Jess is a single mom of two young daughters living in northern California along with their opinionated four-year-old Siamese cat. Jess works for herself as a freelance writer/public relations consultant, which is a job she loves. After getting divorced in 2020, Jess went on to buy her own home and chart her new life as a single parent. Although Jess has done a great job setting herself up with a fulfilling career in a place she loves living, she’s concerned about her long-term financial future. She’s asked for our help in analyzing whether she should take a higher-paying job or if there are other ways she can stretch her income.

What’s a Reader Case Study?

Case Studies address financial and life dilemmas that readers of Frugalwoods send in requesting advice. Then, we (that’d be me and YOU, dear reader) read through their situation and provide advice, encouragement, insight and feedback in the comments section.

For an example, check out the last case study. Case Studies are updated by participants (at the end of the post) several months after the Case is featured. Visit this page for links to all updated Case Studies.

Can I Be A Reader Case Study?

There are four options for folks interested in receiving a holistic Frugalwoods financial consultation:

- Apply to be an on-the-blog Case Study subject here.

- Hire me for a private financial consultation here.

- Schedule an hourlong call with me here.

- Schedule a 30 minute call with me here.

→Not sure which option is right for you? Schedule a free 15-minute chat with me to learn more. Refer a friend to me here.

Please note that space is limited for all of the above and most especially for on-the-blog Case Studies. I do my best to accommodate everyone who applies, but there are a limited number of slots available each month.

The Goal Of Reader Case Studies

Reader Case Studies highlight a diverse range of financial situations, ages, ethnicities, locations, goals, careers, incomes, family compositions and more!

The Case Study series began in 2016 and, to date, there’ve been 94 Case Studies. I’ve featured folks with annual incomes ranging from $17k to $200k+ and net worths ranging from -$300k to $2.9M+.

I’ve featured single, married, partnered, divorced, child-filled and child-free households. I’ve featured gay, straight, queer, bisexual and polyamorous people. I’ve featured women, non-binary folks and men. I’ve featured transgender and cisgender people. I’ve had cat people and dog people. I’ve featured folks from the US, Australia, Canada, England, South Africa, Spain, Finland, the Netherlands, Germany and France. I’ve featured people with PhDs and people with high school diplomas. I’ve featured people in their early 20’s and people in their late 60’s. I’ve featured folks who live on farms and folks who live in New York City.

Reader Case Study Guidelines

I probably don’t need to say the following because you all are the kindest, most polite commenters on the internet, but please note that Frugalwoods is a judgement-free zone where we endeavor to help one another, not condemn.

There’s no room for rudeness here. The goal is to create a supportive environment where we all acknowledge we’re human, we’re flawed, but we choose to be here together, workshopping our money and our lives with positive, proactive suggestions and ideas.

And a disclaimer that I am not a trained financial professional and I encourage people not to make serious financial decisions based solely on what one person on the internet advises.

I encourage everyone to do their own research to determine the best course of action for their finances. I am not a financial advisor and I am not your financial advisor.

With that I’ll let Jess, today’s Case Study subject, take it from here!

Jess’s Story

Hello Liz and Frugalwoods readers! My name is Jess and I’m a 37-year-old single mom of two daughters, ages 6 and 9, living in beautiful Northern California. I have lived in this region most of my life and we have family nearby. My daughters live with me a little over half the time and we have an opinionated four-year-old Siamese cat. I have been a freelance writer/public relations consultant for about 6 years, and I absolutely love the work and the freedom that freelancing offers me. I’m also very involved in my kids’ school and activities, thanks to the flexibility of my work. Life with elementary-aged kids is full of sports, birthday parties, dance class and lots of fun!

Jess’s Hobbies and Lifestyle

When it comes to fun and hobbies for myself, I love hitting the gym and yoga classes, snow skiing, playing tennis, cooking and enjoying the great food and wine in my region. I also like to hike and travel with my boyfriend and spend time with friends and family.

I got divorced in the middle of 2020, because why not throw everything into the air during a pandemic? In all seriousness, it has been a healthy growth experience – fortunately at this point we are all living happy, healthy lives and the kids’ dad and I are good co-parents. It’s not perfect, but we are doing well. Financially, we split everything down the middle so it was a pretty clean break.

I’ve been in a serious relationship for awhile now, and at some point we see a future of combined households, which could change this whole picture – but for now my household is just me and my girls.

What feels most pressing right now? What brings you to submit a Case Study?

I hit a wall recently with work and my income has dropped a bit. At the same time, I bought a house on my own in April (I rented for almost two years post-divorce) and with the market the way it was, let’s just say I paid top dollar. While I qualified for the payment and technically can afford it, it’s tight each month, especially with the slowing of my client work and income. I am working to boost my income and identify new clients/projects, and am also trying to adjust my expenses so there’s more to work with. While the house is the obvious financial liability, it’s also not one I’m willing to sacrifice. We love this home and I am going to do whatever it takes to make it work.

With the big mortgage plus kid costs (activities! Sports! Field trips! Fundraising!) and the cost of living in California, I feel like I am just hemorrhaging money sometimes with not a lot left for fun (can’t a girl get a pedicure!?). I do split kid-related costs with my kids’ dad, which helps, but it can be tight.

The biggest challenge because of these factors is that I feel like I’m not saving enough, especially for retirement, now that I’m on my own. When I got divorced, we split our retirement down the middle and so now I feel like I’m playing catch up. Last year I was really proud to save a little over 10% of my income – I know that’s not quite as high as some experts recommend, but for a single mom, it felt good. I was also putting a lot into my house fund at the same time. This year I haven’t saved nearly that much. I also wish I had more to put away to boost my emergency fund and set aside cash for travel and mid-term expenses so I don’t have to cash flow them.

What’s the best part of your current lifestyle/routine?

I absolutely love the area where we live. It’s a wonderful small town near a bigger suburb, and I wouldn’t change the location for anything. It’s a kind and caring community, we have a great school district, and everything is really easy to get to – we never spend excessive amounts of time driving around to activities or errands, etc. We also have tons of access to the outdoors – lakes, hiking and biking trails, and just an hour or two from world-class skiing in Tahoe.

I would also say the work schedule I’ve built for myself is ideal. I do work hard and on a regular schedule, but I rarely have to work more than 30 hours per week. I’m able to handle personal or household needs between calls or writing projects, for example, and I don’t have to answer to anyone but myself. It also allows me to get in a midday workout or run errands during the day so I have more time later to spend with my girls. The freedom/flexibility is unmatchable.

What’s the worst part of your current lifestyle/routine?

My mortgage feels so expensive! I knew what I was getting into when I bought the house in April, but projection vs. reality feels different, especially as I noted with a dip in my income. And with an expensive mortgage, everything else starts feeling too high. (I did buy this home with the intent to either stay here forever if I’m single, or to turn it into a rental property if my marital status changes in the future and we eventually want to move.)

The mortgage combined with a lack of retirement and health benefits also makes being my own boss stressful. Sometimes I feel like I should just work full-time for an organization for the stability and 401k match + health insurance – but then I realize it’s hard to find a salary to match what I’ve built for myself, especially working the hours I do.

There’s one more component I struggle with, too, which is a bit less tangible. Since becoming a sole income earner, I find I am very fearful financially of going broke, running out of money, having financial disaster strike, etc. It’s more of a psychological issue than a financial one. It’s driven me at times to not put money into retirement because I feel like a cash cushion provides me more stability given our circumstances.

Where Jess Wants to be in Ten Years:

Finances:

-

Admiring my rose bush I want to remain debt-free other than my mortgage.

- I want a solid six-figure income with room to save at least 15% into retirement.

- I’d also like to have my mortgage be more in line with recommended ratios and have it look more like a 15-year mortgage than a 30-year.

- I would like to have some type of rental/income property in 10 years.

Lifestyle:

- I envision being happily remarried, preparing to send my girls off to college, and looking forward to the next “empty nest” chapter with some financial freedom on my side.

- I expect I’ll still be enjoying many of the same hobbies and activities!

Career:

- I could see myself still working independently as long as I keep hustling to stay where I need to keep maintaining (and ideally growing) financially.

- On the other hand, I’m open to moving into a full-time, in-house role with a good company if I find the right fit.

