aid teachers as private mentor for their kid. Also schools in place like Dubai or Saudi Arabia offer high paying jobs , could you do that for 2/3 years to increase your income and diversify your curriculum vitae.

I’ll need to do ten years in the public school system to qualify for PSLF. Then, options are more open.

I repeated Bella´s suggestion (which I missed on my first run-through, sorry) below. I´m familiar with salaries (K-12) in the UAE and (in tertiary) in Saudi and with living expenses in the Gulf. You could realistically pay off all your debts in around two years. Perhaps give some thought to giving up on PSLF? If the promise of PSLF keeps you stuck in underpaid work, PSLF is pushing on a string. You´d have to make sure you don´t overspend while overseas, though. Teaching overseas strikes me as a pre-burnout option. Are you really going to make it 10 years?

Middle East: Years 1 and 2 debt repayment (and a lil travel), optional Year 3 for a healthy emergency fund and a small downpayment for a house or investment fund (and a lil more travel). And you may love it. Or at least like it.

In a post below I mentioned Adveti. But it may be better to first try Emirates Schools Establishment (ESE). The salaries are not quite the highest you can get, but they are looking right now. Also register on teachaway.com.

I work in the UAE. I am British and a teacher and in the UK we too have similar low paid wages. Me and my husband, both teachers, movdled because we were chronically house poor, could make no head way with student loans or starting a family. We intended it to be two/three years but ten years later are still in Dubai. We have paid off our student loans, paid off 90% of the house that made us poor and built a great emergency fund and retirement… Plus two awesome kids. It’s not for everyone but I would say have a good think about it before you rule it out. Good packages have housing included (1 bed apartment), higher salaries and tax free with medical insurance, gratuity and annual return flight

Retired teacher here. Anna, I agree with Mrs. FW to stop using all credit cards (i.e., add no new debt) while you pay them all down using the “debt avalanche” plan Mrs. FW recommends. Continue to take care to make all payments on time (your payment history is 35% of your credit score).

– Reference: https://www.wellsfargo.com/financial-education/credit-management/calculate-credit-score/

– However, when all credit cards are paid off, instead of canceling them all, I recommend you keep one or two, to protect your credit score. In this digital age, even potential employers and landlords can access your credit score to assess your financial reliability. If you’ve canceled all your cards, your credit limit has become 0. That’s a huge hit to your credit score (see reference).

– (I keep two cards, one for online use and one for in-person use.) Let’s say, two cards. Which cards to keep?

– If the same two cards not only have been open the longest (length of your credit history is 15% of your score) but also have the highest credit limits (credit utilization is 30%), then it’s easy: keep those two.

– Otherwise, I would choose the two that have been open the longest. That’s because as you pay down the cards, your utilization will improve but the length of your credit history (how many years the oldest card has been open) will not change. Once you have paid off all the cards and your finances have stabilized, you can apply to have the kept cards’ credit limit raised, further improving your credit utilization.

Sending you all best wishes, Anna!

As a landlady and owner of many properties with many loans, I strongly suggest that you keep 3 lines of credit. Showing that you have credit and can restrain yourself = high credit scores and the 3 lines of credit equals the ability to get a mortgage someday if you’d like to buy. Freeze the cards in ice, store them at your parents’ house, whatever, and break them out once every six months to use them for a little expense so your cards don’t get canceled for no usage, then back into storage if you can’t resist them, and pay off that little charge! You are just this side of financial freedom from debt – it will taste so sweet when you achieve it in only a year! Then your world will open up as you can choose to spend a bit more, save for a special goal, whatever. Your sense of personal power will skyrocket!

I love the plan to pay down the debt but think there is room to increase income in the meantime as well. I have to wonder if the part-time retail job is worth it for only $500 extra a month. Has Anna looked into part-time positions or side hustles that use her teaching skills and experience such as tutoring, teaching an Outschool class or even offering to be a nanny during the summer months? My son’s summer nanny is a special education teacher and I pay her more than I did our nanny last summer because of her unique credentials- especially since he has special needs. Also, if she has summers off, she could possibly work more hours at a summer job. My friend’s husband is a teacher and he’s worked odd jobs as a painter, laying flooring, landscaping work, and at a golf pro shop.

