Brian and Michael, both 34, live with their two cats in central Connecticut. Michael works as a project coordinator for a state behavioral health agency serving young people and has a side job as an advocate and disability leadership coordinator. Brian is a quality assurance manager for a state-run hospital. The couple’s been together since 2013 and looks forward to celebrating their 10-year anniversary in November. While Brian and Michael have achieved a lot, they feel as though their debt and lack of home ownership is holding them back. They’d like our advice on how to unlock this next level of adulting and, crucially, how to be permanently debt-free.

What’s a Reader Case Study?

Case Studies address financial and life dilemmas that readers of Frugalwoods send in requesting advice. Then, we (that’d be me and YOU, dear reader) read through their situation and provide advice, encouragement, insight and feedback in the comments section.

For an example, check out the last case study. Case Studies are updated by participants (at the end of the post) several months after the Case is featured. Visit this page for links to all updated Case Studies.

Need Help With Your Money? Book a Financial Consultation With Liz!

Money is terrifying for a lot of people and many of us don’t know where to start.

That’s where I come in.

I demystify personal finance and break it down into manageable steps.

I explain:

where to start

where to go

how to confidently manage your money on your own

I help people figure out how to make their money enable them to live the life they want.

Financial Tune-up

$1,500

For people who are financially savvy and want a second opinion on their money trajectory.

✶ Most Popular ✶

Complete Financial Consultation

$3,500

For folks who need a complete financial plan & analysis of their financial future. No prior money experience required!

Complex Financial Consultation

$5,500

For folks with complex financial situations, including more than one rental property and/or a small business.

Not sure which package is right for you?

Book a free 15-minute call with me to discuss.

The Goal Of Reader Case Studies

Reader Case Studies highlight a diverse range of financial situations, ages, ethnicities, locations, goals, careers, incomes, family compositions and more!

The Case Study series began in 2016 and, to date, there’ve been 103 Case Studies. I’ve featured folks with annual incomes ranging from $17k to $200k+ and net worths ranging from -$300k to $2.9M+.

I’ve featured single, married, partnered, divorced, child-filled and child-free households. I’ve featured gay, straight, queer, bisexual and polyamorous people. I’ve featured women, non-binary folks and men. I’ve featured transgender and cisgender people. I’ve had cat people and dog people. I’ve featured folks from the US, Australia, Canada, England, South Africa, Spain, Finland, the Netherlands, Germany and France. I’ve featured people with PhDs and people with high school diplomas. I’ve featured people in their early 20’s and people in their late 60’s. I’ve featured folks who live on farms and folks who live in New York City.

Reader Case Study Guidelines

I probably don’t need to say the following because you all are the kindest, most polite commenters on the internet, but please note that Frugalwoods is a judgement-free zone where we endeavor to help one another, not condemn.

There’s no room for rudeness here. The goal is to create a supportive environment where we all acknowledge we’re human, we’re flawed, but we choose to be here together, workshopping our money and our lives with positive, proactive suggestions and ideas.

And a disclaimer that I am not a trained financial professional and I encourage people not to make serious financial decisions based solely on what one person on the internet advises.

I encourage everyone to do their own research to determine the best course of action for their finances. I am not a financial advisor and I am not your financial advisor.

With that I’ll let Michael, today’s Case Study subject, take it from here!

Michael’s Story

Hi, Frugalwoods! I’m Michael, my partner is Brian and we’re both 34. We have two kittens and live in central Connecticut. I work as a project coordinator for a state behavioral health agency that serves young people, and my side job is as an advocate and disability leadership coordinator. I am passionate about my work since I’m a brain injury survivor and have had mental health challenges. Brian works as a quality assurance manager for a state-run hospital. We’ve been together since 2013 and will celebrate our 10-year anniversary this November.

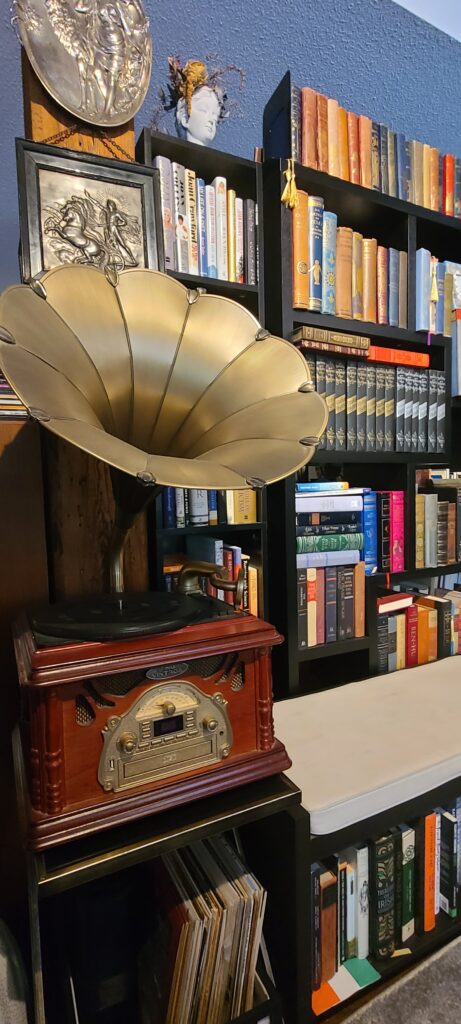

Michael and Brian’s Hobbies

I love books (both reading and collecting) and enjoy cooking and reading about food, drawing, watching tv and movies, and the occasional video game. When he isn’t enjoying quiet time at home with us, Brian enjoys spending time outdoors running, hiking, gardening, attending community events and traveling. He is also a lifelong learner and advocate who enjoys watching documentaries, attending webinars, visiting museums and then sharing the information he learns with others.

Originally from the Boston area, Brian comes from a large Irish Catholic family and spends many weekends traveling to spend time with them. After struggling through his secondary and undergraduate studies, Brian is eager to achieve academic success in a potential future graduate degree program.

Some of our major goals include owning a home, getting married, starting a business, achieving athletic success and leaving a lasting legacy.

What feels most pressing right now? What brings you to submit a Case Study?

A lot happened this past year and we feel like we’re just now making it to the other side. We had two major life events:

- We lost Rex, our dear cat of nearly 8 years, to cancer.

- Our apartment building was sold to a new company that didn’t renew anyone’s lease.

We went from enjoying a cozy, 600 sq ft studio apartment (at $945/month) to navigating the 2022/2023 rental market. We spent 3.5 months scrambling to find a new place to live, packing up our lives and uprooting ourselves from what had been our happy home for the past eight years–all while caring for two new kittens with tummy trouble–it was a lot!

Back in August 2022, our life looked totally different–our plan at that time was to move into a house when we were ready, along with our cat Rex. We were forecasting an ability to re-enter the housing market in late 2023 prior to our unplanned veterinary and moving expenses.

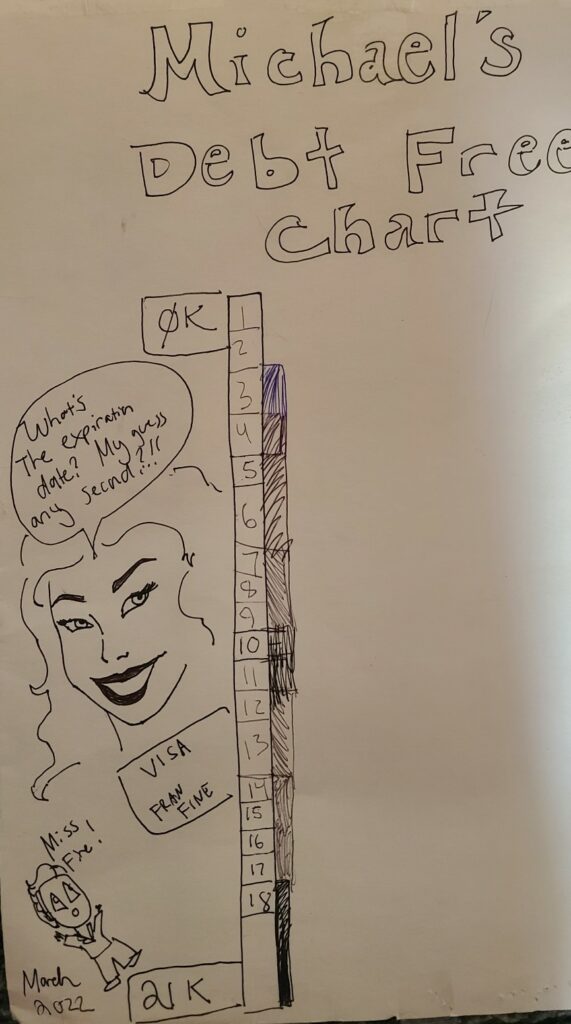

Our Debt

Brian paid off all of his student loans a few years ago (a total of $58,000 ) and has been promoted in his job. He made career changes from corporate to private non-profit and most recently to the public sector (with the state). While he was initially resistant to applying, Brian now acknowledges that had it not been for my encouragement to apply for his current state job, he’d be earning significantly less, would not have such generous benefits (i.e. healthcare for life and a pension) and our standard of living would not be as comfortable.