Jess’s Finances

Income

| Item | Number of paychecks per year | Gross Income Per Pay Period (total BEFORE all deductions) |

Deductions Per Pay Period (with amounts) | Net Income Per Pay Period (total AFTER all deductions are taken out) |

| Jess’ income (self-employed) | 12 | $10,000 | Estimated taxes: $2,500 (note, I typically get back a large chunk in tax refund — anywhere from $5k to $9k, but my accountant prefers I pay plenty upfront) | $7,500 |

| Annual gross total: | $120,000.00 | Annual net total: | $90,000.00 |

Mortgage Details

| Item | Outstanding loan balance | Interest Rate | Loan Period and Terms | Equity | Purchase price and year |

| Mortgage on primary residence | $533,000 | 4.30% | 30-year fixed-rate mortgage | $52,000 | $585k; purchased in April 2022 |

Debts: $0

Assets

| Item | Amount | Notes | Interest/type of securities held/stock ticker | Name of bank/brokerage | Expense Ratio | Account Type |

| Roth IRA | $62,540 | My Roth IRA. I try to max this out annually. No match. | ETFs and Mutual Funds | Schwab | Retirement | |

| Traditional IRA | $53,935 | Money earned through previous employer retirement plans and rolled over. | ETFs and Mutual Funds | Schwab | Retirement | |

| 529 College Fund: Kid 1 (age 9) | $16,930 | We started these when the kids were babies. We have very generous grandparents who have helped fund them! | ETFs and Mutual Funds | Merrill | College fund | |

| Savings account | $14,600 | This is my emergency fund. Slightly lower recently because of unexpected medical bills and moving costs. | Earns .02% interest | Bank of America | N/A | Cash |

| 529 College Fund: Kid 2 (age 6) | $11,935 | We started these when the kids were babies. We have very generous grandparents who have helped fund them! | ETFs and Mutual Funds | Merrill | College fund | |

| SEP IRA | $1,511 | This is an additional retirement account I opened for the years where I’m able to go beyond the max in my Roth IRA. | ETFs and Mutual Funds | Schwab | Retirement | |

| Total: | $161,451 |

Vehicles

| Vehicle make, model, year | Valued at | Mileage | Paid off? |

| Toyota Highlander, 2015 | $24,000 | 100,000 | Yes |

Expenses

| Item | Amount | Notes |

| Mortgage | $3,396 | This includes $89 in PMI, which I would like to get rid of sooner than later! |

| Groceries | $650 | Includes household supplies (such as toilet paper) as well as cat food. |

| Health insurance | $395 | I pay for insurance out of pocket through Covered California |

| Retirement savings | $350 | Listing this as an expense because it’s an item I pay for out of pocket after I pay myself. My goal is always 10% of my income, but this year I haven’t been able to swing it. In my tighter months I don’t save at all. |

| Utilities | $277 | Gas/Electric: Avg. $165/month, Sewer: $400 a year: Trash: $400 a year, Water: $45/month |

| Gas | $275 | Fortunately I don’t have high mileage so I can keep gas bills relatively low |

| Kids activities | $275 | Includes birthdays, sports, dance classes, school field trips, after-school care, summer camps, etc.

This is my half — their dad pays for the other half of all these expenses. |

| HOA | $257 | Covers my gutter cleaning, roof replacement and front yard maintenance |

| Medical expenses | $245 | This is not a typical line item but I’m including it anyway; I had a bit of a health issue this year that cost me nearly $3k out of pocket |

| Restaurants/coffee | $225 | Pizza nights with the kids, occasional date night, etc. |

| Vacation/travel | $200 | I usually save for travel in three-month stretches, but this is probably the average monthly breakdown |

| Emergency Fund savings | $200 | Trying to boost this fund back up as it’s not quite enough for my comfort after buying my house. In my tighter months I don’t save at all. |

| Gym membership | $150 | It’s expensive but I value fitness and love this option to get me out of my house since I’m ALWAYS here |

| Charitable donations | $125 | Not something I want to cut |

| Christmas | $125 | Averaged over the year |

| Car insurance | $104 | Triple A, bundled with my homeowners insurance |

| Household supplies | $100 | This includes essentials plus the occasional home décor splurge or things like towels, sheets, etc. |

| Housekeeper | $90 | This could be considered a “luxury” but it’s a monthly sanity saver for a single working mom! |

| Car maintenance | $75 | Estimate of the average breakdown including regular and major mileage maintenance, tires, etc. |

| Personal care | $75 | Hair cuts, occasional pedicures, beauty/hygiene products |

| Internet | $60 | |

| Subscriptions | $54 | Netflix, Disney+ bundle, Discovery+, Spotify, Audible |

| Gifts | $50 | Includes family/friend birthdays, kids’ birthdays, etc. |

| Entertainment | $50 | Averaged over the year |

| College savings | $40 | I only contribute a little bit to the kids’ funds at the moment. We are fortunate to have generous grandparents who are putting a lot in for our kids! When I have more funds freed up and am meeting my retirement goals, I’d like to increase this. |

| Mobile phone | $20 | Switched to Mint Mobile in October! |

| Dental insurance | $16 | I pay for insurance out of pocket through Covered California |

| Monthly subtotal: | $7,880 | |

| Annual total: | $94,560 | NOTE: I realize this technically puts me in the red…yikes!! |

Credit Card Strategy

| Card Name | Rewards Type? | Bank/card company |

| Bank of America Rewards Card | Cash back | Bank of America |

Social Security

| Item | Annual Amount | Year and age you’ll begin taking SS |

| Jess’ anticipated social security | $47,388 | 2055, age 70 |

Jess’s Questions for You:

1) Is there a better or more creative way to set aside money for retirement that I’m just not seeing?

2) Since I can’t change my mortgage, what other expenses could I cut?

3) Should I be pursuing a full-time job with benefits instead of trying to make freelancing work in my situation?

4) How can I release my financial fears and stop looking to dollar signs for security?

Liz Frugalwoods’ Recommendations

Jess has just come through several very stressful, tumultuous life events–pandemic, divorce, moving and buying a house–with her finances intact! Jess, you should feel tremendously proud of what you’ve been able to accomplish in a few short years. I’m so impressed with your determination to provide a wonderful home for your girls, sustain a job and work/life balance that fulfills you and continue saving and investing for retirement. Many congrats on getting to this point and I hope that today we can help you see even further down the financial road. Let’s dive into Jess’s questions!

Jess’s Question #1: Is there a better or more creative way to set aside money for retirement that I’m just not seeing?

In general, there are three ways to save/invest more money:

- Earn more

- Spend less

- Do a combination of both

Jess currently has $62,540 in a Roth IRA, $53,935 in a traditional IRA and $1,511 in a SEP IRA for a total of $117,986. Let’s take a look at where Jess stands according to Fidelity’s Retirement Rule of Thumb:

Aim to save at least 1x your salary by 30, 3x by 40, 6x by 50, 8x by 60, and 10x by 67.

Since Jess is 37, let’s go with 2x her salary, which would be $240,000 (2 x $120,000). What we’re looking at here is how much Jess should have, at this point, if she intends to work until a traditional retirement age and then draw down a sustainable percentage of her retirement investments to live on each year.

In light of that, Jess is correct in her assessment that she should beef up her retirement savings. Let’s first take a moment to talk about the types of accounts she has available to contribute to and why it’s important to invest for retirement in the first place–and not just save up a bunch of cash.

Also, remember that this total doesn’t include her Social Security, which is inflation-adjusted, and which she projects will be $47,388 a year starting at age 70.

What you want to be able to do in retirement is draw down a sustainable percentage of your overall investment portfolio to live on each year. You want to have enough invested to allow you to do this for the duration of your retirement.

Many experts consider 4% to be a sustainable rate of withdrawal. If, for example, you know you want to spend an inflation-adjusted $50,000 per year in your retirement (and not run out of money before you die), you’d need to have $1.25M in retirement investments at the time of your retirement (because 4% of $1.25M = $50,000 per year).

The reason to invest for retirement—as opposed to just saving cash for it—is threefold:

- There are tax advantages to utilizing retirement accounts

- There are grave disadvantages to cash (opportunity cost and it doesn’t keep up with inflation)

- There are advantages to investments (namely, anticipated rate of return)

Here are the Retirement Accounts Available to Jess:

1) Roth IRA

Jess already has one of these, which is fabulous. IRA stands for “Individual Retirement Account” and there are two different primary types of IRAs: Roth and Traditional. The difference between the two is in how they’re taxed.

- A Roth IRA is a retirement account that’s post-tax:

- That means you pay taxes on the money you put into a Roth IRA, but you don’t pay taxes when you withdraw the money in retirement.

- A Traditional IRA is a retirement account that’s pre-tax:

- That means you don’t pay taxes on money you put into an IRA, but you do pay taxes when you withdraw the money in retirement.

In 2023, the total amount a person can put each year into a traditional IRA and/or a Roth IRA can’t be more than $6,500 (or $7,500 if you’re age 50 or older).

- A person can have both a Roth and a traditional IRA, but their combined annual contribution to both can’t exceed this $6,500 ($7,500 for ages 50+) limit.

A Roth typically makes the most sense if your income is on the low end because in that case, your tax rate is low and so it doesn’t matter that you’re paying taxes on your contributions.

Based on this chart from the IRS, Jess is indeed eligible to contribute to a Roth IRA because her MAGI (modified adjusted gross income) is less than $138k/year (assuming she correctly reported her income above).

2) Traditional IRA

Jess has one of these too. However, from a tax perspective it will likely make the most sense for her to concentrate her contributions to her Roth IRA. Again, you can only contribute $6,500 total to both a Roth and a traditional IRA, which means she should focus on getting her Roth contribution up to $6,500 per year. She can just let her traditional IRA sit in the stock market and grow.