Also, the convenience costs and self soothing costs can really add up if she is spending so much time/energy working! I know when I have really busy weeks I spend more on takeout & online shopping to make my life easier and make me feel better. Could be worth considering if the part time job is doing that for her.

I am a school principal, and I would encourage Anna to look into other teaching positions in other districts, online schools, etc. She is woefully underpaid in a profession that is underpaid. While her income might be more appropriate in the context of the cost of living in her area, she might benefit from looking at other districts around her. In my area, most districts pay a stipend for Special Education teachers because it is such a critical need, but not every district does that. We also have numerous ways for teachers to increase their income through club sponsorships, paid tutoring after school, test prep courses, etc. I’ve had many people increase their income just by shopping benefits in their job search.. For example, our school district has the same average starting salary for new teachers as others in our area ($62,000 this year in an area where someone can rent a 1 bedroom apartment for $1100 per month), but our health insurance is fully supplemented on the lowest plan. This is an added benefit of at least $300 per month when compared to surrounding school districts. We also offer a matching program, which is nearly unheard of in public education. It is a 2% income supplement that many people do not even factor in when looking at salary. Anna should definitely consider looking at the entire compensation package in her district and those around her.

Online education work could hugely supplement Anna’s income or replace it entirely. Once she completes her Masters degree, she might be able to find a teaching position through an online education program. She has so many options out there, and the people who do the work she does are in short supply!

This page is really cool for showing the average salaries across different districts in Illinois: https://www.illinoisreportcard.com/Default.aspx (Also it shows that the state AVERAGE teacher salary is over 72K/year.) Moving to another district, even a different low cost of living rural one could definitely boost income by quite a bit.

I would recommend finding a nonprofit credit counseling service—try National Foundation for Credit Counseling. They will negotiate lower interest rates and you will pay them monthly and get out of debt faster. They also counsel you in terms of creating a budget etc. They do charge a small fee around $30 a month and your credit score will take an initial hit but bounce back quickly. The rates they negotiate are usually around 8 percent—much better than what you have. Just make sure to use a nonprofit—there are some for profit scams that say they can eliminate your debt. What you want is a debt management program.

If you have good credit, you can call credit cards directly yourself and get the same outcome!

Online teaching with for instance Outschool or Allschool can be a more lucrative choice for teachers. Some teachers have managed to pivot to fully online teaching. Anna can do research on YouTube and at those websites to learn more.

Anna is already so thoughtful, and so transparent. You’ve given her great advice and I imagine it will pay off.

I don’t have a lot of financial advice, but I have some social advice because I was a social eater in my 20s (weekend brunches with friends, dinner out a few times a week to catch up with one friend or another) and that was the hardest thing for me to change when I attacked my debt. My friends and I started Breakfast Club and Supper Club. So, Supper Club (WI decor optional) was two or three of us who made a commitment to cook a meal (often pasta or homemade soup and salad) and the other two friends showed up and we all ate. The responsibility for hosting rotated. We often made old school cookbook recipes and then would divide the leftovers up three ways for dinner or lunch next day. It was fun, and it forced me to keep a clean house. I used to try odd recipes, too. Breakfast Club was just all showing up at one person’s house–one with a thermos of coffee, somebody with waffles or pancakes, somebody with bacon or sausage, etc. The host would often do scrambled eggs or a breakfast casserole. And we’d just eat and catch up. Breakfast club could get pretty big and, yes, sometimes we would quote the movie. In the summer we met in the park. This was much cheaper than eating out, but it still scratched that social itch.

I changed so that socializing centered on walks/hikes, attending a free museum/gallery night/reading/theater in the park, movies nights, etc. Also, I’ve joined my friends in volunteer projects, helping a friend with a task/project, visiting to a new-to-me park, beach. cool public art, etc. It’s about being a creator and participant (vs a consumer) I find the above to be *much* more fun than doing something I know I can’t afford.

Resources/Ideas:

– Invite friends for clothing-swap party and then do a fashion show!

– “Soup Night: Recipes for Creating Community Around a Pot of Soup” by Maggie Stuckey

– Budget Bytes website has a huge range of yummy cheap recipes

Wow! I love the breakfast and supper club ideas.

Cecilia – I love these ideas. I am going to try to convince a few friends that we should do Breakfast Club instead of restaurants.