While he currently has no student loan debt, Brian has significant consumer debt and minimal liquid savings. His long term investments are underfunded and not as diverse as he would like, which poses the risk of not having adequate retirement income when we are of retirement age. This is especially concerning to us given the precarious status of Social Security in the current political climate. Brain also views not owning real estate as a vulnerability in the current housing/rental market.

Brian wants to be able to take advantage of the opportunity to “buy low” and is concerned about not being in a financial position to do so when the housing market turns. Brian’s consumer spending is exorbitant; that coupled with his lack of savings makes him fear that he will not be able to achieve his life goals or provide for our family as we get older, given that he may not have time to make up for previous financial mistakes and irresponsible spending. Brian feels that professional help is needed to ensure our individual and shared goals are achievable and don’t become dreams forever deferred.

I have wonderful bosses and leadership at my current jobs, but am feeling called to pursue opportunities on my own as well. I want to devote time going forward to explore how I can use my interests and skills in meaningful and enriching ways, such as through organizing, cooking, coaching, etc.

What’s the best part of your current lifestyle/routine?

Our Hobbies

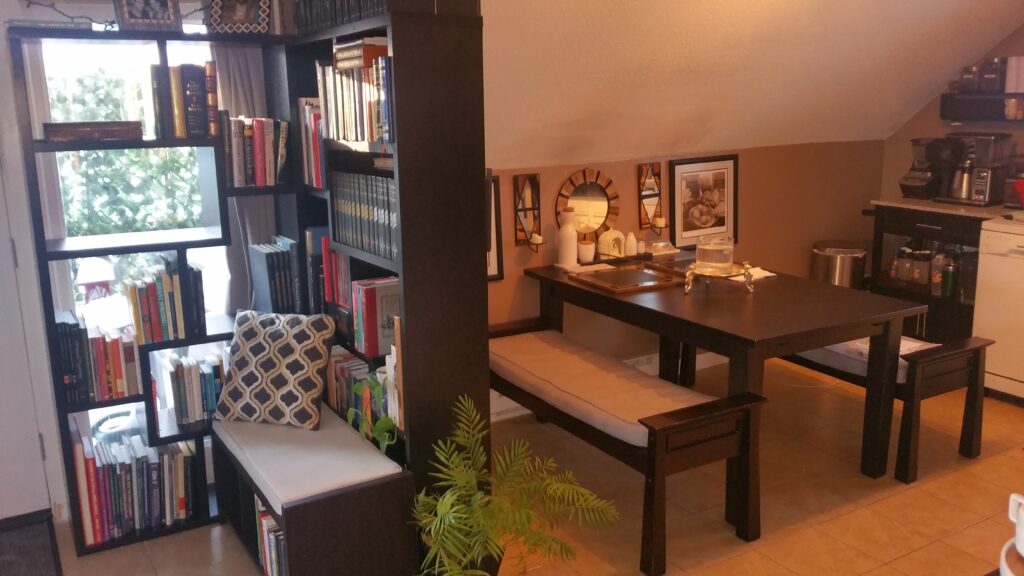

Now that the move is over, Brian has been enjoying running in his free time. Our new space allows us to have a home library/media room with surround sound, which is great for enjoying TV and movies together. The home office also provides us space to each do quiet work on the computer together.

Our Home

We live comfortably in a luxurious two-bedroom, two-bathroom apartment in a refurbished mill. While we’d prefer to live somewhere more rural, our apartment looks out over a quiet private parking lot to a forested river parcel, which provides additional privacy. The building has remarkable industrial architecture that we enjoy in our apartment, including oversized windows and ledges, 12 ft ceilings, exposed wood boards and support beams, various bolts, pulleys and other industrial devices from when this was a working mill. While we loved our former space, our new space gives us room to breathe and provides (almost) adequate space for our large collection of personal belongings (we prefer to call them treasures).

The new space also provides me with a real home office (I was previously relegated to a small corner desk in our studio apartment) as well as a dining room/bar, library/media room, galley kitchen and separate bedroom. Previously all of these (aside from the one bathroom) were in the same room. While not as cozy, this home feels more formal and age-appropriate. The building is quiet with respectful neighbors, there’s a donut shop across the street, I can see the hospital I work at from the parking lot and we’re right off the highway, so hitting the road for a day trip or to travel to see family is a synch.

What’s the worst part of your current lifestyle/routine?

Michael – feeling shame at my financial situation. I was briefly debt-free after years of being in debt, then spent a fair amount with the apartment move and so many things up in the air. Thankfully, it isn’t catastrophic but I wish I’d made different choices. Also, being at home so much is like endless chocolate cake – great at first, but can be isolating! I need to build in more walks outside.

Brian – feeling shame at my financial situation. I feel way behind my peers and family members – financially, professionally, academically, athletically, socially. I don’t like that I lack a clear plan on how to manage my money effectively. I know I’m not saving enough. I also feel like I lack the financial discipline to accomplish basic signifiers of adulthood. I feel as though I am a source of disappointment to my family. Also, I dislike not having our own land – I want to have a garden and some earth to call my own.

Where Brian and Michael Want to be in Ten Years:

- Finances:

- According to Michael:

- Debt free within 1 year for Brian, 6 months for me.

- A comfortable savings amount and increased retirement contribution.

- I am giving myself the goal to make $20-30k more within a year, and have taken some initial steps and sent out some applications.

- Money for travel, technology/hobby upgrades and our other interests.

- According to Brian:

- Debt free.

- 18 months of living expenses in liquid savings.

- Adequately vested in my retirement.

- With diverse assets.

- Working closely with a financial advisor and CPA.

- With an excellent credit score.

2. Lifestyle:

- According to Michael:

- In a home – doesn’t need to be huge, but nature is a must for us.

- We are thinking of staying in central CT but are open to southeast CT where I grew up, or the Rhode Island/CT border.

- Brian’s job is fully in person so that is the deciding factor unless he transfers to a different position; but, there are more opportunities in central CT.

- According to Brian:

- Owning our own homes (primary residence and second home) with in-law space for our parents to live with us part-time and indoor/outdoor space to entertain.

- Married.

- Belonging to a country club.

- Able to travel someplace once each year.

- Owning an electric car.

- Having help around the house for ourselves and our parents.

- Being involved in our communities.

3. Career:

- Brian sees himself growing in his current role and achieving an executive level position within the next five years. He would also like to take over his father’s business and continue being involved in civic affairs (i.e. running for public office, etc.).

- Within ten years, I would like to be able to provide part-time consulting services.

Brian and Michael’s Finances

Income

| Item | Number of paychecks per year | Gross Income Per Pay Period | Deductions Per Pay Period | Net Income Per Pay Period |

| Brian’s job | 26 | $3,929 | Taxes – $1,000.23 benefits & retirement (403b, 457, pension, med/dental/vision/life insurance)– $569.63 | $2,344.36 |

| Michael’s Main Job | 26 | $1,717 | health, vision and dental insurance: $50.84 401k contributions: $171.68 HSA: $134.61 Taxes: $293.97 TOTAL deductions: $651 | $1,066 |

| Michael’s 2nd job | 26 | $798 | Taxes – $94.60 | $703.61 |

| Michael – public speaking / consulting *last calendar year* | Sporadic | $2,000 | ||

| Brian – help with family business seasonally (tax prep support) | Annual | $500 | ||

| Annual total: | $167,544.00 | Annual total: | $109,455.42 |

Mortgages: none

Debts

| Item | Outstanding loan balance | Interest Rate | Loan Period/Payoff Terms | Monthly required payment |

| Brian’s Visa (SCU) | $16,057 | 0% until November 2023 (17.99% after) | The goal is to reduce this as much as possible before November | $302 monthly minimum payment |

| Michael’s Visa Platinum | $9,700 | 10.99% interest | Michael will pay at least $1,400 per month for an estimated 6 month payoff (unless you recommend we reduce our savings in order to pay it off faster!) | $174.03 monthly minimum payment |

| Brian’s Visa Platinum (Navy Federal) | $2,503 | 0.99% until November 2023 (17.74% after) | Brian will snowball this first to pay it off | |