3) SEP IRA

Jess has the triple crown of IRAs with her SEP IRA, often referred to as an IRA for self-employed people because they’re available to businesses of any size (which includes business of one, like Jess’s). SEP contribution limits are a bit more confusing, but the IRS helpfully explains as follows:

Contributions an employer can make to an employee’s SEP-IRA cannot exceed the lesser of:

- 25% of the employee’s compensation, or

- $66,000 for 2023

Since Jess’s gross annual income is $120k, she’s eligible to put $30k into her SEP IRA each year. Even though this plan has the name “IRA” in it, per our buddies at the IRS, you are still allowed to contribute to it as well as the full $6,500 to your Roth IRA.

Grand total, between her Roth and SEP IRAs, Jess could sock away $36,500 in 2023 ($30,000 into her SEP + $6,500 into her Roth), which breaks down to $3,041.66 per month.

Now that we’ve established what Jess is legally allowed to contribute to her two retirement accounts, we need to determine where she’ll find this money. And so, let’s go to…

Jess’s Question #2: Since I can’t change my mortgage, what other expenses could I cut?

Anytime someone is interested in saving more money, I start by categorizing all of their spending as Fixed, Reduceable or Discretionary. These three categories allow us to see where reductions are possible:

- Fixed expenses are things you cannot change. Examples: your mortgage and debt payments.

- Reduceable expenses are necessary for human survival, but you control how much you spend on them. Examples: groceries and gas for the cars.

- Discretionary expenses are things that can be eliminated entirely. Examples: travel, haircuts, eating out.

Now that we know which items have leeway, I went through and assigned a “Proposed New Amount” to each line item. Only Jess knows which items are priorities and which items she can reduce, but the below spreadsheet gets this exercise started for her:

| Item | Amount | Notes | Category | Proposed New Amount | Liz’s Notes |

| Mortgage | $3,396 | This includes $89 in PMI, which I would like to get rid of sooner than later! | Fixed | $3,396 | Jess is correct that this is really high, but, she articulated that this is her highest priority and she doesn’t want to sell her house.

In light of that, we’ll work to determine other areas where reductions are possible. |

| Groceries | $650 | Includes household supplies (such as toilet paper) as well as cat food. | Reduceable | $500 | This is already pretty low, but, it is an area where reductions could be made. |

| Health insurance | $395 | I pay for insurance out of pocket through Covered California | Reduceable | $395 | Jess, have you looked into subsidies through the state of CA? I assume you have, but double checking just in case. |

| Retirement savings | $350 | Listing this as an expense because it’s an item I pay for out of pocket after I pay myself. My goal is always 10% of my income, but this year I haven’t been able to swing it. In my tighter months I don’t save at all. | Reduceable | $0 | In order to not confuse ourselves, I’m removing this retirement amount so that we’re only looking at true expenses on this sheet. |

| Utilities | $277 | Gas/Electric: Avg. $165/month, Sewer: $400 a year: Trash: $400 a year, Water: $45/month | Reduceable | $277 | Any opportunities for reductions here? Have you done an energy audit or used an energy kilowatt monitor to determine areas where you could cut back on electricity usage? |

| Gas | $275 | Fortunately I don’t have high mileage so I can keep gas bills relatively low | Reduceable | $175 | This is already pretty low, but, it is an area where reductions could be made. |

| Kids activities | $275 | Includes birthdays, sports, dance classes, school field trips, after-school care, summer camps, etc.

This is my half — their dad pays for the other half of all these expenses. |

Reduceable | $175 | Any opportunities for reductions here?

Would it be possible to eliminate some of the extra-curricular/discretionary activities? Would it be possible to ask grandparents to gift things like dance lessons for birthdays or Christmas? |

| HOA | $257 | Covers my gutter cleaning, roof replacement and front yard maintenance | Fixed | $257 | Yikes! On top of the mortgage, this brings Jess’s monthly carrying costs for the house to $3,653! |

| Medical expenses | $245 | This is not a typical line item but I’m including it anyway; I had a bit of a health issue this year that cost me nearly $3k out of pocket | Fixed | $245 | |

| Restaurants/coffee | $225 | Pizza nights with the kids, occasional date night, etc. | Discretionary | $0 | Much as I hate to eliminate this, it is a discretionary line item that could be deleted. |

| Vacation/travel | $200 | I usually save for travel in three-month stretches, but this is probably the average monthly breakdown | Discretionary | $0 | Much as I hate to eliminate this, it is a discretionary line item that could be deleted. |

| Emergency Fund savings | $200 | Trying to boost this fund back up as it’s not quite enough for my comfort after buying my house. In my tighter months I don’t save at all. | Reduceable | $0 | Similar to the above retirement contribution, I’m going to eliminate this here so that we’re only looking at true expenses on this sheet. |

| Gym membership | $150 | It’s expensive but I value fitness and love this option to get me out of my house since I’m ALWAYS here | Discretionary | $0 | I hate to eliminate a priority for Jess, but this is something that is technically Discretionary. |

| Charitable donations | $125 | Not something I want to cut | Discretionary | $0 | I hate to eliminate a priority for Jess, but this is something that is technically Discretionary. |

| Christmas | $125 | Averaged over the year | Reduceable | $50 | Any opportunities for reductions here? This totals $1,500 for Christmas.

Would it be possible to purchase second-hand gifts for the kids? Do a Secret Santa with family to reduce the number of gifts to give? Reconsider your gift giving list? I will note that $50/month would still be a total of $600 for Christmas. |

| Car insurance | $104 | Triple A, bundled with my homeowners insurance | Reduceable | $104 | Worth shopping this around if you haven’t done so recently. |

| Household supplies | $100 | This includes essentials plus the occasional home décor splurge or things like towels, sheets etc. | Reduceable | $50 | |

| Housekeeper | $90 | This could be considered a “luxury” but it’s a monthly sanity saver for a single working mom! | Discretionary | $0 | Again, I hate to eliminate it, but it is one of our few Discretionary line items to work with. |

| Car maintenance | $75 | Estimate of the average breakdown including regular and major mileage maintenance, tires, etc. | Fixed | $75 | |

| Personal care | $75 | Hair cuts, occasional pedicures, beauty/hygiene products | Reduceable | $25 | |

| Internet | $60 | Fixed | $60 | ||

| Subscriptions | $54 | Netflix, Disney+ bundle, Discovery+, Spotify, Audible | Discretionary | $0 | Could you pick just one or two of those subscriptions and eliminate the rest? |

| Gifts | $50 | Includes family/friend birthdays, kids’ birthdays etc. | Discretionary | $10 | |

| Entertainment | $50 | Averaged over the year | Discretionary | $0 | |

| College savings | $40 | I only contribute a little bit to the kids’ funds at the moment. We are fortunate to have generous grandparents who are putting a lot in for our kids! When I have more funds freed up and am meeting my retirement goals, I’d like to increase this. | Discretionary | $0 | My suggestion is to stop these contributions while getting yourself on track for retirement. See more notes on this below. |

| Mobile phone | $20 | Switched to Mint Mobile in October! | Fixed | $20 | Well done on switching to an MVNO! |

| Dental insurance | $16 | I pay for insurance out of pocket through Covered California | Fixed | $16 | |

| Monthly subtotal: | $7,880 | Minus retirement & emergency fund savings = $7,330 | Proposed New Monthly subtotal: | $5,830 | |

| Annual total: | $94,560 | Proposed New Annual total: | $69,960 |

To be clear, I am not an advocate for cutting every last expense. And, if Jess were already on track for retirement, I wouldn’t suggest so many eliminations. One of the challenges with Jess’s budget is that her house-related expenses–mortgage + HOA fees–total $3,653 a month. In light of that, she knows she’ll be spending $43,836 per year just on housing. While I understand that this is her highest priority, it does mean she will need to reconsider some of her other stated priorities.

→If the house stays, a lot of other Discretionary items will need to go.

If Jess were to implement the above proposed new budget, she’d be on track to save $20,040 a year ($90,000 net income – $69,960 expenses).

A Note On Saving For the Kids’ College

529s are tax-advantaged college savings accounts and Jess wisely opened one up for each of her children. However, while 529s are great, you need to ensure you’re not prioritizing contributions to a 529 ahead of your own retirement. This is why I suggest Jess stop contributing to her kids’ 529 accounts.

This is a “put your own oxygen mask on first” scenario.

While you want to provide for your children, you must provide for your own retirement. Kids can take out loans for school, you cannot take out loans for retirement. I always advise parents to first ensure they’re on track for their own retirement, then contribute to a 529 account. The scenario you want to avoid is that you pay for your kids’ college and then have to move in with them in your old age because you didn’t save enough for retirement. I’m not saying that’s going to happen to Jess, but that’s my standard cautionary tale around 529s (and other college savings accounts).

What To Do With This $20k Per Year?

If Jess is able to save per the above guidelines, there are two priorities clamoring for her money:

- Her emergency fund

- Her retirement investments

Jess’s Emergency Fund: $14,600

Jess mentioned that her emergency fund is too small and I agree. Your cash equals your emergency fund and your emergency fund is your buffer from debt. Ideally, you want to target an emergency fund of somewhere between three to six months’ worth of your spending. At Jess’s current rate of spending $7,330 per month, she should save up $21,990 (three months’ worth) to $43,980 (six months’ worth).

→However, it’s also true that the less you spend, the smaller your emergency fund needs to be.