$200 a month for clothing is more than spend for a family of 9 that includes three teen daughters. Is the retail PT job in a clothing store that tempts her to spend this much on clothing? If clothing is a priority, could she switch to a PT retail job that offers a discount on clothing? Or shop at thrift or consignment shops or host a swap meet (easy and fun, I’ve done it myself)? Sell some of the clothing on FB marketplace or have a yard sale to help pay off debt?

Yes, sell some clothes. I work in Special Ed and you don’t have to dress up for the role. This is way more than we spend as a family of 5.

I’m shocked at such a low salary. I live in Canada and don’t know exactly how much teachers make, but I’m pretty it’s at least twice this. I have an autistic son so I know how much value special education teachers have! All the best on your journey!

I really don’t know the answer to this but the car insurance situation has me concerned. Anna is 35 and independent from her parents. Unless she lives with them, how is she insured under their auto insurance? If she were to be in an accident I would be EXTREMELY a worried that the insurer would not pay when they found out she doesn’t live in her parents household.

I would definitely look into listing teaching resources you’ve created on Teachers Pay Teachers. If you list things people want in a way that makes it easy for them to find your resources at a reasonable price, you could potentially bring in some side income month after month that only takes the initial set up. This is especially true if you already have tons of handouts, activities, etc that you just use for yourself or aren’t even using anymore so the initial creation work is already done! I wouldn’t count on it bringing in $1000s of dollars a month without significant input, but even $100/month easily replaces a shift working retail.

While reducing her debt Anna is going to need some little bit of entertainment. I suggest she put all her streaming subscription on a rolling schedule.

Subscribe to ONE, (the cheapest?) and plan on viewing for one month only. Then cancel right before that month ends (so you don’t forget). Binge watch what you want. Cancel and move to next streaming channel you’re interested in.

Never subscribe to more than on at a time…

A big part of frugal success is finding creative and fun ways is live a great life on a budget. The good news is that this becomes lots of fun and makes you more engaged and creative with your life. 🙂

Public libraries offer high-quality FREE TV and film entertainment.Items you canj check out from the library itself as well as via services such as Kanopy and Hoopla. Instead of seeking out the most current films/TV shows, check out awesome past TV series and films.

– You could invite friends/family over (or do it solo which is favorite of mine) for a theme fest. Think: favorite comedies, a TV series, Award Winning films, roadtrip flicks, food shows/films, favorite Disney flicks, etc.

Other themes:

– Past films/shows your favorite actors are in.

– Find out who directed your favorite films and watch everything they’ve done.

– Compare versions (Pride & Prejudice, Freaky Friday, The Grinch, Thomas Crown Affair, etc.)

If you like fashion. watch films/shows with:

– Designers nominated for Best Costume awards

– Awesome clothes: September Issue, Devil Wears Prada, Miss Fisher, Mad Men, Queer Eye, Downton Abbey, Sex and the City, etc.)

On this note, Tubi, Pluto and the Roku channel are free streaming services with tons of content.

Also: FilmRise, Plex, and FreeVee. (FreeVee used to be IMDb TV. Now it’s basically all the free stuff from Amazon Prime.)

Those interest rates scare me but Anna can totally do this! I just did some loose math and you can pay off all but the capital one card in the next seven months! (Personally, I would pay off the Target card before Loft, since as the payments snowball you can knock out one per month.) And you can be credit card debt free in 10-11 months! It would be a year of sacrifice that sets you up for life.

Anna is paid a low salary for such an important job and I really sympathise with her. However, I think she needs to face the reality, that in order to get out of debt, she needs to do some work on her mindset about money as her credit card spending has clearly been a real problem. I would advise her to adopt the Dave Ramsey (I hope this is allowed and if not then my apologies) of living on ‘rice and beans’ and have a laser focus on clearing the credit card debt. Also watching ‘smart with money’ on Netflix might help her. My comments are meant with the best of intentions and I want Anna to be out of debt and not having to rely on her parents or anyone else to fund her, to do this she has to learn to be the boss of her money.