| Total: | $28,259 |

Assets

| Item | Amount | Notes | Interest/type of securities held/Stock ticker | Name of bank/brokerage | Expense Ratio (applies to investment accounts) |

| Michael’s 401k | $36,992 | My 401k through work. I contribute 10% and my company matches 4%. I am fully vested. Should I increase my contributions? | Vanguard Target Retirement 2055 | Vanguard | 0.08% |

| Brian’s 401k (old job) | $19,305 | ||||

| Brian’s Pension Fund | $8,953 | Assuming we calculated it correctly on the state retirement calculator… In 2054 after 35 years of service, it shows a monthly payout of $4,150. | |||

| Michael’s Savings Account | $7,000 | This is my emergency fund | Navy Federal Credit Union | ||

| Brian’s 457 | $5,886 | ||||

| Brian’s 403b | $3,389 | ||||

| Brian’s HSA | $3,093 | ||||

| Michael’s HSA | $2,100 | Health Savings Account | |||

| Brian’s IRA | $1,325 | ||||

| Brian’s savings | $1,000 | Sharon Credit Union (SCU) | |||

| Brian’s Holiday Savings | $1,000 | ||||

| Brian’s Stocks | $852 | ||||

| Brian’s FSA | $356 | ||||

| Total: | $91,250 |

Vehicles

| Vehicle make, model, year | Valued at | Mileage | Paid off? |

| 2007 Mercedes C280 | $4,582 (KBB private party value) | $175,000 | Yes |

| 2007 Subaru Outback | $2,824 (KBB Private party value) | $175,000 | yes |

| Total: | $7,406 |

Expenses

| Item | Amount | Notes |

| Rent | $2,000 | |

| Michael – CC Debt payment | $1,400 | Estimated 6 month debt payoff at this payment rate |

| Brian – car repairs, gas, train fare (8 month average) | $1,064 | Brian has had major car repair issues over the last 12 months |

| Brian – Debt payment | $600 | |

| Pet food, litter and vet | $517 | prescription pet food needed , vet is averaged out over last 8 months |

| Groceries | $469 | Main grocery store, 8 month average |

| Electricity | $235 | This is the average; it depends on season. We just switched to a third party supplier, but CT has super high rates regardless. |

| Eating Out | $200 | |

| Brian – gifts | $200 | |

| Michael – Home goods | $200 | |

| Michael – personal care | $150 | includes massage for pain relief |

| Michael – Therapy/Coaching | $150 | |

| Brian’s car insurance | $134 | |

| Internet | $107 | |

| Brian – vacation/travel/gas | $100 | |

| Michael’s car insurance | $99 | USAA |

| Brian – charity | $75 | |

| Michael – gifts | $60 | |

| Michael – books | $50 | |

| Brian – clothing | $40 | |

| Phone | $30 | 2 cell lines with Mint Mobile (may switch in Oct to USA Mobile due to call quality). |

| Brian – personal care | $30 | |

| Gas | $27 | For Water heater |

| Michael – Games | $25 | |

| Renters insurance | $22 | USAA |

| Subscription | $20 | Amazon |

| Michael Gas | $20 | Michael works from home, so his car is not used often |

| Brian – medical | $10 | |

| Michael – Life insurance, short term disability, long term disability – | $0 | Included in Michael’s job benefits – 45k life insurance, and short and long term disability |

| Monthly subtotal: | $8,035 | |

| Annual total: | $96,414.36 |

Credit Card Strategy

| Card Name | Rewards Type? | Bank/card company |

| Michael – Visa Platinum | N/A | Navy Federal Credit Union |

| Brian | N/A | Navy Federal Credit Union |

| Brian | N/A | Sharon Credit Union |

Brian and Michael’s Questions for You:

- Debt repayment – Is there a recommended system?

- Home buying – As a rough estimate, we think this is at least 2-3 years away. Any recommendations or thoughts?

- Retirement and savings – What percentage of each paycheck do you recommend committing to retirement, savings, etc?

- Should Brian pursue a masters degree? We’re worried about acquiring new student debt after he paid all of his off. Is a specialized or more general graduate (masters level) degree more marketable/advantageous? Executive masters vs. traditional? Online vs. in-person?

- I’m curious about how to be content – as someone with a penchant for “more,” these past 6 months have taught me what’s really important and that I need to do more soul searching. I’d love to hear other people’s thoughts on this!

- How would you prioritize the following in terms of the current political and economic climate: debt repayment; home ownership; legal marriage; graduate level education; liquid savings; diversification of assets; tax liability reduction?

Liz Frugalwoods’ Recommendations

I want to start off by saying that Brian and Michael are in good shape! Brian, in particular, seems disheartened about their progress towards adulthood, but I have to say, I don’t share his dismal outlook. I think Brian assumes that everyone else his age has it together, but I can assure him that they do not.

A LOT of people his age have the goal to achieve what he and Michael already have:

- A loving, long-term partnership

- Pets!

- A stable, spacious, gorgeous apartment (that isn’t shared with roommates) in a city they enjoy

- An excellent career and salary

- Time and space to pursue meaningful hobbies

- A close connection with family

Beyond that, everything else is details. I don’t say that to minimize Brian’s concerns, but rather, to put them in perspective and to say that spreadsheet problems–such as debt–are just that: spreadsheet problems. I will brainstorm and outline ways for Brian and Michael to pay off their debt and increase their retirement investments. But at the end of the day, the truly important things in life are already in place for these two. I want them–and everyone else–to keep that in mind.

Yes, managing your money does decrease stress and anxiety. Yes, managing your money does open up new options and possibilities for your life. However, it’s important to remember that while money makes life better and easier, it doesn’t solve life for you. I think we can all cite plenty of unhappy rich people as proof. So yes, it’s important to correctly manage your money and yes, it’ll give you a better retirement; but remember that money is just one component of a well-lived life.

Step #1: Track Your Spending

Before delving into Michael and Brian’s specific questions, I want to encourage them to start rigorously tracking their spending. As they reported here, their annual net income is $109,455 and their annual spending is $96,414. Since their net income accounts for all of their pre-tax retirement contributions and their spending includes their debt repayments, they should have $13,041 leftover every year, which they could use to pay down their debt.

To get a handle on whether or not they have this excess every year, I encourage Michael and Brian to enact an expense tracking system. I use and recommend the service from Empower (formerly Personal Capital) because it’s free and easy to use. Alternately, they can use pen and paper, download their bank and credit card statements or create their own spreadsheet system. Whatever works for them both and whatever they can stick with is fine. It doesn’t matter how you track you spending, it only matters that you do. Until Michael and Brian know where every dollar is going, it’ll be tough for them to articulate how they want to change their spending.

Michael’s Question #1: Debt Repayment Strategies

I know that Michael and Brian are down on themselves about having debt, but I don’t see it as some moral failing. Debt happens; what matters is how you deal with it.

Additionally, their debt load isn’t all that significant. Let’s take a look at it again here:

| Item | Outstanding loan balance | Interest Rate | Loan Period/Payoff Terms | Monthly required payment |

| Brian’s Visa (SCU) | $16,057 | 0% until November 2023 (17.99% after) | The goal is to reduce this as much as possible before November | $302 monthly minimum payment |

| Michael’s Visa Platinum | $9,700 | 10.99% interest | Michael will pay at least $1,400 per month for an estimated 6 month payoff (unless you recommend we reduce our savings in order to pay it off faster!) | $174.03 monthly minimum payment |

| Brian’s Visa Platinum (Navy Federal) | $2,503 | 0.99% until November 2023 (17.74% after) | Brian will snowball this first to pay it off | |

| Total: | $28,259 |

Is $28k in consumer debt great? No, it’s not; but it also isn’t the end of the world. Especially not with Brian and Michael’s household income. I like the strategy they’ve outlined above since it focuses on eliminating debt before mega interest rates kick in. Debt is not inherently “bad,” but high interest rates are bad.

If it were me, I would reduce all of my spending–starting today–in order to pay off this debt as quickly as possible.

While I agree that the couple needs to save more into retirement and their emergency fund, I see these debts as a priority to eliminate because it’ll save them money in the long run.

Debt Payoff Suggestion #1: Reduce Spending ASAP

Michael and Brian have two variables they can adjust here: income and expenses. They can earn more in order to pay off their debt, they can spend less or, for maximum effect, they can do both! I always suggest starting with reducing spending because it’s something you can do right away. Increasing income is equally effective, but it’s typically a longer-term prospect. Plus, Michael noted that he already has his eye on increasing his income this year.

Reducing spending also enables you to identify your priorities.