If Jess were to instead start spending at the proposed new amount of $5,830 per month, she’d want to have an emergency fund of $17,490 (three months’ worth) to $34,980 (six months’ worth).

Why Have An Emergency Fund?

Your emergency fund is there for you if:

- You unexpectedly lose your job

- Something horrible goes wrong with your house that needs to be fixed ASAP

- Your car breaks down and must be repaired

- You’re hit with an unexpected medical bill

- Your dog gets quilled by a porcupine and has to go to the emergency vet

As you can see, an emergency fund is not for EXPECTED expenses, such as:

- Routine maintenance on a car, such as oil changes and brake pads

- Anticipated home repairs, such as boiler servicing/chimney sweeping

- Planned medical expenses

An emergency fund’s reason for existence is to prevent you from sliding into debt should the unforeseen happen. It’s your own personal safety net.

This is also why it’s so critical to track your spending every month. If you don’t know what you spend, you won’t know how much you need to save. I use and recommend the free expense tracking service from Empower, which used to be called Personal Capital (affiliate link).

While everyone needs an emergency fund, some folks have circumstances that make an emergency fund even more critical.

Here are a few examples:

-

The view from a hike Single-income households:

- With only one stream of income, you’re in a more tenuous position because if that person loses their job, you don’t have another income to fall back on.

- Households with children:

- Need I elaborate? My children continue to astound me with their creative methods for spending my money…

- Home owners:

- The roof, the boiler, the oven, the toilet… it’s all going to break at some point. If you’re lucky, it won’t all break in the same month.

- People who must own cars:

- If you must have a car in order to get around, it’s an added liability.

- If you live in a place with ample mass transit and have a car for occasional convenience, you’re not reliant upon that vehicle and so it takes lower priority.

In all of these instances, you have expensive liabilities that could require money to fix. Lucky for Jess, she fits all of these categories, which is why I strongly encourage her to both reduce her spending and increase her emergency fund.

For folks who rent and don’t have pets, children or cars: your liabilities are typically less. If you don’t have other people dependent upon our income and you’re not responsible for home or car repairs, you have fewer potential emergencies to contend with. That’s not to say you shouldn’t have an emergency fund–you absolutely should!–but you can probably calibrate to more like a three-month fund. Knowing your risk level and potential exposure is key when identifying how much you need in your emergency fund.

How To Allocate Between Retirement and Emergency Fund

Since Jess has competing goals here–beefing up retirement and her emergency fund–I put together the below chart demonstrating how she might allocate her savings every year for the next 28 years:

| Year | Jess’s Age | Annual Net Income | Annual Expenses | Difference Between Income and Expenses | Emergency Fund Total | Total $ to Put into Emergency Fund | Total Available $ to Put into Retirement | Annual Roth IRA Contribution | Annual SEP IRA Contribution |

| 2023 | 37 | $90,000 | $69,960 | $20,040 | $14,600 | $2,890 | $17,150 | $6,500 | $10,650 |

| 2024 | 38 | $90,000 | $69,960 | $20,040 | $17,490 | $2,890 | $17,150 | $6,500 | $10,650 |

| 2025 | 39 | $90,000 | $69,960 | $20,040 | $20,380 | $2,890 | $17,150 | $6,500 | $10,650 |

| 2026 | 40 | $90,000 | $69,960 | $20,040 | $23,270 | $2,890 | $17,150 | $6,500 | $10,650 |

| 2027 | 41 | $90,000 | $69,960 | $20,040 | $26,160 | $2,890 | $17,150 | $6,500 | $10,650 |

| 2028 | 42 | $90,000 | $69,960 | $20,040 | $29,050 | $2,890 | $17,150 | $6,500 | $10,650 |

| 2029 | 43 | $90,000 | $69,960 | $20,040 | $31,940 | $2,890 | $17,150 | $6,500 | $10,650 |

| 2030 | 44 | $90,000 | $69,960 | $20,040 | $34,830 | $0 | $20,040 | $6,500 | $13,540 |

| 2031 | 45 | $90,000 | $69,960 | $20,040 | $34,830 | $0 | $20,040 | $6,500 | $13,540 |

| 2032 | 46 | $90,000 | $69,960 | $20,040 | $34,830 | $0 | $20,040 | $6,500 | $13,540 |

| 2033 | 47 | $90,000 | $69,960 | $20,040 | $34,830 | $0 | $20,040 | $6,500 | $13,540 |

| 2034 | 48 | $90,000 | $69,960 | $20,040 | $34,830 | $0 | $20,040 | $6,500 | $13,540 |

| 2035 | 49 | $90,000 | $69,960 | $20,040 | $34,830 | $0 | $20,040 | $6,500 | $13,540 |

| 2036 | 50 | $90,000 | $69,960 | $20,040 | $34,830 | $0 | $20,040 | $6,500 | $13,540 |

| 2037 | 51 | $90,000 | $69,960 | $20,040 | $34,830 | $0 | $20,040 | $6,500 | $13,540 |

| 2038 | 52 | $90,000 | $69,960 | $20,040 | $34,830 | $0 | $20,040 | $6,500 | $13,540 |

| 2039 | 53 | $90,000 | $69,960 | $20,040 | $34,830 | $0 | $20,040 | $6,500 | $13,540 |

| 2040 | 54 | $90,000 | $69,960 | $20,040 | $34,830 | $0 | $20,040 | $6,500 | $13,540 |

| 2041 | 55 | $90,000 | $69,960 | $20,040 | $34,830 | $0 | $20,040 | $6,500 | $13,540 |

| 2042 | 56 | $90,000 | $69,960 | $20,040 | $34,830 | $0 | $20,040 | $6,500 | $13,540 |

| 2043 | 57 | $90,000 | $69,960 | $20,040 | $34,830 | $0 | $20,040 | $6,500 | $13,540 |

| 2044 | 58 | $90,000 | $69,960 | $20,040 | $34,830 | $0 | $20,040 | $6,500 | $13,540 |

| 2045 | 59 | $90,000 | $69,960 | $20,040 | $34,830 | $0 | $20,040 | $6,500 | $13,540 |

| 2046 | 60 | $90,000 | $69,960 | $20,040 | $34,830 | $0 | $20,040 | $6,500 | $13,540 |

| 2047 | 61 | $90,000 | $69,960 | $20,040 | $34,830 | $0 | $20,040 | $6,500 | $13,540 |

| 2048 | 62 | $90,000 | $69,960 | $20,040 | $34,830 | $0 | $20,040 | $6,500 | $13,540 |

| 2049 | 63 | $90,000 | $69,960 | $20,040 | $34,830 | $0 | $20,040 | $6,500 | $13,540 |

| 2050 | 64 | $90,000 | $69,960 | $20,040 | $34,830 | $0 | $20,040 | $6,500 | $13,540 |

| 2051 | 65 | $90,000 | $69,960 | $20,040 | $34,830 | $0 | $20,040 | $6,500 | $13,540 |

| Total contributions: | $188,500 | $372,430 |

As you can see, I kept her income and expenses static for the sake of this model. Obviously that’s very unlikely, but, the great thing about this chart is that Jess can change those variables and view the resulting calculations. Same deal for the Roth and SEP contributions–those are also very unlikely to remain static since the IRS changes them nearly every year. Again, Jess can go in and adjust those amounts as needed. I do have her maxing out her Roth, but not maxing out the SEP (at $30k/year) because she doesn’t have enough room in her budget. However, if she earns more (or spends less), she can work on reaching that max if desired.

How Much Would Jess Have At Age 65?

To answer that question, we have to use a compounding interest calculator and account for her current retirement savings as well:

| Roth IRA | SEP IRA | IRA | Total in all Retirement Accounts at end of 2051 | |

| Total contributions made 2023-2035 | $188,500 | $372,430 | None as all money should go into the other two accounts | |

| Existing Account Balances (as of 3/29/23) |

$62,540 | $1,511 | $53,935 | |

| TOTALS: | $251,040 | $373,941 | $53,935 | $624,981 |

While $624k sounds great, it doesn’t account for stock market returns! Let’s do that projection next:

| Amount Invested Per Month On Average (28 years = 336 months total) | $1,860.06 |