Agreed that Dave Ramsey’s baby steps (and maybe listening to some of the inspirational stories for early ideas) is a good thing. If there are any new with tags clothing that can be returned, do it. If she can start selling some excess, do it. Literally anything that isn’t bolted to the wall should be fair game in “Am I using this? Is it serving me? If not, SELL IT.” With the high interest rates, there is such a multiplier on every dollar put toward debt.

Digging into the person finance blogosphere (and the archives!) is great also. Cait Flanders of Blonde on a Budget still has some archives out there as well as a book.

We obv have very similar attitudes to money management and avoiding debt! If I had my way, personal finance management would be taught in schools and every teenager given a copy of ‘the richest man in Babylon’.

Fellow public-sector union member here, and would suggest that she look through her union contract very carefully to see if there are any additional provisions she isn’t aware of or maximizing. (And/or talk to your friendly local union steward!) For example, some of the bargaining units at my workplace have a provision where they can convert a certain amount of vacation time annually into contributions to their retirement accounts.

(To be clear, I’m also a BIG advocate of taking your paid vacation time. Rest up! Do fun stuff!)

Hi Anna, I am in awe of your choice to be a teacher, a special Ed teacher and to commit to a financial plan. Teaching, in addition to being underpaid, is one of the most stressful jobs – right up there with air traffic controllers. So, while you’re getting your finances together, find ways that will keep you growing and developing a positive relationship with money. Finances are a wonderful adventure within human development. And – reduce your stress and give yourself the love you offer the kids. Sing!!! Dance!!! Many community groups have free or low cost singing and dancing groups. . I love the barter idea.

Questions: how might you nurture yourself, for free, in the way you nurture children? Who nurtures you? Get comfortable asking for help and comfortable saying no to yourself and others – by having a vision in mind. The vision is the yes – each time you’re saying no – it’s because you have a beautiful vision that you’re saying yes to.

Make a vision board, make an appointment with yourself to look at it, add, change and set intentions with it / every day until it becomes a mindset.

Picture your future travels! One of the delights of teaching is time off to reinvigorate yourself.

If you alter your mindset, look into international schools where you can save and travel. Do research!

A few of my colleagues in the international school circuit are also part of FIRE, and a few are unprepared for retirement- as they didn’t save.

In the meantime / follow the plan that Ms FW suggests; create a frugal classroom – you don’t need a lot of things, ask friends if they’d like to donate supplies.

When someone asks you what they can get you for your birthday – know exactly what you want!

And tutor, and in the summers – there are amazing summer/travel jobs.

Anna, you got this! It’s going to feel so good to pay off a different credit card every month! While it’s hard (and humbling) to cut spending, in a year you’ll be in a completely different financial position!

While you go through this year of getting your financial life in order, pay attention to what’s driving your need to overspend. This can be caused by all sorts of things, from people pleasing to ADHD-related impulsivity to perfectionism to a need for status. If you can figure out what’s going on in your life while you are young, you can find other ways to meet your needs that don’t involve a cycle of overspending and then digging out. 🙂

Can Anna move some of these cc balances over to a 0% card and consolidate? Might give her some breathing room as she pays off each of the smaller ones. I personally like doing the debt snowball method, and knock out cc’s from smallest to largest. Also-if Anna can move in with her parents even for a few months she could pay off one or two of the cards with money that would have gone to rent. I’d say look into higher earning districts as well as higher earning part time jobs. Tutoring, reading specialists can make a lot per hour. Maybe waitress and you could earn tips and score some free meals? I wonder if some of the debt is from working in retail-my advice is get out of the stores asap! Also-put spending on your classroom on hold for now.

Good luck on your journey-I know you will do fine!!!

Debt consolidation – I’ve been in a similar position with credit card debt, and the satisfaction of paying off one card and snowballing to the next motivated me to cut expenses everywhere I could to speed up the process. Besides, interest rates for personal loans are pretty high right now, and it may be hard to get an unsecured loan.

Different job – Make sure you stay in a qualified non-profit position so your student loans can be forgiven in 10 years. I don’t know all the rules of the debt forgiveness, but I know they are kind of particular.

Additional income – For the short term (next year or two?), it might make sense to find some summer work to supplement your income. You can get through anything if you know it’s temporary!