We are what we spend and if we’re not spending on our highest and best priorities, we’re frittering away money on things that don’t matter to us. Hence, reducing spending will help Michael and Brian pay off their debts (in the near term) and learn to spend mindfully (in the long term). I suggest they go on a short-term spending detox, which entails eliminating all Discretionary line items and reducing all Reduceables.

The first step, which I’ve done for them below, is to define all of your expenses as Fixed, Reduceable or Discretionary:

- Fixed expenses are things you cannot change. Examples: your rent and debt payments.

- Reduceable expenses are necessary for human survival, but you control how much you spend on them. Examples: groceries and gas for the cars.

- Discretionary expenses can be eliminated entirely. Examples: travel, haircuts, eating out.

Here’s the categorization and suggested new spending I’ve worked up for Michael and Brian:

| Item | Amount | Notes | Category | Suggested New Amount | Liz’s Notes |

| Rent | $2,000 | Fixed | $2,000 | ||

| Michael – CC Debt payment | $1,400 | Estimated 6 month debt payoff at this payment rate | Fixed | $1,400 | Once this debt is paid off, use the money to pay off the next debt and so on |

| Brian – car repairs, gas, train fare (8 month average) | $1,064 | Brian has had major car repair issues over the last 12 months | Fixed | $1,064 | |

| Brian – Debt payment | $600 | Fixed | $600 | Once each debt is paid off, use the money to pay off the next debt and so on | |

| Pet food, litter and vet | $517 | prescription pet food needed , vet is averaged out over last 8 months | Fixed | $517 | |

| Groceries | $469 | Main grocery store, 8 month average | Reduceable | $400 | |

| Electricity | $235 | This is the average; it depends on season. We just switched to a third party supplier, but CT has super high rates regardless. | Reduceable | $235 | |

| Eating Out | $200 | Discretionary | $0 | ||

| Brian – gifts | $200 | Discretionary | $0 | ||

| Michael – Home goods | $200 | Discretionary | $0 | ||

| Michael – personal care | $150 | includes massage for pain relief | Discretionary | $0 | |

| Michael – Therapy/Coaching | $150 | Discretionary | $0 | ||

| Brian’s car insurance | $134 | Reduceable | $134 | ||

| Internet | $107 | Fixed | $107 | ||

| Brian – vacation/travel/gas | $100 | Reduceable | $0 | ||

| Michael’s car insurance | $99 | USAA | Reduceable | $99 | |

| Brian – charity | $75 | Discretionary | $0 | ||

| Michael – gifts | $60 | Discretionary | $0 | ||

| Michael – books | $50 | Discretionary | $0 | ||

| Brian – clothing | $40 | Discretionary | $0 | ||

| Phone | $30 | 2 cell lines with Mint Mobile (may switch in Oct to USA Mobile due to call quality). | Reduceable | $30 | |

| Brian – personal care | $30 | Discretionary | $0 | ||

| Gas | $27 | For Water heater | Reduceable | $27 | |

| Michael – Games | $25 | Discretionary | $0 | ||

| Renters insurance | $22 | USAA | Fixed | $22 | |

| Subscription | $20 | Amazon | Discretionary | $0 | |

| Michael Gas | $20 | Michael works from home, so his car is not used often | Reduceable | $20 | |

| Brian – medical | $10 | Fixed | $10 | ||

| Monthly Subtotal: | $8,035 | Proposed New Monthly Subtotal: | $6,665 | ||

| Annual Total: | $96,414.36 | Proposed New Monthly Subtotal: | $79,980 |

The Result?

- Monthly net income: $9,121.28

- – Monthly spending: $6,665

- = Leftover: $2,456.28

Note that this monthly spending total includes the $2,000 they’re already plowing into debt repayment, which means they’d be able to put a total of $4,456.28 towards debt payoff every single month! Doing very simple, back-of-the envelope math, that means they’d be completely debt-free within 6.5 months! This doesn’t account for the interest rates that’ll kick in come November, which’ll push the pay-off timeline out a tad, but not by too much. Additionally, as each debt is paid off, they should apply that erstwhile payment toward paying off the next debt.

Identifying Priorities and Remaining Debt-Free

Michael and Brian alluded to a cycle of debt-payoff-debt as a recurring problem for them and so I want to spend some time on this idea of remaining debt-free. They are correct that if they keep ricocheting between debts, they won’t ever make actionable progress towards their long-term goals. It’s not a major problem to fall into debt once or twice (and then pay it off in full), but it is a problem when it becomes a habit. Brian and Micheal have the salaries to achieve all of the things they articulated as long-term goals, but not if they keep needing to dig themselves out of debt.

The goal for them is to find a comfortable middle where they can rest.

At present, Brian and Michael are vacillating between feast and famine. They overspent, which resulted in debt, and now I’m suggesting they pull back into an austere, no-spend zone. My fear is that this famine period will result in them boomeranging back into debt in order to recover from this relative deprivation. In light of that, I want Michael and Brian to focus on identifying a tenable, long-term strategy for living within their means.

To help them identify this happy medium, I encourage them to do the following:

- Start tracking every dollar they spend

- Schedule a monthly (or even weekly) money date to review their spending, progress and goals

- Take my free Uber Frugal Month Challenge and discuss the prompts and exercises together

Michael and Brian have already identified their long-term life goals, now they need to start spending in accordance with those goals.

Additionally, I don’t suggest that they eliminate all discretionary spending forever–that’s no way to live! Instead, I suggest they openly discuss which items they want to add BACK into their budget after living without them for a few months. Doing without something for a time makes it pretty clear whether or not you “need” it in your life. I encourage them to do this soul searching work before/in spite of higher incomes. If they don’t iron out this discrepancy between their income and expenses, the problem is very likely to continue with a higher income. Earning more does not help if it just causes you to spend more.

Michael’s Question #2: Buying a House

I hear and understand Michael and Brian’s desire to be homeowners, but they’ve got to tackle a few other financial priorities first. Before they start socking away cash for a downpayment, they need to:

- Pay off their debt and commit to remaining debt-free

- Save up an adequate emergency fund

- Invest fully for retirement

Since we’ve already discussed how to achieve debt freedom, let’s spend some time on emergency funds and retirement.

Emergency Funds:

Your cash equals your emergency fund and your emergency fund is your buffer from debt:

- An emergency fund should cover 3 to 6 months’ worth of your spending.

- At Brian and Michael’s current monthly spend rate of $8,035, they should target an emergency fund of $24,000 to $48,000.

Your emergency fund is there for you if:

- You unexpectedly lose your job

- Something horrible goes wrong with your house that needs to be fixed ASAP

- Your car breaks down and must be repaired

- You’re hit with an unexpected medical bill

- Your dog gets quilled by a porcupine and has to go to the emergency vet

As you can see, an emergency fund is not for EXPECTED expenses, such as:

- Routine maintenance on a car, such as oil changes and brake pads

- Anticipated home repairs, such as boiler servicing/chimney sweeping

- Planned medical expenses

An emergency fund’s reason for existence is to prevent you from sliding into debt should the unforeseen happen. It’s your own personal safety net. This is also why it’s so critical to track your spending every month. If you don’t know what you spend, you won’t know how much you need to save.

→Since an emergency fund is calibrated on what you spend every month: the less you spend, the less you need to save.

At present, Michael and Brian have $9,000 in cash, which would only cover a little more than a month’s worth of their expenses. This makes building up an emergency fund priority #1 after they pay off their debt.

Michael and Brian cited their move and vet bills as two sources of their debt, which is another reason why I urge them to build up their emergency fund. An unexpected move and unexpected vet bills are what an emergency fund is for. It’s there to help ease challenging, expensive periods and prevent you from sliding into debt. Then, once you emerge from a period of unexpected spending, you re-stock your emergency fund so that it’s there to support you the next time an unexpected (but totally predictable) expense crops up. Because it’s always going to be something. This year it might be vet bills, next year it might be car bills, the year after it might be your washing machine–we know this stuff is going to happen, we just don’t know when it’s going to happen. Having the cash on hand to manage these “emergencies” is a crucial part of a healthy financial life.

Retirement

I’m going to skip around a bit and address Michael’s question about retirement because that’s another priority that comes before home ownership.

Investing for retirement is a long-term proposition because:

- The IRS sets a cap on how much you can put into retirement accounts each year. Thus, in order to take full advantage of their benefits, you have to start early and contribute every year.

- It takes decades for your money to grow in the stock market. Retirement accounts are invested in the market and, historical return data show us that we need a long time horizon of investing for maximum growth.