| Projected Portfolio Total in 2051: | $2,585,642.30* |

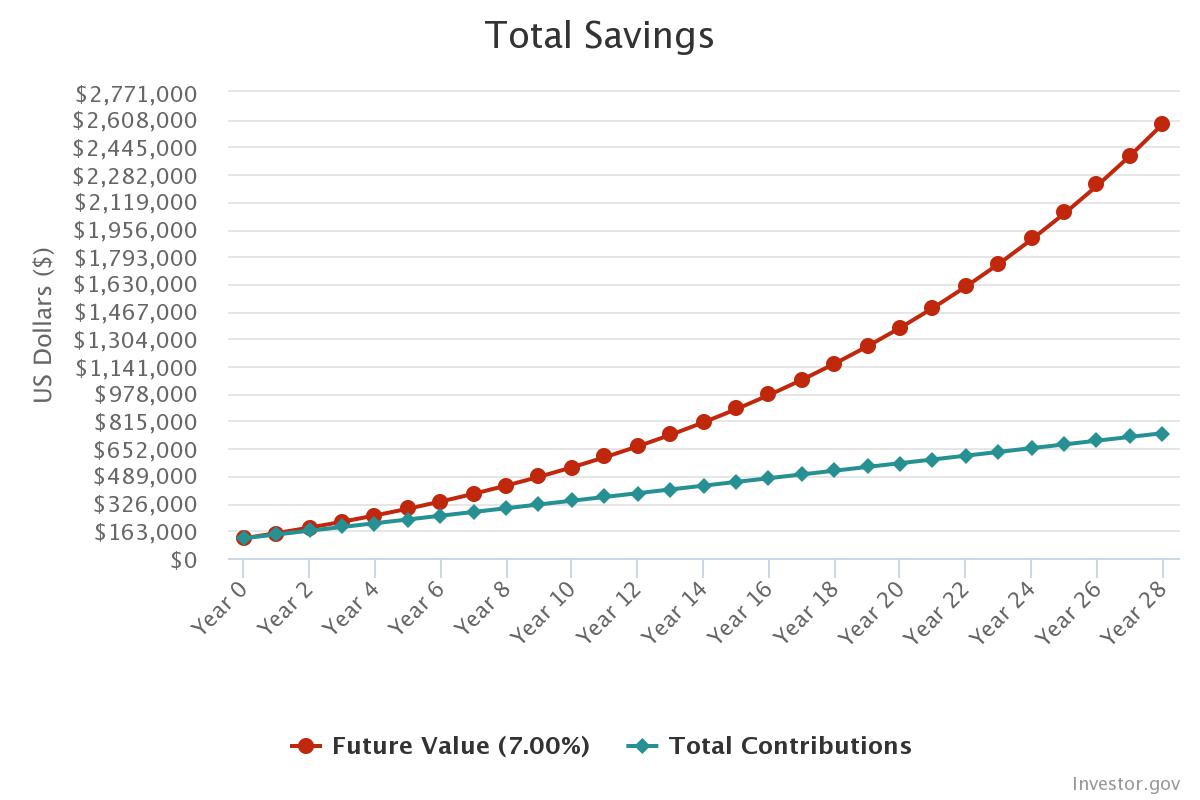

*assuming a 7% market return on 28 years of investing $1,850.06 per month

If Jess were to contribute $1,860.06 per month to her retirement accounts for the next 28 years, she’d be on track to retire at age 65 with $2,585,642.30 in her investments. This assumes a historically average 7% annual market return (which doesn’t mean 7% every year, but rather an average of 7% annually over the course of 28 years). With that amount, if Jess were to withdraw a sustainable 4% annually starting at age 65, she’d have $103,425.692 to live on every year (plus Social Security), which is pretty sweet!

I did this calculation with this compounding interest calculator and here’s a chart demonstrating the growth she could see in her investments:

The caveats with this projection are, of course, that it is a projection since we can’t know:

- What the stock market will actually do.

- What the contribution limits will be for Roth IRAs and SEP IRAs in the future.

- What Jess’s salary and expenses will be over time.

- What inflation will do.

The point of this exercise is to demonstrate the power of compounding interest and the fact that Jess has time on her side. She’s relatively young in her working life if she’s aiming for a traditional retirement age of ~65. In light of that, she can capitalize on several decades worth of potential investment returns. It is much easier to start contributing early to retirement investments than it is to play catch-up later. If you start late, you won’t be able to reap the rewards of investment returns and compounding interest.

The Importance of Expense Ratios

Something missing from Jess’s list of retirement investments are their expense ratios. This is not a minor detail you can ignore because:

Expense ratios are the percentage you pay to a brokerage for investing your money and, as they are fees, you want them to be as low as possible.

As Forbes explains: “An expense ratio is an annual fee charged to investors who own mutual funds and exchange-traded funds (ETFs). High expense ratios can drastically reduce your potential returns over the long term, making it imperative for long-term investors to select mutual funds and ETFs with reasonable expense ratios.”

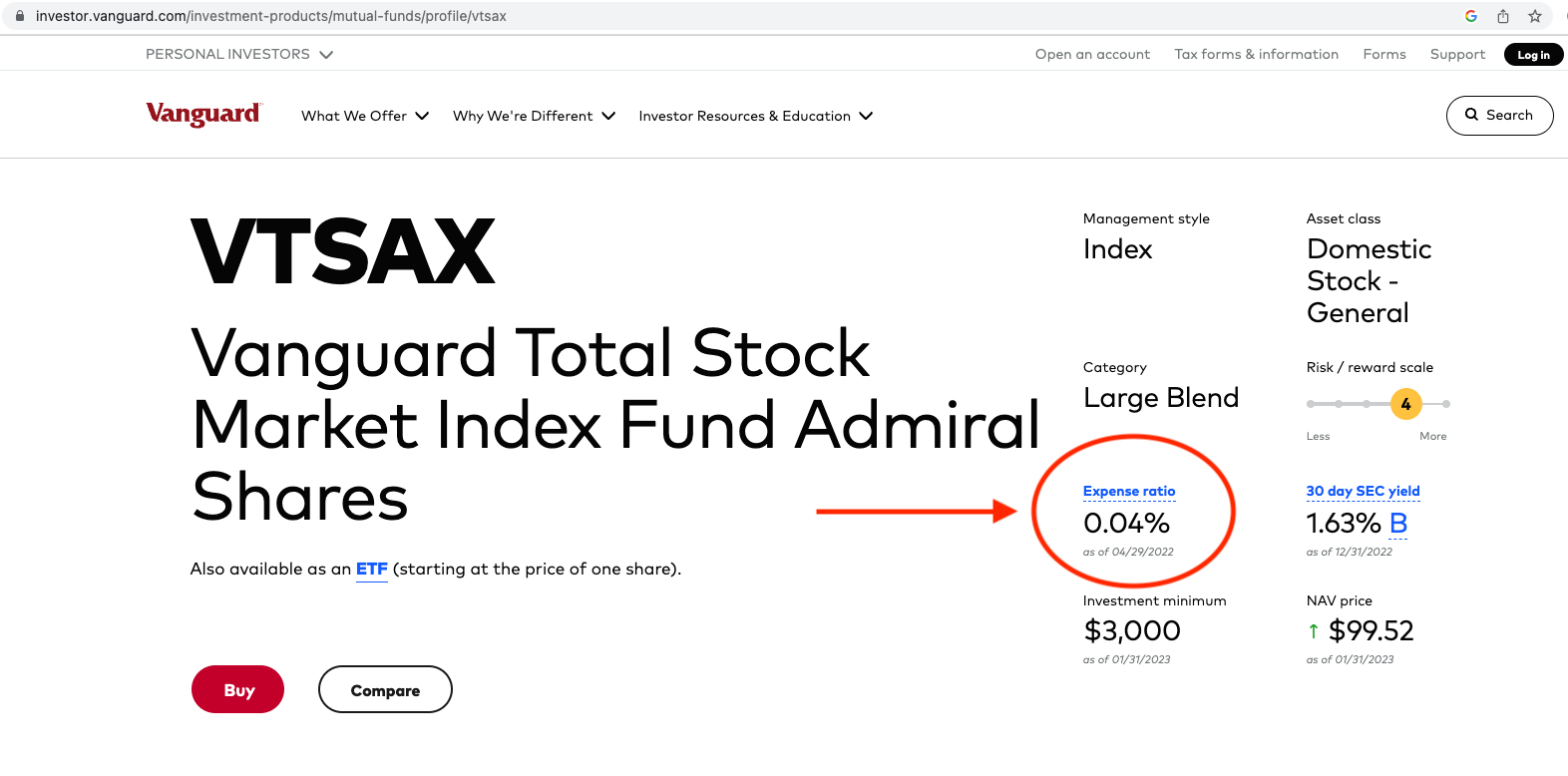

In light of their importance to one’s overall long-term financial health, I encourage Jess to locate the expense ratios for all of her retirement investments. I’m going to use VTSAX as an example of how to find an expense ratio.

You’re going to like this because it’s a three-step process:

1. Google the stock ticker (in this case I typed in “VTSAX”)

2. Go to the fund overview page

3. Look at the expense ratio.

Screenshot below for reference:

And done! Woohoo! To give you a sense of whether or not your investments have reasonable expense ratios, the following three funds are considered to have low expense ratios:

- Fidelity’s Total Market Index Fund (FSKAX) has an expense ratio of 0.015%

- Charles Schwab’s Total Market Index Fund (SWTSX) has an expense ratio of 0.03%

- Vanguard’s Total Market Index Fund (VTSAX) has an expense ratio of 0.04%

You can also use this calculator from Bank Rate to determine what you will pay in fees over the lifetime of your investments, based on their expense ratios. If you find that your investments have high expense ratios, it is well worth your time to investigate whether or not you can move them to lower-fee funds. This is not always possible with employer-sponsored plans (such as 401ks) as you’re beholden to whatever funds your employer offers. But, it’s still worth looking through all available funds to select the ones with the lowest expense ratios.

The Importance of a High-Yield Savings Account

The other thing that jumped out at me about Jess’s accounts is that her savings account isn’t earning anything in interest. Unacceptable ;)!