Miscellaneous expense – As mentioned above, I had a period where I buckled down and paid off a lot of debt in a short period of time. I like walking/running/hiking/biking (free outside) and yoga (lots of free content on youtube). If you can find a running, hiking, or biking club close to you, those are often free. Or maybe find friends who will join you on a weekly basis. For entertainment, I bought an antenna for my TV for free content and subscribed to one streaming service. I’m also an avid visitor to my library and get lots of free movies, music, books, and access to audiobooks (via the Libby app). Even after paying off all my debt, I still don’t pay for a gym membership or more than 1 streaming service.

I am in the middle of paying off a large amount of credit card debt, and my plan is working. So, I’ll share what I’m doing and why it is working for me. One thing I’ve noticed is that Anna has very little cushion or savings. I am not counting any of the retirement funds. I’m talking about her cushion or float that she can use to get through each month. In addition to cutting out expenses to a bare bones budget temporarily, I recommend that she first save very hard to get a cushion account — minimum $1,000 a month up to one month’s net income. I’ll tell you why this helps. There will always be some unexpected small purchases that need to be made, or fluctuations. Whenever these used to occur for me (before I had this cushion or float), I would PUT IT ON THE CREDIT CARD. That is one way debt can incrementally creep up.

I also went to a bare bones budget to be able to work this plan. It IS painful, but it IS necessary, and now that I’m halfway through, I can see that it IS working, so I have high motivation to stick with it!

Once I saved my minimum cushion, I am able to go with the cash flow during the month without any need to put it on a credit card. I can just pay for it (and keep replenishing it). It takes awareness and discipline, though, and I mapped out an elaborate cash-flow budget so that I could project ahead and truly see what each purchase would end up doing down the road.

I have also found it extremely helpful to continue to save while paying off the debt. It is a motivator for me. As my debt is going down, my savings are going up. I am almost at the break-even point where I could take my savings and pay off my debt. That will be a very good feeling! I know this is so, because I projected my cash flow and savings through until the end of this year, when it will be fully paid off.

I no longer put anything on the credit card because I now have money to cover it, and I also am enjoying watching my savings grow while also paying off the debt. In order for me to do this, I chose to do a balance transfer to a 0% interest card, and then I mapped out all payments through to the end of the payoff period (mine was a 15-month period with a 3% balance transfer fee). I have no pressure to pay it off early, because there is zero interest. That way, I can also build savings, and once the debt is paid I will have already saved 2 months emergency fund (in addition to my cushion/float). I am going to celebrate when I get there, because I have had debt hanging around my neck for the past fifteen years. It will feel so good to be done with that!

One word of warning: during the 0% payoff period, DO NOT PUT ANY NEW CHARGES ON THIS 0% CARD, because if you do, the entire balance may be subject to interest charges — read any agreements extremely carefully. I’ll also echo what someone else said above, do not cancel ALL of your cards, because it is good for your credit rating to have at least one card.

Good luck to you — I know you can do this, Anna!

Wow Liza, you’re doing so great! I’m rooting for you as you pay off your last debt. Way to go!

You got this Anna! One item that really pops in your current expenses is the clothes/shoes/accessories at $200/mo ($2400 per year). I wonder if you’ve perhaps accumulated a number of items you don’t wear anymore. If so, in addition to cutting this expense to achieve your debt-free and emergency fund goals, you could do a closet purge and find some items to sell on a site like Poshmark for some extra cash to put towards those debts.

Thank you Mrs. Frugalwoods for this case study and Anna for sharing your story! I appreciate a post featuring debt having an uplifting, optimistic tone.

My favorite idea was bartering for some of the fun classes. I have done this with yoga. My yoga studio stopped it because it was a big chain and employee stuff got complicated. I think it would be easier with local studios.

Would love to see gross income shown in addition to net income on future case studies.

Good luck, Anna!!!!

I have a few suggestions:

-If you can reach out to some high school counselors, see if they need help proctoring the ACT. I used to make $130 for a few hours of work. You can also grade papers while you proctor.

-When I worked at a school another teacher and I used to walk around the gym after school. We would walk about 5 miles. Time went fast when we got to vent to each other. We also had some creative ideas as well. If you want to leave the building (understandable) see if you can find a cheaper gym or one with a discount. Do you have any discounts from your district? Can you join a running club or meet up?

-I am not sure what supplies you need, but in addition to the great comments here, reach out to a local university. Many of the admissions offices have pens, folders, highlighters and pencils. I used to share them with other teachers all the time.