- There are tax benefits associated with contributing to retirement accounts that should be taken advantage of every year (you can’t go back and retroactively get these benefits; you have to contribute each year).

For these three reasons, I suggest folks first have their retirement investing on lock before saving up the cash to buy a house. You can certainly do both at once, but you need to be aware that the benefits of retirement accounts re-start each year. You can’t go back and max out your 2019 retirement contributions–you have to do it each year.

Retirement Accounts Available to Michael and Brian

Michael and Brian have an absolutely enviable number of retirement accounts available to them! Thanks to Brian’s government job, he has access to a 403b, a 457 and a pension, which is truly the triple crown of retirement. Michael asked how much they should be contributing to retirement and my answer is always:

- The very best thing to do is to max out your contributions every year

- If you can’t afford to do the max, the second best thing is to do as much as you can

- The third best thing is to ensure you’re contributing enough to qualify for any match your employer offers

Here’s the maximum amount Michael and Brian are eligible to put into retirement each year:

| Item | Annual Max Contribution Allowed | Benefits/Restrictions |

| 401k (Michael) | $22,500 | This contribution comes out of his paycheck pre-tax and grows tax-deferred, meaning he won’t be taxed on the earnings until he begins to withdraw money in retirement. You need to be age 59.5 before you can withdraw money without a penalty. |

| 403b (Brian) | $22,500 | Same as a 401k. |

| 457b (Brian) | $22,500 | In 457b plans, you’re allowed to withdraw money penalty-free before age 59.5 after you leave the employer who sponsors the plan. Hence, if a person plans to retire earlier than age 59.5, there’s a real advantage to having a 457b. |

| Roth IRA (Michael) | $6,500 | Assuming they’re each filing their taxes as “single,” their MAGI would make them each eligible for a Roth IRA. |

| Roth IRA (Brian) | $6,500 | You pay taxes on the money you put into a Roth IRA, but you don’t pay taxes when you withdraw the money in retirement. A Roth IRA grows tax free. Also note that you can withdraw contributions you’ve made to a Roth IRA, without penalty, at any time regardless of your age |

| TOTAL ANNUAL AMOUNT: | $80,500 |

Since Michael and Brian have so many accounts available to them, they could technically stash away $80,500 per year in tax-advantaged retirement vehicles. That would consume too much of their income at this stage, but, it’s something for them to keep in mind for the future. Particularly as their incomes increase over time, this’ll be a very good strategy for them to employ from a tax-advantaging perspective.

For the time being, I suggest they each work to increase their contributions to their workplace accounts (Michael’s 401k and Brian’s 457b) until they reach the annual allowed maximum.

Retirement Wildcards: Pension & Social Security

It’s tough for me to assess whether Brian and Michael are on track for retirement because of these two wildcards. Brian’s pension sounds like it has the potential to be very generous assuming:

- He stays with this employer for the number of years required and makes all necessary contributions

2. The employer doesn’t default on the pension

3. The pension is inflation-adjusted

If all of these things come true, it’s possible his pension will provide a very solid foundation for their retirement. Additionally, we don’t know how much each of them can expect to receive in Social Security, but that will offer another layer of retirement protection. Social Security is inflation-adjusted and, in my humble opinion, very unlikely to disappear based on its popularity on both sides of the aisle. Anything can happen, which is why I never suggest that someone depend ONLY on Social Security or a pension. But, the combination of these two things bodes very well for Brian and Michael.

Notes on Investing

Brian and Michael didn’t include where all of their investments are held, what they’re invested in or their expense ratios, so I’ll provide the below as nudges for them to do additional research on all of their investments (401k, 403b, 457, stocks, etc).

Things to consider when choosing what to invest in:

- Your risk tolerance. Investing in the stock market is inherently risky. Would you be more comfortable with lower-risk, lower-reward options, such as bonds? Or higher-risk, higher-reward options, such as stocks?

- Your age. How soon do you anticipate withdrawing a percentage of this money? That’ll inform how aggressive you want to be with your investments.

- The fees associated with the funds you’re considering. High fees (some of which are called “expense ratios”) will eat away at your money over the years. DO NOT do that to yourself! For reference, the following three brokerages and funds are considered to be low-fee investment options:

- Fidelity’s Total Market Index Fund (FSKAX) has an expense ratio of 0.015%

- Charles Schwab’s Total Market Index Fund (SWTSX) has an expense ratio of 0.03%

- Vanguard’s Total Market Index Fund (VTSAX) has an expense ratio of 0.04%

Brian’s Old 401k: Roll It Over

Brian should roll his old 401k over into an IRA. “Roll over” just means “move.” The reason to do this is to put yourself in charge of what it’s invested in. Once you roll it into an IRA, you can choose the brokerage and the investments, which means you can optimize for low fees and your personal risk tolerance.

Employer-Sponsored Retirement Accounts

When you’re invested in a retirement account through your employer, you can only choose from the investments they offer. Ask HR for a list of available funds and brokerages; review and select from this list. Note that even though employers don’t always offer the very best funds (or the very lowest expense ratios), it’s still worth it to invest in tax-advantaged retirement accounts.

Michael’s Question #4: Should Brian pursue a masters degree?

My opinion is to only pursue a master’s degree if it’s directly related to a significant salary increase. Otherwise, I wouldn’t spend the time or the money. I personally have a master’s degree that did not advance me professionally and, I can tell you now, there is no point to all the blood, sweat, tears and money I poured into it. Zero point. DON’T DO IT unless there’s a precise, printed, articulated, guaranteed, direct, iron-clad correlation to making more money.

Pursuing education for fun is another conversation entirely and I’m not against doing that, but, Brian didn’t state that as a goal. If he wants to become debt-free, buy a house and achieve the other goals he outlined, then spending time and money on a master’s degree sounds like an unhelpful detour to me.

Michael’s Question #5: How would you prioritize the following in terms of the current political and economic climate: debt repayment; home ownership; legal marriage; graduate level education; liquid savings; diversification of assets; tax liability reduction?

Most of this is already answered above, so here’s my quick rundown in order of priority:

- Marriage: if you want to get married, go for it! No need to spend a ton of money. If you’re concerned about this from a legal perspective, get married at the courthouse tomorrow and save up for a celebratory party at some point in the future.

- Debt repayment

- Emergency fund (liquid savings)

- Retirement

- Save downpayment for a house

- Don’t go to graduate school

- Tax liability reduction: max out all available retirement accounts (see above) and HSAs

- Diversification of assets: worry about this after #1-7 are complete. Read JL Collins’ book, “The Simple Path to Wealth” to guide you.

Summary Of Recommendations:

- Reduce spending immediately in order to pay off all debts as quickly as possible, ideally within 6-8 months.

- Start tracking spending rigorously and have frequent conversations about priorities and mindful spending.

- Take my free Uber Frugal Month Challenge together to facilitate and guide these conversations.

- Enact plans and guardrails to ensure you remain debt-free for the long-run. See-sawing in and out of debt is not a tenable long-term strategy.

- Once the debt is paid off, save up an adequate emergency fund, the amount of which should be calibrated off of your spending.

- After the debt is paid off and the emergency fund is stocked, determine how much you can each put into your retirement accounts. Don’t worry if you can’t max them out right away–set that as a long term goal and focus on doing what you can do now.

- Finally, start stashing away cash for a downpayment on a house. Keep this money in something that earns interest, but is easily accessible, like a high-yield savings account (such as the American Express savings account, which currently offers a 4.3% interest rate).

Ok Frugalwoods nation, what advice do you have for Michael and Brian? We’ll all reply to comments, so please feel free to ask questions!

Would you like your own Case Study to appear here on Frugalwoods? Apply to be an on-the-blog Case Study subject here. Hire me for a private financial consultation here.

It isn’t real clear but I guess this is where I comment on Micheal & Brian’s questions.

1- Get a prenup. I did this after 2 divorces where attempts to ruin my retirement were made and got shortchanged on home owning. It was very difficult to discuss money! But it clarified a lot of things and now neither one of us has worries as we are in Medicare age.

2- Keep funds his/his/ours. Contribute to Ours by percent of income as recommended by Suze Orman. (Writer of financial books – good advice).

3- Pay off own debts as quickly as possible without feeling deprived; feeling deprived will lead to a spending spree.

4- If either of you are compulsive shoppers have 3 ideas;

– join Debtors Anonymous, use their spending plan categories.

– curate your treasures instead of adding to collection, make sure you are fully enjoying them

– read up on where spending money actually leads to happiness; events and people more enjoyable than stuff.

We also do his/hers/ours and it generally eliminates a lot of issues. The other rule is no spending money we don’t have, and if there’s an emergency requiring cash from the emergency fund, that money needs to be built back up first.