Jess needs to find a high-yield savings account ASAP because this is free money! For example, as of this writing, the American Express Personal Savings account earns a whopping 3.75% in interest (affiliate link). If Jess were to put her emergency fund in this account, in one year her $14,600 would earn $548 in interest!!!

Jess’s Question #3: Should I be pursuing a full-time job with benefits instead of trying to make freelancing work in my situation?

This is something only Jess can answer. As I’ve just modeled out, Jess earns enough and has the potential to save enough to have both a fully funded emergency fund and a fully funded retirement. It’s now a question of what’s most important to her.

- Does she want to reduce her spending as outlined above?

- Or would she rather increase her income?

If Jess wants to focus on income increases, then she should go for it with her freelance work and see what’s possible for her. If she’d rather lose the flexibility/hours of freelancing but gain the stability of a paycheck from an employer, she can go that route. The beautiful thing here is that Jess has options. She can control both variables–income and expenses–and she’ll just need to decide which levers to push.

Jess’s Question #4: How can I release my financial fears and stop looking to dollar signs for security?

To a certain extent, you can’t. Money does provide security. It’s a fact. I think it’s naive to assume otherwise. On the other hand, I also think it’s possible to put too much emphasis on financial stability. Financial stability doesn’t necessarily reduce anxiety, make people happier or deliver fulfilling lifestyles. It’s all about your perception of money and the emotional response you have to it.

There are plenty of millionaires who feel financially insecure and terrified. Conversely, there are plenty of folks with far less who experience far greater contentment and stability in their lives. There’s a great deal of privilege in having financial security and the confidence that your basic needs will be met. And so the challenge is to not lose sight of that while also allowing yourself to feel confident about the financial position you’re in.

Summary:

- Move your cash into a high-yield savings account ASAP

- Review the Proposed New Expenses spreadsheet to determine which expenses you’re willing to reduce or eliminate

- Know that if you choose to stay in the house, many other discretionary items will need to be eliminated

- Review the expense ratios for all of your retirement investments and change funds if needed

- Stop contributing to the kids’ 529s while you catch up on retirement

- Implement the above plan for beefing up your emergency fund and retirement investments

- Determine if you’d rather increase income or decrease expenses (or do both) in order to do this

- Keep an eye on the long-term retirement investment targets over the decades

- Know that time is on your side right now in terms of compounding interest and that it’s MUCH better to start investing for retirement sooner rather than later

Ok Frugalwoods nation, what advice do you have for Jess? We’ll both reply to comments, so please feel free to ask questions!

Would you like your own Case Study to appear here on Frugalwoods? Apply to be an on-the-blog Case Study subject here. Hire me for a private financial consultation here. Schedule an hourlong or 30-minute call with me here, refer a friend to me here, or email me with questions ([email protected]).

Wondering about hiring me for a consultation? Grab 15 minutes on my calendar for free to discuss!

Jess is doing a great job and should give herself a pat on the back. I hesitate to offer any advice but based on my experience I would say to Jess not to hesitate in ruthlessly cutting back and explaining to her children the reasons, to learn how to be frugal and be the boss of you money is an invaluable lesson to teach children and will set them up for life. I recently watched ‘smart with money’ on Netflix (I hope this is allowed and apologies if not) and it was vey interesting, especially the part on passive income, Jess is clearly a skilled writer and maybe could explore this aspect. I also started to watch a man called Dave Ramsey (I am in the UK so this is also an eye opener to me) and was struck by how being frugal and saving can lead to serious wealth in later years. All the best to Jess and her family.

Thank you for your kind words and input!

I think Jess is doing really, really well, but obviously wants to do better. I get that, so do I! One thing to note is that her mortgage is really new. I have found that when one first buys a property, especially if it was at a high price generally, that first 1-2 years you absolutely haemorrhage money. You just do. It’s insane. Interest rates go down, options to remortgage come along (and I would strongly suggest you do this at the first opportunity. Getting a much better deal could largely eliminate many of your financial shortfall worries in one fell swoop).

Essentially, you’re in a lean period. As Mrs F notes, there are un-fun things to cut, or at least cut down on, which will address at least some of these worries, but ultimately, over time, if you keep your priorities top of mind, things are likely to shake out okay. I agree with suggestions re not contributing to college funds at this point – you absolutely can resume this later, of course – and to greatly reducing ”travel” and other areas of discretionary spending. Is there a way to get your out-of-the-house exercise time less expensively than at the gym, for example? Also, the extra-curriculars will need close examination: it may be that unless grandparents would be prepared to give those as birthday or Christmas gifts, that the girls need to decide what they really love most, and stick with that. I have 3 kids and the general rule is that they can choose 1 thing that is what I’d think of as ”expensive” vs the free-or-very-inexpensive types of activities.

If it were me, I’d be very reluctant to give up the hours / work-life Jess has. Her girls are young, she’s fairly recently divorced and being available and present for them in a consistent way for at least another year or so would be ideal. As they get a bit older, then absolutely, go back to work full-time for a good salary. It would make a lot of sense to do that, but not quite now. If you’re able to increase your hours to around 35 a week on a regular basis, that might help meanwhile.

I wholeheartedly second all of your points, especially looking at this as a “lean” period – it is temporary.

Definitely nice to think of it this way, thank you!

Another option available for retirement to Jess is a SE-401K, which also has a Roth option. May make more sense if her taxes are likely to be higher in retirement than now.

If her ex is making a lot more money than her there may be scope to reassess how much of the kids’ expenses each are paying. Legally and ethically 50-50 is not always a fair split.

Moving to being an employee rather than self-employed could help her feel less anxiety about money, since her income each month is steady instead of dependent on clients.

Jess, you’re doing so great! If it were me I would def keep the house cleaning expense for sanity reasons as you mentioned. One small idea — BofA is giving you a HORRIBLE interest rate on your savings. You might want to consider moving this to a higher yield account — I personally love Alliant credit union which has a well over 2% interest rate currently. A seemingly small difference but, esp as your savings grow, it could mean having some extra pedicure money. Check out Suze Orman’s special with them bc they will give you extra funds if you set up an account via her arrangement with them.

I just want to echo the recommendation that you move your savings out of BoA as fast as possible. Another option, if you don’t mind a completely online bank would be Wealthfront – their high yield savings account is currently at 4.3%. They’re better known for being a robo-advisor, but their cash account is the highest interest one that I’ve found so far.

Thanks for the advice on BofA! I always figured it’s a hassle to move accounts but I hear you!

I just recently left BOA for a high yield account (local bank @3.5%). i put it off for so long because i feared it would be a hassle – and it was so simple! wish i did this sooner.

Yes, I also recommend finding a better savings account. We use a local credit union for our checking and keep at least $2000 in there at all times in case of an urgent emergency that we need cash for right away. Also, the convenience of a local branch, plenty of ATMs around is nice. The rest of our emergency fund is in an online only high yield savings account (Ally Bank) that we can easily transfer to our checking within a couple days.

Is there a better benchmark than the fidelity rule of thumb for estimating where you should be with retirement savings? My salary is a tad bit higher than Jess’s but I’m spending significantly less and saving significantly more than Jess. I would think monthly living expenses would be a better tool for assessing how ready you are for retirement… Not your salary… But maybe I’m missing something.

This is a great question! I recommend that you use a couple different online calculators to estimate what you’ll need. The best–and most comprehensive–is Engaging Data’s Rich, Broke, or Dead calculator, which enables you to input a number of variables to model out how much you’ll need in retirement. You can also do the back-of-the-envelope 4% rule as I outlined above in Jess’s study. By this I mean: how much would you need in assets in order to be able to live on a 4% annual drawdown?

Jess is doing amazing for her future and her girl’s. I just wanted to sugest – as a self employed person, too – ask your accountant to run figures for you on your retirement account contributions. We max our SEP.accounts every year and our accountant gives us the breakdown for what we saved in taxes by doing the full contribution. I would love to do roth contributions, too, but don’t have the financial flexibility at this point and need the tax reduction from the sep accounts.

Good point. I’ll look into that!

As a CPA, I completely agree with this! Contributing to the SEP would reduce taxes and it would reduce her income for ACA subsidy purposes. Since Jess gets her insurance through Covered California, she might pay less for insurance by contributing to a SEP.

Hi Jess!

I was a Case Study a few years ago (it feels like lifetimes!!) and I just wanted to say hurrah for doing this with Liz, I found it scary but so rewarding!

I also wanted to say that, regarding what you’ve said about your life … perspective is EVERYTHING. My projected five-to-ten-year plan did NOT work out remotely like I imagined it would when I mapped it out with Liz. Not even a bit!

But this helped me learn what I feel to be the most important thing — it’s not about achieving a certain level of concrete financial security that will give you a feeling of finally getting to the point where you can relax and enjoy life. It’s about learning to embrace uncertainty. I spent a long time building financial security so that I could do the things I love instead of prioritizing doing the things I love and achieving financial security second. And there are people who would read my case study and laugh their heads off at my saying this–compared to a lot of people, I absolutely didn’t sacrifice the things I love for money. But I currently feel like I did, hah. But it’s all a matter of perspective 😉

And since you’re a recently divorced person (my husband and I are currently kind of unofficially separated but still getting along and working things out, and I’m 37 and I have a baby girl so I say this from a place of utter solidarity) you know how hard but rewarding uncertainty can be, and how trying desperately to create a solid foundation can be both truly truly necessary and also use up a looooooot of time that could probably be better spent otherwise!