-Stop shopping. If you can’t at least look into thrift stores. Working in your field is stressful, but you need a free hobby.

-For the salon visit every other month, can you go to a hair school? Really cheap prices.

There are a lot of great suggestions in here. Good luck with your job search.

Anna, you can do this bare bones budget. I suggest that you build in some “treats” along the way. A “treat” could be adding back one thing to your budget (e.g., one streaming service, singing lessons or gym) when you meet a goal (e.g., 6 months of adhering to the austere budget or paying off all credit cards over 20%). Nothing to put you back on the spending path, but just to make life a bit brighter.

I don’t think there was mention of what you do on Summer break? Is your teaching salary spread out over 12 months? What full-time job could you get for the summer? Unfortunately, this is not the period in your life you can afford to go on vacation.

YNAB has a really fun “treat yoself” system called “wish gardens”…I highly recommend the video I’ve linked to in my name. Being so thrifty that you can occasionally reward yourself with little pure wants during the debt repayment slog is so important. I have been there.

I’m recommending some tough love via MMM

https://www.mrmoneymustache.com/2012/04/18/news-flash-your-debt-is-an-emergency/

yes, and “rewards” can be hiking, jogging with friends, a calm weekend afternoon by a lake, etc… find frugal (free!) activities to reward yourself with, and make it an indulgence. you’ve got to nip this in the bud ASAP! and take your PTO – I’ve been in special ed for 20 years and the burnout is real unless you pace yourself

You’ve gotten lots of great advice. Could you take on a roommate to cover all or most of your rent while you try to reach your goals?

I agree your first mission should be to pay off all your credit card debt as aggressively as you can. When I was younger I got the best advice: do not put any purchase on a credit card that you do not have money for in the bank. If you do charge, pay it off in full when the bill comes due, every time. Avoid credit debt like the plague. Once your credit debt is gone, go and charge no more!

years ago we were in a similar position, with two kids and lower paying but professional human services jobs. A friend recommended Consumer Credit Counseling Services, which has a non-profit network of offices that work out debt consolidation plans. They negotiated lower interest & monthly payment with all our creditors & took the money out automatically to pay them each month, with a low fee. It took us several years but the relief was amazing & we’ve never gone back into debt. Not an ad for CCCS; there are other reputable companies that do this as well. More than worth it to get a fresh start.

There is lots of great advice here – pay off debt, don’t create more debt, cut expenses, etc. I would add two things:

1. Do some serious soul searching to figure out why you have accumulated so much debt and continue to spend more than you make. You are going to need to figure this out and make serious lasting changes or you will continue to overspend. It might take some counseling to figure this out. Hopefully you medical insurance will cover the mental health counseling.

2. At 35 it is time to wean yourself off your parent’s financial support. I know that sounds harsh but being financially independent is an important step to being an adult and handling life’s ups and downs.

”At 35 it is time to wean yourself off your parent’s financial support. I know that sounds harsh but being financially independent is an important step to being an adult and handling life’s ups and downs.”

THIS! A thousand time. 35 is fully adult, you should not be depending on your parents money. Especially not if you have streaming services, dance classes, signing lessons, haircuts… This is wrong on so many levels…..

Agree.

It can get very easy to continue using other people’s money.

Like everyone else, I’m thankful for the work you do and appalled by your teeny salary. Given that it is what it is, definitely extravangances like $200/mo in clothing and $200/mo in lessons have to go. As much as I would love to, I can’t make those line items work on my budget, and I make twice as much as you. (Don’t buy a house…that’s where ALL hobby money goes!)

I know this is easy to say and difficult to do, but I wonder if it may be time to consider moving to a higher-paying area. Getting a roommate to keep your costs from rising too much while making another $15k-$20k could be life-changing for you, especially if it means who can get off your parents’ support.

Also, I highly recommend looking up full episodes of the 2000s Canadian TV series “Til Debt Do Us Part.” It’s delightful, helpful, and motivating, and lots of people on the show make about what you do. Best of luck, can’t wait for a triumphant update!