Tracking spending as a couple is foundational. It’s very easy to place financial blame on the other partner. Review everything as a whole.

I love this case study – Michael and Brian are doing amazingly well and I can see lots of opportunities ahead for them. As someone with advanced degrees that made very little difference in my career (at this point in my life), I just wanted to suggest Brian look at any tuition reimbursement programs through the state of CT. I started my PhD while working for a University since they covered 2-3 classes per semester – took 1 class to see if I liked the program, and if I could balance the schoolwork with my job. I decided since I was already there and it was being paid for it was worth me pursuing, but I would not have paid out of pocket for the program or taken on student loan debt. Depending on the field he wants to pursue a degree in, too, there may be other opportunities for Brian that would include covering his tuition. Best of luck to them both!

Also had the experience of a PhD that did very little to contribute to salary increase but was incredibly stressful for many years. Finally got my huge student debt forgiven with PSLF but it definitely was not worth it.

“it’s important to remember that while money makes life better and easier, it doesn’t solve life for you.” Great advice Liz. Good luck Michael and Brian!

I do believe you guys are doing better than you think you are. If I remember correctly, the old benchmark is to have one year of salary in your retirement account by age 35 and I believe you might hit that mark with your current plan. I have a 2006 suv and I am finding that repair bills are huge on it now. I just took it in to be serviced and found out that it needs $4,000 worth of work with another $1,500 in the near future and my car is in very good condition for its age. The repair guy said it was not unusual to see $15,000 to $20,000 worth of repair come in at this stage on my make/model. You might want to talk to a mechanic to see what they suggest and guestimate future repairs so you can budget ahead of time. The other long-term question with cars is replacement. Might want to consider a separate line of savings for this as this might be the other surprise stressor that pops up sometime in your budget. Enjoy your new kittens. On the housing question, realtor has a rough estimate monthly payment calculator you could look at and then compare to your current housing situation and then figure out what the difference is per square foot and then ask yourself if x amount of space is worth the extra money per month (contentment question) and decide long term if it is worth saving for. I have found getting in touch with my values and spending based on them, gratefulness, and thanksgiving to be vital keys to contentment. Good luck on your journey.

Marriage now, you don’t know the results of the next election. In your case, beter act now to insure each other rights.

Do you need 2 cars if one is seldomly used.

Pay your debts with speeds and commitment, see if you can roll over into an other no interest credit card. A bank should be a money maker for you, not the other way around.

Rethink the pleasures given by ownership of things, how much is it. Was the amount of hours of work worth it.

Oh wow I had to come straight here to say that I HATE the insertion of the “hire me” widget into the reader case study. The intros/disclaimers were already way too longer IMHO but I didn’t mind scrolling past that, in order to get to the good stuff. But inserting that just felt….disappointing. I held off on saying anything with the new website design bc I wanted to give it time. But I would strongly encourage you to consider removing that from the case study design. It’s just…not what I come to this site and particularly this feature for.

I felt the same way…

But it’s so easy to scroll past…just like all the other intro stuff

Easy to scroll past but made me cringe. Truly doesn’t belong there.

I’d been missing the old look, feel & site set up in general of the Old Frugalwoods. I was also startled by this today. I recognize I am consuming free content by someone who also offers paid content…but I am glad to see I am not the only one struggling with the changes.

Mrs. F is running a business in which she gives and gives and gives content that is amazing for free on such a regular basis that if we have to scroll our fingers for an extra second i think we can all manage. she has spent 1,000’s of hours helping people change their lives and had to tie herself into a knot to even think of charging for her services almost with an apology. the new website is great. keep up the amazing work.

Wonderfully said, Eric. Could the banner take up a little less real estate on the page? Maybe. But the ire at a businesswoman daring to offer her services on her own free, valuable blog is wild to me.

100% agree with Eric’s comment.

Agreed!

With the site changes, I feel I’m being hit over the head with “hire me” messages.

And quite honestly, seeing the “hire me” message at the top of the reader case study felt a little …desperate.

If anything it should be a small non-graphical message perhaps at the bottom of the case study study comments to say something like “ if you would like a similar personalized assessment of your own financial situation I can help” with a link to your Hire. Me pages.

I say this as a long-time reader and 20+ years in technology marketing, including online.

Agree, I say with love and good intentions that this is not good placement from a marketing perspective.

I agree that it struck an odd tone. Maybe there is a way to put it somewhere else on the page?

I completely agree.

Totally agree. Please re-think this.

Another thing to think about before rolling over your old 401k to an IRA is future Roth IRA contributions. If your future MAGI goes over the income limits then you have to do a back door Roth. When you do a back door Roth any assets in traditional IRAs (like a rollover IRA) will be subject to the pro rata rule/tax implications. If your old 401k plan has good options you might want to keep it there.

I wish we hadn’t moved ours. It’s been too complicated to roll over back over into the current 401k (and not all plans allow). So now we are missing out on the tax advantages.

Wanted to specifically comment on Brian’s desire to do a graduate degree. I am in my 40s and just recently finished a graduate degree – best thing I ever did going back to school in my 40s – and like you Brian, I am now convinced of the benefits of lifelong learning.

I would encourage you to look overseas for online international programs. I am with University of London and found the course to be half the price of the same course at an American college. As well as that, with an international program you are studying with people from all over the world which gives you a much more global perspective, and there is much to learn from that alone.

Liz is right. You have the important stuff figured out and the rest is…details. Details that can keep you up at night worrying, but details nonethless. I generally agree with Liz’ advice but with two caveats. First, I am very hesitant to recommend that Michael’s pain relief massage and therapy/coaching be eliminated. Without knowing details that are frankly none of my business, I would consider these fixed unless Michael decides that they are, in fact, discretionary.

Second, make sure that there is no penalty before you move the old 401K. There generally is not but we have a 403B (similar vehicle) that includes a poison pill if you move it before retirement age. My financial advisor discovered this when he was consolidating our accounts and, despite the fact that I pay him based on the value of my assets under his control (while he gives me recommendations for managing all of my assets), he recommended that I leave it where it was (he is a wonderful human being and an excellent advisor). Just make sure you can move it without any issues like that before you roll it over.

Third, if you really want to continue your education, check if your employer will pay for your proposed master’s degree and, if so, what the requirements are for reimbursement.

I love the above comment about curating your treasures and agree wholeheartedly with JackeRose! It can be hard to be selective when many objects spark joy but you will get more pleasure out of your treasures when you are able to feature them in your home. That is much easier to do when there are fewer things to highlight – particularly with mischievous kittens around!

My final comment is for Liz. I was a tad startled by the new hire me insertion but that is just because I have been following you forever, the new design is a change, and change of any kind can be hard. It is your website to do with as you wish, the new addition is not overly pushy or intrusive, and I appreciate all of the wonderful work that you without financial compensation. I see nothing wrong with you reminding readers that you do have a compensated business model available as well.

Normally I am all for Liz’s “tough love” with what she considers reduceable versus discretionary, but I was very disappointed to see Therapy labeled as a discretionary cost. Mental health care is health care. Period.

Agreed, and same with medical/pain relief massage. I’d call these reduceable or even fixed if there isn’t an equivalent lower-cost provider available.

I felt the same way! Therapy should be considered a fixed expense, just as medical is a fixed expense.

In addition, not sure why renter’s insurance is fixed, but car insurance is reducible.

Michael and Brian are doing great! My main observation reading through is that they have a lot of “shoulds” on their goal list – I think Brian even put it as “hitting adult milestones.” I’m not going to deny the power of these, but it’s so helpful to reflect on what you actually want versus what you feel you *should* want based on societal, family, or other pressures. Those things don’t matter in the end!

Just adding to comments that the tenor of the new website is a little off-putting. But I tend to dislike website changes that seem to go from comfortable and homey to more “professional.” I understand the reason for the changes, but…

Meanwhile, it seems like the focus on hiring her comes after her husband fully retired. If their goal was to retire early, it seems like they did that but are now looking to make more money. Not sure I fully understand goals anymore.

Agreed.

I know the world changes and us with it. However, when I saw the big graphical messages before the content, my first thought was it seems overpowering and desperate and I wondered how well the Frugalwoods were doing financially — not a thought you want in reader’s heads when you’re trying to sell them on the benefit of your financial planning advice.

I completely understand to wanting to work even if you’re well positioned for full retirement as I’m in that position myself. I still work even though I have 36x my current gross income in savings and a small pension at retirement age. But I don’t think the site has the strong center and voice that it had a month ago. It’s holding onto some popular items that support Liz’s transition to a non-credentialed financial consultant. And that’s ok—People change, websites change, businesses change, goals change. But I know I’ll probably get slammed for that but it’s the same sort of tough love that Liz has given to recipients of her financial advice.