I (absolutely) agree with Liz that a certain level of financial security is necessary for peace of mind, but (I feel like a bad Yoda here haha) peace of mind is necessary before you’ll ever feel reassured by money. I say work on that. You sound like you really love your community, and to me, that’s the most true and rewarding security you can build for your future.

You’re doing awesome! Really, you are! I’m so impressed!

I know we have totally different lives and interests and backgrounds, but to give you an idea of another person’s experience of a similar situation (*cough perspective) I currently make 850€ a month, have about 2K in savings, and alllllll the rest of my darling Benjamins are tied up in a shared mortgage. And YES I’ve been trawling the real estate ads and can’t wait to set myself and my girl up more securely and have a place of my own…but! I can’t tell you how beautiful it was, when my husband and I first split up, to see all of these people around me offering help and support and love. Being financially insecure bright me closer to my family and my community and while it’s totally nerve-wracking, it’s lovely.

I also am still aiming for FI, but I also think that getting out of a growth mindset and realizing that there are cycles in life–that we don’t spend our whole lives at maximum productivity and sometimes we earn less than we could because we are busy enjoying ourselves more–is more important than being able to never have to financially rely on someone else (a boss, a family member, a friend) ever again.

Anyhow!! I always mean to just pop over to the comment section and say something concise hahaha and it never ever works out that way. Sorry for the long windedness.

Again, you’re doing fabulously well, and now that you’ve consulted Liz, you’ll be doing even better soon! 🙂 Best of luck to you and your family!

Hi Georgia,

would be super interesting to read a follow up on your Case Study.

What habits/suggestions were you able to incorporate?

What did you prioritize? What’s next?

Hi Danielle!

I feel the same about other case studies!

I incorporated all kinds of habits, like paying more attention to small expenditures and trying to make more money. I also did not go back to the States, did not finish my PhD, and wound up lucking into a super job at an art museum in my small town. But the position got eliminated during COVID, and I haven’t found anything I’m ready to trade my free time for just yet!

My husband and I paid off our house a year or so ago (which was super satisfying and our priority!) and invested in some land. I had more savings but some unexpected health concerns for a family member in the US kind of wiped it out.

I actually feel like my comment above was from a very emotional place haha and yet I think if I’ve learned anything about finances it’s that FI is awesome and financial peace of mind is like having great health. Takes work and can be kind of a pain, but so relaxing in the end!

What’s next is buying my own house, figuring out a new job situation, going back into maximum budgeting mode to pay off the house asap, and trying my best to embrace the transition!

I have also taken a fresh look at money and ways to need less of it as an act of ecological solidarity, and I’m really into the concept of degrowth. I have gotten to the point where I’m less interested in not working and more interested in doing work that treats the climate transition as an opportunity to reevaluate how we spend our time.

That said, FI (like degrowth and frugality and moneyless économies etc) makes it way easier for people to become more politically active, which is awesome! So basically I’d like to do a mix of it all.

Anyhow, my best to you!

Thank you. Best of luck to you as well! I know it’s a hard spot to be but you’ve got an awesome outlook!

Thanks, Jess! I actually spent the hours of 2 to 6 am last night feeling absolutely furious and rotten and out of (financial) control and wishing that I’d gotten to FI before having the brilliant idea to get divorced 😂 but then I woke up and … everything was ok.

Best of luck to you, too.

Thanks for your insights & all the best for your future endeavours. I agree working for a good cause can be very rewarding.

I agree with Danielle C, every time I read a case study I wish that former case studies would pop in and tell us what they did and how it went!

Me, too!

Does the house have three bedrooms? If so, could you rent one out to a college student or a young adult who might like being around a family? When I bought my first house, before I married, I had to have roommates to make ends meet. It’s not ideal, long-term, but might be a way to ease the pressure for a few years.

The renter possibly could also be a source for babysitting or housekeeping help, in exchange for a decrease in rent.

^This. Maybe even another single parent with 1-2 kids? Not ideal but given that the mortgage is the largest and most troubling expense, this would be an effective way to tackle it directly and allow her to keep some/most/all of the other expenses in place.

Beth and Laura — I honestly never even considered this as an option but it’s really creative proposition. Thank you!

Hi Jess! Popping in from Northern CA, so hey neighbor!

Following up on a potential room rent…one thing we have explored is providing furnished housing to traveling nurses. Furnishedfinder.com is where many travel nurses and other healthcare professionals go to rent rooms. Most are on 3 month contracts, so it’s a good way to dip your toes into having someone in a shared space, without the full commitment of a year long lease.

I’m impressed at how well Jess is doing! One thought I had was if she does wind up eliminating the cost of a housekeeper, could her girls take an active role in helping to clean the house?

I was thinking the same thing. I remember age 10 being a good time for children to take on household chores in addition the personal ones you have taught them to take care of. An allowance is much cheaper than a housecleaner! Good Job BTW.

Hi I second seriously considering insourcing some housework to your eldest, in exchange for funding their activities. My eldest (boy aged 11) vacuums for me and is so keen to take on extra housework for payment. It’s a great life lesson and he does a pretty solid job.

Yes, great idea. They are keen little helpers!

Hello, I am not sure if you are missing out on other self employed deductions but make sure you are not. I switched to doing my own taxes as a self employed mom and it helps with the big picture. You can deduct a home office, health insurance, office expenses, and any vehicle mileage for work. The sep Ira/hsa is an amazing option as well which might reduce taxes as well. Remember sep ira is 20 percent of net income as well.

I had also noted that Mrs. F’s use of 25% of revenues is not accurate for a self-employed situation. It sounds like Jess is self-employed so she can invest and deduct 20% of her net income from her business activities into her SEP. Maximizing legitimate deductions will reduce her tax burden but will also reduce what can be contributed to the SEP.

Yes, I was going to chime in that the SEP-IRA maximum contribution is 20% of NET self-employment income:

“If you’re self-employed, your contributions are generally limited to 20% of your net income. (Net compensation for self-employed individuals is generally the net profit from IRS Schedule C reduced by the deductible self-employment tax. The eligible compensation limit, indexed for inflation by IRS is $305,000 for 2022 or $330,000 for 2023).”

https://investor.vanguard.com/accounts-plans/small-business-retirement-plans/sep-ira

Would renting out a bedroom be a possibility? There would be lots to consider ( proper vetting of tenant etc.) but it might help make the house contribute to its own cost.

Jess is doing great! I wondered about the option to increase her income, which Mrs FW didn’t talk a lot about. If Jess is already regularly making six figures before tax as a freelancer, she must have a well-established reputation. Can she hustle for more clients? Can she raise her rates for new clients? When was the last time she raised her rates – how much more experience does she have now? Is she sure she’s not underselling herself for her skill set/level of experience? Is there a related field she could branch into and start to build a client base there?

Yes, I hear you! I definitely am trying to hustle to build up a higher income right now. The economy is the tricky part but I’m trying to outsmart it 🙂

You might consider refreshing your tax withholding amounts. If you always get a $5-9k tax refund then you’ve given the government an interest fee loan until you can that refund check.

Wondering about the $275 every month for gas, especially since Jess works at home. Where is she going? I realize her vehicle is paid for and that it would be impractical to replace it, but surely this expense can be cut.

I had a similar thought. I guess CA gas prices must truly be sky-high, because we have two cars and don’t drive much, and we spend maybe $125/month on gas. But we’re in a MCOL area. I also wonder if it’d be practical to trade in the Highlander for a smaller hybrid car? Just a thought.

Jess is working 30 hrs a week and spending quality time with the kiddos. I’d happily cut down on discretionary to keep this amazing time up! If cleaning is worth sanity I say stick with it. areas where I’d be kinda ruthless to keep living an amazing life: food, eating out/coffee, kids activities, gifts, xmas, and beauty/household.

But the food and coffee can still be quality on the cheap, cheap. going out to eat with kids is an excuse to dip into the indulgent- why not buy some frozen apps at the grocery store like mozz sticks, frozen pizza ( or pre made pizza dough and a block of mozz!) , chicken tenders and make popcorn for an at home movie night. 3 tummies full for $15-30 beats any place to eat for 3, even off the kids menu.

Audible can be replaced for free with Libby, the app from your library. Or go to the library 🙂 But I get audiobooks on the run. Libby is great though and free.

The activities with the kids: grandparents paying for experiences over gifts (maybe with a weekly pic and thank you during swim or dance lessons so they can see the happiness of their gift vs the actual act of gift giving), getting out and about for free esp since fitness and being out of the house is important for you, asking the ex to chip in for activities as bday/xmas gifts instead. That could be 3 birds, xmas, bday, and activities, with one frugal stone! Maybe even asking Great Auntie who blows $40 per kid per gift for the gift of Hulu or disney +. sending a pic of happy feet watching a movie would be better than dealing with another toy i’m sure.