Just came here to say that it’s HORRIBLE that you’re paid such a low amount and that you have to buy your own classroom supplies. That makes me SO ANGRY with the gol-darn system. Have you reached out to some of the parents at your school to see if they can contribute classroom supplies or gift cards to supplies stores like Staples? When my kids were in elementary school, I always tried to give Staples gift cards instead of mugs or plaques. My youngest daughter really liked giving a present instead of a gift card, so we would go to Staples or Walmart and load up on stuff she knew the classroom needed.. “Glue sticks and construction paper, Mom!” We’d pack it all in a reusable grocery bag.

P.S. I’d personally keep the dance class…it’s exercise, it’s fun, it’s one of your passions, and it’s good connections with the world. My daughter (age 30) suffers from chronic anxiety and dance classes keep her sane. In fact, when she briefly lost her job, we paid for them because I didn’t want her to lose the physical and mental health benefits

Special ed provider here. The bigger districts in my state tend to pay better. Classroom supplies that are required for service of your students are legally mandated by the IEP and the district should be providing them to stay in compliance. Put together a list of supplies monthly that you need and email it to admin, add to it each month if they fail to provide. For “wish list” items, add a link to your email signature for an Amazon wishlist, and let your classroom parents know that’s where they can find it.

Tutoring or respite care in the afternoons/after hours when you are done with your masters would help. If you are using your cell/computer/office supplies/etc for teaching, you can write those items off when you pay taxes.

Also, you are probably more fashionable than I am, but those clothing expenses need to go, since special ed is casual. Follow some sustainable fashion bloggers who recommend selling/reusing what you have to satisfy that itch. Take a hard look at your spending and make cutting the costs into a game. Share what you are doing with others, that can help hold you accountable to yourself.

My sister is a teacher – I am pointing this out so that you know that I understand how hard it can be to do a job that pays fairly poorly. When she began teaching she earned less than I did on my graduate student/PhD stipend. One thing I have not noticed mentioned is whether Anna works a 12-month position. If not, summers may provide time to increase income. Also, this may sound harsh, but Anna just needs to stop spending money she does not have on clothing, coffee shops, and other non-necessary items. $700 a month for groceries etc is more than I spend feeding myself, 2 2 pets, and 2 boys now 20 and 23in a very high-cost-of-living area right outside of Boston. I understand that the $700 includes classroom stuff, but I think she just has to cut out classroom stuff from her personal budget completely! I am glad Anna has come here for advice, because peerhaps she did not have it growing up – I have successfully taught my chldren that credit cards should only be used as a convenience to buy things that you have actual money in the bank for – not for things you can not afford. Good luck Anna!!!!!!!

First off, if you are in what I call the Alabama part of IL (I live in IL), you are going to have to move to the northeast part of the state (Rockford/Chicago burbs) or Peoria/Springfield. Quincy area is nice but pay is not on par with the other areas.

While you teach children with disabilities, do you have disability insurance for yourself – I did not see it listed. You need this far more than life insurance. You die tomorrow, creditors will have to write off your debts (unless your parents co-signed student loans/took out students loans for you which is their problem, not yours). Credit card companies are SOL. If you are renting, landlord is SOL for remainder of lease. The creditors can fight over the resale value of your vehicle.

Hey Anna! Thanks for sharing your story. I just want to tell you that 10 years ago I was pretty much in your boat- 35, single, and with a slightly lower income and slightly less debt than you have, but the ratios seem similar. I got a job paying about twice as much and in a couple of years I had all my debt paid off without much stress. I still live somewhat frugally but splurge a lot and… it’s fine. Plenty of savings, plenty of options.

It’s frustrating and amazing how many low-interest loans and great credit cards are available when you no longer need them!

Pay off those super-high-interest credit cards and keep looking for a higher-paying job. Best of luck.

You should also check into the other teacher loan forgiveness program. You need to teach 5 years as a highly qualified teacher to qualify. Since you’re working on your masters, you may not be considered Highly qualified yet. But keep that in mind. You can get up to $17,500 forgiven depending on your position and if your school is low-income. Whatever isn’t forgiven through that program can later be forgiven through the PSLF program. As a severe and profound teacher you may be able to get your district to pay for your certification or you should look into changing districts. I teach in neighboring Iowa and there are several

districts offering $2000 to $5000 in hiring bonuses for Strat II teachers. Bigger districts often pay more, too.