Wow. Judge much?

Liz has earned a living writing since leaving formal employment. In a since, she is not retired at all but financially free. And she is 100% free to use her website to promote her consultancy business. She could have had this site laden with banner ads etc. like many others do.

I am sure she will survive if you stop consuming her free content.

You make excellent points.

Most utility companies offer a budget arrangement in which you pay the same amount each month until the twelfth month, when you pay a slightly larger or smaller amount to zero out the balance of the year’s charges. Then the payment resets and you start a new year. This makes budgeting much easier, it doesn’t cost anything, and is easy to set up — just call customer service. We have been doing this for over 40 years and find it vastly useful to keep monthly expenses level. I suggest you look into it for your electricity bill to avoid winter spikes.

Some do – I used to do budget for natural gas.. until the “budget” amount was adjusted quarterly. Told them to take a hike. I paid a flat amount monthly for over 10 years and only one time did I owe a few bucks when natural gas spiked to $1.00 and change per BTU. Budget was auto debit to boot so now the company gets to deal with my check every month.

I don’t think they are doing all that bad but I agree get married. Employer benefits and social security are worth it (I’m on the fence re: pre-nup). And P&C insurance might be less expensive. I will say being a non “traditional” couple is less stressful today than it was for my uncles 45+ years ago. They are still together today and doing well.

Agree that what I call the pimp for hiring is an annoyance.

I agree with Liz and many of the comments, prenup for sure and make debt repayment a priority. I would say the next step is to refine your interest and next steps in a degree program only if it leads to more professional options/upgrades.

In my opinion, once you get the debt paid off, get in the habit of not getting into consumer debt if at all possible–(mortgage and school debt not included). It seems to weigh on you guys, like it is a bad habit you wish would just go away. But this is just like any behavior, recognize it, address it, make it a positive attribute of your shared vision.

As for the new “frugalwoods”-you go Liz!!!! Change is hard, but growth is everything!!!

First off – I want to say how sorry I am for the loss of your kitty. We’re currently dealing with expensive vet bills ourselves, so my heart goes out to you – it’s not an easy thing to deal with at all. One of the things we’ve always done with our pets is have a separate “pet fund” that we deposit money into each and every month from the time we adopt our pets. The only thing we use ours for is unexpected vet bills and prescriptions they need as they grow older. Any other needs they have come out of our regular budget, but this way when life happens it’s so much easier to handle knowing the money is there to pay for whatever medical needs our cat has without straining our budget.

Make sure you’ve got all of your medical power of attorney, financial power of attorney and wills in order as well as any beneficiaries for things like 401ks, insurance, etc. People tend to blow those off, but they are so very important to protect each other and make it easier for people to help you if you need it. A friend of ours had a very serious accident and we were his power of attorney. He wasn’t able to speak for himself, but we’d had discussions with him and knew what he wanted and were able to advocate for him. Relatives came out of the woodwork insisting they knew best and were responsible for his care – but because he had signed those documents, we were the ones legally responsible, which is exactly as he wanted. In the absence of having them, he would’ve had people he didn’t like and hadn’t spoken to in years making those decisions.

One last thing – life is so much easier if you don’t compare yourself to what everyone else around you is doing. There’s no one right way to live your life, and no milestones you have to reach by a certain age. If you are enjoying what you’re doing and the people you have surrounded yourself with – that is absolutely amazingly awesome and you should be proud. Thank you for sharing your case study – you’ve got so much to be proud of in your lives and I hope your future is a bright one. 🙂

This is an excellent comment! Seconding all of this!

Calculate what an hour of take-home pay is (i.e. for Brian ~$29.30). Then when tempted to purchase something I like to think about it in terms of hours of work. Would I really want to put in an extra two hours of work for this throw blanket that will probably get pilly after a few washes or the cat will destroy shortly? No, no I probably wouldn’t. That and the wait and see approach to purchases where I make myself wait before buying things are very helpful.

I love this. It really helps to identify that stuff actually costs actual money- not when you’re in the store swiping the credit card but for months afterwards. Using the credit card also means you might end up paying 17% interest on that little fun item unless you pay off the credit card in full every month.

You two are doing a great job! To be in your 30’s and have a loving partner, pets, no roommates, AND hobbies????? Give yourself credit for what you’ve already achieved and I wish you the best in your continued financial journey!

Liz, I think the new website looks great! The text is very readable and as a long time reader I’m so happy for you taking time and space to prioritize your own growth, especially after all the time you’ve spent helping others grow 🙂

Hear hear!

Hi Brian

Just saw this article on LinkedIn and thought you might be interested – highlights the importance of finding a cost effective option.

https://www.linkedin.com/news/story/is-graduate-degree-still-worth-it-5496585/

I would suggest downloading and looking at a year or two’s worth of credit card statements. Ponder each purchase from the view of was this lunch/marathon fee/book worth it to still be paying for *now* as well as paying interest. Sure the UHaul rental for your move was necessary, but probably not a lot of the things you’re still paying off.

I suspect that a chunk of the “missing” income was spent on hobbies. Maybe I missed it but although they are book and music collectors I didn’t see a specific line item for “books”, or “albums” or “concerts”.

I would also look for any available 0% credit card offers. Don’t use it as a way to ignore the debt for another year (not saying you would) but as a means save a little interest while aggressively paying off the debt.

I like the new web site and applaud Liz promoting her services.

Yep, it is different and a lot of us long time readers have to adjust.

But Liz has been offering free content and advice for YEARS and well she’s allowed to make a living from it.

Go girl! You are doing a great job.

I don’t see a graduate degree being in Brian’s best interest UNLESS he has a specific reason for doing so and job in mind. Someone else mentioned it as well, but if he does decide to pursue it, there are many options in Europe that are way cheaper than the US, plus what a fun adventure!

Books – I love books and reading as well, plus the look of a library. To allow you to continue reading, for now anyway, go check out your local library. That’ll save you $$!

Good job to both of you for tackling your debt now. I hope you’re able to pull in that spending and look at it as an experiment to find free/cheap ways to have fun. Host a dinner party w/friends instead of going out, for example. Rotate the dinner party around and don’t worry about the size of the homes… it’s about the company! If there is a particular thing you enjoy like concerts, athletic events, museums, plays, etc look into volunteering. You can often get to experience the event, but not have to pay for it as a reward. Just a few thoughts. 😉

Wow, saw the super critical posts the “hire me” message from Liz and I thought what did I miss.

So just want back and read post again and STILL couldn’t find a “hire me” message. Are there trolls now hitting these accounts?

I kinda miss the cozy style of previous Case Studies but understand Liz is moving into a more professional role and updated the web site accordingly. Well done Liz! (I’m sure we’ll all adjust, being the big girls and boys we are 🤗)

And thanks, Liz, for linking to updates! I’ve always wondered how the people did w their consults and now I can go find out. Brian and Michael you’re doing great! Will also add the counseling and both work should stay as an integral part of your wellness process. And agree w Liz to stop a lot of the other stuff. Until you reach your goals at least. Then add back what’s of most value. Like gifting etc but modestly.

Another great post!

The hire me message is right under her picture towards the top of the page before it really gets into the case study.

I think the new website looks very nice. Doesn’t bother me a bit for Liz to remind me what her time is worth if I need her full attention.

Therapy and massage are funny. They have this reputation for being rich-people things, and therefore unnecessary. But that really just means we live in a society where some truly necessary things appear to be only for the rich. If I miss my appointment and get into a downward health spiral that loses me my job, well, that was a necessary thing. Only the individual can say.

Thank you, Brian and Michael, for sharing.

Well said!

Actually I think the addition of the “hire me” link in the middle of the case study is pretty reasonable. This blog, unlike almost any other blog, has basically zero advertising. There are occasional affiliate links and that’s about it. Other than that, the blog is clean and well-organized; easy to read and no pop-ups. Very rare in personal blogging space for this to be the case these days. One clean “rates bar” in the middle of an article (not even a pop up!) doesn’t seem like that big a deal. Also, I’m impressed that she’s so transparent about her rates. True desperation is when people force you to click and fill out personal information in order to send you their rates so that they can then bombard you with email advertisements for eternity.

I suspect that Liz has been inundated by strangers (perfectly nice strangers, but strangers nonetheless) asking for free advice for the past decade. She has run several free programs for internet strangers (the uber frugal month challenges). She has done dozens (hundreds?) of detailed case studies for free. After all this time and experience, it makes sense that she is setting a boundary: if you want advice, here’s how much it costs. Take it or leave it. My guess is that as a busy mom of two small children, she has calculated what price for an hour is worth it to her, and it’s a fairly high price, which makes perfect sense to me.