Decreasing food- make 2 double batch meals once a month from scratch. grill up xtra chicken breast and freeze them and twice a month have a pasta night with chopped chicken or pasta and chicken parm. We LOVE ground turkey enchiladas that are half black beans. and homemade enchilada sauce is heaven and takes about 10 minutes. buying the beans dried and crock potting them, then putting them in containers to freeze (usually 1 c portions so we aren’t wasting) is an easy peasy way to get healthy, cheap protein and you add it to fill up meals. Nacho night? bet your rump cheeks there is a splendid dose of black beans on them. Need a side? Rice and beans – flavor goes a long way and maybe you can bond with your girls by cooking more at home? You seem so family motivated and the happiest memories are made at home.

Showing your girls the value of what can be bought in stores. Do they know the difference between brand and generics? Can you give them a $10 home dinner night challenge and use it as a learning experience?

For friend dates/dates- just be honest and the house is a huge expense and your prioritizing time with your girls . “I’m cutting back. Want to come over for drinks or coffee instead of going out?” It is a statement more than a question.

Plus it sounds like you have a house you love, curate it more with the things you have already and the people you have already in life. I work from home too and trust me, I understand you can be sick of your 4 walls. But an outside space is an oasis and a hell of a workout maintaining. Just my two pennies.

So great that you can spend time with your family on your terms vs being sucked into the vortex of “the companies needs at this time.” Wanted to see your kids at a soccer game? Sorry, gotta work late to meet xyz deadline for Major PIA client. Eh, hard pass.

I second Libby for audio books and e-books! It’s awesome. Using the library has also helped me with patience…I get on the list for a bestseller and practice patience until it’s my turn!

Thank you for your thoughtful suggestions! I really appreciate it!

Jess you are doing really well being able to free lance and buy a home as a single parent (especially in California). Looking at your pictures I believe we live in the same area. I am super impressed that your utilities and gas are so low. I wish I could reduce ours to those numbers. With that said, we live in an area where everyone seems to have housekeepers, get pedicures, and belong to expensive gyms. You can easily cut some expenses cleaning your own house and exercising at home – walk, do Yoga in the Park in the summer, and yoga on Utube in the winter. We also have a number of gyms that are less than $50 a month that you could switch to. I would cut spending and stay freelancing if at all possible. Your children will only be young for a few years and freelancing allows you to spend more time with them than a full time job working for someone else.

Thank you! Yes, you’re right — the “norm” around here isn’t necessarily the right path financially. I’m about to ax my pricey gym membership today! 🙂

I’d highly recommend the peloton app for a cheap gym alternative- I love their yoga, strength and outdoor running classes. Free 60 day trial available too!

Meghan – do you use the app if you dont have a peloton? is that mandatory? what if you have a luddite type stationary bike? thank you!

You don’t need the Peleton equipment if you just get the app – I have a Schwinn spin bike, and use my tablet to do cycling classes and it works great. You just need to do a little searching for potential resistance conversions (as the Peleton resistance can be a bit off from other bikes).

I actually think that Jess’s mortgage is very typical for many families in the US right now and not particularly high. Housing costs are extremely high, whether you rent or own, and interest rates are also high. If you bought a house before 2021, lucky you. If you bought in the last few years, especially in an urban-adjacent area (where, let’s be honest, most of the higher-paying employment opportunities are), chances are you are spending about what Jess is, if not more. I think that what appears to be Frugalwoods’ surprise at Jess’s high housing costs reveals a disconnect with the reality for most people’s lived experience. The average percentage of income that is going towards housing has been rising for the past 20 years and is now typically around 30%, which is about what Jess is paying. Let’s normalize high housing costs as it is the unavoidable reality for most. Thank you for sharing your financial snapshot, Jess, and thank you to Frugalwoods for her analysis.

This is incorrect. Jess is paying about 50% of her take home pay on her mortgage and HOA. ($3650 for housing and $7500 take home per month) While I agree that high housing costs are becoming the norm, this is significantly higher than average.

It’s all about priorities. It doesn’t sound like early retirement is a plan since she likes her job. I don’t think she needs to change much right now except reduce some of the discretionary expenses. She has a great set up that many would love to have with the working from home on a flexible schedule while still make $100K+. One issue to be a little concerned about is emergency savings. She has a large mortgage and kids with a single income so she should have more in savings than most people. I would not focus on retirement savings too much right now. She can save more in retirement after the kids are out of the house and then either reduce workload or increase retirement savings once the house is paid off. She has a job she likes and should be able to do into her older years if needed/wanted. One things that could throw a wrench in and isn’t mentioned is whether the boyfriend and possible future husband has an income that at least covers his own costs. That makes a big difference.

My emergency savings is honestly such a priority for me! Thanks for sharing your thoughts!

You are doing great in a very expensive state! The health insurance cost seems low to me (my Massachusetts costs are very high). Is this a plan for just you and the kids covered by their father? Is it a high deductible plan hence the 3k in expenses last year? Look into HSA options or have a separate savings account for deductible and copays. Keep the house cleaning- for us it is the best money we spend to keep up with the chaos and good for mental health. The gym membership – does your health insurance give any reimbursements or incentives for things like that? Charitable giving is also important to me but that money right now needs to go towards emergency fund. Is there a way to give your time or talent and not your needed cash? In expenses, I don’t see clothing, shoes for growing kids or yourself.

Get the kids involved in spending, saving, choices. I have a 9 year old and we practice grocery math – prices per ounce, per roll, sales, percents, etc.

Yep, that’s a bronze plan in CA just for me. Kids are on their dad’s!

Your kids are good ages to chip in with chores like housecleaning. I got a video from the library, now there is YouTube, and watched it with my kids. We started to do chores together. It made the close fun. Same with making pizza from scratch, or even semi homemade. They loved contributing and by the time they left for college they could cook and clean.

Your library has an app called Ali by that will save you loads of money with ebooks. Our library has a Kanopy where you can check out movies. There is a monthly limit but again it is a huge free benefit. Our library has all kinds of tools and such you can check out. It is worth exploring.

I gave the kids their age in allowance and divided it into money for savings and gifts and fun money. I set up bank accounts in order for them to learn savings habits. Once they had enough in their savings accounts I transferred it to Vsnguard. It added up. It helped with college and again taught them small savings add up and you have to plan ahead.

Could you work parttime at your gym in exchange for a membership or trade your services with them?

Fun suggestions! Honestly my girls are so ready to start helping and they’re starting to do more and more every day. Love the idea of helping the kids learn money management, too.

You’ve done a great job. I don’t have children and am 20 years older, but I freelance. It’s rewarding and scary at the same time. Perhaps you can consider a 12-month austerity program to save more and realign your budget? After a year, you can add in a few non-essentials. Make it a family project. Get your kids to help around the house so you can omit the cleaning help and reduce your overall stress. With more cash reserves, you will feel more secure. Good luck.

Love love love this idea! I think a short-term focus/prioritization could be fun and rewarding.

Re the housing expense, I live in a community where there is zero ownership housing affordable for families making less than 120% AMI (area median income), so it is very common to rent out a room on your home, and if it long term and for the local workforce (not Airbnb) it is much appreciated by the community (there is no rental housing available under 80% AMI).

My advice as a retired CPA: get a new accountant. It is bad advice to try to get a refund of 5k-9k every year when you don’t have enough money month to month. (Bad advice even if you did have enough). You are essentially giving the IRS free use of your money. Your goal should be to get as close to $0 owed, $0 refunded each year. I also did not see an expense for tax services so maybe you are not paying for bad advice.

I wish you the best. Mrs. Frugalwoods has given you great advice. Good luck. 🍀

Yeah…I’ve struggled with that fact, too…probably the right call. Thank you!

Congratulations for deciding to look at your finances and future planning. It takes some courage to bare your soul and share your finances like this. The house certainly creates a challenge for you. I agree that prioritization is key. I do believe the the information on the maximum allowable contribution to the SEP-IRA is not totally correct. For a self employed person, there is some calculation in determining the maximum amount you can contribute. Bottom line, the maximum 25% contribution actually works out to about 20% or a bit less – check the IRS publications to confirm. I’d also add one more category of persons to the list for whom an emergency fund is extremely important – and that is self-employed or variable income persons – so another compelling reason to beef up the emergency fund as soon as you can. And finally, I would note that in my experience my mortgage payments (while not as large as yours) were much more difficult for the first couple of years and then somehow became progressively easier to deal with. Best wishes to you.

Thank you! Honestly just doing this exercise has been eye opening and really helpful to getting a reality check but also figuring out my actions and priorities.

I think your expenses are very high but you are in a high COL state. That being said. I would not eliminate things completely because life needs to be worth living IMO. But you can reduce things like eating out, vacation, date nights, etc. Obviously you will need to talk to your ex about reducing kid expenses but he might be looking to do the same so it’s worth a shot. But kids just get more expensive as they get older. My biggest recommendation is to not start down the club sport path – it adds up so quickly. If you can increase your income some that gives you breathing room. Maybe create 2 budgets. The first bare bones for times like right now when you are in the red each month. That’s when you cut everything. When you have a month with a higher income have a second budget that allows more for discretionary stuff.

Oh my gosh, I totally agree on the club sports. And good thoughts on the 2 budgets, I like that!