If either employer offers a company match then contribute enough to get that and of course make the necessary pension contribution. Beyond that, paying off the consumer debt is more important than additional retirement contributions at this time. A larger cash savings is also important. Nothing wrong with renting so I would put off the home purchase for several years at least. Pay off the debt, get married and go on a reasonable honeymoon, build a emergency savings, buy a new car for Brian since he needs one for work and his is old and having issues. Then you can look into buying a home focusing on Brian’s job as a place to get a home since he makes the big money and has to go to a physical work place every day. No need for Michael to go back to school, they make plenty of money, just need to reduce spending. Good luck.

My two cents is if you want to get married then do it! Also if you want a party don’t wait!

Please don’t wait for the reception, if you want a party. It doesn’t have to be expensive and it doesn’t have to look like any reception you have ever been to. I have a friend that “rented a field” for the solar eclipse. Some folks are camping, some are staying nearby and coming for the eclipse. They are providing drinks and some snacks, nothing fancy. Everyone is genuinely excited about hanging out for the eclipse and celebrating their relationship.

Just brainstorming (and some of these need work):

Scavenger hunt or “escape room” at your local library or maybe a favorite bookstore.

Group camping/nature thing you both enjoy

Rent a boat for the afternoon and have a party

Potluck in a favorite park

“Adopt” an community lot or highway program and invite your friends to a work day planting native flowers and plants (the folks that don’t want to dig in the dirt would probably still love to come hangout and spend time with you all. Tell them to bring a chair and supervise… I mean socialize)

“Brian feels that professional help is needed to ensure our individual and shared goals are achievable and don’t become dreams forever deferred.” This is the heart of this case study; both men feel like the financial life they are living right now will prevent them from realizing their dreams. I would encourage more long term professional help on this front – a financial therapist/coach or someone similar who can help this couple move beyond the financial patterns they have created. Michael indicated that he is ready to do some soul-searching. Yes.

As many have said already, didn’t really like the HIRE ME portion at the top… It’s totally fine to advertize but maybe not in that spot since the case studies are the ones you do for free, no?

Also the new design for me is a bit of a turn off, I guess I’m old fashioned but I liked the wholesome look, it made you very relatable. This new corporate look is not my cup of tea. I know the content is the same but it really feels like a business now and that’s not what I prefer I guess.

Michael and Brian, you’re doing well! Just focus on paying your debt, you can do it! And then anything is possible. 🙂

A sincere question for Liz that perhaps you can explain more in a future post or point to where you have explained this in the past: You are advertising your services for a financial consultation. But in the intro to the case study you write:

“And a disclaimer that I am not a trained financial professional and I encourage people not to make serious financial decisions based solely on what one person on the internet advises. “

What is the difference between what you are offering privately and the advice you are giving in the case study?

Thank you from a long time follower!

Yes, I was going to comment to say exactly this. She also still says that ‘I am not a financial advisor and I am not your financial advisor’. But now she has a business model to be…your financial advisor?

Liz, I think there’s a disconnect between what you’ve always said with the case studies and your new business model, and you might need to rethink this section.

Also, I fully support Liz’s pivot towards offering paid advice – I’m sure she’s built up an incredible store of knowledge over the years she’s been writing Frugalwoods and if she now wants to build a business doing something she obviously loves to do, more power to her. The free content is still here and free (and free from ads/pop ups, sponsored posts, etc, as someone noted above).

People have criticized Liz in the past for monthly spending reports when they feel she’s been living a too-indulgent lifestyle and honestly Liz, the criticism about the blog changes is coming from the same place – readers who think you should always be providing the same content you originally provided (including your extreme frugality…even after you achieved the goals that frugality was meant to help achieve!).

I want to draw a parallel with Modern Mrs Darcy’s summer reading guide which she stopped giving away for free this year (largely because of how big it’s become and how much work goes into making it) and which she also clearly felt so conflicted about doing this she made an elaborate video to explain and she got a substantial amount of criticism on her blog. It’s not ok to assume we have the right to demand women’s labour for free. These are not just blogs now – they’re businesses – and the kick ass women who run them are allowed to charge for their work (and charge what they are worth).

In response to all the ridiculous hullabaloo about having to scroll a tiny bit extra past your new consultation offers— Liz, you are a professional and your work deserves to be treated as such. I’m pretty sure that those of us who have been benefitting from your free humor and advice for years can manage a tiny bit of (understandable) self-promotion in this space. It makes complete sense when reading about others’ financial situations to want to better understand our own— and that’s where your services come in! I’d rather scroll past your offering than unrelated advertisements (but yes, the intros do involve quite a bit of scrolling on phone view 🙃). Congratulations on the new website!

I have been a long time reader and have also found all the business info a little off setting. However, while reading these comments it did occur to me that when reading other blogs I have to constantly scroll past ads and little video ad screens pop up every few seconds that I have to close. I would much prefer a stationary “hire me” blurb that I can scroll past than ads that follow me all the way down the page and block the text on my screen 🙂

Free content isn’t free. It costs her time to produce. Please be respectful of the authors time and effort by politely ignoring the advertisement if you aren’t interested. We come to this site to be entertained and educated and it shows poor gratitude for all the time she has gifted by complaining.

Well said Erin!

I feel very saddened by the fact that Brian and Michael have asked for help and advice from this community but most of the comments have been focused on the new website. Isn’t this forum supposed to be about them?

Liz, I don’t mind the section about hiring you. You have a lot of knowledge and people can pay you for it or not.

Brian and Micheal: you have many things you can cut out and use that money to pay down your debt. Just follow Liz’s ideas, you got this. I would not go back to school. Get married if you want. Keep separate bank accounts. TRACK your expenses. Best wishes and happy life.

Focus on paying down that debt but also not adding to it. We built emergency fund by focusing on one key area at a time so for you that might be adding money for vet bills and car repairs. I am amazed you had an apartment in CT under $1000 so sad to loose that. Now that rent has doubled, the need to track every penny and decide where to cut is needed and it will be eye opening.

I disagree with frugalwoods that therapy and massage for pain are discretionary!! As someone with chronic illness and chronic pain these are essentials. Are there cheaper options? A LICSW covered by HMO or is chiropractic or acupuncture covered by health insurance or a clinic that charges a sliding scale?

Ramit Sethi has great book I will teach you to be rich that very clearly outlines 6 step program to manage your money long term. I wish I would have read it 20 years ago! Highly recommend his book along with his podcasts which interview couples and really gets into the psychology of money.

Just wanted to say that my son was engaged when the Roe decision leaked. He and his fiance planned a wedding in 3 weeks. The actual ceremony was my husband and I, the other groom’s parents, and friends who performed the ceremony and took pictures. They had a small reception at a local hotel with a cake, some bowls of nuts on the tables, and an open bar that my husband and I paid for as their gift. My son-in-law put together a spotify play list (they asked for requests on the invitation) and used his college party speaker to play it. We had a wonderful time and everyone commented what a good time it was. Their plan was to do it up small in case same-sex marriage became illegal again and have a larger ceremony at some point. What they planned and executed was so fun and meaningful that I don’t think they are even planning another ceremony, although they may have a blowout party on an anniversary. If you are sure about your decision to marry, I would get the legalities tied up. It’s awful that you even have to factor that in, but that seems to be the world we’re currently living in. Good luck!

Dear Brian and Michael,

Thank you for sharing with us, especially sharing your true feelings about your debt. That was a brave and, I hope, empowering step to take. In my experience, noticing/naming (with as little judgement as possible) is the first step toward real change. 🙂

Speaking on change, you might find one or both of the following useful.

1) BJ Fogg’s excellent info and skills re: clarifying intentions, setting goals, and establishing effective habits

2) “Motivational Interviewing” can be a helpful process (“Motivational Interviewing: Helping People Change” by Miller & Rollnick & “Building Motivational Interviewing Skills: A Practitioner Workbook” by Rosengren). You could each do it separately (for your self and for the couple) and then compare and discuss results/findings.

It’s so important to invest in your relationship (and each other). Here are some ideas.

– Living with pain/tension: Try mutual couple self-care practices, such as mindful breathing, meditation, head/face massage, back scratches, acupressure points, etc.

– Daily walk (tea date, after-work cuddle,…): start w/short and easy (so you do it daily); perhaps half of the time is for noticing/appreciating the world around you and the other half is for noticing/appreciating your partner (or mix it up in other ways to bring freshness and energy to your relationship).